8. References - Cardiff Business School

advertisement

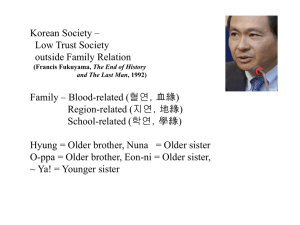

Paper submission for the 2012 Interdisciplinary Perspectives in Accounting (IPA) Conference, Cardiff, United Kingdom, 11th to 13th July 2012 Names: Sue (S.E.) Yong Institution affiliation: Accounting academic group, School of Business and Law, Auckland University of Technology, Private Bag 92006, Auckland 1142, New Zealand Tel: 64 9 921 9999 extension 5721 Email: sue.yong@aut.ac.nz Topic: Business behaviours and the ethnic entrepreneurs: An intra-cultural study Abstract With the increasing cultural diversity in most OECD countries, there is a need to understand whether cultural values impinge on business behaviours. This study aims to examine the effects of ethnicity on the tax and accounting decisions made by entrepreneurs of the four largest ethnic groups in New Zealand. Data were collected from qualitative interviews of 59 ethnic entrepreneurs, business experts and tax practitioners. Hofstede’s (1980, 2001) cultural dimensions of individualism-collectivism, power distance and long term-short term orientations are used to explain ethnic entrepreneurs’ tax and accounting decisions. Ethnic groups with cultural values of long term orientation (emphasis on the future) and collectivism (allegiance to in-groups) were found to have least difficulty in paying their taxes and they incur lower tax compliance costs. Comparatively, collectivistic groups are more permissive of the cash economy than individualistic groups. As part of the emphasis on taxpayers as “customers”, it is needful for tax authorities and business communities to understand the cultural values impinging on business behaviours. It is by doing so that business taxpayers’ voluntary compliance can be enhanced, business compliance costs can be reduced, and tax revenues of the government increased, resulting in a win-win situation for all parties. Keywords: Hofstede, culture, ethnicity, tax compliance, SMEs, cash management, accounting assistance 1 1. Introduction Small and medium sized enterprises (SMEs) have been acknowledged to contribute significantly to most countries’ economy in terms of GDP value-added outputs and employment (Beddall, 1990; Ministry of Economic Development, 2009; OECD, 2004). SMEs also collect value added and employment taxes on behalf of governments (Joulfaian, 2009; Torgler, 2007) and despite their important economic roles, smaller businesses in particular, are known to participate in the cash economy (Bajada, 2002; Caragata, 1998; Cash Economy Task Force, 2003; Morse, Karlinsky, & Bankman, 2009) and therefore they pay less than their fair share of taxes (Ahmed & Braithwaite, 2005; Joulfaian & Rider, 1998). Small business entrepreneurs are also known to have inadequate tax and accounting knowledge (Ahmed & Braithwaite, 2005; McKerchar, 1995) and they do not trust or want to interact with the tax authorities (Adams & Webley, 2001; Bird, 1992; Lewis, Ashby, Coetzer, Harris, & Massey, 2005). However, with the influx of tertiary qualified business migrants with various ethnicity (Deakins, Smallbone, Ishaq, Whittam, & Wyper, 2009; Pio, 2010), is the existing literature still relevant? Unlike mainstream Anglo-Saxon Europeans, nonEuropean entrepreneurs operating in the OECD countries are known to use co-ethnic labourers, finance and support systems for their businesses (Basu, 2006; Basu & Altinay, 2002). Ethnic groups with collective traits (group’s interests overrides individual’s interests) are shown to depend on their social networks as sources of business information exchanges (Bhalla, Henderson, & Watkins, 2006; Ram, Smallbone, & Deakins, 2002; Rothengatter, 2005a) . Given the above and the increasing trend of cultural diversity of SME entrepreneurs in the OECD countries (Basu, 2006; Ministry of Economic Development, 2007; Smallbone, Fadahunsi, Supri, & Paddison, 1999), there is a need to understand the applicability and relevance of the existing literature to non Anglo-Saxon entrepreneurs. This information is important as it has policy implications in terms or regulation and assistance granted to assist ethnic entrepreneurs to comply with the tax requirements. 2 This study seeks to examine whether ethnicity affects the tax and accounting decisions made by SME entrepreneurs. It does so by analysing and comparing the decisions made by the four largest ethnic SME groups in New Zealand, namely: European, Asian, Maori, and Pacific Peoples (Ministry of Economic Development, 2007, 2009). New Zealand provides an interesting case study of the effects of ethnicity and business behaviours as it is one of the most culturally diverse nations in the OECD, with more than 200 ethnicities (Pio, 2010). “Ethnic” for the purpose of this study is based on the differences between categories of people (Petersen, 1980) and it is defined as people having a set of connections and regular patterns of interaction among people “sharing common national background or migratory experiences” (Aldrich & Waldinger, 1990, p. 112). For the purpose of this research, “ethnicity” and “culture” are used interchangeably. Although living in the same country, the Asian, Pacific Peoples and Maori ethnic groups exhibit different traits from mainstream Anglo-Saxon Europeans. For example, indigenous Maori show tribal and collective values (Warriner, 2007) whereas Pacific Peoples are predominantly a collective group with strong church affiliations (Meleisea, 1987). On the other hand, Asians are largely long term oriented (emphasis on future rather than past or present outcomes) (Ahlstrom, Chen, & Yeh, 2010; Tsui-Auch, 2005) and the Europeans are comparatively more individualistic (Frederick & Henry, 2004) than the other groups. Additionally, the total percentage of SME ownership by the non-European groups in New Zealand and United States is gaining importance (Ministry of Economic Development, 2009; United States Census Bureau, 2010) and therefore their business behaviours ought to be given some attention. The next section will detail the literature pertaining to SMEs in terms of cultural influences and their tax attitudes. This is then followed by an outline of Hofstede’s cultural framework in Section Three. Section Four discusses the methodology and the research design. Section Five reports the findings and analysis and the contribution to knowledge is explained in Section Six. Section Seven concludes the paper and offers suggestions for future research. 3 2. Literature review 2.1 Culture, business behaviours and tax attitudes Despite SMEs being heterogeneous in terms of business size, business duration and the sectors in which they operate (Gartner, 1985; IFC & The World Bank, 2010), research has shown that the cultural background of SME entrepreneurs affects their business behaviours and tax attitudes (Coleman & Freeman, 1997; Schwartz, 1999; Trompenaars, HampdenTurner, & Trompenaars, 1994). In order to effectively regulate culturally diverse entrepreneurs-taxpayers, it is needful for government authorities to account for the range of culture-determined value systems of its citizens because culture, although basically unconscious, manifests itself in the business practices and decisions that entrepreneurs make (Crocombe, 2008; Hampden-Turner & Trompenaars, 1996). Cultural values are believed to be enduring, are deeply embedded within individuals, and the visible effects of their actions, words and behaviours are traceable to their cultural values (Hofstede, 1991; Hofstede & Hofstede, 2005; Hoppe, 1998) . Coleman and Freeman (1994) observe that “attitudes towards taxes and the tax system is a product of taxpayers’ cultural background” (p. 366). Similarly, Smith and Kinsey (1987) claim that “attitudes towards the tax system have indirect effects on intentions and attitudes are part of the cultural context”(1987, p. 656). Coleman and Freeman (1994) and Bankman and Karlinsky (2002) also anecdotally suggest tax attitude differences between local born entrepreneurs and immigrants but fail to specify what those differences are. An earlier quantitative, intra-cultural study of Israeli self-employed by Dornstein (1976) found that new migrants and those from the least developed countries were less tax compliant than those from Western Europe and migrants who had been in the country longer. Her research, based on data obtained from the tax authority, showed that ethnicity affects entrepreneurs’ tax attitudes. Given that, her research findings suffered some weaknesses as ethnic entrepreneurs’ views were not taken into account even though they were the ones affected by tax regulations. 4 More recent research on ethnic entrepreneurs’ tax attitudes was undertaken by Rothengatter (2005b) using focus groups. He claims that that the “extent that cultural norms and values regarding business conduct and one’s payment of taxes may vary from one ethnic group to another” (p.14). He found that Asians, Greeks and Lebanese had different tax attitudes from local born Australians with the Asians undertaking extensive tax planning to minimise taxes. The variations in the tax attitudes are attributed to the deeply embedded social networks of the Asians, Greeks and Lebanese (also known as collectivistic groups). Tax evasion via the cash economy was considered acceptable for some of the Asian, Greek, and Lebanese entrepreneurs, though this practice was abhorred by the local born Australians. SME entrepreneurs who identified themselves as Australians were more willing to contribute towards taxes compared to those who did not (Rothengatter, 2005a, 2005b). Similarly, Coleman and Freeman (1994) found a South African entrepreneur practiced income smoothing to avoid attention from the tax authority. They assert that “a [tax] strategy which is successful with one group may completely repel another” (Coleman & Freeman, 1994, p. 355) for culturally diverse taxpayers-entrepreneurs. Though Rothengatter’s (2005b) focus group inquiry is useful in identifying broad compliance issues associated with ethnicity (Kitzinger & Barbour, 1999), his findings are dependent on the perceived status of the participants within the group. In addition, the more dominant voices may also mute the quieter ones which can skew the findings (Arksey & Knight, 1999; Finch & Lewis, 2003; Kitzinger & Barbour, 1999). Rothengatter (2005b) also reported that each ethnic group was accusing other groups of tax evasion, which limits our understanding as to how ethnic groups undertake measures to comply with the tax regulations. With this, a more useful approach is to study how ethnic groups make accounting and tax decisions by seeking ethnic entrepreneurs’ views and the views of others who could verify their actions. Earlier studies have shown that whites are more tax compliant and expressed greater commitments to pay taxes than non-whites (Roth, Scholz, & Witte, 1989; Song & Yarbrough, 1978). However, the New Zealand survey on European, Chinese, Indian and Maori students by Birch et al (2003) found a higher percentage of Europeans than Chinese had understated their taxable incomes and that more Europeans and Maori knew of peers who had evaded taxes. Though the authors acknowledged that “research into the relationship between 5 taxpayer compliance and ethnicity is relatively scarce”(Birch et al., 2003, p. 71), their survey findings had several limitations. First, their student sample did not reflect the demographics or composition of the New Zealand population (Statistics New Zealand, 2001). Second, student samples are not always good proxies for actual taxpayers due to their tax, education, working, and age differences (Cuccia, 1994; Fehr, Fischbacher, Rosenbladt, Schupp, & Wagner, 2003; Yong, 2006). In addressing their research limitations, Birch et al (2003) suggest that future research to ensure “the mix of respondents [be] broadened in order to more closely represent the New Zealand population and further data to be collected to explore the underlying reasons behind taxpayers’ responses”(p. 96). This study responds to this call by broadening the sample respondents to reflect the mix of the New Zealand population by including the four largest ethnic groups in the country. 2.2 Cross-cultural research and tax compliance Cross-cultural studies linking tax attitudes have found that some countries have higher tax morale (intrinsic motivation to pay taxes) (Frey & Torgler, 2007) than others. In their experimental research, Alm and Torgler (2006) discovered that United States have higher tax morale than Spain, and Switzerland has higher tax morale compared to other European countries. Similarly, Cummings et al.(2004) found tax compliance differences between the United States, Botswana, and South Africa was due to cultural differences in these countries. The effects of culture on tax behaviours is further reinforced by Richardson (2005) who found tax attitude differences between Australian and Hong Kong students. However, his research on students has been criticised for not providing real life perspectives of actual tax compliance behaviours (Ho & Wong, 2008). Though it is argued that students are important participants for tax research (Alm, 2011; Alm & Jacobson, 2007), their results ought to be interpreted carefully as students’ behaviours cannot be equated to that of actual taxpayers. This is because students may gameplay (Cuccia, 1994) and they undertake more risks than actual taxpayers (Gerxhani & Schram, 2006; Starmer, 1999). Unlike actual taxpayers, any tax 6 evasion undertaken by students in experimental and survey research will not cost them or adversely affect their reputations (Torgler, 2007). Although the abovementioned cross-cultural studies indicate that country, as a generic measure of culture, does affect taxpayer’ attitudes, they did not explore the different characteristics (Hofstede, 1980), multidimensionality (Tsakumis, Curatola, & Porcano, 2007) and complexity of culture (Hall, 1976; Trompenaars et al., 1994). Given that “culture is a multivariate concept” (Tsakumis et al., 2007, p. 132), it is imperative to study the different dimensions of culture to better understand how these might affect tax compliance decisions and perceptions. 2.3 Cultural dimensions and tax compliance To better explain the effects of culture on tax attitudes, several cross-cultural studies compare collectivistic to individualistic societies. McGee et al. (2008) found that collectivistic Hong Kong students are more conditional in their tax attitudes compared to individualistic United States students, who view tax evasion as morally wrong. Hong Kong students justify their tax evasion perceptions based on the government’s performance whereas United States students form their judgements based on moral values and less on government’s performance. Similarly, Chan et al.(2000) also observe that collectivistic Hong Kong students are less compliant and have less favourable attitudes toward the tax system compared to individualistic United States students. The above cross-cultural studies provided some useful insights into the individualismcollectivism cultural dimensions on tax perceptions. However, Oosterbeek, Sloof and van de Kuilen (2004) argued that most cross-cultural studies contain data from only one city of each country, and that differences in outcomes may simply reflect differences across different locations rather than differences across countries. They cautioned the generalisability of cross-cultural research findings as representative of the entire country and suggest that a more fruitful research would be to consider the tax attitudes of the various ethnic groups within a location. Additionally, there may be other cultural dimensions beyond collectivismindividualism dimension that can help explain the tax attitude differences. 7 In an attempt to incorporate several cultural dimensions on tax compliance, Tsakumis et al. (2007) differentiated compliant from non-compliant countries by applying Hofstede’s (2001) four cultural dimensions of individualism-collectivism (the relationship between individuals and collectives); power distance (the management of inequality between people); uncertainty avoidance (their stance towards ambiguity and uncertainty); and masculinity-femininity (task focused or relationship focused). Tsakumis et al.(2007) profiled non-compliant countries as those with high uncertainty avoidance, low individualism, low masculinity and high power distance values. Their research findings are valuable for international tax comparisons and to identify audit strategies for taxpayers from different countries. Their research however failed to include Hofstede’s long term and short term orientation (individual’s stance towards time) (Hofstede, 2001; Hofstede & Bond, 1988) which is particularly relevant to Asian countries. To further understand cultural differences, Richardson (2008) extended the Tsakumis et al.(2007) study by including legal, political and religious variables on the tax evasion index of 47 countries. His regression results indicate that the higher the level of uncertainty avoidance and the lower the level of individualism, legal enforcement, trust in government, and religiosity, the higher is the level of tax evasion in the country. Like the Tsakumis et al.(2007) study, Richardson failed to include Hofstede’s long term-short term orientation cultural dimension to help explain the tax evasion differences in different countries. Furthermore, Richardson admitted that research data used from country survey ratings “could be prone to measurement error” (Richardson, 2008, p. 72) and consequently, his findings should be used with some caution. All cross-cultural research has certain limitations which ought to be considered when interpreting their results, such as using countries as proxies for culture and the focus on tax evasion attitudes. First, the use of countries as proxies for culture and assuming cultural homogeneity within the country contradicts the increasing trend of multi-cultural societies in the world (Naylor, 1996). Torgler (2007) advises that some cross-country tax analysis may be misleading as “further efforts are still needed to better control for the properties of the tax system and the way in which taxes are administered so as not to confound culture with features of the tax structure” (p. 56). He acknowledges that in addition to culture, differences 8 in the country’s tax structures and tax administrations may affect the individuals’ tax compliance decisions and perceptions. Agha and Haughton (1996) also caution using tax recommendations based on cross-country analysis. They state that “recommendations based on cross-country comparisons are apt to have a “one size fits all” quality, which overlooks the history, traditions and special features of any given country” (Agha & Haughton, 1996, p. 307). Li (2010) also admonishes crosscountry tax analysis, as other important factors such as “the countries’ tax burden, legal origin, culture, and income distribution ought to be taken into account” (p. 160). Given that cross-country tax analysis can be misleading due to the uniqueness of each country’s tax system and historical background, it may be fruitful to undertake an intra-cultural study to overcome these limitations and to identify the possible effects of cultural values on accounting and tax behaviours. Second, most of the abovementioned cross cultural tax research has concentrated on tax evasion attitudes. However, not everyone wants to cheat on their taxes, as research has shown a considerable proportion of honest taxpayers, who always pay their taxes (Baldry, 1987; Elffers, 2000; Pyle, 1991). Pyle (1991) observes that “it seems that whilst the odds are heavily in favour of evaders getting away with it, the vast majority of taxpayers behave honestly” (p. 173). It has been claimed that some taxpayers are “simply predisposed not to evade [taxes]” (Long & Swingen, 1991, p. 130) and they do not search for ways to cheat on taxes (Frey & Foppa, 1986). Torgler (2007) laments that “tax compliance researchers have paid substantial attention to tax evasion and thus to the decision as to how much income to report in a tax return. But little is known about individuals’ compliance behaviour and variables such as timely filing out of the tax form and paying individual taxes on time” (p. 258). Given that, it is worthwhile researching actual business behaviours of ethnic entrepreneurs in terms of tax decisions. The study reported in this paper addresses the methodological concerns associated with these prior studies. It explicitly considers the impact of ethnic differences amongst real entrepreneurs-taxpayers for whom compliance is thought to be relatively low – i.e. SME 9 entrepreneurs. In order to appropriately consider these ethnic differences, Hofstede’s cultural framework is employed as a theoretical perspective. 3. Hofstede’s cultural framework According to Hofstede, a person’s behaviour is partially determined by his or her mental programme or culture which is defined as the “collective programming of the mind that distinguishes the members of one group or category of people from others” (Hofstede & Hofstede, 2005, p. 4). Culture affects one’s behaviour and it “forms the roots of action” (Trompenaars et al., 1994, p. 24). Hofstede’s cultural dimensions have been used to analyse human tendencies from different countries (de Mooij, 2001; Hoppe, 1998) and ethnic groups within a country (Cohen, 2007; Luczak, 2009; Popper & Sleman, 2001). According to Hofstede and Hofstede (2005), the main cultural differences between nations/ethnic and regional groups lie in their values. Hofstede used five cultural dimensions to explain the differences in people’s behaviours across nations and ethnic groups which are: power distance, individualism-collectivism, long term-short term orientations, uncertainty avoidance and masculinity-femininity. As this paper only specifically examines three business aspects of the entrepreneurs, only the first three cultural dimensions will be discussed. 3.1 Cultural dimensions of the ethnic groups Power distance (PD) indicates the extent to which the less powerful members of institutions within a society expect and accept that power is distributed unequally. For the purpose of this research, Hofstede’s assessment of a country’s cultural dimension is based on the dominant group, which in the case of New Zealand is the Anglo-Saxon Europeans (Pfeifer, 2005). Hofstede states that New Zealand exhibits low power distance (Hofstede, 1980) compared to the Asians, Maori and Pacific Peoples (Begley & Tan, 2001; Lucas, 2009; Pfeifer, 2005). The cultural dimension of individualism pertains to societies in which the ties between individuals are loose, whereas collectivism pertains to societies in which people are, from birth, integrated into strong, cohesive groups which continue to protect them throughout their 10 lives in exchange for unquestioning loyalty (Hofstede & Hofstede, 2005). This dimension is measured in terms of how much the individual interest prevails over collective interests. New Zealand, as a country, is highly individualistic whereas Asians, Maori and the Pacific Peoples are collectivistic (Earley & Gibson, 1998; Mead, 2003; Redding, 1993; Tiatia, 1998). Long term (LT) orientation relates to the “fostering of virtues oriented toward future rewards [such as] long term planning, perseverance, and thrift, whereas short term (ST) orientation relates to the fostering of virtues related to the past and present [such as] respect for tradition, living for the day, preservation of “face”, and fulfilling social obligations” (Hofstede & Hofstede, 2005, p. 210). Asian countries are high scorers for LT orientation whereas New Zealand overall has medium term orientation (Hofstede & Hofstede, 2005). Pacific Peoples are ST oriented with little future planning (Crocombe, 2008) and they generally undertake tasks only when they are needed (Crocombe, 1976; McCoy & Havea, 2006). To the Maori, “decisions require much contemplation and consideration from every angle” (Mataira, 2000, p. 25) with little emphasis on future planning. They however emphasised present living and nurturing relationships to preserve one’s mana (aura) (Clydesdale, 2007; Mitchell, 2009) . 3.2 Credibility and criticisms of Hofstede’s cultural framework Although Hofstede has been widely cited in various disciplines including accounting, international taxation, management, and entrepreneurship (Gray, 1988; Newman & Nollen, 1996; Sivakumar & Nakata, 2001), not everyone endorses his work. The main criticisms have been targeted at: his chosen sample; the suitability of the self-report methodology; the existence of cultural heterogeneity within country borders; and the dynamic nature of cultures (Baskerville, 2003; McSweeney, 2002; Tung, 2008). Despite these criticisms, there have been rebuttals and multiple independent verifications of Hofstede’s model (Hoppe, 1998; P. Smith, 2006; Sondergaard, 1994; Taras, Kirkham, & Steel, 2010; Williamson, 2002) which attest to the soundness and credibility of his framework. Despite its limitations, business researchers have applied Hofstede’s framework in increasing numbers, making it “the dominant culture paradigm” (Sivakumar & Nakata, 2001, p. 557). 11 Some have labelled Hofstede’s model as “a watershed conceptual foundation for many subsequent cross-national research endeavours” (Fernandez, Carlson, Stepina, & Nicholson, 1997, pp. 43-44) and “the beginnings of the foundation that could help scientific theory building in cross-cultural research” (Sekaran, 1983, p. 69). (For further discussions of the criticisms and credibility of Hofstede’s work, see: (Sivakumar & Nakata, 2001; P. Smith, 2006; Taras et al., 2010; Williamson, 2002)). Since no alternative cultural framework has yet been applied and tested to the extent that Hofstede has, Hofstede’s framework has been used to theorise the business behavioural differences amongst the ethnic groups in New Zealand in this study. 4. Research methodology and research design Given the diversity of ethnic SME groups, it is appropriate to adopt a relativist ontology where multiple realities are assumed (Denzin & Lincoln, 2005; Guba, 1990). As collectivistic Pacific, Maori and Asian groups prefer face-to-face interactions (Brown, Tower, & Taplin, 2005; Tsui-Auch, 2004; Warriner, 2007), a subjective epistemology (Guba, 1990) is therefore adopted. The naturalistic methodology (Lincoln & Guba, 1985) is also used to collect and analyse the research evidence. A total of 59 face-to-face, in-depth interviews were conducted with 36 ethnic entrepreneurs (nine from each ethnic group), eight tax practitioners and 15 business experts in Auckland from November 2006 to May 2010. The business experts are knowledgeable in every aspect of SME operations and seventy-five percent of them had been SME entrepreneurs themselves. They interact with SME entrepreneurs on a regular basis as they represent the Inland Revenue Department (IRD), the Auckland Chamber of Commerce, Business Enterprise New Zealand, the Pacific Business Trust, the Ministry of Maori Development, the Maori Women Development League, the Small Business Advisory Group and the Ministry of Commerce. The participants were drawn from the largest city in New Zealand, Auckland, for several reasons. First, Auckland has the highest number of SMEs in the country with three times 12 more than the second highest, Canterbury (Ministry of Economic Development, 2009). Second, Auckland is the most culturally diverse city in New Zealand (Statistics New Zealand, 2010). Third, Auckland has the highest net Maori asset base in New Zealand, which is almost twice that of the second highest in the Waikato region (NZIER, 2007). Fourth, Auckland remains the fourth largest 'Pacific' country by population (Baker, 2007) and the city of Auckland is often described as the Polynesian capital of the world (Robie, 2009). 4.1 Demography of the sample participants There were three groups of participants in this study namely: ethnic entrepreneurs, business experts and tax practitioners. Eighty eight percent of the ethnic entrepreneurs were in micro businesses (up to five employees) and 12 percent were in small and medium sized businesses (from five to 99 employees). This is consistent with the averages of the New Zealand business demographics in 2007 and 2009. The participants were 44 percent male, 47 percent female and nine percent husband and wife teams. Seventeen percent of the businesses were under two years old, 14 percent were from two to five years old, 36 percent were from six to ten years old and 28 percent were more than 10 years old, with five percent recording nondisclosure. They operated in 14 of the total 19 industrial sectors in New Zealand (Ministry of Economic Development, 2009). An equal number of sole tax practitioners and tax practitioners from the small and medium sized accounting firms participated in this research with equal numbers of male and female tax practitioners. On the other hand, there were more male participants in the business expert sample, with seven of them from ethnic-specific government agencies and business associations. 4.2 Interview questions and data analysis The interview questions comprised of some fixed and some open ended questions for the three groups of participants. The open–ended questions allowed the researcher to enter the fieldwork without being constrained by predetermined categories of analysis (Patton, 2002). Specific questions for the ethnic entrepreneurs explored their sources of accounting assistance used, cash job participation and their tax payment decisions. Specific questions for 13 the business experts and tax practitioners explored cultural values on business behaviours including tax payments and accounting assistance used by ethnic entrepreneurs. The analysis of the findings follows a path as suggested by O’Dwyer (2004) involving data reduction, data display, and data interpretation and conclusion drawing. This analytical method is an adaptation of the analytical process developed by Miles and Huberman (1984). 5. Findings and discussion This study examines three aspects of business decisions made by ethnic entrepreneurs namely: tax payments, accounting assistance used and their participation in the cash economy which is discussed in the following subsections. 5.1 Cultural values and tax payments As can be seen from Table 1 below, more than 67% of the Maori and Pacific entrepreneurs had tax payment difficulties compared to only 33% for the European and none for the Asian. Difficulty in meeting tax payment and/or having to make arrangements with the IRD Yes No Subtotal Europeans Asians Maoris Pacific Peoples Total 3 6 9 0 9 9 6 3 9 7 2 9 16 20 36 Table 1: Participants having difficulty meeting tax payments and having to arrange a payment plan with the IRD The Asian group’s behaviour can be traced to their thrifty nature and financial assistance provided by family members. The strong financial support from families for the Asian group was noted as the factor distinguishing this group from the collectivistic Maori and Pacific groups: “I see the Indian community very much work within their group, their own family, their own extended family. They seldom use banks, the family is the bank. That is also prevalent in other cultures like the Chinese is similar but the Pacific Islander don’t work in a similar way because they don’t have the money.” (Business Expert 9) 14 Being long term (LT) oriented, future financial planning is given priority by Asian entrepreneurs, unlike the short term (ST) oriented Pacific and Maori. Asian entrepreneurs prefer to pay their taxes on time to avoid penalty costs and to maintain good taxpaying histories to stave off future adverse repercussions: “Oh I plan ahead. I make sure that I do not get into that situation. I budget my cash flows as I know when the tax amounts are due and I see that I have enough liquid cash to pay that. We have never had the situation with inadequate cash flows.” (Asian entrepreneur 3) The fact that Europeans show some difficulty with tax payment is a reflection of their medium term orientation. On the other hand, Maori and Pacific Peoples emphasised living for the present and maintaining traditions and social standing. Their short term orientation led to poor cash flow management and planning, as experienced by Pacific entrepreneur 1: “Managing cash flows was an issue for us. At the start we did not have any budget and what we did was money was coming in and money was going out and we didn’t track where the money was going. Like we didn’t keep money for PAYE, or keep money for tax or for GST and then cash flow suffered and then you had to inject some of the family money into the business to keep going... We were just naïve because we put all the tax payments on the back burner.” (Pacific entrepreneur 1) One of the contributing factors for collectivistic Maori and Pacific Peoples in having tax payment difficulties is due to their obligations to fulfil their in-groups’ needs, including church giving, overseas remittances and family contributions: “The culture to give to your family is ingrained in you the minute that you are born. Your whole existence is to give to the church and to give to the family. We have got family that are going into debt, family falling apart and children running around without shoes while the parents are paying pokies to try to get some money to pay the rent because they have given all their money to the church.” (Pacific entrepreneur 7) Collectivistic Maori also spent considerable resources and effort in maintaining one’s mana (aura). The traditional Maori attitude towards ownership and possessions is “to utilise and share which contrast(s) to the accumulate and acquire dispositions of non Maori” (De Bruin 15 & Mataira, 2003, p. 179). Furthermore, many do not have suitable collateral for borrowings due to their multiple tribal land ownership, as observed by Business Expert 5, even though they are asset rich but are cash poor: “Mainly is because they do not have the collateral for borrowings. For example, they may be living on the land but often the land is not theirs but it is jointly owned by the iwi (family) or hapu (sub-tribe). And therefore you cannot use the land as collateral against the loan”. The above findings showed that collectivism and long term orientation cultural dimensions have influenced tax payment decisions made by ethnic entrepreneurs. 5.2 Sources of accounting assistance used by ethnic groups Ethnic entrepreneurs used three main sources of accounting assistance to file their tax returns, namely paid accountants, unpaid family and friends, and the IRD, as shown in Table 2 below: Accounting Europeans Asians Maoris Pacific assistance Peoples used to file tax returns Paid 8 3 6 6 Accountant, or bookkeeper, or business mentor or business coach Family or 0 4 3 1 Friends or peers (unpaid) IRD 1 2 0 2 Subtotal 9 9 9 9 Table 2: Sources of help sought by ethnic groups with tax queries Total 23 8 5 36 In Table 2, the Asian group is most dependent on family and friends for assistance, followed by the Maori and Pacific groups, thus reflecting their collectivistic traits. The Asians are the least dependent on their paid accountants, which exhibits their long term orientation of frugality. Unlike Maori, some of the Asian and Pacific entrepreneurs showed greater 16 willingness to interact with the IRD despite their high power distance values. This is because cost savings is more important than their fear of authority, particularly for those who were knowledgeable in accounting and had good taxpaying histories. On the other hand, individualistic Europeans were dependent on their paid accountants to assist with their tax filing tasks. Their low power distance values also resulted in their collegial relationship with their accountants: “I speak to my accountant because they are more knowledgeable about our accounts and I feel that they can explain the accounts to me and I still prefer to talk to my accountant than the IRD as the accountant will give us some solid advice on our business. Possibly also that the accountant is working for us but not necessarily the IRD” (European entrepreneurs 9). The Maori and Pacific entrepreneurs in this sample also showed lack of tax knowledge and therefore were reliant on paid accountants to help fulfil their tax obligations. Due to high power distance values, they revered their accountants by not challenging them, and they implicitly undertook a subordinate role to their accountants: “Like some Polynesians we do not question the accountants and go back and ask them. I am always too scared to question my accountant too. It is kind of fear them as they will not look at you favourably and help you more in the future sort of thing. My attitude is that I try to stay away from them as much as I can, and also I don’t want to upset them or question them.” (Pacific entrepreneur 3) “The Pacific Islanders look at authorities with high esteem and that’s why they struggle with that they always rely on others to tell them what to do and how to do it and they are followers.” (Business Expert 10) In Table 2, the Maori sample would not seek help directly from the IRD due to their high power distance values and fear of authority brought about by historical oppressive European colonisation and land confiscation (Henry, 2007). Most viewed the IRD as a “white bureaucracy” who could harm them and therefore they preferred to be “out of sight” from the authority. Their non contact with the IRD has led to higher tax compliance costs with adverse consequences: “They are terrified of the IRD or anything relating to compliance even with the local government and things like that. This has something to do with the history, and how the government has dealt with the people in terms of the land loss, the Crown and stuff like that. The injustices relating to the historical events and the perceptions of 17 the “big brother governance” still remain in some people.” (Business Experts 3 and 4) The fear of the IRD is very real for the Maori entrepreneurs, as Business Expert 10 felt that majority of them perceived the IRD as wielding the big stick. With this, power distance values do exert significant influence on the entrepreneurs’ decisions as to what assistance they would use to discharge their tax obligations. The above showed the interplay of collectivism and power distance affecting the decision made by the ethnic entrepreneurs regarding the sorts of accounting assistance used when filing their tax returns. 5.3 Ethnic groups’ perception of the cash economy All the SME entrepreneurs from the collectivistic groups in this study had participated personally by purchasing goods and services in the cash economy. Most were aware of peers who were also involved in the cash economy and felt there were valid justifications for the cash economy by way of tax savings and retaliating the taxing authorities: “The small businesses do not earn a lot of money. The IRD is quite strict with the recording and small businesses have to make sacrifices in some ways and in order to compensate them for the sacrifices, cash jobs would help.” (Asian entrepreneur 6) “Of course people would want to cheat the government because they don’t get anything from them back other than the fear, penalty, and stress. The IRD is like a big brother who is bullying, bullying all the time and you don’t want to do anything nice for him but you want to take as much from him when they are not looking sort of thing.” (Pacific entrepreneur 3) “In the Maori businesses, unlike the classic business model, there is more cash and more in-kind business transactions like bartering. It is also harder to keep good records. Also there is an element in some of the areas that they (Maori) are not part of the New Zealand tax system, and that they are not taxpayers and therefore they do not want to be brought into the fold.”(Business Expert 6) In contrast, individualistic Europeans in this sample were totally against participating in the cash economy as they viewed the practice as morally wrong and not benefitting their business: “But I personally would not do it, as I am against it totally. Someone offered me cash job the other day, and I refuse it.” (European entrepreneur 8) 18 “I don’t know but I have a business partner and I made sure that everything is done through the books... I have been approached by people who want to do a cash job and I refused because I can’t see how it can help them.”(European entrepreneur 2) The above findings are consistent with the findings by Rothengatter (2005a, 2005b), McGee et al (2008) and Chan et al (2000) as shown in sections 2.1 and 2.3 that collectivistic groups particularly Asians are more permissive of the cash economy than local born Australian (Europeans) and Americans. This is important for policy makers to understand the rationale behind the cash economy for collectivistic groups. 6. Contribution to knowledge It is important to understand the rationale for the different ethnic groups’ tax and accounting decisions. This study shows that their business decisions are dependent on their cultural values of power distance, individualism-collectivism and long term orientations. This study found that ethnic groups with long term orientation and collectivistic traits had no problems with their tax payments or accessing in-group accounting assistance. In addition, collectivistic groups were shown to be more permissive of the cash economy than the individualistic group. This adds to the existing literature that cultural values should be given some consideration in understanding ethnic group’s business behaviour. This information is useful to assist policy makers, government agencies and regulators in identifying strategies to encourage better compliance from ethnic taxpayers. 7. Conclusion and suggestions for future research This research shows that cultural values can and do influence their business decisions and their participation in the cash economy. Some cultural values assist with ensuring timely tax payments and enabling access to in-group resources which makes it easier to comply with the tax regulations. On the other hand, some cultural values promote the practice of the cash economy as well as raising tax compliance costs. Given that, both the tax authority and the business community should be mindful of the cultural influences on businesses and to customise their regulatory and assistance measures to effectively meet the needs of the ethnic groups. 19 As this study has shown the effects of ethnicity on business behaviours, further research should be undertaken to extend the present study. There are several suggestions that follow. First, increase the sample size of the four ethnic groups in Auckland to verify and validate the present findings. Second, the sample participants should be drawn from other regions outside of Auckland where there are large concentration of SMEs. Third, subgroups within the four ethnic groups can be included to determine the relevance of the present study to these subgroups. Fourth, ethnic SME entrepreneurs from other international tax jurisdictions with similar tax regime should be tested to validate the present findings. In conclusion, government authorities need to have a better understanding of the cultural values of the entrepreneurs-taxpayers and how these impinge on their business behaviour. This understanding will assist them to target their regulatory strategies in order to match the varied characteristics of their taxpayers. It is also consistent with the call for responsive regulation (Braithwaite, 2007) that there should be a suite of regulatory strategies in order to more effectively meet the needs of culturally diverse entrepreneurs-taxpayers. The aim is to build a more cooperative relationship between the tax authority and the business community by understanding how culture may affect the way businesses are operated. 20 8. References Adams, C., & Webley, P. (2001). Small business owner's attitudes on VAT compliance in the UK. Journal of Economic Psychology, 22(2), 195-216. Agha, A., & Haughton, J. (1996). Designing VAT systems: Some efficiency considerations. Review of Economics and Statistics, 78, 303-308. Ahlstrom, D., Chen, S., & Yeh, K. (2010). Managing in ethnic Chinese communities: Culture, institutions, and context. Asia Pacific Journal of Management, 27, 341-354. Ahmed, E., & Braithwaite, V. (2005). Understanding small business taxpayers: Issues of deterrence, tax morale, fairness and work practice. International Small Business Journal, 23(5), 539-568. Aldrich, H., & Waldinger, R. (1990). Ethnicity and entrepreneurship. Annual Review of Sociology, 16, 111-135. Alm, J. (2011). Measuring, explaining, and controlling tax evasion: Lessons from theory, experiments, and field studies. International Tax and Public Finance, 18, on line version. Alm, J., & Jacobson, S. (2007). Using laboratory experiments in public economics. National Tax Journal, LX(1), 129-152. Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology, 27, 224-246. Arksey, H., & Knight, P. (1999). Interviewing for the social scientists. London: Sage Publications. Bajada, C. (2002). Australia's cash economy: A troubling time for policymakers. Aldershot: Ashgate Publishing. Baker, G. (2007). Pacific pathways. New Zealand Business, 10-11. Baldry, J. (1987). Income tax evasion and the tax schedule: Some experimental results. Public Finance, 42(3), 357-383. Bankman, J., & Karlinsky, S. (2002, April). Developing a theory of cash business tax evasion behaviour and the role of their tax preparers Symposium conducted at the meeting of the 5th International Conference on Tax Administration ATAX, University of New South Wales, Sydney. Baskerville, R. (2003). Hofstede never studied culture. Accounting, Organizations and Society, 28(1), 1-14. Basu, A. (2006). Ethnic minority entrepreneurship. In M. Casson, B. Yeung, A. Basu, & N. Wadeson (Eds.), The Oxford handbook of entrepreneurship (pp. 580-600). New York, US: Oxford University Press. Basu, A., & Altinay, E. (2002). The interaction between culture and entrepreneurship in London's immigrant businesses. International Small Business Journal, 20(4), 371393. Beddall, D. (1990). Small business in Australia: Challenges, problems & opportunities: Recommendations and main conclusions. In Report of the House of Representatives Standing Committee on Industry, Science and Technology: Australian Government Publishing Service. Begley, T., & Tan, W. (2001). The socio-cultural environment for entrepreneurship: A comparison between East Asian and Anglo-Saxon countries. Journal of International Business Studies, 32(3), 537-553. Bhalla, A., Henderson, S., & Watkins, D. (2006). A multiparadigmatic perspective of strategy: A case study of an ethnic family firm. International Small Business Journal, 24(5), 515-537. 21 Birch, A., Peters, T., & Sawyer, A. (2003). New Zealanders' attitudes towards tax evasion: A demographic analysis. New Zealand Journal of Taxation Law and Policy, 9(1), 65109. Bird, S. (1992). Small business and the ATO: Moving towards a market based approach. Canberra: ATO Publications. Braithwaite, V. (2007). Responsive regulation and taxation: Introduction. Law and Policy, 29(1), 3-10. Brown, A., Tower, G., & Taplin, R. (2005). The importance of oral communication in a Pacific Island countries' context. Journal of American Academy of Business, Cambridge, 7(2), 133-140. Caragata, P. (1998). The economic and compliance consequences of taxation: A report on the health of the tax system in New Zealand. In. The Netherlands: Kluwer Academic Publishers. Cash Economy Task Force. (2003). The cash economy under the new tax system: Report to the Commissioner of Taxation. Canberra: Commonwealth of Australia. Chan, C., Troutman, C., & O'Bryan, D. (2000). An expanded model of taxpayer compliance: Empirical evidence from the United States and Hong Kong. Journal of International Accounting, Auditing & Taxation, 9(2), 83-103. Clydesdale, G. (2007). Cultural evolution and economic growth: New Zealand Maori Entrepreneurship & Regional Development, 19, 49-68. Cohen, A. (2007). One nation, many cultures: A cross-cultural study of the relationship between personal cultural values and commitment in the workplace to in-role performance and organisational citizenship behaviour. Cross-cultural research, 41(3), 273-300. Coleman, C., & Freeman, L. (1994). The development of strategic marketing options directed at improving compliance levels in small business. Australian Tax Forum, 11, 347367. Coleman, C., & Freeman, L. (1997). Cultural foundations of taxpayer attitudes to voluntary compliance. Australian Tax Forum, 13(3), 311-336. Crocombe, R. (1976). The Pacific way: An emerging identity. Suva, Fiji: Lotu Pasifika Productions. Crocombe, R. (2008). The South Pacific (7th ed.). Suva: IPS Publications: University of the South Pacific. Cuccia, A. (1994). The economics of tax compliance: What do we know and where do we go? Journal of Accounting Literature, 13, 81-103. Cummings, R., Martinez-Vazquez, J., McKee, M., & Torgler, B. (2004). Effects of culture on tax compliance: A cross check of experimental and survey evidence. Working Paper Series, 2004-13. CREMA. Basel. De Bruin, A., & Mataira, P. (2003). Indigenous entrepreneurship. In A. De Bruin & A. Dupuis (Eds.), Entrepreneurship: New perspectives in a global age (pp. 169-184). Aldershot: Ashgate Publishing Limited. de Mooij, M. (2001). Convergence and divergence in consumer bahaviour: Consequences for global marketing and advertising (Doctoral dissertation). Universidad de Navarra, Pamplona (Spain). Deakins, D., Smallbone, D., Ishaq, M., Whittam, G., & Wyper, J. (2009). Minority ethnic enterprise in Scotland. Journal of Ethnic and Migration Studies, 35(2), 309-330. Denzin, N., & Lincoln, Y. (2005). Introduction: The discipline and practice of qualitative research. In N. Denzin & Y. Lincoln (Eds.), The Sage handbook of qualitative research (3rd ed.) (pp. 1-32). Thousand Oaks: Sage Publications. 22 Dornstein, M. (1976). Compliance with legal bureaucratic rules: The case of self-employed taxpayers in Israel. Human Relations, 29(11), 1019-1034. Earley, P., & Gibson, C. (1998). Taking stock in our progress on individualism-collectivism: 100 years of solidarity and community. Journal of Management, 24, 265-304. Elffers, H. (2000). But taxpayers do cooperate! In M. Van Vugt, M. Snyder, T. Tyler, & A. Biel (Eds.), Cooperation in modern society: Promoting the welfare of communities, states and organizations (pp. 184-194). London: Routledge Research International Series in Social Psychology. Fehr, E., Fischbacher, U., Rosenbladt, B., Schupp, J., & Wagner, G. (2003). A nation-wide laboratory: Examining trust and trustworthiness by integrating behavioural experiments into representative surveys. Working paper no. 954. CESifo. Munich. Fernandez, D., Carlson, D., Stepina, L., & Nicholson, J. (1997). Hofstede's country classification 25 years later. The Journal of Social Psychology, 137(1), 43-54. Finch, H., & Lewis, J. (2003). Focus Groups. In J. Ritchie & J. Lewis (Eds.), Qualitative research practice: A guide for social science students and researchers (pp. 170-198). London: Sage Publications Frederick, H., & Henry, E. (2004). Innovation and entrepreneurship amongst Pakeha and Maori in New Zealand. In C. Stiles & C. Galbraith (Eds.), Ethnic entrepreneurship: Structure and process (Vol. 4, pp. 115-140). Oxford, UK: Elsevier. Frey, B., & Foppa, K. (1986). Human behaviour: Possibilities explain action. Journal of Economic Psychology, 7, 137-160. Frey, B., & Torgler, B. (2007). Tax morale and conditional cooperation. Journal of Comparative Economics, 35, 136-159. Gartner, W. (1985). A conceptual framework for describing the phenomenon of new venture creation. Academy of Management Review, 10(4), 696-706. Gerxhani, K., & Schram, A. (2006). Tax evasion and income source: A comparative experimental study. Journal of Economic Psychology, 27, 402-422. Gray, S. (1988). Towards a theory of cultural influence on the development of accounting systems internationally. Abacus, 24, 1-15. Guba, E. (1990). The alternative paradigm dialog. In E. Guba (Ed.), The paradigm dialog (pp. 17-27). London: Sage Publications. Hall, E. (1976). Beyond cultures. New York: Anchor Press/Doubleday. Hampden-Turner, C., & Trompenaars, F. (1996). A world turned upside down: Doing business in Asia. In P. Joynt & M. Warner (Eds.), Managing across cultures: Issues and perspectives (pp. 275-308). London: International Thomson Business Press. Henry, E. (2007). Kaupapa Maori entrepreneurship. In D. Leo-Paul & R. Anderson (Eds.), International handbook of research on indigenous entrepreneurship (pp. 536-548). Cheltenham, UK: Edward Elgar. Ho, D., & Wong, B. (2008). Issues on compliance and ethics in taxation: What do we know? Journal of Financial Crime, 15(4), 369-382. Hofstede, G. (1980). Culture consequences: International differences in work-related values. Beverley Hills: Sage Publications. Hofstede, G. (1991). Cultures and organizations: Software of the mind. London: McGrawHill. Hofstede, G. (2001). Culture consequences: Comparing values, behaviours, institutions, and organizations across nations (2nd ed.). Thousand Oaks: Sage Publications. Hofstede, G., & Bond, M. (1988). The Confucius connection: From cultural roots to economic growth. Organizational Dynamics, Spring, 5-21. Hofstede, G., & Hofstede, G. (2005). Cultures and organizations: Software of the mind (2nd ed.). New York: McGraw Hill. 23 Hoppe, M. (1998). Validiting the masculinity/femininity dimensions on elites from nineteen countries. In G. Hofstede (Ed.), Masculinity and femininity: The taboo dimension of national cultures (pp. 29-43). Thousand Oaks, CA: Sage Publications. IFC, & The World Bank. (2010). Doing business 2010: Reforming through difficult times comparing regulation in 183 economies. Retrieved 13th October, 2010, from http://www.doingbusiness.org/documents/fullreport/2010/DB10-full-report.pdf Joulfaian, D. (2009). Bribes and business tax evasion. The European Journal of Comparative Economics, 6(2), 227-244. Joulfaian, D., & Rider, M. (1998). Differential taxation and tax evasion by small business. National Tax Journal, 51(4), 675-687. Kitzinger, J., & Barbour, R. (1999). Introduction: The challenge and promise of focus groups. In R. Barbour & J. Kitzinger (Eds.), Developing focus group research: Politics, theory and practice (pp. 1-20). London: Sage Publications. Lewis, K., Ashby, M., Coetzer, A., Harris, C., & Massey, C. (2005). Family, friends and government agencies: A report on SMEs and the support infrastructure. Wellington: New Zealand Centre for SME research. Li, S. (2010). Social identities, ethnic diversity, and tax morale. Public Finance Review, 38(2), 146-177. Lincoln, Y., & Guba, E. (1985). Naturalistic inquiry. Beverley Hills: Sage Publications. Long, S., & Swingen, J. (1991). The conduct of tax-evasion experiments: Validation, analytical methods, and experimental realism. In P. Webley, H. Robben, H. Elffers, & D. Hessing (Eds.), Tax evasion: An experimental approach (pp. 128-138). Cambridge: Cambridge University Press. Lucas, N. (2009). The impact of westernisation on Tongan cultural values related to business (Master of Arts). Western Kentucky University Bowling Green. Luczak, C. (2009). Network derived benefits and cultural roots: Study of Indian and Western service SMEs (Doctor of Philosophy). University of Illinois, Chicago. Mataira, P. (2000). Maori entrepreneurship: The articulation of leadership and the dual constituency arrangements associated with Maori enterprise in a capitalist economy (Doctor of Philosophy). Massey University, Auckland. McCoy, M., & Havea, S. (2006). Making sense of Tonga: A visitor’s guide to the kingdoms rich Polynesian culture. Nuku’alofa, Tonga: South Pacific: Training group of the Pacific. McGee, R., Ho, S., & Li, A. (2008). A comparative study on perceived ethics of tax evasion: Hong Kong vs the United States. Journal of Business Ethics, 77, 147-158. McKerchar, M. (1995). Understanding small business taxpayers: Their sources of information and level of knowledge of taxation. Australian Tax Forum, 12(1), 25-41. McSweeney, B. (2002). Hofstede's model of national culture differences and their consequences: A triumph of faith - a failure of analysis. Human Relations, 55, 89-118. Mead, H. (2003). Tikanga Maori: Living by Maori values. Wellington: Huia Publishers. Meleisea, M. (1987). Ideology in Pacific studies: A personal view. In A. Hooper, S. Britton, R. Crocombe, J. Huntsman, & C. Macpherson (Eds.), Class and culture in the South Pacific (pp. 140-153). Suva: Institute of Pacific Studies of the University of the South Pacific and Centre for Pacific Studies of the University of Auckland. Miles, M., & Huberman, A. (1984). Qualitative data analysis. London: Sage Publications. Ministry of Economic Development. (2007). SMEs in New Zealand: Structure and dynamics. Wellington: Ministry of Economic Development: New Zealand Government. Ministry of Economic Development. (2009). SMEs in New Zealand: Structure and dynamics: Ministry of Economic Development: New Zealand Government. Mitchell, L. (2009). Maori and welfare. Wellington: New Zealand Business Roundtable. 24 Morse, S., Karlinsky, S., & Bankman, J. (2009). Cash businesses and tax evasion. Stanford Law and Policy Review, 20(1), 37-68. Naylor, L. (1996). Culture and change: An introduction. Portsmouth: Greenwood. Newman, K., & Nollen, S. (1996). Culture and congruence: The fit between management practices and national culture. Journal of International Business Studies, 27, 753-778. NZIER. (2007). A time for change in Maori economic development. Wellington: Te Puni Kokiri. O' Dwyer, B. (2004). Qualitative data analysis: Illuminating a process for transforming a "messy" but "attractive" "nuisance". In C. Humphrey & B. Lee (Eds.), The real life guide to accounting research: A behind-the-scenes view of using qualitative research methods (pp. 391-407). Amsterdam: Elsevier B. V. OECD. (2004). SME statistics:Towards a more systematic statistical measurement of SME behaviour. Background report for the 2nd OECD Conference of Ministers responsible for small and medium enterprises (SMEs). Oosterbeek, H., Sloof, R., & van de Kuilen, G. (2004). Culture differences in ultimatum game experiments: Evidence from a meta-analysis. Experimental economics, 7, 171188. Patton, M. (2002). Qualitative research & evaluation methods (3rd ed.). Thousand Oaks: Sage Publications. Petersen, W. (1980). Concepts of ethnicity. In S. Thernstrom (Ed.), Harvard encyclopedia of American ethnic groups (pp. 234-242). Cambridge, Massachusettes: Harvard. Pfeifer, D. (2005). Leadership in Aotearoa New Zealand: Maori and Pakeha perceptions of outstanding leadership. Massey University, Wellington. Pio, E. (2010). Longing and belonging: Asian, Middle Eastern, Latin American and African peoples in New Zealand. Wellington: Dunmore Publishing. Popper, M., & Sleman, K. (2001). Intercultural differences and leadership perceptions of Jewish and Druze school principals. Journal of Educational Administration, 39(3), 221-232. Pyle, D. (1991). The economics of taxpayer compliance. Journal of Economic Surveys, 5, 163-198. Ram, M., Smallbone, D., & Deakins, D. (2002). Ethnic minority businesses in the UK: Access to finance and business support. London: British Bankers' Association. Redding, S. (1993). The spirit of Chinese capitalism. New York: Walter de Gruyter. Richardson, G. (2005). An exploratory cross-cultural study of tax fairness perceptions and tax compliance behaviour in Australia and Hong Kong. The International Tax Journal, 31(1), 11-24. Richardson, G. (2008). The relationship between culture and tax evasion across countries: Additional evidence and extensions. Journal of International Accounting, Auditing & Taxation, 17, 67-78. Robie, D. (2009). Diversity reportage in Aotearoa: Demographics and the rise of the ethnic media. Pacific Journalism Review, 15(1), 67-91. Roth, J., Scholz, J., & Witte, A. (1989). Taxpayer compliance: An agenda for research (Vol. 1). Philadelphia: University of Pennsylvania Press. Rothengatter, M. (2005a). Social networks and tax (non-) compliance in a multicultural nation: Emerging themes from a focus group study among ethnic minorities in Australia. International Journal of Entrepreneurial Behaviour & Research, 11(4), 280-314. Rothengatter, M. (2005b). "Sticks, carrots or sermons?" - Improving voluntary taxcompliance among migrant small-business entrepreneurs of a multi-cultural nation. 25 Working paper 82 Centre for Tax System Integrity, Research School of Social Sciences, Australian National University. Canberra. Schwartz, S. (1999). A theory of cultural values and some implications for work. Applied Psychology: An International Review, 48, 23-47. Sekaran, U. (1983). Methodological and theoretical issues and advancements in cross-cultural research. Journal of International Business Studies, 14(Fall), 61-73. Sivakumar, K., & Nakata, C. (2001). The stampede toward Hofstede's framework: Avoiding the sample design pit in cross-cultural research. Journal of International Business Studies, 32(3), 555-574. Smallbone, D., Fadahunsi, A., Supri, S., & Paddison, A. (1999. The diversity of ethnic minority enterprises. presented at the meeting of the RENT XIII, November 25-26, London. Smith, K., & Kinsey, K. (1987). Understanding taxpaying behaviour: A conceptual framework with implications for research. Law and Society Review, 21(4), 639-663. Smith, P. (2006). When elephants fight, the grass gets trampled: The GLOBE and Hofstede projects. Journal of International Business Studies, 37, 915-921. Sondergaard, M. (1994). Hofstede's consequences: A study of reviews, citations and replications. Organization Studies, 15, 447-456. Song, Y., & Yarbrough, T. (1978). Tax ethics and taxpayer attitudes: A survey. Public Administration Review, 38, 442-457. Starmer, C. (1999). Experiments in economics: Should we trust the dismal scientists in white coats? Journal of Economic Methodology, 6, 1-30. Statistics New Zealand. (2001). Census 2001: National Summary - Tables. Retrieved 7 November 2010, from http://search.stats.govt.nz/search?w=2001%20census Statistics New Zealand. (2010). 2006 census data – QuickStats-about-culture-and-identitytables.xls Retrieved 9 September, 2010, from http://www.stats.govt.nz.ezproxy.aut.ac.nz/Census/2006CensusHomePage/QuickStats /quickstats-about-culture-and-identity-tables Taras, V., Kirkham, B., & Steel, P. (2010). Examining the impact of Culture's Consequences: A three-decade multilevel, meta-analytic review of Hofstede's cultural value dimensions. Journal of Applied Pyschology, 95(3), 405-439. Tiatia, J. (1998). Caught between cultures: A New Zealand-born Pacific Island perspective. Auckland: Christian Research Association. Torgler, B. (2007). Tax compliance and tax morale: A theoretical and empirical analysis. Cheltenham: Edward Elgar Publishing. Trompenaars, A., Hampden-Turner, C., & Trompenaars, F. (1994). Riding the waves of culture: Understanding diversity in global business. Burr Ridge: Irwin Professional Publications. Tsakumis, G., Curatola, A., & Porcano, T. M. (2007). The relation between national cultural dimensions and tax evasion. Journal of International Accounting, Auditing & Taxation, 16, 131-147. Tsui-Auch, L. (2004). The professionally managed family-ruled business: Ethnic Chinese business in Singapore. Journal of Management Studies, 41(4), 693-723. Tsui-Auch, L. (2005). Unpacking regional ethnicity and the strength of ties in shaping ethnic entrepreneurship. Organization Studies, 26(8), 1189-1216. Tung, R. (2008). The cross-cultural research imperative: the need to balance cross-national and intra-national diversity. Journal of International Business Studies, 39, 41-46. United States Census Bureau. (2010). 2010 census data. Retrieved 14 June 2011, from http://2010.census.gov/2010census/data/ 26 Warriner, V. (2007). The importance of traditional Maori values for necessity and opportunity: Maori entrepreneurs-iwi-based and individually owned. In D. Leo-Paul & B. Anderson (Eds.), International handbook of research on indigenous entrepreneurship (pp. 558-564). Cheltenham: Edward Elgar. Williamson, D. (2002). Forward from a critique of Hofstede's model of national culture. Human Relations, 55(11), 1373-1395. Yong, S. (2006). A critical evaluation of the economic deterrence model on tax compliance. New Zealand Journal of Taxation Law and Policy, 12(2), 95-116. 27