American Water Works (AWK)

advertisement

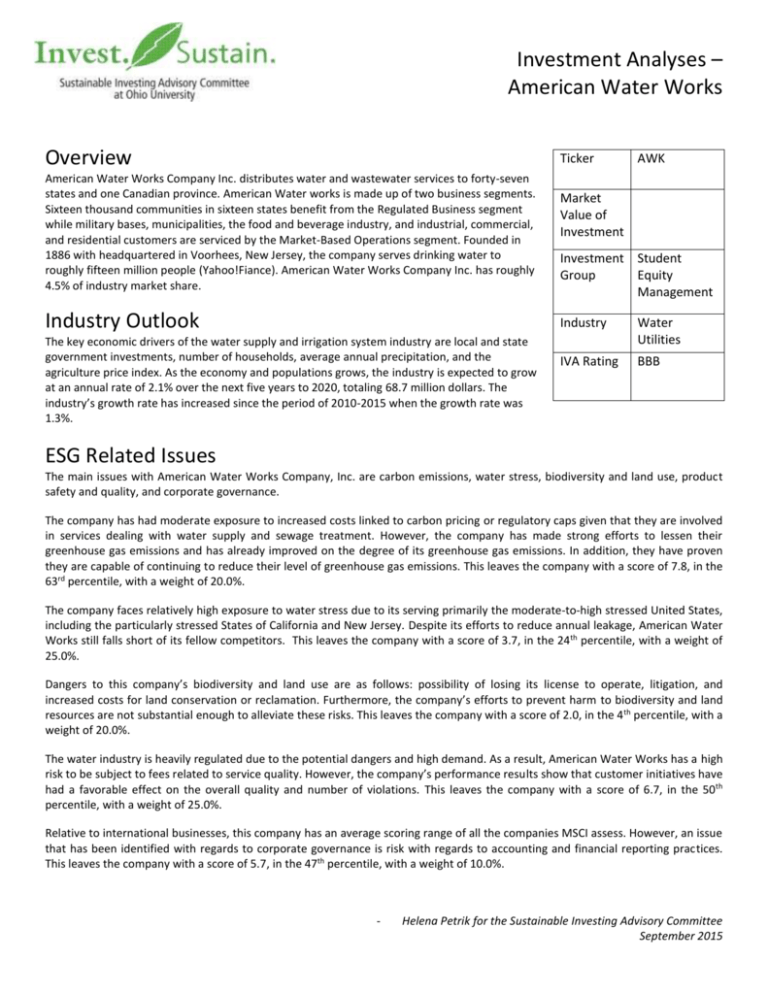

Investment Analyses – American Water Works Overview Ticker American Water Works Company Inc. distributes water and wastewater services to forty-seven states and one Canadian province. American Water works is made up of two business segments. Sixteen thousand communities in sixteen states benefit from the Regulated Business segment while military bases, municipalities, the food and beverage industry, and industrial, commercial, and residential customers are serviced by the Market-Based Operations segment. Founded in 1886 with headquartered in Voorhees, New Jersey, the company serves drinking water to roughly fifteen million people (Yahoo!Fiance). American Water Works Company Inc. has roughly 4.5% of industry market share. Industry Outlook The key economic drivers of the water supply and irrigation system industry are local and state government investments, number of households, average annual precipitation, and the agriculture price index. As the economy and populations grows, the industry is expected to grow at an annual rate of 2.1% over the next five years to 2020, totaling 68.7 million dollars. The industry’s growth rate has increased since the period of 2010-2015 when the growth rate was 1.3%. AWK Market Value of Investment Investment Student Group Equity Management Industry Water Utilities IVA Rating BBB ESG Related Issues The main issues with American Water Works Company, Inc. are carbon emissions, water stress, biodiversity and land use, product safety and quality, and corporate governance. The company has had moderate exposure to increased costs linked to carbon pricing or regulatory caps given that they are involved in services dealing with water supply and sewage treatment. However, the company has made strong efforts to lessen their greenhouse gas emissions and has already improved on the degree of its greenhouse gas emissions. In addition, they have proven they are capable of continuing to reduce their level of greenhouse gas emissions. This leaves the company with a score of 7.8, in the 63rd percentile, with a weight of 20.0%. The company faces relatively high exposure to water stress due to its serving primarily the moderate-to-high stressed United States, including the particularly stressed States of California and New Jersey. Despite its efforts to reduce annual leakage, American Water Works still falls short of its fellow competitors. This leaves the company with a score of 3.7, in the 24th percentile, with a weight of 25.0%. Dangers to this company’s biodiversity and land use are as follows: possibility of losing its license to operate, litigation, and increased costs for land conservation or reclamation. Furthermore, the company’s efforts to prevent harm to biodiversity and land resources are not substantial enough to alleviate these risks. This leaves the company with a score of 2.0, in the 4 th percentile, with a weight of 20.0%. The water industry is heavily regulated due to the potential dangers and high demand. As a result, American Water Works has a high risk to be subject to fees related to service quality. However, the company’s performance results show that customer initiatives have had a favorable effect on the overall quality and number of violations. This leaves the company with a score of 6.7, in the 50th percentile, with a weight of 25.0%. Relative to international businesses, this company has an average scoring range of all the companies MSCI assess. However, an issue that has been identified with regards to corporate governance is risk with regards to accounting and financial reporting practices. This leaves the company with a score of 5.7, in the 47th percentile, with a weight of 10.0%. - Helena Petrik for the Sustainable Investing Advisory Committee September 2015 References American Water Works Company, Inc. (AWK) (2015). Profile, business summary. Yahoo!Finance. Retrieved from http://finance.yahoo.com/q/pr?s=MSFT. Ulama, Darryle. (2015, July), Water Supplies and Irrigation Systems in the U.S. Retrieved from www.ibisworld.com. MSCI Intangible Value Assessment (2014, October), American Water Works Company, Inc. Retrieved from www.esgoncampus.msci.com