Tuition Reimbursement Policy - Community Resources for Justice

advertisement

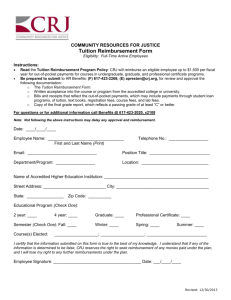

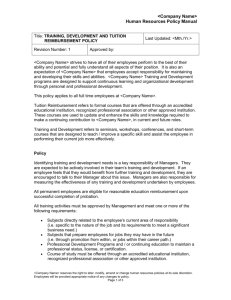

Tuition Reimbursement Program Policy Community Resources for Justice (CRJ) encourages the professional and personal development of every employee. The following policy establishes reimbursement for qualified educational expenses and successful completion of courses for undergraduate, graduate, and professional certificate programs in accredited colleges and universities. This Tuition Reimbursement Program is an IRS taxexempt program. Eligibility: All Full-time active employees are eligible for the Tuition Reimbursement Program upon the completion of three (3) months of continuous employment prior to the time of course or program enrollment. The course(s) taken must be job related or related to the Human Services Occupational field. Reimbursement Documentation Requirements: Employees interested in participating in the Program must be prepared to submit the following documentation: The Tuition Reimbursement Form. Written acceptance into the course or program from the accredited college or university. Bills and receipts that reflect the out-of-pocket payments, which may include payments through student loan programs, of tuition, text books, registration fees, course fees, and lab fees. Copy of the final grade report, which reflects a passing grade of at least “C” or better. All documentation must be submitted to Human Resources for review and approval. Reimbursement Amount: CRJ will reimburse an employee up to $1,500 per fiscal year for out-ofpocket payments for courses in undergraduate, graduate, and professional certificate programs. Reimbursements are paid through payroll in two (2) parts: Part 1: payment up to $750 when the following documentation is submitted: o Tuition Reimbursement Form o Written acceptance into the course or program from the accredited college or university. o Bills and receipts that reflect the out-of-pocket payments, which may include payments through student loan programs, of tuition, text books, registration fees, course fees, and lab fees. Part 2: payment up to $750 when the following documentation is submitted: o Bills and receipts that reflect the out-of-pocket payments, which may include payments through student loan programs, of tuition, text books, registration fees, course fees, and lab fees. o Copy of the final grade report, which reflects a passing grade of at least “C” or better. Reimbursement Restrictions: An employee will not be eligible for reimbursement if they withdraw from an approved course or if the approved course is cancelled. The employee is required to immediately notify Human Resources if they withdraw or a course is cancelled. Revised 12/30/2013 An employee will not receive reimbursement for grants, scholarships, GI Bills, and other stipends allocated to pay for educational expenses. Employees will only receive reimbursement for out-ofpocket payments, which may include payments through student loan programs. Termination of Eligibility: An employee’s eligibility ceases upon termination of employment prior to completion of an approved course or program. No reimbursements will be made to employees who have been involuntarily terminated and former employees after leaving employment. Miscellaneous: An employee who applies for tuition reimbursement after all budgeted program funds have been depleted will be kept on a waiting list. When the tuition reimbursement account is credited with funding, the employee will be considered a priority over others who are applying for reimbursement. An employee who is approved for the Tuition Remission Program, sponsored by the Providers’ Council, may be eligible to receive reimbursement of tuition, text books, registration fees, course fees, and lab fees that are out-of-pocket payments under CRJ’s Tuition Reimbursement Program.