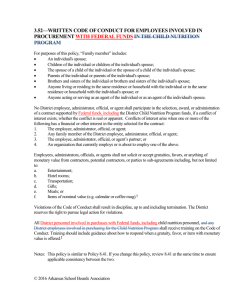

PROBLEMS (p. 341)

advertisement

PROBLEMS (p. 341) 1. You are a wage earner in a “typical family,” with $50,000 gross annual income. Use the easy method to determine how much insurance you should carry. (LO10.1) = $245,000. 2. You and your spouse are in good health and have reasonably secure careers. Each of you makes about $40,000 annually. You own a home with an $80,000 mortgage, and you owe $15,000 on car loans, $5,000 on personal debts, and $4,000 on credit card loans. You have no other debt. You have no plans to increase the size of your family in the near future. Estimate your insurance needs using the DINK method. (LO10.1) Insurance need (DINK) = ½ debts + funeral costs Total insurance needs = $62,000 3. Shaan and Anita are married and have two children, ages 2 and 7. Anita is a “nonworking” spouse who devotes all of her time to household activities. Estimate how much life insurance Shaan and Anita should carry. (LO10.1) Insurance needed = $160,000. 4. Obtain premium rates for $50,000 whole life, universal life, and term life policies from local insurance agents. Compare the cost and provisions of these policies. (LO10.2) The purpose of this problem is to learn that term life insurance is the least expensive form of life insurance. 5. Use the Figure It Out! worksheet on page 323 to calculate your own life insurance needs. (LO10.1) Responses will vary. 6. Use Exhibit 10-1 to find the average number of additional years a 20-year-old male and female were expected to live, based on the statistics gathered by the U.S. government as of 2008 (LO10.1) Male 56.5 years: Female 61.2 years 7. Mark and Parveen are the parents of three young children. Mark is a store manager in a local supermarket. His gross salary is $65,000 per year. Parveen is a full time stay-at-home mom. Use the easy method to estimate the family's life insurance needs. (LO10.1) = $318,500 8. You are a dual-income, no-kids family. You and your spouse have the following debts (total): mortgage, $200,000; auto loan, $10,000; credit card balance, $4,000; other debts, $10,000. Further, you estimate that your funeral will cost $8,000. Your spouse expects to continue to work after your death. Using the DINK method, what should be your need for life insurance? (LO10.1) Total need for life insurance = $120,000 9. Using the "nonworking" spouse method, what should be the life insurance needs for a family whose youngest child is 8 years old? (LO10.1) = $100,000 10. Using the "nonworking" spouse method, what should be the life insurance needs for a family whose youngest child is 4 years old? (LO10.1) = $140,000 11. Your variable annuity charges administrative fees at an annual rate of 0.15 percent of account value. Your average account value during the year is $100,000. What is the administrative fee for the year? (LO10.4) You will pay $150 in administrative fees. 12. Sophia purchased a variable annuity contract with a $25,000 purchase payment. Surrender charges begin with 7 percent in the first year, and decline by 1 percent each year. In addition, Sophia can withdraw 10 percent of her contract value each year without paying surrender charges. In the first year, Sophia needed to withdraw $6,000. Assume that the contract value had not increased or decreased because of investment performance. What was the surrender charge Sophia had to pay? (LO10.4) = $245. 13. Shelly’s variable annuity has a mortality and expense risk charge at an annual rate of 1.25 percent of account value. Her account value during the year is $50,000. What was Shelly’s mortality and expense risk charge for the year? (LO10.4) = $625