Campaign Expenditures

advertisement

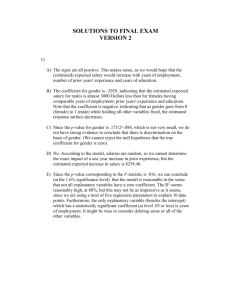

Chaojun LI 李超君 5101209122 Campaign Expenditures To study whether campaign expenditures affect election outcomes, we run a regression and get the estimated equation, voteA=45.08788+6.081356log(expendA)–6.615630log(expendB)+0.152014prtystra (3.926796) (0.382114) (0.378889) (0.062026) (1) To conduct the Breusch-Pagan, we regress the squared residuals on the three independent variables, and get R2=0.054761, nR2=3R2=0.164283, degree of freedom:3 H0: nR2=0, H0: nR2≠0 Critic value: 7.815, given α=0.05 3R2=0.164283<7.815, so we cannot reject the null hypothesis. Thus we can think that the homoscedasticity holds. (2) The White Procedure voteA=45.08788+6.081356log(expendA)–6.615630log(expendB) +0.152014prtystra (4.069780) (0.515030) (0.331477) (0.056016) In the white procedure, the standard error for the coefficient of log(expendA) and the intercept is larger, while that for the coefficient of log(expendB) and prtystra is smaller. (3) β1 means that when expendA increases by 1% ceteris paribus, voteA increases by β1/100. For example, for the equation we get β1 equals 6.081356, which means if expendA increases by 1%, voteA will increase by 0.0608 (4) H0: β1+β2=0, H1: β1+β2≠0 ̂1 and 𝛽 ̂2 are separately 0.382114 and 0.378889 and (5) Since the t-statistics for 𝛽 the p-value are separately 0.0000 and 0.0000. Thus we can think that both A’s and B’s expenditure affect the outcome. To test the hypothesis in (4), we first use t-test to get whether our conjecture is right. ̂2 − 𝛽 ̂1)=var(𝛽 ̂2)+var(𝛽 ̂1)-2cov(𝛽 ̂2 , 𝛽 ̂1)=0.14355+0.14601-2*(-0.002679)=0.29493 Var(𝛽 t-statistics: (6.081356-6.615630)/(0.29493)^0.5=-0.983794 critical point: (using standard normal approximation): ±1.96, given the level of significance is 5% Since t-statistics is larger than -1.96, we cannot reject the null hypothesis. Thus we can think that 1% increase in A’s expenditure is offset by a 1% increase in B’s expenditure. (6) In order to estimate a model that directly gives the t statistic for testing the hypothesis in (4), we first rearrange the model by plugging c=β1+β2 in and get, voteA=β0+β1(log(expendA)–log(expendB))+c log(expendB)+β3prtystra+u After we run the regression, we can get the function, voteA=45.0879+6.08136(log(expendA)–log(expendB)) (3.926796) (0.382114) -0.534275log(expendB)+0.15201prtystra (0.533114) (0.062026) H0: c=0, H1: c≠0 t-statistics: -0.534275/0.533114=-1.00217 degree of freedom: 173-3-1=169 The critic value: ±2.261548, given the level of significance is 5% Since t-statistics is -1.00217>-2.261548, thus we cannot reject the null hypothesis. We can think that 1% increase in Candidate A’s expenditures is offset by a 1% increase in B’s expenditure, which is the same conclusion as we get in (5). Price Discrimination This article is to check whether fast-food restaurants charge higher prices in areas with a larger concentration of blacks. We first run a regression and get the estimated equation, Log(psoda)=-1.463332+0.072807prpblck+0.136955log(income)+0.380360prppov obs: 401 (0.293711) (0.030676) (0.026755) (0.132790) ̂1=0, H1: 𝛽 ̂1≠0 (1) H0: 𝛽 t-statistics: 2.373458 degree of freedom: 401-3-1=397 Given the level of significance is 5%, the critic value: ±1.965957 Given the level of significance is 1%, the critic value: ±2.58827 Since t-statistics=2.373458>1.965957 when the level of significance is 5%, we can ̂1 does not equal to zero. reject Ho and think that 𝛽 However, when the level of significance is 1%, t-statistic is less than 2.58827. We cannot reject the null hypothesis. (2) The covariance between log(income) and prppov is 0.002802. The variance of log(income) and prppov are 0.000716 and 0.017633, respectively. The correlation is 0.002802/(0.000716*0.017633)^0.5=0.788585 Variable t-statistics P-value Prpblck 2.373458 0.018098 Log(income) 5.118780 4.80205E-07 prppov 2.864364 0.004400 (degree of freedom of the three variables are all 397) Log(income) and prppov can be statistically significant in any cases. However, prpblck is not significant given the level of significance is 1%. (3) After we add log(hseval) into the model, the function we get is, Log(psoda)=-0.841514+0.097550prpblck-0.052991log(income) (0.292432) (0.029261) (0.037526) +0.052123prppov+0.121306log(hseval) obs: 401, RU2=0.183930 (0.134499) (0.017684) ̂ 𝐻0 : 𝛽loĝ (ℎ𝑠𝑒𝑣𝑎𝑙) =0, H1: 𝛽log(ℎ𝑠𝑒𝑣𝑎𝑙) ≠0 t-statistic for βlog(hseval): 6.859602 degree of freedom: 396 P-value: 2.66811E-11 Thus we can reject the null hypothesis and think log(hseval) is statistically significant. ̂ = 𝛽prppov ̂ =0, (4) H0: 𝛽log(𝑖𝑛𝑐𝑜𝑚𝑒) ̂ ≠ 0, or 𝛽𝑝𝑟𝑝𝑝𝑜𝑣 ̂ ≠0 H1: 𝛽log(𝑖𝑛𝑐𝑜𝑚𝑒) Using F test, we rewrite the regression model and get the new function, Log(psoda)=-1.043086+0.128829prpblck+0.090341log(hseval), obs:401, RR2=0.169411 (0.126569) (0.022473) (0.010618) F-statistics: 2 2 (𝑅𝑈 −𝑅𝑅 )/2 2 )/(401−4−1) (1−𝑅𝑈 = (0.183930−0.169411)/2 (1−0.183930)/396 = 3.522690~F2,396 p-value: 0.030448 critical value: 3.01851, given the level of significance is 5% Since the p-value we get is less than 5%, we cannot reject H0. Thus we can think that the two variables are jointly significant. (5) I will use the regression of (3), that is, the function I believe more is, Log(psoda)=-0.841514+0.097550prpblck-0.052991log(income) (0.292432) (0.029261) (0.037526) +0.052123prppov+0.121306log(hseval) obs: 401, RU2=0.183930 (0.134499) (0.017684) I believe this model first because it contains more valid variables. We have already justify that log(hseval) is significant and log(income) and prppov are jointly significant. Compared to the original model, this one takes log(hseval) out of the error term and make the assumption that u is independent of regressors more valid and thus make the model better. Secondly, the adjusted R-squared also increases, which means the dependent variable is better complained. As a result, I think this model is better and once the proportion of black increase by one, the price of the medium soda will increase by 9.755%.