Woodford Robert Woodford Mrs. Burr, Instructor English 1010, 2nd

advertisement

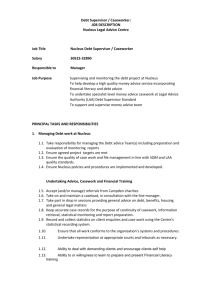

Woodford 1 Robert Woodford Mrs. Burr, Instructor English 1010, 2nd Period March 26, 2014 America’s Economic Crises America has a problem. The economic situation of the United States has translated to an ever increasing national debt which currently sits around $17.6 trillion or roughly $55.2 thousand per U.S. citizen (this figure includes non-taxpayers). Many ideologies conflict on what course of action should be taken to combat the repercussions and consequences of having such a high debt, or whether anything should be done at all. However, as with any debt that has interest, the debt will continue to rise unless something is done. In order to fix America's growing debt problem and the consequences affiliated with it, a major and affective solution must be implemented—better sooner than later. Mankiw states when the government tax revenue is less than government spending the budget deficit arises. In order to finance the deficits, government issues bonds (qtd.in “Budget Deficit”, 75). In other words, the National Debt is the cumulative amount of budget deficits and bonds are money given to the government; eventually the government will pay the respective party back the amount given to them plus interest. Every year, the president of the United States is required to submit a budget for the upcoming year with the help of the Congressional Budget Office (CBO). The budget, after many processes, make it to the House and Senate where it is either agreed on or rejected, however, neither one has an obligation to agree to the budget in which case the previous year's budget resolution is put in place. Most of the budget is spent on social programs, namely Social Security, Medicare, Medicade, and Welfare. These social programs are either entitlement programs or criteria programs meaning, Woodford 2 if an individual fits the established criteria or meets a certain set of standards, the government is required to give that service. The rest of the budget is mostly spent on discretionary spending and paying the interest on the national debt. Since the government is only required to pay the interest on the national debt, the national debt only increases. As the national debt increase, so does the interest. Since the interest gets increasingly expensive, it eats up more of the budget which translates into other discretionary programs getting cut or eliminated. The serious problems will begin to occur when the interest on the National Debt and the expanding need of social programs take out discretionary spending, and then the government will be forced to cut back on social programs which would cause a plethora of problems. Unless the U.S government reforms how social programs work, or how to successfully combat the national debt (preferably both), America will face enormous budget problems (and all the problems that follow) in the near future. Budget: Roughly represents how federal dollars are used; Social Security, Medicare, and Interest on Debt are non-discretionary expenses (Sdvfp, 1). Woodford 3 Conservative ideals and Liberal ideals of how debt and budget should work are polar opposites of each other and often resulting in indecision and delayed action. Thus when deciding on what should be done about dealing with the National Debt (or anything) they often find themselves in a political gridlock causing a compromised deal that may not even be in the best interest of the country but a way to somewhat satisfy both parties (Mcmahon, 1). Many politicians, whether they are Republican or Democrat, leaning conservative or liberal, will not vote for a balanced or reduced budget. Often times, politicians get elected because they promise some kind of change in their respective area, things like better schools and facilities, better care for the poor and etcetera. As with most things, changes for the betterment of the community simplifies to one thing—more funds. Therefore if anything, politicians want to increase the budget as opposed to limit it. Other problems that haven’t taken place yet are imminent. One financial crises America will face in the near future is taking care of the older generation, “[Y]ou just can’t stand against the march of an ageing population and the effect that’s going to have on our entitlement programs, which are growing at a faster rate than the economy” (Kiplinger, qtd. in “The Ticking Debt Bomb”, 51). In other words, due to obligations stated in our entitlement programs, the younger generation will have to pay increased taxes (or the government will have to go into increased debt) in order to meet the obligations stated in America’s social programs. Since the ratio of those employed and paying into the Social Security fund and other social programs will be relativity close to beneficiaries of social programs, huge percentages of working American’s paychecks will go to these social programs and many of those working can barely make it on present day taxation (Berasek, 1). Even though we need to limit many of America’s social programs, it is highly improbable to happen because the fact is that those who benefit from these social programs are those who are voting for it (or at least voting for politicians who support it). It is no great secret that younger people as a whole (the ones who don’t benefit Woodford 4 from these programs) don’t often vote until later in their lives which leaves it mostly up the past generations to determine policy. The older generation usually votes to keep policies such as Social Security and benefit from it whereas the younger generation does not have as much of a voice in the matter. Although in an ideal world the government would be able to take care of everyone, the government simply cannot keep spending this way and will eventually be forced to reform how America’s budgetary system works or face economic collapse. Many have proposed a solution to fix the national debt and other flaws of the America’s budgetary system. Although no plan is perfect and can foresee every eventuality, there are several steps that can be taken in order to lessen the damage—a turn in the right direction. A first step that should be taken to help control budgetary deficits is by cutting, reducing, or limiting America’s social programs. One thing American government could do is raise the eligibility age for Social Security. Since medicine and health care has improved vastly throughout the past hundred years, and because the life expectancy of Americans has gone up, it’s only logical that the eligibility age for Social Security should go up to. Another thing government can do is encourage people not to go into debt (nationaldebtsolutions, 2). Some could argue that by having food stamps and other welfare reliefs, it encourages citizens to go into debt and to live off the government. While this is not necessarily true and most use welfare responsibly and out of necessity, there are a small percentage of those who “play” the system and abuse the welfare system. Government needs to crack down on this by having stricter requirement regarding reception of welfare. Perhaps the most important thing that can be done is not by the government but by the people. Citizens need to realize and vote for politicians that support policies that have logical and positive long-lasting affects; not ones that satisfy momentary need and led to the expansion of government and increased use of federal dollars. Woodford 5 National debt and poor budgetary choices have led to and will lead to serious economic hardships on the future generations of America. Serious and immediate reforms to governmental programs and logical budgetary decisions are needed if the American economy is to survive. Ideological but illogical practices such as entitlement programs need to be changed if they are to continue to be of benefit to people. The American people and government must get passed their differences in order to implement an affective situation to fix the debt problem soon, because as time progresses the problem will only get worse.