Direct Combustion emissions projections 2014*15

advertisement

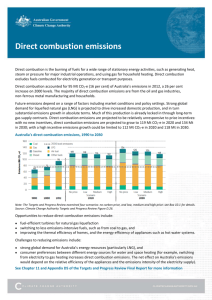

Direct Combustion emissions projections 2014–15 August 2015 Published by the Department of the Environment. www.environment.gov.au This work is licensed under the Creative Commons Attribution 3.0 Australia Licence. To view a copy of this license, visit http://creativecommons.org/licenses/by/3.0/au The Department of the Environment asserts the right to be recognised as author of the original material in the following manner: or © Commonwealth of Australia (Department of the Environment) 2015. Disclaimer: While reasonable efforts have been made to ensure that the contents of this publication are factually correct, the Commonwealth does not accept responsibility for the accuracy or completeness of the contents, and shall not be liable for any loss or damage that may be occasioned directly or indirectly through the use of, or reliance on, the contents of this publication. Executive summary Key points • Direct combustion emissions occur when fuels are combusted for stationary energy purposes to generate heat, steam or pressure (excluding electricity generation). Direct combustion emissions are produced from almost all sectors of the economy including energy, mining, manufacturing, buildings and primary industries. • In 2013–14, direct combustion surpassed transport to become the second largest emissions sector in Australia after electricity. • In 2013–14, emissions from the direct combustion of fuels were 93 Mt CO2-e, equating to 17 per cent of Australia’s total domestic emissions. • Direct combustion emissions are projected to rise throughout the projections period, primarily due to growth in LNG production and coal mining in response to export demand for Australia’s energy resources. – Emissions are projected to reach 115 Mt CO2-e in 2019–20; a 54 per cent increase on 1999–2000 levels. – Emissions are projected to reach in 129 Mt CO2-e in 2029–30; a 73 per cent increase on 1999–2000 levels. – Emissions are projected to reach 130 Mt CO2-e in 2034–35; a 74 per cent increase on 1999–2000 levels. • The 2014–15 direct combustion projection is 4 per cent lower than the 2013 projection in 2019–20 and 2029–30 due to industrial closures, an improvement in energy sector modelling and the recalculation of emissions factors. Throughout this report: 1. Totals may not sum due to rounding. 2. Percentages have been calculated prior to rounding. 3. Years in charts and tables are financial years ending in the stated year. Baseline projections • Between 1989–90 and 2013–14, direct combustion emissions have been rising at an average annual rate of Direct Combustion emissions projections 2014–15 2 1.5 per cent per year. From 2013–141 to 2034–35, direct combustion emissions are expected to continue to grow at an annual average rate of 1.6 per cent. • The increase in projected direct combustion emissions is largely driven by the expansion of Australia’s liquefied natural gas (LNG) industry and increased coal production. • The direct combustion sector is broken down into five subsectors: energy, mining, manufacturing, buildings and primary industries. Emissions growth is projected to be highest in energy and mining: – From 2013–14 to 2019–20, direct combustion emissions from the energy subsector are projected to more than double to 31 million tonnes of carbon dioxide equivalent (Mt CO2-e) in 2019–20. This increase in emissions is almost entirely due to the expected commencement of seven new Australian LNG projects from 2014–15 to 2019–20. – From 2019–20 to 2034–35, growth in direct combustion emissions from the LNG industry is expected to moderate. After an initial surge in emissions in the early to mid 2020s, direct combustion LNG emissions stabilise as some mature projects wind down. Emissions growth over this period is dominated by the mining subsector. Mining emissions are projected to grow at 31 per cent from 2019–20 to 2034–35. The subsectors other than mining are projected to be relatively stable during this period. – Direct combustion emissions from mining are projected to increase from 17 Mt CO2-e in 2013–14 to 22 Mt CO2e in 2019–20; an increase of 31 per cent, due to activity increases in the coal mining and non-energy mining subsectors. Figure 1 Direct combustion emissions 1989–90 to 2034–35 Sources: Department of the Environment (DoE) 2015, DoE analysis. Table 1 Direct combustion emissions, key years 2000 1 2014 2020 2030 2035 2013–14 forms the base year of the 2014–15 Projections as the latest financial year for which national greenhouse gas inventory emissions data is available. Direct Combustion emissions projections 2014–15 3 Mt CO2-e Mt CO2-e Mt CO2-e Increase on 2000 Mt CO2-e Increase on 2000 Mt CO2-e Increase on 2000 Energy 15 15 31 104% 36 134% 33 118% Mining 6 17 22 281% 27 376% 29 400% Manufacturin g 33 38 37 12% 39 19% 40 21% Buildings 16 18 18 7% 18 11% 18 13% Primary industries 4 7 8 70% 9 99% 10 115% Total 75 93 115 54% 129 73% 130 74% Sources: Department of the Environment (DoE) 2015, DoE analysis. Impact of measures • There are no measures in the 2014–15 direct combustion projections. Projections of abatement from the Emissions Reduction Fund are not included to avoid disclosing potentially market sensitive information, and because the safeguard element of the Fund has yet to be decided. • The Government will consider including estimates of abatement in future projections if it is possible to do so without reducing the effectiveness of the Emissions Reduction Fund auctions. Changes from the 2013 Projections • The 2014–15 direct combustion overall projection is lower than that published in 2013. Compared to the 2013 Projections, direct combustion emissions are 4 per cent lower in 2019–20 and 2029–30. This decline is due to: – announced industrial closures which reduce activity forecasts in basic non-ferrous metal and non-metallic mineral product manufacturing and refinery output – a lower emissions forecast in the energy sector due to modelling improvement in the other oil and gas subsector – a recalculation of emissions from the manufacture of solid fuels over the historical period. Direct Combustion emissions projections 2014–15 4 Table of Contents Executive summary .................................................................................................................................... 2 Key points ................................................................................................................................................................. 2 Baseline projections ............................................................................................................................................. 2 Impact of measures ............................................................................................................................................... 4 Changes from the 2013 Projections ................................................................................................................ 4 1.0 Introduction ..................................................................................................................................... 7 2.0 Projections results ...................................................................................................................... 12 3.0 Sensitivity analysis ..................................................................................................................... 19 1.1 1.2 1.3 1.4 2.1 2.2 2.3 2.4 2.5 2.6 3.1 3.2 3.3 Sources of emissions from direct combustion ............................................................................... 7 Recent trends—national greenhouse gas inventory.................................................................... 9 Projections scenarios ............................................................................................................................ 10 Outline of methodology ........................................................................................................................ 11 Trends in the direct combustion projections ............................................................................... 12 Energy ......................................................................................................................................................... 13 Mining ......................................................................................................................................................... 14 Manufacturing ........................................................................................................................................... 15 Buildings .................................................................................................................................................... 17 Primary industries ................................................................................................................................. 18 Energy ......................................................................................................................................................... 19 Mining ......................................................................................................................................................... 20 Manufacturing .......................................................................................................................................... 21 Appendix A Changes from the 2013 Projections ................................................................... 24 Appendix B Modelling approach ................................................................................................. 25 Appendix C References ................................................................................................................... 27 Figures Figure 1 Direct combustion emissions 1989–90 to 2034–35 ................................................ 3 Figure 2 Direct combustion emissions by sector 1989–90 to 2013–14 .......................... 10 Figure 3 Direct combustion emissions by sector 2013–14 to 2034–35 .......................... 12 Figure 4 Projected annual average change in direct combustion emissions ................ 13 Figure 5 Direct combustion energy emissions 1989–90 to 2034–35............................... 14 Figure 6 Direct combustion mining emissions 1989–90 to 2034–35 .............................. 15 Figure 7 Direct combustion manufacturing emissions 1989–90 to 2034–35 ............... 16 Figure 8 Direct combustion buildings emissions 1989–90 to 2034–35 .......................... 17 Figure 9 Direct combustion primary industries emissions 1989–90 to 2034–35 ............................................................................................................................... 18 Figure 10 Direct combustion energy emissions sensitivity analysis ............................... 20 Figure 11 Direct combustion mining sensitivity analysis .................................................... 21 Figure 12 Direct combustion manufacturing sensitivity analysis .................................... 22 Direct Combustion emissions projections 2014–15 5 Tables Table 1 Direct combustion emissions, key years ....................................................................... 3 Table 2 Sources of direct combustion emissions ....................................................................... 8 Table 3 Projections scenarios ........................................................................................................ 10 Table 4 Direct combustion energy sensitivity analysis, key years .................................... 20 Table 5 Direct combustion mining sensitivity analysis, key years ................................... 21 Table 6 Direct combustion manufacturing sensitivity analysis, key years .................... 23 Table 7 Differences between the 2014–15 and 2013 direct combustion projections 24 Direct Combustion emissions projections 2014–15 6 1.0 Introduction The 2014–15 direct combustion projections are a full update of the 2013 direct combustion projections. Emissions were projected by economic sector and fuel type using Commonwealth or third party activity information including National Greenhouse and Energy Reporting Scheme (NGERS) data, Monash Multi-Regional Forecasting model growth rates, Bureau of Resource and Energy Economics (BREE) analysis (now Office of the Chief Economist), Wood Mackenzie’s LNG Tool and AME Group’s coal industry analysis (BREE 2014, Wood Mackenzie 2015, AME Group 2014). These data were supplemented by a consultancy report by Core Energy Group to model residential and commercial gas activity levels and to provide advice on potential fuel switching in the industrial sector over the projections period (Core Energy Group 2014). Historical emissions data from 1989–90 to 2013–14 are based on Australia’s National Greenhouse Gas Inventory September 2014 Quarterly update and project or facility-specific emissions data reported under the NGERS (DoE 2015). Detailed results are separately reported for the major direct combustion subsectors: energy, mining, manufacturing, buildings and primary industries. 1.1 Sources of emissions from direct combustion Greenhouse gas emissions from direct combustion are defined in the national greenhouse gas inventory as emissions from combustion of fuels for energy used directly, in the form of heat, steam or pressure (excluding for electricity generation and transport). Energy used in mobile equipment in mining, manufacturing, construction, agriculture, forestry and fishing is included in direct combustion. The 2014–15 direct combustion projections are updated for the 2006 IPCC Guidelines for National Greenhouse Gas Inventories, with combustion emissions from pipeline transport being moved to the transport sector since the 2013 Projections. Emissions arising from the use of electricity in the extraction, production and processing of LNG are included in the 2014–15 electricity generation projections. Fugitive emissions from the extraction, production, and processing of LNG are reported in the 2014–15 fugitive projections. In line with national greenhouse gas inventory accounting rules, carbon dioxide emissions from wood heating are not included in residential emissions, but methane and nitrous oxide emissions are included in the projection. Direct Combustion emissions projections 2014–15 7 Table 2 Sources of direct combustion emissions Source Description Energy Direct combustion emissions from the extraction, production and processing of LNG from natural gas used in direct drive gas compressors (used to export gas from gas fields to processing facilities and for liquefaction). Emissions from other oil and gas extraction from power generation for exploration and diesel vehicle use, including the use of stationary diesel engines which supply power for equipment. On-site combustion for the generation of electricity and heat for petroleum refining. Combustion emissions from the manufacture of solid fuels from the production of coke and brown coal briquettes. Gas-fuelled compressors used in gas production and distribution to distribute gas from the place of production to the eventual consumer. Mining Emissions from diesel-powered vehicles and equipment on mine sites including trucks, graders, excavators, air compressors, pumps and conveyors. A small proportion of emissions also occur from on-site equipment powered directly by natural gas. Manufacturing In non-ferrous metal manufacturing, emissions from the manufacture and casting of metals (mostly alumina, for which very high temperatures are required). In non-metallic mineral manufacturing, emissions from the manufacture of industrial products such as cement, where kilns are used. Emissions from fuel use in chemicals manufacturing, such as the manufacture of ammonia, where high temperatures are required. Emissions from fuel combustion in iron and steel manufacturing and casting stages, mainly for the pelletisation of iron ore, which requires very high temperatures. Combustion emissions from the pulp, paper and print industries, food, beverage and tobacco manufacturing and all other manufacturing; mostly a result of heat and steam required for pulp and paper production and food processing. Buildings In the residential subsector, fuel combustion in households, primarily gas combustion for space heating, water heating and cooking. Commercial building emissions from gas combustion for space heating, hot water heating, cooking, industrial chillers and hospital equipment, as well as vehicles and equipment used on-site. Combustion emissions in the construction subsector from construction vehicles and equipment used on site. Primary industries Emissions from fuel combustion in agriculture, forestry and fishing (including fish farms). This is mainly attributable to diesel use to power farm and fishery equipment such as tractors, dozers, harvesters, all-terrain vehicles, generators and pumps. Vehicle emissions within a farm boundary are also recorded as combustion emissions. Direct Combustion emissions projections 2014–15 8 1.2 Recent trends—national greenhouse gas inventory Total direct combustion emissions in 2013–14 are estimated to have been 93 Mt CO2-e, accounting for an estimated 17 per cent of Australia’s total emissions (DoE 2015). From 1999–2000 to 2013–14, direct combustion emissions increased by 19 Mt CO2-e, or 25 per cent, at an annual average growth rate of 1.6 per cent. The majority of this growth was driven by mining emissions, which increased by 11 Mt CO2-e, or 190 per cent over the same period. The sharpest increase in mining emissions has occurred post 2009–10, as Australian coal and iron ore exports grew by 28 and 67 per cent respectively. High coal and iron ore prices around 2009–10 lifted exploration investment in Australia, which has resulted in substantially higher output. A more gradual increase in mining production and emissions is forecast over the projections period where emissions are projected to grow at an annual average rate of 2 per cent. Emissions from the energy subsector were 15 Mt CO2-e and have fluctuated around 15 Mt CO2-e from 1999–2000 to 2013–14 (Figure 2). Emissions growth from the production of natural gas has outpaced the decline in refinery emissions. Recent closures of Australian petroleum refineries (including conversion to import terminals) have contributed to a 10 per cent decline in energy emissions from 2009–10 to 2013–14. Emissions from the manufacture of solid fuels rose from 1999–2000 to 2009–10 and have declined below 1999–2000 levels due to a steep drop in emissions from coke production closures in the Illawarra. Mining emissions were 17 Mt CO2-e or 18 per cent of overall direct combustion emissions in 2013–14, while manufacturing emissions accounted for the largest share at 38 Mt CO2-e or 41 per cent of overall emissions. Buildings emissions accounted for the second largest share at 18 Mt CO2-e or 19 per cent of overall direct combustion emissions. Primary industries accounted for the smallest share at 7 Mt CO2-e or 7 per cent of overall direct combustion emissions. Direct Combustion emissions projections 2014–15 9 Figure 2 Direct combustion emissions by sector 1989–90 to 2013–14 Source: DoE 2015 1.3 Projections scenarios The baseline projection has been developed on the basis of current policies in place in the direct combustion sector (Table 3). The baseline scenario does not include the expected impact of the Emissions Reduction Fund because there is insufficient information to account for it at this time. High and low sensitivity scenarios are also provided to indicate the level of uncertainty around key assumptions for the major growth sectors of energy, mining and manufacturing. Further details are presented in Chapter 3. Table 3 Projections scenarios Scenario Description Baseline Best estimates of emissions based on current information. Energy production LNG production is assumed to be: i) 8 per cent higher, and ii) 12 per cent lower than in the baseline scenario. Mining production Coal production is assumed to be: i) 6 per cent higher, and ii) 16 per cent lower than in the baseline scenario. Iron ore is assumed to be: i) 2 per cent higher, and ii) 10 per cent lower than in the baseline scenario. Manufacturing production Iron and steel production is assumed to be: i) <1 per cent higher, and ii) 9 per cent lower. Ammonia production is assumed to be: i) the same, and ii) 30 per cent lower Direct Combustion emissions projections 2014–15 10 Scenario Description than the baseline. Cement and lime production is assumed to be: i) 13 per cent higher, and ii) 16 per cent lower. Fuel switching is assumed to: i) reduce gas use by around 650PJ and increase coal use by 650 PJ, and ii) be unchanged. 1.4 Outline of methodology The 2014–15 direct combustion projections are based on projections of activity in sectors of the Australian economy and estimates of the emissions per unit of production (emissions intensity). The modelling was prepared for numerous commodities or industries, based on the 2006 IPCC Guidelines for National Greenhouse Gas Inventories. A consistent modelling approach was taken whereby the activity forecast and emissions intensity forecast were used to generate a projection for each national greenhouse gas inventory subsector. The LNG industry, within the energy sector, was modelled at an individual project level owing to the variation in process and project design between Australian projects. For many sectors, the emissions intensity forecasts were prepared by fuel type (solid, liquid, gaseous) in order to achieve a projection of fuel use, from which emissions were derived. Many direct combustion sectors use significant amounts of natural gas for fuel. Quality assurance was undertaken to ensure that the natural gas fuel balance was consistent across the 2014–15 Projections. The check on the fuel balance involved reconciling the projected domestic gas use from the direct combustion, electricity, transport and industrial processes and product use projections, with the amount of natural gas expected to be extracted and processed for use in Australia in the fugitive emissions projections. Activity forecasts were prepared in consultation with other Commonwealth agencies and third parties. Where activity levels influenced multiple areas of the projection (for example, emissions from LNG production also arise in the electricity generation and fugitive sectors) common activity data were used for each sector. During the first half of 2014–15 international commodities (particularly oil and iron ore) experienced a phase of significant price volatility. Forecasts for the Australian dollar foreign exchange rate and terms of trade were revised down, along with international oil and gas prices. The activity forecasts within the 2014–15 Projections have taken account of these international developments. Direct Combustion emissions projections 2014–15 11 2.0 Projections results Direct combustion emissions were 93 Mt CO2-e in 2013–14. Emissions are projected to increase by 23 per cent to 115 Mt CO2-e in 2019–20, and by 39 per cent to 130 Mt CO2-e in 2034–35. In 2013–14 direct combustion surpassed transport to become the second largest emissions sector in Australia. Over the projections period, the projected increase in direct combustion emissions is the second highest of any sector in absolute terms (second to electricity) and the third fastest growing (behind the land use, land use change, forestry sector and the fugitive sector). 2.1 Trends in the direct combustion projections The projected increase in direct combustion emissions is driven by significant changes in activity levels in the energy and mining sectors (Figure 3). In recent years (2009–10 to 2013–14), direct combustion mining emissions increased by 87 per cent. In the near future (2013–14 to 2019–20), the change in direct combustion emissions will be dominated by the energy sector which is projected to increase by 111 per cent (Figure 4). Emissions increases of this magnitude are unusual and reflect the structural shift currently occurring in the Australian economy away from traditional manufacturing sectors to energy and resource exports. Figure 3 Direct combustion emissions by sector 2013–14 to 2034–35 Source: DoE analysis Anticipated activity changes in the energy sector are the major driver of emissions growth in direct combustion over the projections period. The recent decline in energy emissions from 2010–11 to 2013–14 is expected to be reversed. From 2014–15, the Australian LNG industry is expected to undergo a rapid expansion and Australia is expected to become the world’s largest exporter of LNG by 2018–19. A second wave of Australian LNG production is projected to commence during the early–mid 2020s. After this second expansion phase, direct combustion energy emissions are expected to become relatively stable. Direct Combustion emissions projections 2014–15 12 The second largest growth area is direct combustion mining emissions, which are expected to grow by 72 per cent between 2013–14 and 2034–35. However the rate of growth in mining emissions is expected to be highest in the period to 2019–20, during which time Australia iron ore and coal production are expected to experience the largest increase in output. Direct combustion manufacturing emissions are projected to increase over the projections period as economic conditions improve and export demand for Australian products increases. There is an initial period of contraction between 2013–14 and 2017–18 due to a decline in activity levels driven by the recent high Australian dollar and labour costs. Emissions in the buildings subsector are expected to be relatively stable over the projections period with growth of 5 per cent between 2013–14 and 2034–35, which is concentrated in the commercial building sector. Primary industries emissions are expected to experience growth of 47 per cent over the projections period, driven by rising export demand and productivity. As the smallest contributor to direct combustion emissions, the annual change in primary industry emissions is quite small in absolute terms (Figure 4). Figure 4 Projected annual average change in direct combustion emissions Source: DoE analysis. 2.2 Energy There are five subcategories of direct combustion energy emissions: LNG production, other oil and gas extraction, petroleum refining, manufacture of solid fuels and gas production and distribution. In 2013–14, LNG production and other oil and gas extraction combined was the highest source of direct combustion energy emissions and the third highest source of total direct combustion emissions (DoE 2015). Emissions from the energy subsector are projected to increase 125 per cent over the projections period from 15 Mt CO2-e in 2013–14 to 33 Mt CO2-e in 2034–35 (Figure 5). This rapid increase is primarily due to higher forecast Direct Combustion emissions projections 2014–15 13 LNG production, with Australia poised to overtake Qatar as the world’s largest exporter of LNG by 2018–19 (BREE 2014). From 2014–15 to 2019–20, seven new projects are expected to commence, increasing Australia’s LNG production by approximately 255 per cent from 23 Mt in 2013–14 to 81 Mt in 2019–20. A second wave of new Australian LNG production is forecast from the early 2020s, which further increases projected energy emissions to a peak of 36 Mt CO2-e in 2029–30. Figure 5 Direct combustion energy emissions 1989–90 to 2034–35 Source: DoE 2015, DoE analysis LNG emissions increase by 328 per cent over the projections period. LNG’s share of direct combustion energy emissions increases from 36 per cent in 2013–14 to 70 per cent in 2034–35. Emissions from petroleum refining are projected to decrease due to a decline in domestic production of refined products. The proportion of direct combustion energy emissions from petroleum refining is projected to decline from 32 per cent in 2013–14 to 7 per cent in 2034–35 as Australia is expected to import a larger share of refined products. Emissions from the manufacture of solid fuels are projected to rise from 2016–17 when the production of brown coal briquettes for export to China is expected to commence. 2.3 Mining Mining is broken down into non-energy mining and coal mining. Non-energy mining and coal mining were the fourth and fifth largest sources of direct combustion emissions in 2013–14 (DoE 2015). Direct combustion emissions from mining are projected to increase 72 per cent over the projections period from 17 Mt CO2-e in 2013–14 to 29 Mt CO2-e in 2034–35. This projected increase in emissions reflects the transition of the mining boom from a period of substantial investment to one of increased output. For example, from 2013–14 to 2019–20 Australia’s coal production is projected to increase at an average annual rate of 4.8 per cent (DoE analysis). Australia’s iron ore export volumes are projected to increase most strongly at an annual rate of 6.9 per cent (DoE analysis). Coal mining emissions are projected to increase by 75 per cent from 2013–14 to 2034–35 and non-energy mining emissions by 70 per cent from 2013–14 to 2034–35 (Figure 6). Direct Combustion emissions projections 2014–15 14 Figure 6 Direct combustion mining emissions 1989–90 to 2034–35 Sources: DoE 2015, DoE analysis The projected increase in iron ore exports is due to a number of factors. While China’s steel consumption is projected to pick up in the medium term, an oversupply of iron and low steel prices in the domestic Chinese market makes switching from high-cost domestic iron ore to low-cost imported iron ore a more competitive option. As Australia is one of the world’s cheapest producers of iron ore, prevailing low prices have less of an impact on Australian producers and more iron ore is expected to be imported from Australia. This expected increase in export demand will be supported by rapid growth in Australia’s iron ore output due to increases in production capacity. Expansions to mines in the Pilbara and the openings of Kings Mine and Roy Hill will provide this increase, along with enhancements to existing infrastructure. The expected increase in iron ore production is projected to have a corresponding impact on direct combustion mining emissions, due to associated increased in machinery and vehicle use. The expected increase in coal production is predominantly driven by export demand, with the vast majority of Australian coal (currently over 99cent per of metallurgical and nearly 80cent per of thermal) being exported. The projected increase in export demand is due to increasing global demand, particularly from Asian countries. For example, in China and India the projected increase in steel production in the medium term will lead to increased demand for metallurgical coal. Australia will be well-placed to meet these import needs due to its high-quality coal reserves and capacity to further develop required infrastructure. This increase in production would be met new mines and expansions of existing mines, which are expected to increase coal production through to 2019–20. The increase in production from these expansions is expected to more than offset production losses from mines that have closed due to falling coal prices. 2.4 Manufacturing The direct combustion manufacturing subsector includes basic non-ferrous metal manufacturing, chemicals manufacturing, non-metallic mineral product manufacturing, iron and steel manufacturing, pulp, paper and print manufacturing, food processing, beverages and tobacco manufacturing and other manufacturing. The largest of these is basic non-ferrous metal manufacturing, which was also the largest source of total direct combustion emissions in 2013–14 (DoE 2015). Direct Combustion emissions projections 2014–15 15 Direct combustion manufacturing emissions are projected to grow slightly over the projections period from 38 Mt CO2-e in 2013–14 to 40 Mt CO2-e in 2034–35 (Figure 7). There is an initial period of decline from 2013–14 to 2017–18 which is driven by the recent high Australian dollar and labour costs affecting the competitiveness of Australian manufacturing. From 2017–18, direct combustion manufacturing emissions are projected to increase overall as economic conditions improve and export demand for Australian products increases. Figure 7 Direct combustion manufacturing emissions 1989–90 to 2034–35 Sources: DoE 2015, DoE analysis Despite numerous expected or completed industrial closures across basic non-ferrous metal manufacturing (Rio Tinto’s Gove alumina refinery), non-metallic mineral product manufacturing (Adelaide Brighton’s decommissioning of clinker kilns) and other manufacturing (particularly automotive manufacturing with announced closures from Toyota, Ford and Holden), direct combustion manufacturing emissions are projected to rise from 2013–14 to 2034–35 due to expected growth from other facilities or commodities. Basic non-ferrous metal manufacturing emissions are expected to increase from 2019–20 to 2034–35, partly due to increased alumina exports. Non-metallic mineral manufacturing emissions are also expected to rise somewhat steadily to 2034–35. This expected increase is due to projected growth in lime production to meet growing demand for road construction and agricultural fertilisers and continuing demand for metals processing. The projected increase in supply will be supported by the expansion of Cockburn Cement’s Munster lime facility. Emissions from pulp, paper and print and food, beverage and tobacco manufacturing are projected to increase over the projections period due to the expected depreciation of the Australian dollar, which will make Australian manufacturing more competitive over the long term. The projected increase for food, beverage and tobacco can also Direct Combustion emissions projections 2014–15 16 be attributed to projected growth in foreign incomes and population (particularly in China and other developing countries), which are expected to drive an increase in demand for sheep meat, beef and milk. This demand is expected to result in an increase in direct combustion emissions from machinery use increasing proportionally to production. 2.5 Buildings The direct combustion buildings subsector includes residential, commercial and construction direct combustion emissions and other emissions not elsewhere classified. In 2013–14, emissions from the residential sector were the second highest source of direct combustion emissions (DoE 2015). Direct combustion emissions from buildings are projected to increase by 1 Mt CO2-e over the projections period to reach 18 Mt CO2-e in 2034–35 (Figure 8). Residential and commercial emissions are projected to remain relatively stable from 2013–14 to 2019–20 as consumers moderate their gas usage in response to projected price increases, and as the energy efficiency of buildings and appliances is assumed to continue to improve. Figure 8 Direct combustion buildings emissions 1989–90 to 2034–35 Sources: DoE 2015, DoE analysis From 2019–20 to 2034–35, residential building emissions are projected to continue around current levels, despite the expectation that domestic gas prices will stabilise beyond 2019–20. This is a result of current and expected improvements to the efficiency of appliances and buildings. This efficiency improvement is the basis for declines in demand for gas over each connection, which continues to outweigh the impact of new connections occurring as a result of population growth. A similar trend is expected for commercial buildings, where connection numbers are expected to increase while demand per connection drops. However, commercial buildings emissions are projected to increase slightly beyond 2020–21 once retail gas prices have stabilised, due to a broad linkage with economic growth. Construction emissions are expected to remain relatively stable over the short term to 2019–20. This is mostly due to the stabilisation of mining activity after a recent period of growth, which is expected to lead to an associated drop in the construction of bridges, railways, ports, energy infrastructure and pipelines. After 2019–20, emissions are projected to increase steadily to 2034–35 due to expected economic growth leading to an increase in infrastructure Direct Combustion emissions projections 2014–15 17 projects such as roads, railways, renewable energy and telecommunications. 2.6 Primary industries The primary industries subsector consists of emissions from the combustion of fuels for equipment in agriculture, fisheries and forestry. Emissions from primary industries are projected to increase 47 per cent over the projections period from 7 Mt CO2-e in 2013–14 to 10 Mt CO2-e in 2034–35 (Figure 9). The main driver of this increase is export demand, which is expected to strengthen as a result of growth in foreign incomes and population, and depreciation of the Australian dollar. Seasonal conditions are also assumed to return to normal in 2015, which would allow for increased livestock numbers and crop production. Figure 9 Direct combustion primary industries emissions 1989–90 to 2034–35 Sources: DoE 2015, DoE analysis. Projected growth in export demand and productivity would lead to growth in agricultural activity and emissions. This includes activities which generate direct combustion emissions, for example diesel use to power farm equipment such as tractors. Direct Combustion emissions projections 2014–15 18 3.0 Sensitivity analysis The key uncertainties in the direct combustion emissions projection are the forecasts of activity in different sectors of the economy. Due to the high degree of linkage between direct combustion and other emissions sectors, the higher and lower activity forecasts are consistent with those used elsewhere in the 2014–15 Projections. Sensitivity analyses have been completed for the three largest direct combustion subsectors of energy, mining and manufacturing. The sensitivity analyses have been completed in the form of scenario analysis for alternative higher and lower activity forecasts, as well as fuel switching from gas to coal for some processes. The fuel switching sensitivity is based on industrial gas users switching to coal use (where technically and economically feasible) in response to the projected rise in wholesale gas prices in eastern Australia. Sensitivity analyses have not been completed for buildings or primary industries since the projected changes in emissions are not as substantial as for energy, mining or manufacturing. 3.1 Energy The greatest uncertainty in the direct combustion energy projection is the level of LNG production and the year in which it occurs. Sensitivity analysis has been completed using the same low and high LNG production scenarios as the 2014–15 fugitive emissions modelling. In the low scenario, initial production is assumed to be delayed from several new projects, while some projects that are more speculative are assumed not to proceed at all. In this scenario, emissions reach 30 Mt CO2-e in 2019–20 (5 per cent lower than the 2019–20 baseline projection) and 31 Mt CO2-e in 2034–35 (7 per cent lower than the 2034– 35 baseline projection) (Figure 10). The high production scenario would be the same as the projection until 2023–24, since for a project to be producing in 2024–25, it would have to be at an advanced planning stage now. By 2034–35, if more speculative projects were constructed based on higher demand for Australian LNG, emissions would reach 36CC tM 2-e (9cent per higher than the 2034–35 baseline projection). Direct Combustion emissions projections 2014–15 19 Figure 10 Direct combustion energy emissions sensitivity analysis Sources: DoE analysis. Table 4 Direct combustion energy sensitivity analysis, key years 2020 Change from baseline 2035 Change from baseline Mt CO2-e % Mt CO2-e % Baseline 31 - 33 - High emissions 31 - 36 8% Low emissions 30 -5% 31 -7% Projection Source: DoE analysis 3.2 Mining Direct combustion mining emissions are strongly dependent on the iron ore and coal production forecasts. Australian exports of both iron ore and coal are forecast to increase over the projections period in response to rising Asian demand. However, if current low prices and global oversupply persist for longer than expected, the pace of the projected growth in iron ore and coal production could change. The low scenario is based on reduced demand for Australian iron ore and coal due to the continuation of global oversupply suppressing prices, and importing nations’ environmental policies that could reduce their coal demand. This scenario uses a lower coal production forecast consistent with the low scenario in the 2014–15 fugitive projections. In this scenario, emissions reach 20 Mt CO2-e in 2019–20 (10 per cent lower than the 2019–20 baseline projection) and 25 Mt CO2-e in 2034–35 (12 per cent lower than the 2034–35 baseline projection) (Figure 11). Direct Combustion emissions projections 2014–15 20 If iron ore and coal prices recover faster than anticipated, Australian production could increase as Australian producers take on a greater market share. In this scenario, emissions reach 22 Mt CO2-e in 2019–20 (1 per cent higher than the 2019–20 baseline projection) and 31 Mt CO2-e in 2034–35 (6 per cent higher than the 2034–35 baseline projection) (Figure 11). Figure 11 Direct combustion mining sensitivity analysis Source: DoE analysis. Table 5 Direct combustion mining sensitivity analysis, key years 2020 Change from baseline 2035 Change from baseline Mt CO2-e % Mt CO2-e % Baseline 22 - 29 - High emissions 22 1% 31 6% Low emissions 20 -10% 25 -12% Projection Source: DoE analysis 3.3 Manufacturing The sensitivity analysis of manufacturing emissions has been completed based on higher and lower production forecasts, as well as the possibility of fuel switching in some industries. As the fuel switching is from gas to coal, which increases emissions, the sensitivity analysis is weighted to the upside. Direct Combustion emissions projections 2014–15 21 In the low emissions scenario, reduced production is assumed in non-metallic mineral products, iron and steel and chemicals manufacturing. Lime production is assumed to not exceed the 2019–20 level projected in the baseline scenario to reflect increased import competition. Iron and steel is assumed to have a 50 per cent slower annual production growth rate than in the baseline scenario. The projection for ammonia assumes a decline in production due to the rising price of gas as a feedstock. In this scenario, emissions reach 36 Mt CO2-e in 2019–20 (3 per cent lower than the 2019–20 baseline projection) and 36 Mt CO2-e in 2034–35 (8 per cent lower than the 2034–35 baseline projection) (Figure 12). In the high scenario, both higher production levels and fuel switching contribute to higher emissions. As with the low scenario, the production changes in the manufacturing sectors of non-metallic mineral products, iron and steel and chemicals are the same as those used in the 2014–15 industrial processes and product use projections high sensitivity analyses. In addition to higher levels of production, fuel switching is assumed to occur in non-metallic mineral products, basic non-ferrous metals and chemicals manufacturing. In the high scenario, emissions reach 40 Mt CO2-e in 2019–20 (9 per cent higher than the 2019–20 baseline projection) and 46 Mt CO2-e in 2034–35 (16 per cent higher than the 2034–35 baseline projection) (Figure 12). Fuel switching is only assumed to occur where it is technically and economically feasible, as well as consistent with environmental regulations. Domestic gas prices are expected to rise as Australia’s east coast gas market becomes linked to international market with the commencement of LNG exports from eastern Australia from 2014–15. The rising cost of developing new gas supply is also contributing to price increases. These price rises may influence large gas users to consider alternative fuels. In the high sensitivity analysis, in basic non-ferrous metals, some metal refining processes may be able to replace gas fired boilers with coal fired boilers for generating process heat to dry metal ores. In non-metallic mineral products, coal is assumed to replace some gas-fired kilns since coal ash is chemically similar to some of the end products. In chemicals manufacturing where natural gas is used for a feedstock for some chemicals, some replacement with synthetic gas (or syngas) derived from coal is assumed. Figure 12 Direct combustion manufacturing sensitivity analysis Source: DoE analysis Direct Combustion emissions projections 2014–15 22 Table 6 Direct combustion manufacturing sensitivity analysis, key years 2020 Change from baseline 2035 Change from baseline Mt CO2-e % Mt CO2-e % Baseline 37 0% 40 0% High emissions 40 9% 46 16% Low emissions 36 -3% 36 -8% Projection Source: DoE analysis Direct Combustion emissions projections 2014–15 23 Appendix A Changes from the 2013 Projections The 2014–15 direct combustion overall projection is lower than the 2013 Projection (DoE 2013). The difference is 4 Mt CO2-e in 2019–20 and -32 Mt CO2-e cumulatively from 2012–13 to 2019–20 (Table 7). The direct combustion modelling categories are not directly comparable between the 2013 and 2014–15 Projections due to a difference in industry aggregation in the modelling approaches. Industrial closures announced since the preparation of the 2013 Projections have reduced activity forecasts and emissions in basic non-ferrous metal and non-metallic mineral product manufacturing. In the energy sector, emissions have been revised downwards in line with the oil and domestic gas production forecasts from the 2014–15 fugitive projections, which are lower than in 2013. Other reductions in direct combustion energy emissions are due to: • a lower emissions factor used in the projection of emissions from manufacture of solid fuels, following a recalculation of historical emissions from this source • a lower activity forecast for refinery output following the announcement of the Bulwer Island refinery closure. Since 2013, the forecast of residential and commercial gas use has been revised down reflecting expectations of larger increases in gas prices than previously anticipated. This has contributed to lower direct combustion buildings emissions. Table 7 Differences between the 2014–15 and 2013 direct combustion projections Projection 2014 2020 Cumulative 2013 to 2020 2030 Mt CO2-e Mt CO2-e Mt CO2-e Mt CO2-e -1 -4 -32 -5 Difference Sources: DoE 2013, DoE analysis Direct Combustion emissions projections 2014–15 24 Appendix B Modelling approach In 2013, direct combustion emissions were modelled using the Monash Multi-Regional Forecasting model. In 2014–15, direct combustion emissions were modelled in-house using models developed by the Department. The primary data sources for the 2014–15 Projections were the national greenhouse gas inventory, Commonwealth agreed or third party activity information and NGERS data. The 2014–15 direct combustion projections are based on production or activity forecasts for different commodities and estimates of the emissions per unit of production or activity. Unless otherwise stated, the emissions intensity was assumed to remain constant over the projection period. These projections also assume that current policy settings in states and territories, such as restrictions on hydraulic fracturing in Victoria and regulations around coal seam gas development New South Wales, are maintained over the course of the projection period. Energy Cwing to the rapid projected growth of Australia’s LNG industry, direct combustion emissions from the production of LNG have been modelled at an individual project level using the same LNG production forecast as the 2014–15 fugitive projections. Emissions factors were prepared using actual emissions data reported under the NGERS (for currently operating projects), information contained in environmental impact statements and other company statements (for future conventional projects), and assumptions detailed by Jacobs and used in the Australian Energy Market Cperator’s (AEMC’s) 2014 forecasting exercises (Jacobs 2014). Production forecasts for other oil and gas, gas production and distribution and petroleum refining were sourced from the 2014–15 fugitive projection. Together with national greenhouse gas inventory and NGERS data, the production forecasts were used to generate the other oil and gas projection. Direct combustion emissions from the manufacture of solid fuels were modelled using a combination of bottom up modelling and industry growth rates from the Monash MultiRegional Forecasting model from the 2013 Projections. Mining The non-energy mining subsector was modelled for iron ore, gold and other mining. The iron ore and gold production forecasts were based on Office of the Chief Economist data and industry growth rates from the Monash MultiRegional Forecasting model. The other mining activity forecast was based on the industry growth rates from the Monash Multi-Regional Forecasting model from the 2013 Projections. The coal mining subsector forecast was based on the coal production assumptions outlined in the 2014–15 fugitive projections and emissions intensities derived from the NGERS. Manufacturing Activity forecasts for the manufacturing subsectors of basic non-ferrous metals, non-metallic mineral products, and iron and steel were based on Office of the Chief Economist data. The pulp print and paper projection was based on a forecast of paper and paperboard demand to 2016–17, and then industry growth rates from the Monash MultiDirect Combustion emissions projections 2014–15 25 Regional Forecasting model from the 2013 Projections thereafter. The projections for chemicals, food, beverage and tobacco and other manufacturing subsectors were based on industry growth rates from the Monash Multi-Regional Forecasting model from the 2013 Projections, with adjustments to the other manufacturing sector to account for announced closures in Australian car manufacturing. Buildings The residential and commercial gas forecasts were based on forecasts of the number of residential and commercial gas connections and the gas demand per connection (Core Energy Group 2014). For the projections base year of 2013–14, these figures were calibrated against gas use and gas flow data from network gas arrangements and Gas Bulletin Boards. For the projections period, gas price forecasts and the impact of these prices on consumer behaviour, and movements in population and household densities from Australian Bureau of Statistics projections were used to project the number of connections and gas use per connection. The historical trend of declining gas demand per residential and commercial connection—caused by policy changes, improved energy efficiency, and trends in households switching from gas to electricity—was assumed to continue to at least until 2034–35. Liquid and solid fuel use in the commercial sector was based on industry growth rates from the Monash MultiRegional Forecasting model from the 2013 Projections. The construction emissions projection was based on an activity forecast from the Australian Construction Industry Forum to 2022–23 and NGERS-derived emissions intensities (ACIF 2014). A five-year compound average growth rate from 2018–19 to 2022–23 was used to extend the emission series to 2034–35. Primary industries These projections are based on a forecast of diesel use from the 2014–15 Agriculture projections. Diesel use for fisheries and forestry is assumed to grow at the same rate as diesel use in agriculture. Direct Combustion emissions projections 2014–15 26 Appendix C References ACIF 2014, Australian Construction Market Report, Australian Construction Industry Forum, December 2014. AME Group 2014, AME Direct, Hong Kong. BREE 2014, Resources and Energy Quarterly, September Quarter 2014, Bureau of Resource and Energy Economics, Canberra, ACT. Core Energy Group 2014, Guidance on Fuel Switching, Report to the Department of the Environment, June 2014. DoE 2013, Australia’s Abatement Task and 2013 Emissions Projections, Department of Environment, Canberra, ACT. DoE 2015, Australian National Greenhouse Accounts: Quarterly Update of Australia’s National Greenhouse Gas Inventory September 2014, Department of the Environment, Canberra, ACT. Jacobs 2014, Updated Projections of Gas and Electricity Used in LNG, report prepared for the Australian Energy Market Operator. Wood Mackenzie 2015, LNG Tool, Edinburgh, UK. Direct Combustion emissions projections 2014–15 27