Expropriation Problem Explained

advertisement

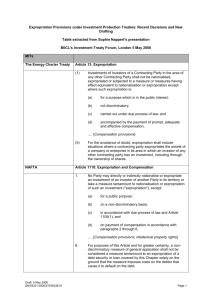

from SUGGESTED SOLUTIONS TO CHAPTER 17 PROBLEMS The author’s solution tends to confuse students. Here it is, with my notes at the bottom of the page: 2. Suppose a firm projects a $5 million perpetuity from an investment of $20 million in Spain. If the required return on this investment is 20 percent, how large does the probability of expropriation in year 4 have to be before the investment has a negative NPV? Assume that all cash inflows occur at the end of each year and that the expropriation, if it occurs, will occur prior to the year-4 cash inflow or not at all. There is no compensation in the event of expropriation. ANSWER. This problem can be solved by breaking the cash flow stream into two components--one component if expropriation takes place and the other if no expropriation takes. The expected value of these streams is found by multiplying the first component by the probability that expropriation will take place and the other component by the probability that expropriation will not take place. Note that the cash flow streams are identical prior to year 4. All numbers are in millions of dollars. Year Cash Flow with expropriation Cash Flow without expropriation 0 $20 $20 1 $5 $5 2 $5 $5 3 $5 $5 4 0 $5 5+ 0 $5 If the probability of expropriation in year 4 is p, then the expected cash flows associated with this investment are: Year 0 -$20 1 $5 2 $5 3 $5 4 $5(1 - p) 5+ $5(1 - p) The net present value of these cash flows, discounted at a 20% required return, is -20 + 5/1.2 + 5/(1.2)2 + 5/(1.2)3 + 5(1 - p)/(1.2)4 + ... + 5(1 - p)/(1.2)t + ... = -20 + 5/.2 - (5p/.2)/(1.2)3 = -20 + 25 - 14.68p note: This should read 14.468, not 14.68. It appears to be a typo. (5p/0.2)/(1.2)3=p(5/0.2)/(1.2)3=p(25)/(1.728) =p(14.468) not p(14.68) Setting this quantity equal to 0 yields a solution of p = 34.1%. This means that the probability of expropriation has to be 34.1% before the investment no longer has a positive NPV. Substituting 14.468 for the erroneous 14.68 yields p=34.6%, not p=34.1% Note. The summation of the terms in the NPV equation uses the fact that the sum of an infinite annuity (a perpetuity) is a/r, where a is the annuity and r is the discount rate. Recognize also that the expected cash flow can be split into two annuities--one beginning in year 1 and equal to 5 per annum and the other beginning in year 4 and equal to -5p per annum. Here are my notes: The expropriation issue only matters to us under certain circumstances. What we have are two possible outcomes. Each can be valued and understood by itself. Scenario A (No Expropriation): Find NPV of a $5 million perpetuity at 20% with I 0 = $20 million $5MM / 0.20 = $25MM $25MM - $20MM = $5MM NPV Positive NPV, therefore approve the project Scenario B (Expropriation in year 4): Find NPV of a 3-year annuity of $5MM at 20% with I0 = $20 million N = 3, PMT = 5MM, FV = 0, I = 20, solve for PV = $10.5324MM $10.5324MM - $20MM = -$9.4676MM Negative NPV, therefore decline the project If both scenarios returned a positive NPV, we wouldn’t care (it would be approved either way). In this case, where the decision is different for each outcome, the question really is: At what probability does the weighted average NPV equal zero? This is the same thing as asking: Find p where NPVEXPROP x p = NPVNO_EXPROP x (1-p) There are several ways to approach this. The one I find most intuitive is based on something called Geometric Probability. In $ millions, the successful result (no expropriation) is anything from 0 NPV to 5 NPV (range = 5). The range of all possible results extend from -9.4676 NPV to 5 NPV (range = 14.4676). The ratio of the two is the maximum acceptable probability of the unsuccessful outcome (p = 5/14.4676 = 0.3456) Checking this against the author’s formula above: 0 = -20 + 5/.2 - (5p/.2)/(1.2)3 using p = 0.3456 becomes this: 0 = -20 + 5/.2 - (5*0.3456/.2)/(1.2)3 What if we want to use algebra to solve this problem? If expropriated, NPV = -9.4676 If not expropriated, NPV = 5 The key question to consider is, at what point would we be indifferent? If -9.4676 is given a weight of p and 5 is given a weight of (1-p), we would be indifferent when the weighted average NPV is neither positive nor negative. Therefore, when -9.4676p + 5(1-p) = 0, we are indifferent -9.4676p + 5(1-p) = 0 -9.4676p + 5 - 5p = 0 -9.4676p - 5p = -5 -14.4676p = -5 p = -5/-14.4676 p = 0.3456 As long as the probability of expropriation is no greater than 0.3456, we would approve this project.