Simon Henry, CFO of Shell, comments on the Q1 2014 results 0:06

advertisement

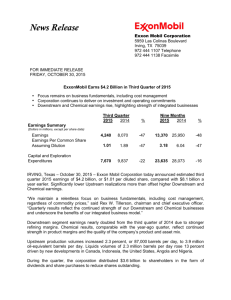

Simon Henry, CFO of Shell, comments on the Q1 2014 results 0:06 Hello, I am Simon Henry, the Chief Financial Officer of Royal Dutch Shell. 0:12 Today we announced our quarterly financial results. 0:15 Let me give you the highlights. 0:18 Our first quarter 2014 earnings were $7.3 billion on a clean Current Cost of Supplies basis. 0:26 The earnings per share decreased by 2% from first quarter 2013. 0:32 Our Cash flow generated was around $14 billion. 0:38 On a Q1 to Q1 basis we saw a decline in Downstream earnings and broadly flat Upstream results. 0:46 These are more robust results from Shell. 0:51 However, as we saw in 2013, there is high volatility in the macro-environment, 0:57 and high volatility in our quarterly results. 1:01 Our strategy and financial framework have not changed. 1:06 We aim to grow our dividends sustainably through the business cycle, driven by growing 1:13 cash generation. 1:15 All at competitive returns. 1:19 The priorities we set out at the start of this year have not changed. 1:23 There is no complacency. 1:25 We still have much to do to improve our current results. 1:31 This means focusing on better financial performance, on enhanced capital efficiency 1:37 which includes an increase in the asset sales programme, and continuing strong project delivery. 1:45 We have taken an $2.6 billion impairment today, in Downstream, that reflects Shell’s 1:53 updated views on the outlook for refining margins, 1:58 where there are substantial pressures on the industry. 2:01 This impairment represents about 14% of the fixed assets in our total refining business. 2:10 Upstream underlying earnings were $5.7 billion, essentially unchanged from year ago levels. 2:20 Our Upstream results included a record result from the Integrated Gas business 2:25 which showed an 30% increase year-over-year, and as well we saw strong results from gas trading. 2:35 Downstream earnings were $1.6 billion, 15% lower than year-ago levels, as industry margins declined. 2:47 We have added new opportunities during this quarter, we started up new production, 2:53 we announced further asset sales. 2:56 This is all part of positioning the company for profitable growth for the future. 3:02 We completed the Repsol LNG acquisition, made new gas discoveries in Asia Pacific, 3:08 and we added new exploration acreage world-wide. 3:13 We entered FEED on a series of new projects, that includes the LNG opportunity in Canada, 3:22 the deep water new hub development at Appomatox in the Gulf of Mexico 3:27 and the Peterhead CCS project in the United Kingdom. 3:34 We announced divestments of businesses in Australia, Italy and the USA. 3:41 Dividends are Shell’s main route for returning cash to shareholders, and we are announcing 3:47 a 4% increase in dividend for Q1 today. 3:53 We have distributed more than $11 billion of dividends in the last 12 months, 3:58 and completed some $6 billion of share buy backs. 4:03 All of this underlines our commitment to shareholder returns. 4:07 Thank you.