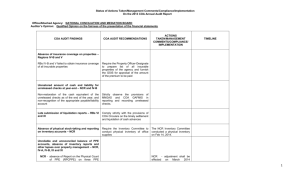

2012 CAAR- status per coa per report

advertisement

Updates/Status of Actions Taken/Management Comments/Compliance/Implementation On the 2012 COA Annual Audit Report and Prior Years Audit Findings and Recommendations Office/Attached Agency: NATIONAL CONCILIATION AND MEDIATION BOARD Auditor’s Opinion: Qualified Opinion on the fairness of the presentation of the financial statements COA AUDIT FINDINGS 1. ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION Unrestored amount of cash and liability for unreleased checks at year end – Central Office and NCR The reported balances of cash and accounts payable in the books of the Central Office and NCR were both understated by P202,563.06 and P90,583.01, respectively, due to the non-restoration of the cash equivalent of the unreleased checks of that amount as of year-end and non-recognition of the appropriate payable/liability therefrom as prescribed by Government Accountancy and Financial Management Information System (GAFMIS) Circular Letter No. 202-001 dated December 16, 2002. 2. COA AUDIT RECOMMENDATIONS We recommend to require the Cashiers and the Accountants of the Central Office and NCR to strictly comply with the provisions of the aforementioned COA circular in reporting and recording unreleased checks. Partially Implemented We recommended that the Heads of Office at the Central Office, NCR and Region XIII comply with the following courses of action: Partially Implemented The NCMB-NCR had not implemented the audit recommendation as it again failed to restore and recognize the cash and liability accounts relative to the checks issued but unreleased as of Dec. 31, 2013. Fully Implemented at the NCMB-Main Unreconciled and unreliable balance of inventory accounts – Central Office, NCR and Region XIII Out of the P1,716,877.94 balance of inventory accounts, a total of P976,987.97 or 56% as recorded in the books of the Central Office, NCR and RB XIII is noted with deficiencies like the absence of actual physical stock-taking, unreconciled balances, errors in recording, weak control and monitoring over inventory management, were contrary to the pertinent provisions of the Manual on the New Government Accounting System (NGAS), and rendered doubtful the accuracy and existence of the balance. Noted deficiencies are summarized below: Central Office Eleven items of office supplies posted negative a. the reconciliation of records and elimination of discrepancies noted in the office supplies inventory per count and stock cards as against the inventory ledger cards maintained at the accounting unit. Henceforth, a regular reconciliation be made between the accounting records and the property for the stocks on hand; No inventory report was submitted on Jan. 31, hence, no physical stock-taking and reconciliation between the property and accounting records was conducted at the NCR. Fully Implemented at the NCMB-Main and RB XII. 1 COA AUDIT FINDINGS NCR beginning balances as of January 1, 2012. Twenty items of office supplies were listed in the December 31, 2012 balance but the items were neither part of the beginning balances nor were these purchases during the year. Twenty items of inventories listed in the Report of Supplies and Materials Issued still posted balances in the property stock cards and in physical count, and from where such supplies were issued. However, in the accounting ledger cards, these items posted zero balances, thus the value of the items were already recorded as expense. Thirty three non-moving items in the office supplies inventory due to obsolescence and/or spoilage, have not been disposed of thus depriving the agency the use of additional space inside the stockroom as well as overstating the balance of inventory account by P55,968.28. Fifty-one library books valued at P38,517.40 that have been missing/unaccounted still formed part of the inventory. Errors in recording receipts and issuances of inventories at the accounting unit resulted in the overstatement of the account balance by P104,948.19. No actual physical count of inventories was undertaken. The agency’s designated Supply Officers managed to submit a Report on the Physical Count of Inventories as of December 31, 2012 but with incomplete information on the inventory items listed. The columns for Balances per Card and Per Count as well as shortages and/or overages and the Remarks Column were left blank. A discrepancy of P78,019.43 existed between the balance of the account per inventory report and book balance. Where the books posted a balance of P264,889.99, the reported inventory COA AUDIT RECOMMENDATIONS ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION b. the disposal of all obsolete and unserviceable office supplies following the guidelines prescribed in the GAAM, to free the stockroom of all these items and to render the office supplies inventory balance accurate; c. the employees accountable for the unaccounted books to present the items to the inventory committee for purposes of physical stock-taking or direct the employees responsible for the items to request for relief from accountability following the guidelines prescribed in the Government Accounting and Auditing Manual, if warranted, or direct the payment for the cost of the missing books in the event that the same have been lost in their possession; d. the conduct of physical count of inventories every six months and submission of report with the Stock Cards (SC) and Supplies Ledger Cards (SLC) using the form prescribed in Appendix 62 of the Manual on NGAS, Volume II; and 2 COA AUDIT FINDINGS amounted to only P186,870.56. Thus reconciliation between the accounting and supply records were not undertaken. Postings to the stock cards were not updated by the Supply Officer and stock ledger cards were not maintained by the Accounting Analyst. Issuances of office and other supplies were not based on the requisitioned items and approved Requisition and Issue Slips (RIS) so that the monitoring and control over inventories were rendered inadequate. COA AUDIT RECOMMENDATIONS ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION e. preparation and update of the SC and SLC for inventory accounts and issuance of office and other inventory items based on duly approved Requisition Issuance Slips (RIS). RB XIII Supplies Ledger Cards and Stock Cards were not maintained by the Accountant and Supply Officer Designates, respectively, for the office supplies inventory items, rendering the validity of balances in the books doubtful. 3. Deficiencies on property management such as nonreconciliation of the accounting and property/inventory records/reports, nonreclassification and/or disposal of unserviceable properties of P847,941.81 as well as other lapses noted were contrary to Section 490 of Government Accounting and Auditing Manual, Volume I and of other existing rules and regulations. Office Central Office NCR Deficiencies A total discrepancy of P2,407,378.86 existed between the accounting and property records/inventory reports for a number of PPE account balances: CO P2,095,639.00 We recommended that the Heads of the above offices comply with the following courses of action: a. b. the creation of an Inventory Committee to regularly conduct physical count of PPE and submit report thereon in accordance with the guidelines on inventory taking prescribed under COA rules and regulations; Partially Implemented Not implemented at the NCMB-NCR. Balances remain unreconciled and four PPE accounts were not covered with inventory report. Fully implemented at the NCMB-Main and RB II. Partially Implemented at the NCMB-RBIVA. the Accountant and the Property Officer to (i) exert efforts toward the immediate reconciliation of their respective records; (ii) maintain and update PPELC and PC; and (iii) henceforth, conduct periodic reconciliation of their records to detect any errors and/or discrepancies in the PPE balances and the causes thereof for 3 COA AUDIT FINDINGS NCR NCR COA AUDIT RECOMMENDATIONS NCR Region II a. The Property, Plant and Equipment Ledger Cards (PPELC) and Property Cards (PCs) were neither updated nor maintained by the Accounting and Property Offices, respectively. Hence, regular reconciliation was not made between their respective records. NCR a. Region IV- a. Unserviceable properties with a total value of REASON FOR PARTIAL OR NON- IMPLEMENTATION correction, to ensure reliability of the accounts in financial statements; 311,739.86 a. There was no actual physical count of PPE units conducted during the year to support the inventory report submitted and no new inventory tags were attached to the units. b. The Inventory Report submitted not in accordance with the prescribed format under Appendix 63, Vol. II of the MNGAS. c. Small tangible assets with serviceable life of more than one year but small enough to be considered as PPE in the total amount of P25,430.00 were still classified as PPE instead of charging the same to appropriate expense accounts, respectively. ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION c. the Accountants to prepare JEV to reclassify the cost of small tangible items from Furniture and Fixtures to inventory accounts and to record these items as expense upon issuance; and the Property Officer prepare separate inventory report for small tangible items for control and monitoring purposes; d. the Property Officer prepare the IIRUP for the unserviceable properties; e. the Accountants reclassify the value of the unserviceable equipment from PPE to Other Assets account based on the IIRUP; f. prompt disposal of items that do not have economic value which are recommended for immediate condemnation or destruction; and g. the Property Officer facilitate the preparation and submission of an updated list of all insurable properties to the GSIS for insurance coverage to ensure indemnification of the equivalent value thereof in case of loss or damages; and thereafter, ensure prompt renewal of the insurance properties for continuity of coverage. 4 COA AUDIT FINDINGS A COA AUDIT RECOMMENDATIONS ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION P772,289.50, were not yet reclassified to Other Assets account: b. NCR 56,209.00 IV-A 716,080.50 Central Office NCR Region IVA 4. 5. a. Unserviceable properties with a net book value of P847,941.81 CO NCR IV-A 75,652.31 56,209.00 716,080.50 Absence of insurance coverage over the Region’s insurable assets - NCR Out of the recorded PPE of ₱4,572,360.83 at NCR as of December 31, 2012, only ₱1,198,036.00 or 26.20% covering motor vehicles were covered with insurance, thereby exposing the agency to the risk of not being indemnified or compensated for any damage to, or loss of its property in case of destruction thereof through fire, flood or other force majeure for insurable properties not covered by insurance. We recommend that the Property Officer facilitate the preparation and submission of an updated list of all insurable properties to the GSIS for insurance coverage to ensure indemnification of the equivalent value thereof in case of loss or damages thereafter, ensure prompt renewal of the insurance properties for continuity of coverage. Fully Implemented Absence of reports on fuel consumption – Central Office, NCR and RB III We recommend that the Heads of the Central Office, NCR and Region III direct the submission to the COA Audit Team the required Monthly Report of Official Travels and Monthly Report of Fuel Consumption with supporting Driver’s Trip Tickets from January to December 2012 and onwards. Partially Implemented. The validity of the account Gasoline, Oil and Lubricants Expenses as of December 31, 2012 in the total amount of ₱495,141.29 of the Central Office, NCR and Region III is doubtful due to absence of the Monthly Report of Official Travels and of Monthly Report of Fuel Consumption as provided in COA Circular No. 77-61 dated September 26, 1977 as well as the absence of strict monitoring and control on the use of motor vehicles. The use of government vehicle at the NCMB-Main had not been properly controlled and regulated in the absence of duly accomplished driver’s trip tickets and Monthly Report of Official Travels. Fully implemented at the NCMB-NCR and RB III. a. in addition the marking at the NCR official vehicles with “For Official USE Only” and the corresponding name of agency and for its drivers and respective passengers to 5 COA AUDIT FINDINGS Office/Region NCMB-Main NCR Region III Total No. of Vehicles 4 2 3 Amount ₱268,095.79 ₱61,650.00 ₱165,395.50 ₱495,141.29 COA AUDIT RECOMMENDATIONS accomplish the properly; and Driver’s Trip ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION Tickets b. the officials responsible at the Central Office to prepare and submit the required reports covering trips made for all motor vehicles. 6 COA AUDIT FINDINGS 6. COA AUDIT RECOMMENDATIONS ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION Deficiencies in Procurement Process – Regions I, VIII, XI and XII The Management of Regions I, VIII, XI and XIII did not substantially comply with the pertinent provisions of the IRR of RA 9184 on procurement activities that the same may not have been economical for the government. We recommend that responsible officials – the agency’s Partially Implemented Fully Implemented in RBs I, VIII and XII. Partially Implemented in RB XI. a. should resort to the alternative mode of shopping only when the aforementioned conditions exist and should refer to Republic Act 9184 for their guide in the procurement of supplies to save time and effort in the payment of piece meal purchases and the agency may also avail of discounts if supplies purchased are in a greater quantity. b. procure common-use supplies and equipment only at the DBM. PS Depot, as mandated by AO No. 17 dated July 28, 2011 and DBM Circular Letter No. 2011-6 dated August 25m 2011. Common-use supplies not available at the PS Depot should be procured in accordance with the IRR of RA 9184. c. (i) refund the total amount of ₱4,025.00 in Region XI; and (ii) management should strictly comply with the existing government accounting rules and regulations to avoid the transactions to be suspended or disallowed in audit. Management commented that the irregularity in the procedural process flow of the transaction will be taken into consideration. Personnel concerned will be given due process in accordance with law. Moreover, Management has recognized their shortcomings 7 COA AUDIT FINDINGS COA AUDIT RECOMMENDATIONS d. 7. Limit the procurement of goods on reimbursement basis and or charging to PCF to prevent the nonwithholding of creditable valueadded tax due to the Bureau of Internal Revenue; and comply strictly with the provisions of Republic Act 9184 in the application of any of the alternative modes of procurement, subject to the approval of the head of the procuring entity and upon the recommendations of the Bids and Award Committee. If reimbursement could not be avoided, shopping can be applied in this case, as an alternative mode of procurement, provided, the required conditions for the application thereof, stated in Republic Act (RA) 9184, are indicated and at least three price quotations from known and responsible suppliers should be secured. ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION and emphasized that to defraud the government in spending the funds was not the real intention. Perfect Attendance Incentive The provision on Perfect Attendance Incentive incorporated under the Collective Negotiation Agreement (CNA) of the NCMB Employees Association with the Board, at the NCMB – Central Office covering the period 2009-2012, which grants one day leave for each month of perfect attendance did not comply with the existing rules and regulations issued by the Civil Service Commission on the Revised Omnibus Rules on Leave. We recommend that Management deduct from the balances of accumulated leave credits the total leave of absences availed of by the agency personnel on account of the Perfect Attendance Incentive provided under the CNA. Fully Implemented 8 COA AUDIT FINDINGS 8. ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION Liquidation Report of Cash Advances – RB XIII Report of Disbursements which serves as the liquidation report of the cash advances granted to the Disbursing Officer were not prepared in violation to Section 37 of New Government Accounting System (NGAS) Volume I. 9. COA AUDIT RECOMMENDATIONS We recommend that Management instruct the designated Cashier and Accountant to comply strictly with the regulations on the cash management, particularly on the proper procedure in the liquidation of cash advances as prescribed under Section 37 of NGAS, Volume I. Fully Implemented Gender and Development Lack of information and awareness on Gender and Development (GAD) at the NCMB-Main and Regions, non-preparation of Plan and Budget as well as improper allocations of funds, failure to implement programs and activities and/or to report expenses relative thereto were not in accordance with Joint-Circular No. 2004-1 of the DBM, NEDA and PCW. We recommended that the Head of the Agency – Reiterated in 2013 CAAR a. at the NCR designate a GAD Chairperson/Focal Person and direct the preparation of GAD Plan and Budget for the succeeding year to conform with the guidelines/policies set forth in DBM-NEDA-NCRFW (now PCW) Joint Circular No. 20041 and identify activities/projects that clearly specify the gender issues to be addressed. Henceforth, direct the timely submission of duly accomplished Annual Gad Plan and Accomplishment Reports following the format prescribed under regulations; b. at Regions I, III and VI to direct the respective Budget Officer to allocate funds for GAD programs and activities to at least five percent of the total Regional Office budget appropriations; and c. maximize utilization of amount allotted for the purpose on Partially Implemented (CO & RBs) 9 COA AUDIT FINDINGS COA AUDIT RECOMMENDATIONS ACTIONS TAKEN/MANAGEMENT COMMENTS/COMPLIA NCE/ IMPLEMENTATION REASON FOR PARTIAL OR NON- IMPLEMENTATION implementing GAD programs and projects. 10. Senior Citizens and Differently-Abled persons The NCMB – Central Office, Region XII and NCR have neither provided programs and projects related to Senior Citizens and Differently-Abled Persons contrary to Section 29 of the General Provisions of RA 10155 or the General Appropriations for Fiscal Year 2012. We recommend that Management undertake programs and projects to address the concerns of senior citizens and differently-abled persons in order to improve their well-being as well as provide means of livelihood. Partially Implemented We recommend that the Heads of offices – Partially Implemented The Regional Branches have not provided funds nor implemented programs and projects related to Senior Citizens and differently-Abled Persons Fully Implemented at the NCMB-Main 11. Status of Suspension and Disallowances Audit suspensions and disallowances in the amount of ₱50,426.14 and ₱57,363.18 respectively remained unsettled at the end of the year. Office Main Office NCR Region VII Region XIII Total Suspension ₱50,426.14 ₱50,426.14 Disallowance ₱28,253.27 7,965.10 6,870.00 14,274.81 ₱57,363.18 a. direct the Accountants to monitor settlement of audit suspensions and disallowances; and Disallowances of NCMB-Main, RBs VII and XIII have been settled during the year. NCR - b. enforce settlement of disallowances following the pertinent provisions of the RRSA. 10