Clarification in Debt - Ministry of Finance and Economic Development

advertisement

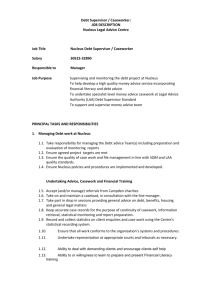

Reply to Defi Media article of 11 August 2013 and News on Sunday 16-22 August on Debt Following your article, your readers may find it useful to consider the following facts and clarifications: We agree that all countries should be worried about excessive public debt. This is why in 2008 Government for the first time in our history adopted a Public Debt Management Act (PDMA) that set the targets for Debt reduction. The good news is that the Act is working. This is why excessive debt is not a concern for our country according to the specialists of debt. Moody’s has in fact upgraded us at a time when many countries have been downgraded on debt concerns. Moreover, the positive evolution of debt is clear in the table below. To better understand the assessment of debt experts, it is useful to consider the obligations imposed by the PDMA. The PDMA uses two definitions of public debt: o Total Public Sector Debt; and o Discounted Public Sector Debt. Discounted Public Debt evaluates Total Public Sector Debt for the fiscal risks associated with debt of para-statals and state-owned enterprises. Accordingly, this debt is discounted whenever the fiscal risk is small. For operational purposes of adherence to the provisions of the PDMA, it is discounted Public Sector Debt that is relevant. In practice, the two measures of Debt usually follow the same trends as indicated in the table below. Total Public Sector Debt (as a % of GDP) Total Public Sector Debt Discounted for the purpose of Debt Ceiling (as a % of GDP) 05/06 69 06/07 63 07/08 55 08/09 57 Jul Dec 09 60 2010 59 2011 59 2012 58 Jun-13 58 2005 2006 2007 2008 2009 2010 2011 2012 Jun-13 64 61 54 48 56 55 54 53 54 The PDMA requires Government to reduce Discounted Public Sector Debt to 50% of GDP by 2018. Government fiscal policies have been consistent with these legal provisions. Consequently, Discounted Public Sector Debt has been reduced very sharply from 64% of GDP in 2005 to 54% of GDP as at June 2013, as indicated in the table above. Clearly, our level of public debt is not only well below the internationally accepted threshold of 60%, contrary to the statement in your article, but is on a declining path. A serious assessment of public debt and debt sustainability requires the use of appropriate statistics and ratios. In particular, assessment of public debt should be based on its share to GDP rather than on absolute figures. Debt is a positive means for individuals, companies and countries to finance expensive items such as a house, machinery or a road. Moreover, debt is only a problem if it cannot be repaid. To understand better why ratios matter and absolute figures are irrelevant, the following example could be considered. If the income of person A is Rs 100,000 per month and he takes a loan of Rs 1 M, with a monthly repayment of Rs 10,000, his repayment ratio (% of income used for repayment of debt) is 10%. On the other hand if person B earns Rs 10,000 per month and takes a loan of Rs 500,000, with a monthly repayment of Rs 5,000, his repayment ratio is 50%. If we use this type of analysis, we would conclude that person A is very badly off because he owes Rs 1 M, whilst person B is twice as well off on debt because he owes half that amount. In reality, once we consider the capacity to pay, everyone would agree that person A is in fact not only better off, but with manageable debt. In contrast, person B faces financial disaster, which a simplistic analysis of absolute debt would overlook. This point is both elementary in economics and crucial for a good understanding of debt issues. Thus, it is worrying to observe that the same mistakes of analysis are routinely and widely made in many other articles on debt and other related discussion forums. Once we use the correct metric, it is clear that our debt level does not pose any threat at this stage – which is one of the indicators of resilience. In fact the level of debt is much lower than the debt levels in many countries in the rest of the world including, most of the Euro Zone nations, US, UK, India, Brazil. In these countries debt ranges from 66.8% to 106.5% compared to only 58% in Mauritius. An increase in absolute public sector debt is a normal phenomenon even for the best managed countries in the world, and should not be a cause for ringing alarm bells. For example, in Germany public debt has almost doubled from 1.2 trillion Euros in 2000 to well over 2 trillion Euros over the 12-year period to 2012. More important than general aggregates is the purpose for borrowing. Greece and other countries have run into trouble by borrowing to finance consumption and unsustainable increases in public sector expenditure. In our case, our borrowing has largely been driven by the need to modernize, upgrade and expand our public infrastructure. Against the increase in public debt in absolute terms we also need to set off the massive increase in public investment since 2005. MOFED is well aware of the need to reduce vulnerabilities related to public debt. In this regard, our Debt Strategy is focused, inter-alia, on minimizing cost of borrowing to the public sector and smoothing the debt profile through the use of longer term debt instrument to further reduce our exposure to external shocks. It should also be noted that as at June 2013, nearly 78% of the total public sector debt is held locally. This is why we face little risk of the type of debt crisis that afflicted Brazil, India, Indonesia, S. Korea and Thailand amongst others. In these countries large amounts of foreign debt became difficult to service when the exchange rate suffered unexpected depreciation. We have demonstrated a good level of resilience in that we have been able to keep a low exposure to the international debt market, which is part of the reason for the upgrade by Moody’s. It is the credibility of a country’s economic policies and the capacity to repay its debt, which determine whether a given level of debt is sustainable or not. Our recent upgrade to Baa1 reflects Mauritius scoring positively score on both of these metrics. In fact, our recent upgrade Moody’s is largely the result of a positive assessment of our debt dynamics. In a report following the upgrade to Baa1 published on 27 June 2013, Moody’s states: “Mauritius has undertaken various steps to geographically diversify its export market away from slow-growth European economies and towards faster-growing African and Asian economies. Progress in this area will mitigate the economy's external vulnerabilities, thereby maintaining its favourable external debt metrics.” “With short-term debt having shrunk to 18% of the total debt stock from 30% in 2007, rollover risk has diminished substantially. The government can rely almost exclusively on the very liquid domestic debt markets, and its external exposure is modest, albeit increasing vis-a-vis multilateral lending. It should be noted that its debt affordability (i.e., the interest-payments-torevenue ratio) has also improved from 21% in 2007 to 14% in 2012, primarily as a result of lower interest rates and better tax collection.” Similarly, the IMF notes in its latest Article IV Report on Mauritius: “The debt sustainability analysis (DSA) shows a broadly positive debt outlook, as in the previous DSA. Both total public and external debt are on sustainable trajectories and the results of stress tests indicate that debt dynamics are resilient to most shocks.” Considering all of the above, there is no reason to doubt the ability of Mauritius to maintain its current debt level. In fact, our assessment (which is shared by the IMF) is that Mauritius is well on track to achieve its target of bringing public sector debt below 50% by 2018, and possibly earlier. Research Team Ministry of Finance and Economic Development 20 August 2013