Marriage Equality Recognized Nationwide

advertisement

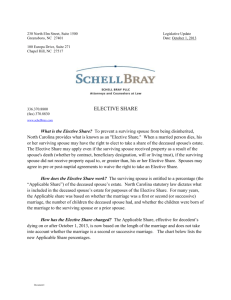

MARRIAGE EQUALITY RECOGNIZED NATIONWIDE By: Colleen Meredith Cmeredith@ssrl.com On June 27, 2015, in what has been described as a landmark opinion, the U. S. Supreme Court ruled in favor of nationwide marriage equality. If you or someone you know has entered into a same-sex marriage there are a number of practical issues you need to be aware of. Out-of-State Marriage If you were married in a State which previously recognized same-sex marriages you do not need to obtain a new marriage license. Same-sex marriages are now recognized by the State of Ohio and in every state across the Nation. Same-sex married couples now have all of the rights and responsibilities previously reserved for traditional married couples. Obtaining a Marriage License Probate courts across Ohio were prepared for this decision and worked hard to provide quick and easy access to marriage licenses following the Supreme Court’s decision. If you prefer to obtain a marriage license in Cuyahoga County, it is recommended to pre-register through the Cuyahoga County Probate Court website at www.probate.cuyahogacounty.us. Couples must appear in person to obtain the marriage license. The office is located at 1 Lakeside Avenue, Room 146, Cleveland, Ohio, 44113. The office hours are Monday through Friday 8:30 AM to 4:30 PM. View the website for dates and times to obtain a marriage license at a satellite office. The fee is $60 and the marriage license is valid for 60 days. The Probate Court will perform marriage ceremonies during normal business hours, at the convenience of the Court, for a fee of $100. If you live outside of Cuyahoga County, or outside of the State of Ohio, contact your local county probate court, as each county and state have different requirements. Adoption Previously, adoptions were limited to a single adult, a step-parent, or a husband and wife, jointly. Contact the local probate court to determine how each court will now process adoptions by same-sex married couples. Domestic Relations Couples who are thinking of marrying may want to enter into a prenuptial agreement, also called an antenuptial agreement. A prenuptial agreement can address a broad range of marriage-related legal issues, including division of property when the marriage ends by separation, divorce or death. 00517280.DOCX_5 An individual seeking a divorce will want to protect his or her rights regarding division of assets, spousal support, and parenting issues. Estate Planning Estate planning is the area of law which provides the best opportunity for same-sex married couples to assert their newly-enacted rights. We recommend such couples review their plan with an estate planning attorney to determine which documents they need or which documents need updating, including for example: Prenuptial Agreements (if the couple is not already married); Wills, Trusts; Durable Powers of Attorney; Living Wills and Health Care Powers of Attorney. Same-sex married couples can now take advantage of the unlimited marital deduction from federal estate and gift tax for transfers between spouses, and the preservation of the deceased spouse’s unused estate tax exemption amount (presently $5,430,000, indexed annually for inflation), commonly referred to as “portability.” Estate Administration The surviving spouse of a same-sex married couple now has all the rights of a surviving spouse under Ohio law. These rights include the family allowance, right to live in the marital residence for one year rent free, and the right to elect against the deceased spouse’s will. Other Items to Consider Retirement Assets. A surviving spouse is entitled to “roll over” the deceased spouse’s retirement account into his or her own account without taking required minimum or lump sum distributions. Under ERISA covered plans the spouse is presumed to be the beneficiary. The spouse must sign a waiver if an individual wishes to designate someone other than his or her spouse as the beneficiary. Contact your attorney for more information. Gifts. Married couples may make unlimited gifts to each other without any gift tax consequences. They may also make annual gifts up to twice the annual exclusion amount (presently $14,000) to third parties if both spouses agree to “split” gifts. Income Tax Returns. Married couples must file as “married filing jointly” or “married filing separately.” Non-Citizen Spouses. Non-citizen spouses are eligible for citizenship or permanent residency. Social Security. If you are a spouse, divorced spouse, or surviving spouse Social Security encourages you to apply for benefits. If you receive Supplemental Security Income (SSI) Social Security considers samesex marriages when determining SSI eligibility and payment amount. You must report changes to marital status to Social Security. Death Certificate. A same-sex spouse will now be listed as the surviving spouse on the deceased spouse’s death certificate. 00517280.DOCX_5