LETTER TO OPPOSITION Dear Changes to tax deductions for self

advertisement

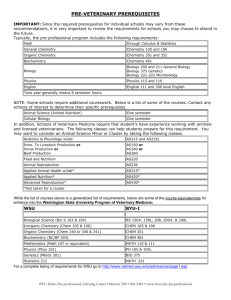

LETTER TO OPPOSITION Dear Changes to tax deductions for self-education expenses The government’s recent announcement that tax deductions for self-education expenses will be limited to $2000 a person per year from 1 July 2014 is of great concern to me. As a veterinarian, a cap on allowable deductions will impact my ability to fulfil the basic continuing educational requirements of the veterinary profession. In [insert state], Veterinarians are required under legislation to attend continuing educational courses in order to maintain registration. The proposed education deduction limit of $2000 will be less than the out-of-pocket expenses required to attend quality programs to maintain professional standards. Veterinary science and animal health advances are rapid. Professional education is critical for veterinarians in order to deal with emerging diseases such as Hendra virus, new technologies, medicines and procedures, as well as meet the demands of higher client expectations. Australian veterinarians also need to travel overseas to learn the latest medical techniques in their particular field of speciality, which can make self-education costs very high. [ if applicable - For me, living in a rural/remote area means travelling to capital cities or large regional centres to access quality veterinary education.] It would be a shame if veterinarians are forced to pursue less specialised educational options at the expense of the health and welfare of animals. Animal standards and biosecurity surveillance will also be put at risk as many veterinarians play a crucial role in these areas. For these reasons, I would urge you to oppose this change and for the Coalition to publicly commit to overturning this measure as part of the 2013 Election Policy platform. I look forward to your support on what is a critical issue for veterinarians, the welfare of animals, and your constituents.