Module 3/4 Group Case -

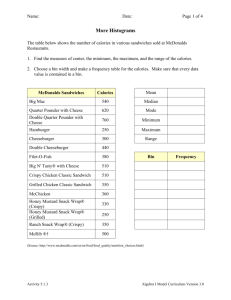

advertisement

Marketing Principles (MKTG300; FALL 2014; Dr. Carter) *** REVISED DUEDATE OF SATURDAY NOVEMBER 15TH *** *** SOCIAL ENTERPRISE MARKETING – COMBINING COMMERCE & COMMUNITY *** ~~ “TIME-BANKING” & “SHARING-ECONOMY” TYPED GROUP CASE ASSIGNMENT ~~ Segmentation, Targeting, Positioning (STP) Product Life Cycle (PLC) Marketing Mix (4Ps + CRM & Soc-Media) (30 Points; DUE by email Saturday November 15th @ 11:59pm) . INTRODUCTION This Group Case Assignment gives you an opportunity to insightfully apply marketing concepts and strategies to the situation presented above in the case discussion. As we know, MARKETING encompasses social and community purposes for commercial practices and conceptual principles. These types of community ventures are described as “Social Enterprises” http://en.wikipedia.org/wiki/Social_enterprise; https://www.se-alliance.org/what-is-social-enterprise; http://www.hbs.edu/socialenterprise/ ; http://caseatduke.org/index.html ; http://www.socialenterprise.net/pdfs/SocEntCaseStudyegs.pdf … including “Social Entrepreneurship” http://en.wikipedia.org/wiki/Social_entrepreneurship ; https://www.ashoka.org/social_entrepreneur ; http://csi.gsb.stanford.edu/social-entrepreneurship ; http://www.ssireview.org/topics/category/social_entrepreneurship . These “Social Enterprises” have legal status as “Benefit (B) Corporations” http://en.wikipedia.org/wiki/Benefit_corporation, and are also commonly associated with “Sustainable Business” principles http://en.wikipedia.org/wiki/Sustainable_business ; http://www.mckinsey.com/insights/energy_resources_materials/the_business_of_sustainability_mckinsey_global_survey_results. Also, remember that “Social Enterprise” marketing is physical, digital/virtual, and global. So, with this wide range of possibilities, you can certainly develop conceptually accurate and creative marketing strategies. In order to complete this Social Enterprise case assignment, you must specifically formulate marketing strategies for “Time-Banking” http://en.wikipedia.org/wiki/Time-based_currency ; http://www.yesmagazine.org/new-economy/timebanking-an-idea-whose-time-has-come ; http://timebanks.org/ and fashion them for the emerging “Sharing Economy” http://en.wikipedia.org/wiki/Sharing_economy ; http://www.economist.com/news/leaders/21573104-interneteverything-hire-rise-sharing-economy ; http://venturebeat.com/2014/10/06/sharing-economy-series-what-sharingeconomy-startups-know-that-you-dont/ ; http://www.triplepundit.com/topic/rise-of-the-sharing-economy/. In addition, you will have to apply specific marketing concepts and strategies learned from the course. Four (4) textbook concept frameworks are required to complete this group case assignment: a) Value Proposition (ch.2) … Define and design the case idea for creating brand/customer/market value b) Segmentation & Target Market Selection (ch.8) … Choose the types of customers (B2C/B2B) who value the idea c) Product Life Cycle (ch.11) … Plan marketing strategies over the projected life of the idea in the market. d) Marketing Mix (4Ps), CRM & Social-Media Strategies (chapters 10 – 19, 21 & 22) … Determine which strategic approaches will best create value to the idea being marketed for target customers. 1 CASE STUDY MATERIAL Can Crispy Green Go National? By LORA KOLODNY Published: November 18, 2009 http://www.nytimes.com/2009/11/19/business/smallbusiness/19casestudy.html The Company: Crispy Green of Fairfield, N.J., a maker of freeze-dried fruit snacks sold in silver packages that has seven employees and had 2008 revenue of $2.2 million. The snacks are a gluten-, dairy- and nut-free alternative to chips. The Challenge: To increase sales aggressively. Crispy Green wanted to get its snacks on the shelves of major national food chains. But it didn’t want to sacrifice profitability by doing what chains generally require: discounting products steeply and paying expensive fees in exchange for shelf space. The company lacked the cash to “pay for play” the way Kraft or General Mills might. And it feared that discounting its product would undercut its premium image and hurt relationships with its existing customers. The Background: Since 2005, when Crispy Green introduced its freeze-dried slices of apples and pears, the company has stuck to a “transparent” pricing policy, giving wholesale customers, large or small, the same rates. Among other things, Angela Liu, the company’s chief executive and founder, feared that choosing to discount or to pay fees might represent a slippery slope that would undermine the company’s long-term prospects. A first-time entrepreneur who had left a chemical engineering career in pharmaceuticals to start Crispy Green, Ms. Liu knew she was going against the grain. Early buyers included mom-and-pop stores and gourmet grocers like Central Market in Houston and Balducci’s in New York. By the start of 2008, having built relationships with some 200 independent groceries and small chains across the United States, Crispy Green was growing at a year-over-year clip of 80 percent. But as Ms. Liu prepared to approach buyers and distributors at bigger chains, a Crispy Green consultant, Alan Levitan, a 30-year veteran of the grocery industry, warned that her pricing policy could become an impediment. 2 CASE STUDY MATERIAL Crispy Green Case (continued) She remained optimistic — until a meeting in late October 2008 between her sales staff and UNFI, a specialty foods distributor that works with Hannaford Supermarkets, a grocery chain with more than 150 stores in the northeastern United States. UNFI seemed to view Crispy Green favorably but said Hannaford’s corporate policy required discount terms — 10 to 15 percent lower prices than the Crispy Green would offer other wholesale customers — to fuel special sales throughout the year. UNFI wouldn’t even show Crispy Green products to Hannaford buyers unless Ms. Liu agreed to the discounts. Ms. Liu responded that selling Crispy Green at 15 percent off one week and at the suggested retail price the rest of the season could actually drive shoppers to buy less often, encouraging them to wait for specials and thereby hurting sales volume for Crispy Green as well as for Hannaford. She concluded that offering “high-low” pricing to please a distributor was too much of a sacrifice — no matter how desirable the relationship. As it happened, however, sales at Crispy Green’s largest retail partner to date, the Northeast division of 7-Eleven, were slowing. Ms. Liu’s buyer contact there suggested the fruit snacks were getting lost among a huge variety of items. He believed that, after a great debut, the snacks needed to be “refreshed.” Maybe special sales could do that. Ms. Liu began to wonder: Was it time for a new pricing strategy? Or was it time to abandon the hope of growing through major chains? The Options: Ms. Liu and Mr. Levitan deliberated over the pricing strategy for weeks, but she continued to follow her instincts. “I think like a shopper,” she said. “What I don’t want in the middle of a recession is for prices to go up on a favorite snack.” Whatever she did, she didn’t want to give major chains a huge advantage over the smaller outlets whose loyalty had helped her establish the business. They settled on two options: One was to cut operating expenses enough to create a new layer of lower, bulk wholesale prices that could be extended across the board. This would be intended to satisfy the major national groceries — but not to favor any one chain. To cut expenses, Mr. Levitan suggested scaling back plans to refresh the brand’s packaging and Web site. The second option was to forget the big chains entirely and try to expand within existing channels. To sell a higher volume of Crispy Green where it was already known, Ms. Liu thought, she’d probably have to introduce and market new flavors and pack sizes to stimulate shopper interest. This could get expensive, she feared. Or worse, it could tax Crispy Green’s fruit supply chain. 3 CASE STUDY MATERIAL Crispy Green Case (continued) The Decision: In the end, Crispy Green decided to try to have it both ways: It would offer a new discount that would attract, it hoped, some national chains, but it would also introduce new products that it hoped would increase sales in existing channels. It was risky — Crispy Green would have to achieve enough operational savings to pay for the initiatives while still preserving profitability. And trying to do both within its established budget could lead to too-slight discounts or too-few new products to make a difference with new prospects and old customers alike. But Crispy Green introduced improvements to packaging and Web pages, as well as new snacks — banana, mango and strawberry. It didn’t ramp up spending on advertising as it had once considered. Instead, it focused on garnering positive reviews from blogs and other media outlets. To cut costs, Ms. Liu negotiated deals with growers and shippers, and postponed hiring a national sales manager. She dedicated savings to meet national chains and their distributors halfway on pricing, and extended the same type of pricing, under different terms, to smaller accounts. The Results: With her new discount pricing layer and flavors, Ms. Liu won meetings with distributors and buyers for the likes of Target, Giant Eagle (a grocery chain with 223 stores in the eastern U.S.), and ShopRite. The new pricing and flavors, however, weren’t enough for 7-Eleven, which discontinued sale of Crispy Green. Demand online, and in test store locations of ShopRite and Giant Eagle helped offset the blow to the bottom line, Ms. Liu reports. But overall, the company has failed to make a national deal with a major chain in 2009. And it failed to increase its volume of sales greatly within existing, smaller accounts. As a result, it has so far achieved less revenue growth than it had sought for the year. The company set out to increase sales by at least 50 percent but eventually reined in its goal to 33 percent. It expects to meet these diminished expectations and has preserved margins and its premium image in a challenging economy. How Would You Build Sales of Crispy Green? We just published a small-business case study written by Lora Kolodny that looks at the efforts of Crispy Green, a maker of freeze-dried fruit snacks, to break into the national food chains. Below are the analyses of several other business owners with retailing experience: Susan Griffin Black, founder and chief executive of EO Products, maker of “sustainable” personal care products: When I was reading about Crispy Green’s products, I thought, This sounds really good! But I don’t really look for freeze-dried fruit when I shop. It’s not on my list. To inspire both new and repeat customers, I think it may be worthwhile for Crispy Green to come up with creative sampling ideas, and to approach some more, non-grocery distribution partners instead of pursuing national distribution deals. I’m thinking about cafes like Peet’s and Starbucks, or delis, or salad and healthfood restaurants, or franchises — even places like Integral Yoga or any kind of Green Festival event. That’s where you’ll find a discerning and educated customer who will be loyal and want to have a pack at work and another in their bag. 4 CASE STUDY MATERIAL Crispy Green Case (continued) How Would You Build Sales of Crispy Green? (continued) Timothy Moley, founder and chief executive of Chocolove, manufacturer of premium chocolate bars: I make decisions on issues like these on a daily basis. It is an ongoing process as long as you are in the food business. Can new-product development drive sales volume higher? Maybe. But so many products are entering the distribution channel these days that food stores are quick to cut brand extensions in favor of just the few things that shoppers buy. In my opinion pricing policy should reflect what is needed to operate the company. Typically, distributors take larger orders and that means less work per unit sold. Greg Koch, founder and chief executive of Stone Brewing, a craft beer brewery and operator of Stone World Bistro & Gardens in Escondido, Calif.: I question whether shoppers at a big national chain would want Crispy Green instead of an extra-large bag of Doritos. Go stand around in some of the stores, and see what they pick up. Then, fish where the fish are! Stone Brewing has never advertised or discounted in our entire 13-year history. You have to be really good if you want to sell but not sell at discount. If Crispy Green already has a product that is discernibly better than the rest, and I mean in a way that an average person can see and taste, then they should hire that sales director they’ve been wanting and work to educate the market and develop true brand equity. Sample packs you can hand out in stores for parents to take home to kids would be a good way to make Crispy Green better known. Improving the visuals on the Web site would help, too. When I go there, I see a lot of packaging. I don’t see a lot about what I’m going to be eating, actual fruit slices. What do you think? Did Crispy Green make the right call? FOR THE MKTG 300 SOCIAL ENTERPRISE MARKETING STRATEGY CASE ASSIGNMENT … … HOW CAN “TIME-BANKING” & THE “SHARING ECONOMY” ACHIEVE CRISPY GREEN’S BUSINESS/MARKETING GOALS WITH A SOCIAL ENTERPRISE BUSINESS/MARKETING MODEL? 5 INSTRUCTIONS The specific steps to complete the SOCIAL ENTERPRISE “Crispy Green” Case assignment are as follows: Format … Use ONLY MS Word, 12 pitch Times font, 1 inch margins, and subheadings for each step outlined below. First (4pts) … Develop a Social Enterprise brand/customer/market VALUE PROPOSITION for Crispy Green http://www.mindtools.com/CommSkll/ValueProposition.htm that incorporates both “Time-Banking” and the “Sharing Economy.”. A short paragraph of 7 - 9 sentences (or bullet points) should be composed to describe the basic plan for Crispy Green’s Value Proposition” --not specific marketing strategies addressed in later sections. Focus on the “Time-Banking” and “Sharing-Economy” design focus, features, and functions that create community brand/customer/market value. Also include a brief statement explaining your group members’ interest in the idea. Second (6pts) … Select the TARGET MARKET (chapter 8) for Crispy Green’s “Time-Banking” and “Sharing-Economy” Value Proposition idea/offering from the First step. Describe the “Target Market in a paragraph of 7 – 9 sentences (or bullet points) that specifies the types of customers as individuals (B2C) and/or organizations (B2B), by applying ALL 4 “segmentation bases.” Also, briefly justify why your group chose the “descriptors” used to profile each of the 4 “segmentation bases”: (a) Demographic (b) Geographic/Global (c) Psychographic (d) Benefits/Usage -- behavioral. Third (8pts.) … Plan and chart the PRODUCT LIFE CYCLE (PLC – chapter 11) pattern of Crispy Green’s “Time-Banking” and “Sharing-Economy” Value Proposition idea/offering based on how your group forecasts its introduction and growth pattern in the market. In other words, how will the Crispy Green idea/offering be adopted, used, purchased, or consumed by the “Target Market” identified in the Second step above, over the “life” of the idea/offering. In a paragraph of 7 – 9 sentences (or bullet points) explain the rationale supporting the types of PLC patterns predicted. MUST also draw a PLC diagram to plot 3 curves across 4 PLC stages – Introduction, Growth, Maturity, and Decline: a) Revenue Pattern b) Profit Pattern c) Customer Satisfaction Pattern (not included in most PLC charts). Fourth (12pts.) … Describe the main MARKETING MIX (4Ps), CRM, & SOCIAL-MEDIA STRATEGIES that will be used in each of the four PLC stages to maximize the market acceptance and customer satisfaction for Crispy Green’s “TimeBanking” and “Sharing-Economy” Value Proposition idea/offering. MUST specifically read and reference concepts/frameworks with page numbers from the textbook chapters 10 – 19, 21 & 22. Your group should plan to learn these key “Marketing Mix” (4Ps), “Customer Relationship Management” (CRM), and “Social-Media” (SM) strategic concepts independent of the course lectures, by studying the textbook chapters, as well as by accessing slides and other helpful course website content. The course lectures will not completely address these strategic concepts before the assignment is due. Therefore, self-study will be required to complete this fourth step. In six (6) separate paragraphs of 7 – 9 sentences (or bullet points) – one paragraph for each of the 4Ps and one paragraph each for CRM and Social-Media -- describe the strategic concepts included in Crispy Green’s “Marketing Mix,” CRM and Social-Media strategies. PRIMARILY apply the textbook chapter concepts, but ALSO use the link here http://www-rohan.sdsu.edu/~renglish/370/notes/chapt11/ , and the PLC chart below as a guide. 6