Introduction to Assessment Briefings

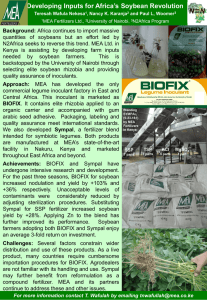

advertisement

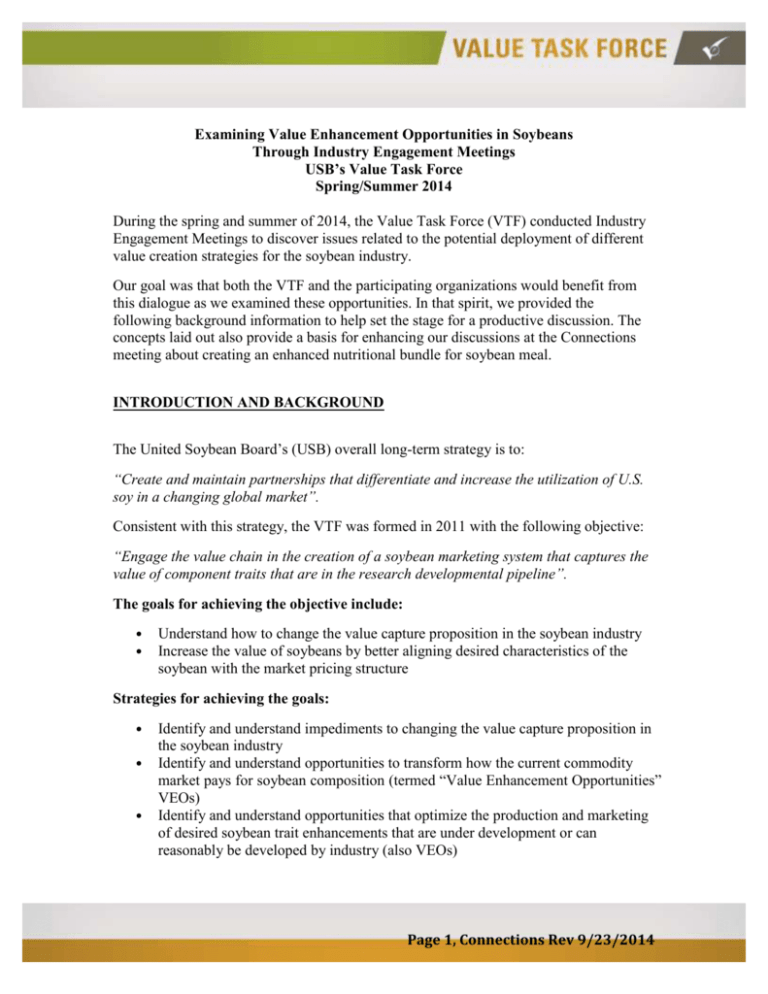

Examining Value Enhancement Opportunities in Soybeans Through Industry Engagement Meetings USB’s Value Task Force Spring/Summer 2014 During the spring and summer of 2014, the Value Task Force (VTF) conducted Industry Engagement Meetings to discover issues related to the potential deployment of different value creation strategies for the soybean industry. Our goal was that both the VTF and the participating organizations would benefit from this dialogue as we examined these opportunities. In that spirit, we provided the following background information to help set the stage for a productive discussion. The concepts laid out also provide a basis for enhancing our discussions at the Connections meeting about creating an enhanced nutritional bundle for soybean meal. INTRODUCTION AND BACKGROUND The United Soybean Board’s (USB) overall long-term strategy is to: “Create and maintain partnerships that differentiate and increase the utilization of U.S. soy in a changing global market”. Consistent with this strategy, the VTF was formed in 2011 with the following objective: “Engage the value chain in the creation of a soybean marketing system that captures the value of component traits that are in the research developmental pipeline”. The goals for achieving the objective include: • • Understand how to change the value capture proposition in the soybean industry Increase the value of soybeans by better aligning desired characteristics of the soybean with the market pricing structure Strategies for achieving the goals: • • • Identify and understand impediments to changing the value capture proposition in the soybean industry Identify and understand opportunities to transform how the current commodity market pays for soybean composition (termed “Value Enhancement Opportunities” VEOs) Identify and understand opportunities that optimize the production and marketing of desired soybean trait enhancements that are under development or can reasonably be developed by industry (also VEOs) Page 1, Connections Rev 9/23/2014 Tactics for undertaking strategies for achieving the goals: • • • Sponsor initial research of issues specific to creating additional value in the soy complex from a variety of different VEOs (this is essentially complete) Undertake a series of Industry Engagement Meetings to elicit deeper insights from a broader group of industry experts about the VTF process in general and to vet specific VEOs Hold an Industry Workshop that brings key representatives of the entire soybean value chain together to target which VEO(s) is/are most promising and to begin developing strategies for transforming the market so that all can achieve optimal economic benefit from the VEO(s) The remainder of this document provides a summary of considerations that apply broadly across all VEOs. Following that are two “Assessment Briefings” that include discussions of the value proposition and the market transformation required to bring two potential meal enhancement opportunities to market. KEY CONSIDERATIONS FOR MARKET TRANSFORMATION IN THE SOY VALUE CHAIN Many interconnected factors have shaped the soybean value chain to be what it is today – it is big, efficient and can be very rigid. Introducing change will be met with natural resistance, even if the change can ultimately provide win-win outcomes. Below is a summary of some of the concepts and forces that will need to be acknowledged as we consider the introduction of new traits or other market transformation events. Following each of the concepts, keys to success and questions for further exploration are stated in italics. Stages of Market Transformation Market transformation will occur at different rates and to different degrees based on the specific characteristics of a given VEO. However, we can generally think about the major stages in the transformation as follows: 1. Niche Introduction – Few processors in cooperation with one or two seed companies contract for limited acreage in limited geographies based on perceived demand by the processors and limited by seed availability. End users test the trait and determine whether it is worthy of a long-term commitment. Processors determine whether they can attract enough acreage and demand to make crushing and further processing (if required) economical on a larger scale. 2. Broad Market Expansion – Multiple processors participate in acreage contracting and additional seed companies provide more seed available over a wider geography, which allows for broader distribution of any end product(s). Acreage remains a significant minority of all soybean acreage planted. Page 2, Connections Rev 9/23/2014 3. Commoditization – A wide dispersion of processor locations create “sub-markets” in which the trait enhanced soybeans are either preferred or required in commercial trade. Premiums per se for growing the enhanced trait soybeans disappear, but somewhat separate markets evolve that effectively create economic incentives for producers to favor trait enhanced seed where markets exist. International demand for the trait enhanced soybeans and/or any products derived from the traits are served through normal export channels. Navigating through these three stages will be very different for each VEO and will be further impacted by other market developments that may come up along the way. It will be critical to map out the expected progression for each VEO and identify potential challenges along the way. The value chain must realize that the period from Stage 1 Niche Introduction to Stage 3 Commoditization (large scale or small scale) will be inefficient and somewhat uneconomical. Value chain segments must be willing to “invest” through acceptable economic losses and/or through direct dollar investments to achieve commoditization in a timely manner. Based on anticipated market size and adoption rates, develop scenarios to determine the rates of production, handling, and processing growth needed to effectively serve the downstream users and estimate the economic challenges during Stage 2 Broad Market Expansion. With this knowledge, value chain segments can invest accordingly and educational programs can be developed to prepare the market for efficient conversion. Seed Technology Performance Robust seed technology is very important. This includes yield parity, consistent expression of the desired trait, and necessary agronomic packages. If yield and agronomic parity to commodity soybeans is not possible, then the incremental value of the quality enhancement will need to be sufficient to cover such shortfalls. Seed companies need to be prepared to share credible performance data with the marketplace to assure that yield parity exists, or to quantify any shortfalls in yield performance that need to be accounted for in the market. Confidence in the Investment Seed companies must gain sufficient confidence that they will be able to recapture value from these traits to give them justification to invest in development. This means that the details of the value capture propositions need to be worked out years ahead of the introduction of seed to the market. A clear understanding of the downstream value needs to be developed and shared with end-users to validate that they would use and be willing to pay for a portion of the value added. Page 3, Connections Rev 9/23/2014 All chain participants must have realistic expectations about the actual value that can be realized and understanding that part of the return will be realized in the form of a more competitive soybean industry. Producers, in particular, must understand that the primary value to them results from more demand for one or both soybean products or the soybean itself, which in turn results in more soybeans demanded and higher soybean prices for all soybean producers, not just those growing the enhanced soybean. Research is needed to determine exactly how much value there is to go around and develop scenarios of how the value is shared. Results need to be incorporated into educational materials to begin setting the stage across the industry well before rollout. Enabling Practices and Technologies Identify Preservation (IP) costs must be kept at an absolute minimum so they do not erode a large portion (or all) of the incremental value created. Perceived IP costs all along the value chain must better reflect real IP costs. Credible research needs to identify actual IP costs across the value chain. These results can then be shared with value chain participants through educational efforts prior to rollout to set realistic expectations. Cost effective, accurate, and consistent measurement technology that is broadly accepted will be a key to the success of many of the VEOs. Building on the previous point, research is needed to determine the frequency, accuracy, and acceptable cost of measurement technology to enable fair trade and maximize value capture. Current risk management tools must be effective in protecting producers and other participants up and down the value chain from the new areas of risk that will arise from constituent-based pricing; otherwise, new tools must be developed to protect adequately from any added risk. Conduct research to understand the cost of variability and potential temporary loss of supply. Based on this, risk management “needs assessment” can be developed and presented to organizations in the business of insuring such risks. The Impact of Emerging Market Forces Traits need to be competitive in the long-term. Natural market forces drive users of soybean oil and meal to perpetually seek out cheaper, more functional or higher value alternatives. Competing product sectors are investing in research and technologies to develop better products, just as the soybean industry is doing. Thus, an important factor is the amount of time it takes to bring a particular trait to market and then up to production scale. It is important to not get caught up in focusing on today’s competition with solutions that will not be ready for 5 to 10 or even 15 years, unless we are confident that the competition will not change and that the underlying need will remain. Page 4, Connections Rev 9/23/2014 Need to understand if we are headed in the right direction to remain competitive given what the competition will be bringing to the market over the next 10-20 years? Companion technologies (processing, etc.) may provide value to traits that on their own would have limited value. Again, it is not just technologies that exist today, but those that will exist 10-20 years in the future. Need to understand existing and new technologies that could be coupled with new soybean quality traits that might add unique value that is not available from competing products. Page 5, Connections Rev 9/23/2014