E.5: Arrangements for Banking, Cash & Cheques

advertisement

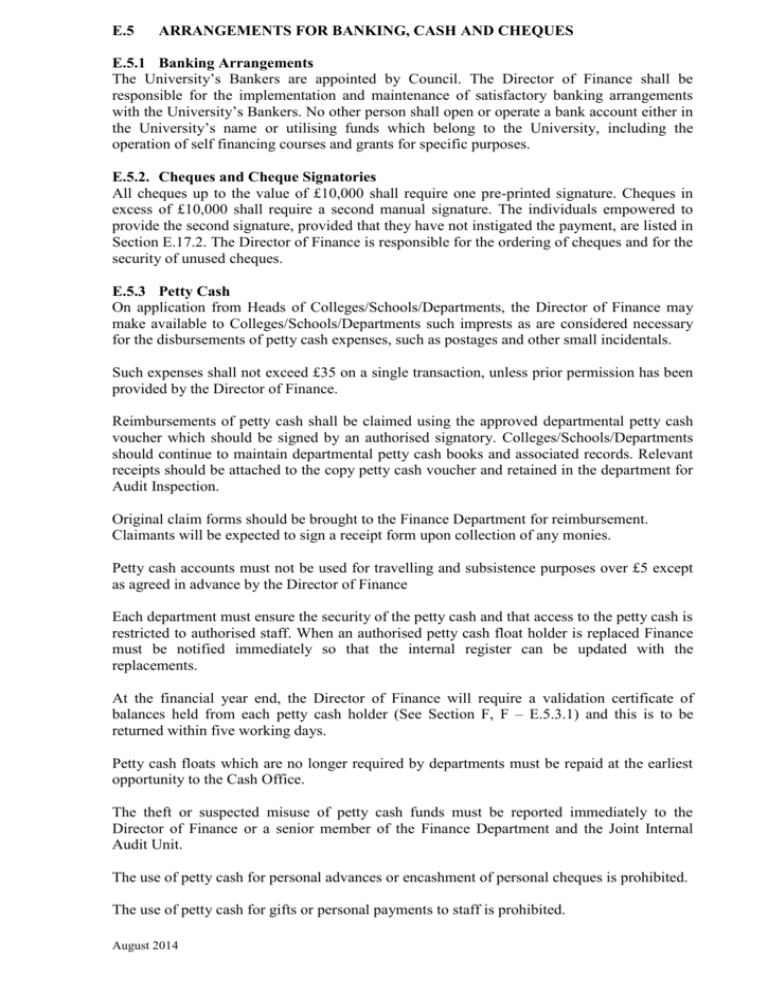

E.5 ARRANGEMENTS FOR BANKING, CASH AND CHEQUES E.5.1 Banking Arrangements The University’s Bankers are appointed by Council. The Director of Finance shall be responsible for the implementation and maintenance of satisfactory banking arrangements with the University’s Bankers. No other person shall open or operate a bank account either in the University’s name or utilising funds which belong to the University, including the operation of self financing courses and grants for specific purposes. E.5.2. Cheques and Cheque Signatories All cheques up to the value of £10,000 shall require one pre-printed signature. Cheques in excess of £10,000 shall require a second manual signature. The individuals empowered to provide the second signature, provided that they have not instigated the payment, are listed in Section E.17.2. The Director of Finance is responsible for the ordering of cheques and for the security of unused cheques. E.5.3 Petty Cash On application from Heads of Colleges/Schools/Departments, the Director of Finance may make available to Colleges/Schools/Departments such imprests as are considered necessary for the disbursements of petty cash expenses, such as postages and other small incidentals. Such expenses shall not exceed £35 on a single transaction, unless prior permission has been provided by the Director of Finance. Reimbursements of petty cash shall be claimed using the approved departmental petty cash voucher which should be signed by an authorised signatory. Colleges/Schools/Departments should continue to maintain departmental petty cash books and associated records. Relevant receipts should be attached to the copy petty cash voucher and retained in the department for Audit Inspection. Original claim forms should be brought to the Finance Department for reimbursement. Claimants will be expected to sign a receipt form upon collection of any monies. Petty cash accounts must not be used for travelling and subsistence purposes over £5 except as agreed in advance by the Director of Finance Each department must ensure the security of the petty cash and that access to the petty cash is restricted to authorised staff. When an authorised petty cash float holder is replaced Finance must be notified immediately so that the internal register can be updated with the replacements. At the financial year end, the Director of Finance will require a validation certificate of balances held from each petty cash holder (See Section F, F – E.5.3.1) and this is to be returned within five working days. Petty cash floats which are no longer required by departments must be repaid at the earliest opportunity to the Cash Office. The theft or suspected misuse of petty cash funds must be reported immediately to the Director of Finance or a senior member of the Finance Department and the Joint Internal Audit Unit. The use of petty cash for personal advances or encashment of personal cheques is prohibited. The use of petty cash for gifts or personal payments to staff is prohibited. August 2014 E.5.4 Use of Cash Tills All departments using a till must be issued with a copy of the University’s standard till control procedures. Departments should contact the Finance Department and request a copy when a till is put into use. A copy of the procedures are contained in Section F (F – E.5.4). The Head of Department or nominee must confirm that each procedure is in place and identify which members of staff are responsible for operating the procedures. Departmental cash income routines may periodically be reviewed to ensure that procedures are being complied with. E.5.5 Opening of Cheques for Cash Whenever possible, the opening of cheques for cash should be avoided. However, the following guidelines should apply:Cheques may be opened for cash:i. ii. iii. where departments need to distribute small sums to students etc. instead of drawing cheques e.g. Refund of Laboratory Deposits or payments to students for participating in experiments etc. (Full receipted details including signatures must be returned to Finance) where departmental visitors from abroad, who do not have UK bank accounts need to be reimbursed for expenses etc. Cheques should be made payable to the visitor concerned. Departments must ensure such requests arrive in time for the relevant payments run. Cash payments from the Cash Office are not permissible where the recipient does not have a UK bank account Cheques may not be opened for cash in any other instance unless approved by the Director of Finance. Departments requiring cash for other approved activities may apply in writing to the Director of Finance. Such requests must be sent at least three days in advance of the date required. In those circumstances cheques may be made payable to cash, drawn and held in the Cash Office pending payment. Cash and Travel advances to be returned must be done through the departmental banking within 3 working days The regulations relating to cash advances are contained in Section E.8.16. All payments must be covered by receipts from the spending departments normally within fourteen days of collection. E.5.6 Cash Receipts Employees receiving cash and cheques in the course of their duties shall be required to remit all monies and / or bank in full, within 7 working days of receipt. E.5.7 Treasury Management 1. The Swansea University has adopted the following four key recommendations of CIPFA’s Treasury Management in the Public Services: Code of Practice (the Code) 2001, as described in Section 4 of that code. August 2014 - Public service organisations should put in place formal and comprehensive objectives, policies and practices, strategies and reporting arrangements for the effective management and control of their treasury management activities. - Their policies and practices should make clear that the effective management and control of risk are prime objectives of their treasury management activities - They should acknowledge that the pursuit of best value in treasury management, and the use of suitable performance measures, are valid and important tools for responsible organisations to employ in support if their business and service objective; and that within the context of effective risk management, their treasury management policies and practices should reflect this. In order to achieve the above, the University has: i) Adopted the four clauses in section 5 of the code (see below). ii) Adopted a treasury management policy statement as recommended in section 6 iii) Followed the recommendations in section 7 concerning the creation of Treasury Management Practices “It is CIPFA’s view that throughout the public services the priority is to protect capital rather than to maximise return. The avoidance of all risk is neither appropriate nor possible. However, a balance must be struck with a keen responsibility for public money.” The University strongly endorses this view. 2. The University has adopted: a Treasury Management policy statement, which is contained in the financial policies and procedures (see below) Treasury Management practices (TMP’s), which set out the manner in which it seeks to achieve its policies and objectives, how it will manage and control its Treasury Management activities (see Section F – E.5.6) 3. The Finance Committee will receive appropriate reports on Treasury Management policies, practices and activities. 4. The University delegates responsibility for the implementation and monitoring of its treasury management policies and practices to the Finance Committee, and for the execution and administration of treasury management decisions to the Director of Finance, who will act in accordance with the organisation’s policy statement and TMP’s (and the CIPFA’S standard of Professional Practice on Treasury Management). Policy Statement The University has adopted the following definition of treasury management: “The management of its cash flows, its banking, money market and capital market transactions; the effective control of the risks associated with those activities; and the pursuit of optimum performance consistent with those risks”. The University regards the successful identification, monitoring and control of risk to be the prime criteria by which the effectiveness of its Treasury Management activities will be measured. Accordingly, the analysis and reporting of treasury management activities will focus on their risk implications for the organisation. August 2014 The University acknowledges that effective treasury management will provide support towards the achievement of its business and service objectives. t is therefore committed to the principles of achieving best value in treasury management, and to employing suitable performance measurement techniques, within the context of effective risk management. E.5.8 Borrowing All borrowing undertaken by the University will be in accordance with the Treasury Management Policy Statement (see Section F – E.5.6). E.5.9 Investments - Short Term The Director of Finance, as advised by the Finance Committee is responsible for making arrangements for the short term investment of cash balances held on behalf of the University. The limit for investment with any one organisation shall be determined by the Finance Committee. All investments will be in accordance with the Treasury Management Policy Statement (see Treasury Management Policy, F – E.5.6)). E.5.10 Anti-Money Laundering Policy The University’s anti-money laundering policy can be found at F - E.5.10. August 2014