Ques McDaniel, S.A., et al (2013). Generationing relations in

advertisement

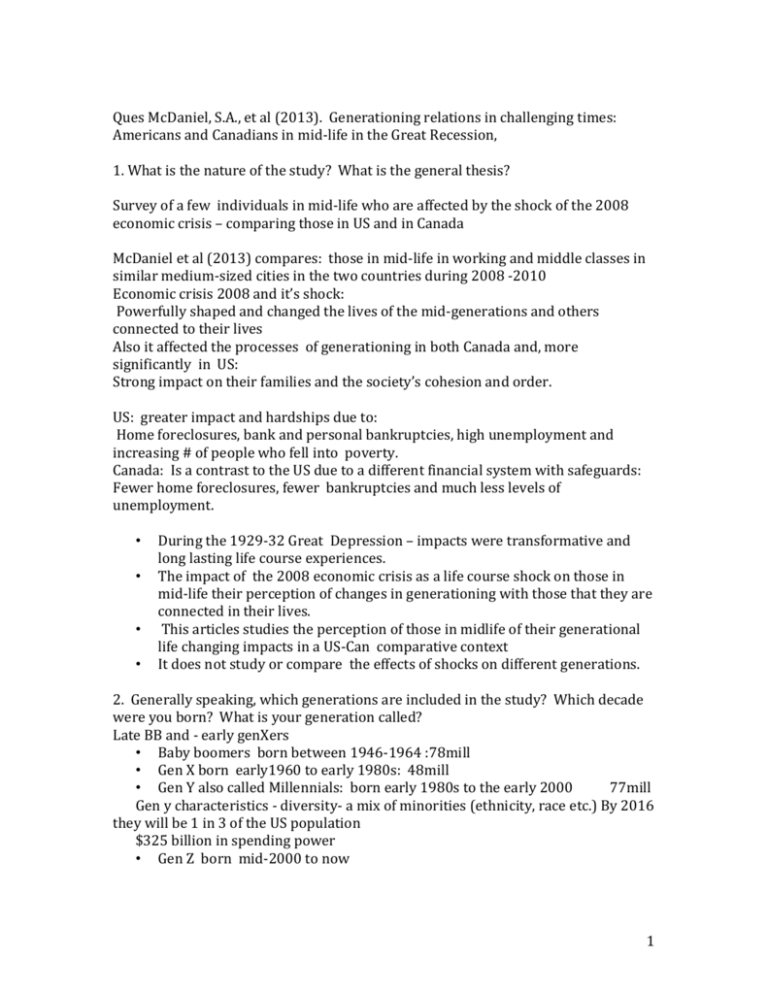

Ques McDaniel, S.A., et al (2013). Generationing relations in challenging times: Americans and Canadians in mid-life in the Great Recession, 1. What is the nature of the study? What is the general thesis? Survey of a few individuals in mid-life who are affected by the shock of the 2008 economic crisis – comparing those in US and in Canada McDaniel et al (2013) compares: those in mid-life in working and middle classes in similar medium-sized cities in the two countries during 2008 -2010 Economic crisis 2008 and it’s shock: Powerfully shaped and changed the lives of the mid-generations and others connected to their lives Also it affected the processes of generationing in both Canada and, more significantly in US: Strong impact on their families and the society’s cohesion and order. US: greater impact and hardships due to: Home foreclosures, bank and personal bankruptcies, high unemployment and increasing # of people who fell into poverty. Canada: Is a contrast to the US due to a different financial system with safeguards: Fewer home foreclosures, fewer bankruptcies and much less levels of unemployment. • • • • During the 1929-32 Great Depression – impacts were transformative and long lasting life course experiences. The impact of the 2008 economic crisis as a life course shock on those in mid-life their perception of changes in generationing with those that they are connected in their lives. This articles studies the perception of those in midlife of their generational life changing impacts in a US-Can comparative context It does not study or compare the effects of shocks on different generations. 2. Generally speaking, which generations are included in the study? Which decade were you born? What is your generation called? Late BB and - early genXers • Baby boomers born between 1946-1964 :78mill • Gen X born early1960 to early 1980s: 48mill • Gen Y also called Millennials: born early 1980s to the early 2000 77mill Gen y characteristics - diversity- a mix of minorities (ethnicity, race etc.) By 2016 they will be 1 in 3 of the US population $325 billion in spending power • Gen Z born mid-2000 to now 1 3. What does generationing refer to? Generationing: Generation as a notion is attributed to a process that begins during the formative years and continues through other stages of life During one’s formative years, i.e., life’s crucial stages that define historical, social and biographical experiences, generation building occurs. These experiences formed during the youthful period become a specific common generational view. Thus these experiences are the basis of the process called generationing. 4. What does McDaniel, et al identify as differences and similarities between a generation’s and a multigenerations’ experiences and what are their impacts? • Generationing is used to study: Multigenerations’ experiences of the historical and social events and the techno-cultural milieu in which they live • They are expressed in the collective narrative of the generations’ memories and how they frame their interpretations of the times in which they have experienced these events • These influence the way they live and would continue to live in the future • One generation’s experiences also become shared experiences of the earlier and the following generations’ experiences • However, the shared narratives and memories are different for different generations. • The same decade of history may be narrated or remembered differently depending on one’s generational belonging. Generationing as a process produces a generational identity i.e., self definitions are integrated to form this identity. Identity with one’s own generation and differentiating from other generations. 5. In their midlife, how did the demands of older and younger generations affected them and why? How and why: In their midlife, how did the demands of older and younger generations affected them and why? (Interviews done in 2008 - the housing bubble burst and financial markets in the US slumped through spring 2010. ) It was not just a market crisis but an economic crisis that spread beyond the housing and financial sectors in the US It left millions without jobs and threatened entitlements: pensions, Millions in US and elsewhere, lost their life savings and destroyed the international confidence in the soundness of the AIC’s economies 6. What are the impacts on the US as a whole? What do you find in Table 1? US and Canada: US: 2 • • • • Steep and unalterable rise in long term chronic unemployment Long term persistence of record number of unemployed, still plaguing the US Rise of ghost towns and empty neighbourhoods due to housing market collapse and mortgage defaults and housing foreclosures Poverty and inequality: Already high inequality in the US compared to other OECD countries, now became worse • 7. What is the life course perspective and how is its narrative grouped? Give an example of how it is related to social inequality. Life course perspective and structures of social inequality: • The life course perspective examines and explains people’s and their social experiences as processes from birth to death • Life course perspective narratives can be grouped under: path dependency gravity shocks • We can see Path dependency as one’s early transitions into adult statuses, e.g. having family, children earlier, finding a job and entering workforce with less education, confront life-long adverse circumstances. • Others who delay these experiences of adulthood and enter it when they have resources, find themselves experience less life course adversity • Path dependency has adverse impact on one’s early life course transitions and it is hard to overcome. 8. How do path dependency, gravity, and shocks impact on one’s equality ? 3 • • • • Gravity: Powerful forces of social disadvantage, e.g., unequal access to resources, living in poverty, marginalization- these impede and arrest the development of individuals even if they have made sound life choices There is a gravity pull of adverse situations they have experienced that clings to them and are extremely hard to overcome even with education. Inequality persists and intensifies while other enabling forces are weaker or become unavailable. Shocks: Whether these are individual or socioeconomic may occur unexpectedly and their impacts are severe. Preparedness, savings, social supports can help to temper shocks. 9. What are the differences presented in Table 2? In US , among mid-lifers: unemployment seems lower than in Canada In Canada: Higher labour market participation US-Can: Contrasts in mortgage arrears and in home foreclosure rates. 39% of American households with somebody unemployed, debt (negative equity) on their homes, or defaulted or in arrears on house payments. US: low or no expectations on reliability of their economic performance or stock market, recovery in housing or job markets 10. What are the differences in facing the Uncertain Future, between Canada and the US? What are the differences between classes and why? • • US: Biggest concerns is uncertainty of employment: job loss, esp. those whose health insurance is linked to their job – will the job lost until retirement if one has a job? US & Can: Classes – middle vs. working classes – distinctly different retirement concerns between the two classes - middle-class is more confident but working-class members are uncertain/fearful of jobs and of any prospects of retirement funds 4 Canadian middle-class – more optimistic in their concerns on retirement, but increasingly they fear that their prospects may decline with a declining economy. Canadian mid-lifers feel concerned about that Increasing cost of living and declining returns from investments and RRSPs and know that this will have generationing implications, i.e., their linked family next generation members will have to be supported • Comparison (cont’d) US: Middle-class families face housing and real estate price declines, increasing cost of health care and uncertain future of Social Security Can: Working-class is not financially ready or preparing for retirement or planning for old age – in US and in Canada, working class wishes to continue working if there is a job for them and to take one day at a time as they live pay to pay left with nothing to save. • • • • US: Working-class say that they will will be financially worse off than their earlier generations. Their parents had good jobs had better and dependable govt. support programmes – had affordable housing pensions Medicare/Medicaid and Social Security. Mid-life middle class US people say that they are more secure when compared to what the working class counterparts say. They feel that they would be better off than their parent’s. Middle-class feel more confident than the working-class that they will be in a better positions in their later years than the preceding generation. Canada: Middle-class Canadians, in contrast, doubt whether their security would continue under the global financial stress – a mixed view compared to their parent’s generation If it is an immigrant and their parents are from the III world, Canada feels like a security-ensuring country even under the fin crisis. 11. Why are the mid-lifers concerned about the Younger generation and their life course expectations? Younger generation and their life course expectations: Both mid-life Canadian and Americans seriously worry about their lack of financial security of their relatives of the younger generation. While middle-class persons are concerned, working-class individuals fear how their children will be able to face their future in such a declining economy. Working-class Americans are anxious and frustrated that the next generation - their younger relatives would encounter worsening economic and political contexts that would be unfavourable to them. Likely economic recession, disappearing or diminishing social programmes, absence of good jobs and retirement with pension. Can: Immigrants from poorer countries find Canada as a heaven even under fin stress. Canadian working-class immigrants say that they expect that their children’s later years will be better off . 5 12. What are the clear differences between US midlife middle/working class reactions and those of Canada? 1. US: • • • Midlife middle and working class reaction: Distrust or openly hostile to their government High in anxiety and sense of insecurity about health care and Social Security Angry that the govt is worsening the prospects of the next generation- the youth • Fear of losing their health insurance 2. Canadian middle class: are concerned about • Pension value and sustainability • Changing eligibility to qualify for old age security • Working-class Canadians fear government’s plan to increase the minimum age of eligibility, and reduction in benefits. 3. All Canadians are worried about cutbacks in public programme. 4. In contrast to the Americans, Canadians do not see the govt. as the main problem but the 2008 crisis as the problem particularly for the increasing cost of living and housing 13. What are the characteristics found in the American and Canadian midlifers in Generationing through difficult transitions? 3. Generationing through difficult transitions Canadian and Americans in mid-life: • Support significantly with financial help to younger generations but rarely get financial support from younger or older generation of relatives. • deeply worried about their own future years. • working-class American expect that they would ask for help from their own and their spouse’s siblings or same-generation relatives if they are in dire straights. • In financial difficulties, both Can and American hope to receive support from family, younger, older and same generation. But few will ask friends or colleagues. (cont’d) • Generationing might tie multiple generations and drag them all financially down as they turn to support each other. • Co-residency of adult children with their parents is a common pattern . • US: Co-residency of generations can provide temporary shelter at difficult life course transitions - working-class American, provides support for her son who is recovering from a serious car accident 6 • Returning to the parental home during a life transition, such as work relocation, schooling, or union dissolution, helps adult children financially and emotionally Their views on the younger (Next) generation: • More and lengthy period of education and training before jobs • Cost of housing rising beyond their ability to get one • Joblessness or temp jobs • Little or diminishing access to social support or security, benefits • The youth will be less independent due to these circumstances • Live with parents • Mid-life parents as the only fin support to the transition of their young adults • Even after they move out of the parental home, parental support is necessary. • During the recession, household debt rose to a record high level in both countries: • 2009: American household debt-to-income ratio: over 160% Canadian household debt over 140% . • Grandparenting regular childcare (anticipated and actual) for grandchildren • Both Can and American: Mid-lifers rarely move in with their parents – the older generation • • • • • • Canadians: When the parent’s generations age, Midlifers expect that they would have to provide personal help and support for daily chores and care This is significantly based on gender specific allocation of work – women frequently support physically and personally with instrumental support to older generations. When parents face difficulties with physical mobility, their mid-life daughters or daughters-in-law support them. Men Midlifers help with regular phone calls, visits, or advice. Mid-life Canadians worry that social and community support systems are disappearing due to austerity cutbacks to programmes. More middle-class Canadian than working-class mid-lifers feel that the older generation needs better services , more and better affordable seniors’ housing, transportation, homecare, meals on wheels, caregiver support and emotional/social support. Americans: do not anticipate any improvement in social services other than what they have due to the crisis. They worry that the existing and limited Medicare/Medicaid and social security might decline or disappear. They rely on family support, have few expectations about support beyond basic health and social security programme. What are the conclusions? Conclusion: 1. US & Can: Generations are radically affected during and after the economic recession. Especially the middle-class youth are insulated by the processes 7 of generationing as they are being supported by their parental generation. In contrast, the working-class youth are not insulated by the generationing, and therefore they fall into further unequal opportunity trap as social inequalities widen in society. 2. In US: younger middle-class generations who gain from generational transfer of support of different kinds are at risk. Their support other than generational is diminishing. Mid-lifers work hard to compensate for the impact of economic recession on younger generations, even as they themselves do not feel that there is security in their own future. 3. Canadian mid-lifers are mildly touched by the crisis relative to their American counterparts – Canadians are less hard hit, but are quite concerned about their own future as they age. They are worried that they may not be able to help their younger and older relatives in financial straights as they themselves may be depleted of resources. The exception is Canadian immigrants, 8