Chap2

advertisement

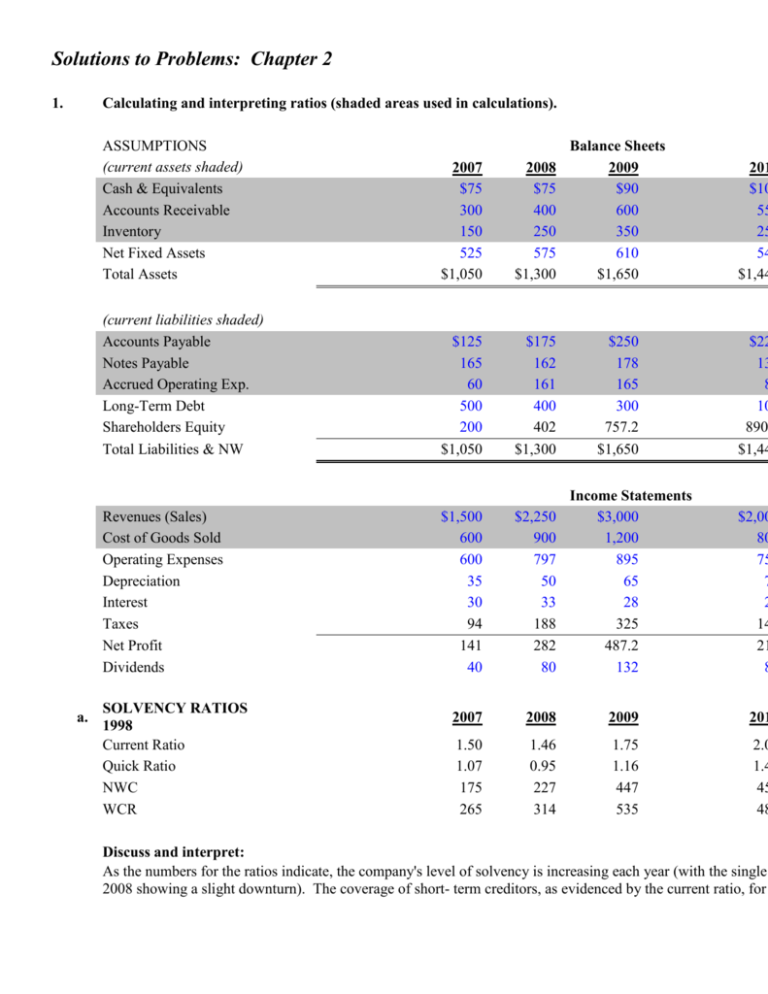

Solutions to Problems: Chapter 2

1.

Calculating and interpreting ratios (shaded areas used in calculations).

ASSUMPTIONS

(current assets shaded)

Cash & Equivalents

Accounts Receivable

Inventory

Net Fixed Assets

Total Assets

2007

$75

300

150

525

$1,050

(current liabilities shaded)

Accounts Payable

Notes Payable

Accrued Operating Exp.

Long-Term Debt

Shareholders Equity

Total Liabilities & NW

$125

165

60

500

200

$1,050

Revenues (Sales)

Cost of Goods Sold

Operating Expenses

Depreciation

Interest

Taxes

Net Profit

Dividends

a.

SOLVENCY RATIOS

1998

Current Ratio

Quick Ratio

NWC

WCR

2008

$75

400

250

575

$1,300

Balance Sheets

2009

$90

600

350

610

$1,650

201

$10

55

25

54

$1,44

$175

162

161

400

402

$1,300

$250

178

165

300

757.2

$1,650

$22

13

8

10

890

$1,44

Income Statements

$3,000

1,200

895

65

28

325

487.2

132

$1,500

600

600

35

30

94

141

40

$2,250

900

797

50

33

188

282

80

$2,00

80

75

7

2

14

21

8

2007

2008

2009

201

1.50

1.07

175

265

1.46

0.95

227

314

1.75

1.16

447

535

2.0

1.4

45

48

Discuss and interpret:

As the numbers for the ratios indicate, the company's level of solvency is increasing each year (with the single

2008 showing a slight downturn). The coverage of short- term creditors, as evidenced by the current ratio, for

increases from $1.50 of current assets per dollar of current liabilities in 2007 to $2.27 of current assets for ever

current liabilities in 2011.

b. Calculating the cash conversion period.

Days Sales Outstanding = Receivables / (Sales / 365)

Days Inventory Held = Inventory / (COGS / 365)

Days Payable Outstanding = Payables / (COGS / 365) *

Purchases = Ending inventory - Beginning inventory + Cost of Goods Sold

Operating Cycle = Days Sales Outstanding + Days Inventory Held

Cash Conversion Period = Operating Cycle - Days Payable Outstanding

Days Sales Outstanding

Days Inventory Held

Days Payables Out

Operating Cycle

Cash Conversion Period

NA

2007

73.00

91.25

76.04

164.25

2008

64.89

101.39

70.97

166.28

2009

73.00

106.46

76.04

179.46

201

100.3

114.0

102.6

214.4

88.21

95.31

103.42

111.7

Interpret the 4-year trend:

The cash conversion period shows an increasing Trend over the five-year period. Although the firm’s solvency

over the period in question (see part a), the firm becomes more liquid (as evidenced by the longer CCPs).

2. a. The repayment of $50,000 in trade credit with cash will not change the current ratio if the initial current ratio is

illustrate, assume that the initial levels of current assets and liabilities equal $200,000 apiece. The transaction r

above implies that the new current ratio equals 1.00 ([200,000-50,000]/[200,000-50,000]).

b. An intial current ratio of 0.50 implies initial current assets of $200,000 and current liabilities of $400,000. Thu

repayment of trade credit will reduce the current ratio to 0.43 ([200,000-50,000]/[400,000-50,000]).

c.

3.

In this case the current ratio will increase. An intial current ratio of 1.70 implies initial current assets of $340,0

liabilities of $200,000. Thus, the repayment of trade credit will increase the current ratio to 1.93 ([340,000-50,

50,000]).

Current DSO =

Desired DSO =

Revenue =

Borrowing rate =

35

30

10,000,000

2.5%

days

days

Next year's DIH =

Next years's DPO =

45

75

days

days

$958,904

a. The given data suggests that the current level of A/R is

to 30 days without a reduction in revenues suggests that receivables will drop to

This implies that reducing the DSO will result in a

$136,986

b. Financing cost reduction =

c.

Hence, reducing the

lower investment in

$3,424.66

75 days

0 days

The new OC equals

The new CCP equals

OC = DSO + DIH

CCP = OC - DPO

4. Central Mississippi Devices -- considering a cash discount.

DATA FOR CURRENT TERMS:

prompt payors

percent of total customers

average payment day

average invoice amount

80%

35

$4,000

laggards

percent of total customers

average payment day

average invoice amount

annual cost of capital

a. Cashflow timeline under current terms.

Avg Prompt Payor Day =

35

---|------------------------------------------------|------------------------------|------------->

Avg Invoice =

(0.8)($4K)

Day 0

$3,200

Avg Laggard Day =

Avg Invoice = (0.2)

$800

PV = $3,200 x 1 / [1 + (0 .11/365) x 35]

=

$3,166.60

PV = $800 x 1 / [1 + (0.11/365) x 72]

=

$783.01

Total PV of Current Terms = $3,166.60 + $783.01 =

$3,949.6

b. Cashflow timeline under proposed 2/10, net 30 terms

DATA FOR PROPOSED TERMS:

prompt payors

laggards

percent of total customers

payment day, discounting

payment day, non discounting

average invoice amount

percent discount

percent to take discount

80.00%

10

40

$4,000

2.00%

50.00%

Day 0

percent of total customers

payment day, discounting

payment day, non discounting

average invoice amount

percent discount

percent to take discount

annual cost of capital

Day 40

Day 10

Da

80

--|--------------------------------------|---------------------------|------------------|-------->

40% x 0.98 x $4K / day

40% x $4K / day 16% x $4K

+ 4% x .98 x $4K / day

$1,724.80

$1,600.00

PV = $1,724.80{ 1 / [1 + ( .11/365)(10)]}|

PV

$1,719.62

PV = $1,600{ 1 / [1 + (.11/365)(40)]}

PV

$1,580.94

FV = $640

PV = $640{ 1 / [1 + (.11/365)(80)]}

PV

$624.93

Total PV of Proposed Terms =

$1,719.62

+

=

c.

$1,580.94

+

$3,925.49 per day

Net Present Value of Proposal = $3,925.49 - $3,949.61 =

So, if the forecasts are correct, on an average invoice the firm will lose $24.12

per day from the proposed change.

d. Other factors to take into account are industry practice, any other direct costs for this

product line, marketing aspects, company or competitor promotions going on or

anticipated in the future, and the company's overall strategy.

e.

$624.93

By varying the percentage of discount takers, we can observe the change in NPV of the

proposed change. The analysis is valuable in this case, showing that even with no cash

discount takers, the proposal is a loser. In other words, there is no "prompt payor" cash

discount utilization rate which would make this project a winner on an NPV basis.

Here are the sensitivity analysis results:

($24.12

% Cash Discount

Takers (Prompt Payors)

0%

30%

40%

base case

50%

60%

70%

NPV per average invoice

($6.46)

($17.05)

($20.59)

($24.12)

($27.65)

($31.18)