2015 State Final Farm Business Management. Page 2015 State

advertisement

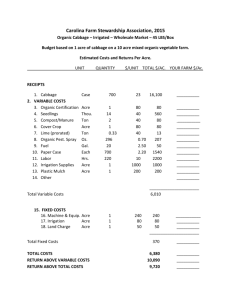

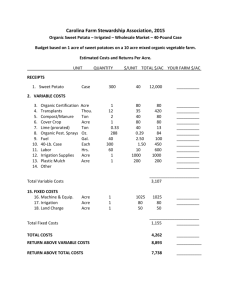

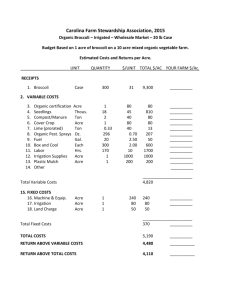

2015 State Final Farm Business Management. Page 1 FFA Farm Business Management Career Development Event State Final April 2015 ###### PART II ###### 200 Points 2 Hours Answer each question on the scartron form provided. You should receive a package with 4 exhibits that are part of the test. Your test booklet should have 9 numbered pages of questions (including this page) as well as selected sections from the Farmers Tax Guide (Exhibit 4). There are 25 questions and each correct answer is worth 8 points. You may use a calculator. For each question make only those assumptions specified for that question. Unless explicitly specified, assumptions do not "carry forward" to the next question. Prepared by Dustin Bass, M.A.B. Owner Lady Lake Equestrian Center (352) 750-4411 2015 State Final Farm Business Management. Page 2 For Questions 1-5 use the following scenario to determine your responses. You have a cow-calf operation with plans to sell your calves once they reach 300 lbs. The variable cost of producing 200 calves is $40,000. The fixed cost of the operation is $2,000. The marginal cost to increase production is $250 per calf. 1. What is the total cost of this cow-calf operation? A. $50,000 B. $42,250 C. $40,000 D. $42,000 2. What is the break-even price per pound needed for this example? A. $0.70 B. $0.83 C. $133.33 D. $140 3. Assuming the current market price is $1.40 per lbs., how many calves will you have to sell in order to break-even? A. 95 B. 100 C. 101 D. 150 4. Assuming the current market price is $1.00 per lbs., what should you do to maximize profitability? A. decrease production B. maintain the current level of production C. increase production D. close down 5. If the market price drops to $0.80 per lbs., what action should you take? A. decrease production B. maintain the current level of production C. increase production D. close down 2015 State Final Farm Business Management. Page 3 To answer questions 6-10, refer to the estimated cost and returns of producing watermelons for 150-acres in Exhibit 1. This budget was prepared by Suzette P. Galinato, Research Associate, IMPACT Center, School of Economic Sciences, Washington State University; Carol A. Miles, Associate Professor/Associate Scientist and Vegetable Extension Specialist, WSU Mount Vernon Northwestern Washington Research and Extension Center. 6. According to this budget, how many tons of watermelons are assumed to be harvested per acre? A. 1 B. 25 C. 360 D. 3000 7. According to the budget, which input is the largest variable cost per acre? A. Watermelon transplants B. Marketing C. Fertilizer D. Packing material 8. Assuming these costs would remain the same for any size farm, what would be your total cost of production for producing 20 acres of watermelons? A. $7,429.93 B. $133,883.29 C. $148,598.60 D. $180,000 9. You note at the local farmers’ market that watermelons are selling for $0.50 per pound. What would be your total revenue on 1 acre if you sold your watermelons at the farmers market? A. $9,000 B. $4,500 C. $1,000 D. $25,000 10. Realizing that you under estimated your labor costs, change your hourly costs to $15 per hour. Based on this change what would your new estimated total variable cost be per acre be? A. $6,520.44 B. $6,790.44 C. $7,294.93 D. $7,564.93 2015 State Final Farm Business Management. Page 4 11. You are curious to know how increasing the number of transplants will affect your costs. What will be your total variable cost per acre if you increase the number of watermelon transplants to 3,500 and add 2 hours of labor for planting? A. $7,593.93 B. $6,795.44 C. $980.00 D. $6,819.44 To answer questions 12-16, refer to the balance sheet example for a family farm in Exhibit 2. 12. What was the net working capital for this producer A. $-6,654 B. $8,746 C. $15,400 D. $23,500 13. Based on the information given, what is the company’s debt-to-equity ratio? A. 7.8% B. 75.6% C. 83.3% D. 183.3% 14. What is the quick ratio/acid test ratio for this company? A. 0.35 B. 0.41 C. 0.57 D. 0.54 15. Based on the information in this balance sheet, this company would be considered: A. Liquid B. Solvent C. Both Liquid and Solvent D. Neither Liquid nor Solvent 16. If we assume this farm will reach $500,000 in sales, what will their asset turnover ratio be? A. 1.41 B. 2.52 C. 1.37 D. 0.90 2015 State Final Farm Business Management. Page 5 To answer questions 17-20, refer to the compounding interest tables for 6% interest in Exhibit 3. 17. What is the present value of $10,000 to be received in 15 years using a 6% discount rate? A. $24,540.94 B. $2,908,187.12 C. $4,074.82 D. $84.39 18. As a freshman you decided to start building your savings by depositing $200 each month into a money market account with 6% interest. How much will your savings be worth at the end of a four year high school career? A. $3,049.17 B. $10,819.57 C. $1,889.04 D. $8,516.06 19. You want to set up an annuity that will pay you $1,000 per month for the next 30 years. Assuming a 6% interest rate, how much would you have to initially invest to achieve your goal? A. $6,022.57 B. $1,004,515.04 C. $1,660.42 D. $166,791.61 20. If you deposit $10,000 today, what would it be worth in 50 years at the 6% interest when you are ready to retire? A. $199,355.95 B. $37,871,910.85 C. $5,016.10 D. $1,899,678.75 To answer questions 21-25, refer to the selected sections of the 2013 Farmers Tax Guide which can be found in Exhibit 4. 21. The dollar limits for section 179 expenses decreased. What is the maximum amount you can elect to deduct for property placed in service in 2014? A. $15,000 B. $25,000 C. $200,000 D. It is impossible to tell with this information 2015 State Final Farm Business Management. Page 6 22. Which method of accounting do most farmers use? A. Cash B. Accrual C. Farm inventory D. Combination 23. Your vehicle is driven 3,000 miles for farm business. If you use the standard mileage deduction, how much can you claim on your 2014 taxes? A. $3,000 B. $1,125 C. $1,680 D. $1,350 24. Currently, California is experiencing a severe drought that is affecting many of their agricultural operations. Some livestock producers are being forced to sell more animals than they normally would as a result. Which of the following conditions are required for those farmers to postpone claiming those gains until nest year? A. Your principal trade or business is farming. B. You use the cash method of accounting. C. The weather-related condition caused your area to be designated as eligible for assistance. D. All of the above. 25. On which form would you report the sale of dairy cows that are no longer producing? A. Schedule F B. Schedule E C. Form 4797 D. Form 4835 2015 State Final Farm Business Management. Page 7 Exhibit 1. Estimated Cost and Returns of Producing Watermelons for 150-Acres ($/acre) Total Returns Watermelon Variable Costs Watermelon transplants Unit ton Unit transplants Price/unit $360.00 Cost/unit $0.28 Quantity 25 Quantity 3000 Total $9,000.00 Total $840.00 Land preparation Fumigation acre $275.00 1 $275.00 Disease control acre $115.00 1 $115.00 Plastic mulch acre $200.00 1 $200.00 Plastic mulch installation hour $12.00 8 $96.00 Insect control acre $60.00 1 $60.00 Lime acre $255.00 1 $255.00 Fertilizer acre $650.00 1 $650.00 Irrigation acre $85.00 1 $85.00 Labor Machine operation hour $12.00 16 $192.00 Weed control hour $12.00 8 $96.00 Planting hour $12.00 13 $156.00 acre $600.00 1 $600.00 Packing labor acre $400.00 1 $400.00 Packing material acre $1,200.00 Year-end crop removal acre $117.50 1 $117.50 Maintenance and Repairs Machinery Repair acre $100.00 1 $100.00 Fueling and Lubrication acre $75.00 1 $75.00 acre $720.00 1 $720.00 Chemicals and Fertilizer Harvesting and packing Hand harvest Other Variable Costs Marketing Overhead (5% of variable costs) acre Interest on Variable Costs (5%)[2] acre Total Variable Costs $1,200.00 $301.18 $121.76 $6,655.44 Fixed Costs Depreciation Machinery, Equipment and Irrigation System Irrigation System acre $212.86 acre $26.67 $147.96 Interest Other Fixed Costs Land and Property Tax acre $200.00 Insurance Cost (on entire farm) acre $40.00 Management acre $150.00 Total Fixed Costs Total Cost Estimated Net Returns $774.49 $7,429.93 $1,570.07 2015 State Final Farm Business Management. Page 8 Exhibit 2. Balance Sheet for Family Farm. ASSETS LIABILITIES Current Assets Current Liabilities Cash Accounts receivable $5,346 0 (less doubtful accounts) Accounts payable $2,300 Short-term notes 2,000 Current portion of long-term notes 8,600 Inventory 2,000 Interest payable Temporary investment 1,000 Taxes payable Prepaid expenses Total Current Assets 400 $8,746 Fixed Assets Accrued payroll Total Current Liabilities $22,000 Mortgage Land 250,000 Other long-term liabilities (less accumulated depreciation) Plant and equipment (less accumulated depreciation) Furniture and fixtures 60,000 TOTAL ASSETS 0 $15,400 Total Long-Term Liabilities $150,000 0 $150,000 0 25,000 (3,842) 2,000 (less accumulated depreciation) Total Net Fixed Assets 2,500 Long-term Liabilities Long-term investments Buildings 0 Shareholders' Equity Capital stock Retained earnings $355,158 $363,904 Total Shareholders' Equity TOTAL LIABILITIES & EQUITY $175,004 23,500 $198,504 $363,904 2015 State Final Farm Business Management. Page 9 Exhibit 3. Compound Interest Table