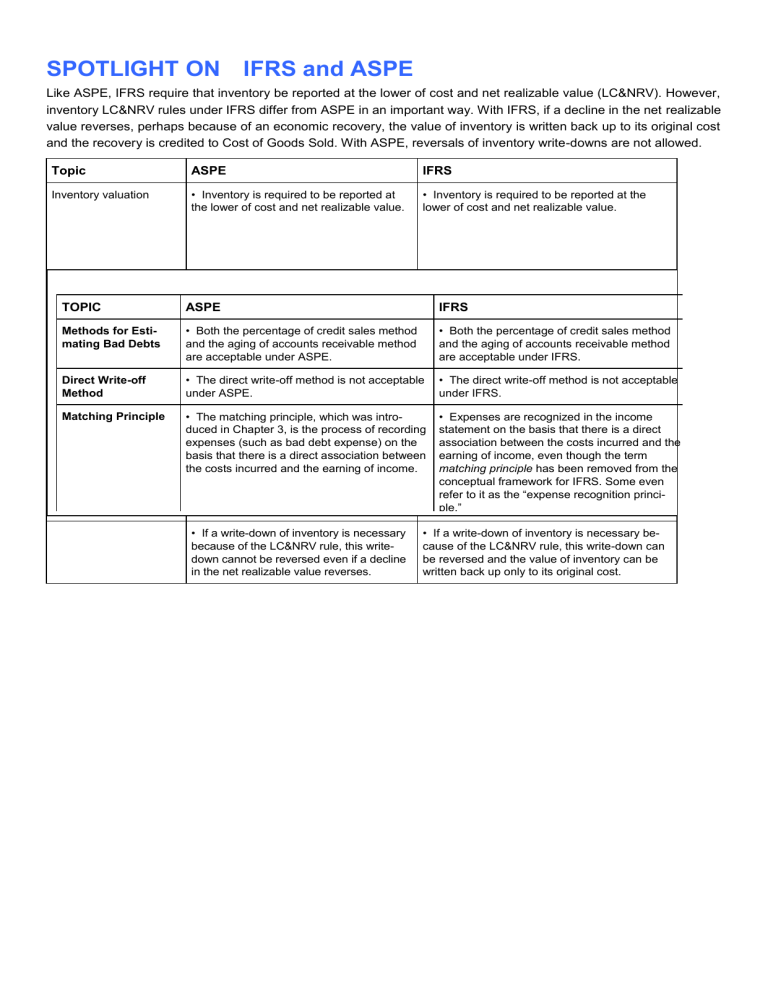

SPOTLIGHT ON*IFRS and ASPE

SPOTLIGHT ON IFRS and ASPE

Like ASPE, IFRS require that inventory be reported at the lower of cost and net realizable value (LC&NRV). However, inventory LC&NRV rules under IFRS differ from ASPE in an important way. With IFRS, if a decline in the net realizable value reverses, perhaps because of an economic recovery, the value of inventory is written back up to its original cost and the recovery is credited to Cost of Goods Sold. With ASPE, reversals of inventory write-downs are not allowed.

Topic

Inventory valuation

ASPE

• Inventory is required to be reported at the lower of cost and net realizable value.

IFRS

• Inventory is required to be reported at the lower of cost and net realizable value.

TOPIC

Methods for Estimating Bad Debts

ASPE

• Both the percentage of credit sales method and the aging of accounts receivable method are acceptable under ASPE.

IFRS

• Both the percentage of credit sales method and the aging of accounts receivable method are acceptable under IFRS.

• The direct write-off method is not acceptable under ASPE.

• The direct write-off method is not acceptable under IFRS.

Direct Write-off

Method

Matching Principle • The matching principle, which was introduced in Chapter 3, is the process of recording expenses (such as bad debt expense) on the basis that there is a direct association between the costs incurred and the earning of income.

• Expenses are recognized in the income statement on the basis that there is a direct association between the costs incurred and the earning of income, even though the term matching principle has been removed from the conceptual framework for IFRS. Some even refer to it as the “expense recognition principle.”

• If a write-down of inventory is necessary because of the LC&NRV rule, this writedown cannot be reversed even if a decline in the net realizable value reverses.

• If a write-down of inventory is necessary because of the LC&NRV rule, this write-down can be reversed and the value of inventory can be written back up only to its original cost.