Introduction to Financial Derivatives

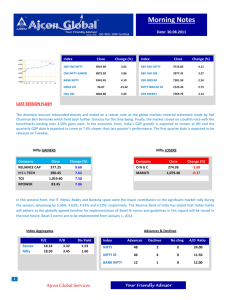

advertisement

Introduction to Financial Derivatives Risk in Financial Markets Financial markets have been marked by increased volatility. Foreign exchange rates, interest rates and commodity prices continue to experience sharp and unexpected movements. Corporations exposed to these risks and to be equipped to manage them effectively. The derivative instruments have become more readily available, their application has extended beyond traditional risk management to the more opportunistic realm of speculation. Definition of Derivatives A “derivative” is a financial instrument or contract between two parties which derives its value from an underlying asset or underlying reference rate or index. Derivatives are created and traded into inter-linked markets i.e., organised exchanges at the national and regional level exchanges and Over The Counter (OTC). A derivative product can be used for risk management or investment for speculation, for risk mitigation or risk-sharing. Users of Derivatives corporates, commercial banks, individual and institutional investors to reduce or “lay off” various risks, including the interest rate risk, foreign currency risk, commodity price risk and investment risk. The derivatives themselves help allocate economic risks efficiently by transferring risks between parties such that each hold the risks is better able or more willing to bear. Derivative Products Forward Contracts Future Contracts Options Swaps Swaptions Objectives of Derivatives A derivative is like a razor. You can use it to shave yourself and make yourself attractive for your girlfriend. You can slit her throat with it. Or you can use it to commit suicide. (Financial Times, 4 March 1995) Derivatives have been likened to aspirin; taken as prescribed for a headache, they will make the pain go away. If you take the whole bottle at once you may kill yourself. The old business adage “You get what you pay for” is very relevant. Forward Contract A forward contract is an agreement to purchase or sell an asset at a fixed time in the future at a fixed price, the forward price. A forward contract is an agreement between the seller and the buyer whereby the seller is obligated to deliver a specified asset to the buyer on a specified date, and the buyer is obligated to pay the seller a specified price (the contract price) upon delivery. Future Contracts A Futures contract is an agreement between a seller and buyer that calls for the seller (called the short) to deliver to the buyers (called the long) a specified quantity and grade of an identified commodity, at a fixed time in the future, and at a price agreed to when the contract is first entered into. Options An option on an asset is an agreement between two parties that gives one party (the holder) the right to buy (or sell) the asset from (to) its counterparty by a certain date, the maturity date, for a certain price, the exercise. Because an option is a right and not an obligation, it has positive value at inception. This is known as the premium or price. An option to buy the asset is known as a call option and an option to sell the asset is known as a put option. American style options can be exercised at any time prior to maturity while a European style option can be exercised only at maturity. Options are traded on exchanges as well as over-the counter and are written on assets such as stocks, stock indices, commodities, currencies, and treasury bonds. An option is a contract between the buyer (or holder) of the option and the seller (or writer) of the option. Swaps A swap is an agreement to exchange payments tied to one index with payments tied to another rate or index at periodic intervals for a fixed period of time (tenor). A swap is any agreement to a future exchange of one asset for another, one liability for another, or more specifically, one stream of cash flows for another. Equity Swap An equity swap is an agreement to exchange the total return on a stock or stock index with the total return on another index (typically a bond index). A Swaption is an option to enter into a swap with pre-determined characteristics at some fixed date in the future. Asset Swap Assets swaps are used to change the characteristics of an asset. Asset swaps are not only used by investors to change the characteristics of their investments, but also by banks to create synthetic investment packages for their clients. A bank purchases a bond which can be converted into a more desirable asset. Then the bank arranges a currency swap with the purchased bond and puts together an investment package. Commodity Swap Commodity dealers use commodity swaps to manipulate payments of their products. A corn producer wanting to receive fixed unit price payments for a given amount of corn produced may enter into a swap to receive payments from a counterparty who wants to pay a fixed unit price for a given amount of corn bought. Interest Rate Swap An interest rate swap is an agreement between two parties to exchange at fixed intervals (for example, every quarter) for a fixed period of time (typically ranging from a few months to several yearly), floating-rate interest payments with fixed-rate interest payments on a fixed principal amount. Interest rate swaps : These entail swapping only the interest related cash flows between the parties in the same currency. Currency swaps: These entail swapping both principal and interest between the parties, with the cashflows in one direction being in a different currency than those in the opposite direction. Derivative Markets in India • Promulgation of the Securities Laws (Amendment) Ordinance, 1995 which withdrew the prohibition on Options in Securities. • SEBI appointed 24 member committees under the Chairmanship of Dr L C Gupta on November 18, 1996 to develop appropriate regulatory framework for derivative trading in India • Committee submitted Report on March 18, 1998 • Prescribed necessary pre-coordinators for introduction of derivative trading in India. • Approved by SEBI in May and circulated in June 1998. • SEBI set-up J R Varma Committee in July 1998 to recommend measures for risk containment in derivative markets in India • Submitted its report in October 1998. • SC(R) Act 1956 was amended in December 1999 included Derivatives as Securities • A Security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences or any forms of security Products in India • Nifty Futures : June 12, 2000 • Nifty Options : June 4, 2001 • Stock Options : July 2, 2001 • Stock Futures : Nov 9, 2001 • Nifty IT • Nifty Bankex S&P CNX NIFTY • Most scientific on-line real time index in India • 50 top blue chip and highly liquid companies • Covering more than 20 sectors • Technical oversight by S&P • Calculated on the most liquid exchange, I.e. NSE • Reflects market movement more accurately • Provide fund managers a tool for measuring portfolio returns vis-à-vis market returns Nifty Futures - Contract specifications • Expiry on last Thursday of a month • Lot size of 200 units • Price steps 0.05 • GTC/GTD orders cancelled end of 7 days • Settlement on T+1 days • Daily futures contracts close price • Last day Closing Value of S&P CNX Nifty Nifty Options - Contract specifications • OPTIDX - Options on Index • NIFTY - Underlying S&P CNX Nifty Index • 27 SEP 2001 - Expiry Date • CE / PE - Call European / Put European examples of Options contract • OPTIDX NIFTY 27 SEP 2001 CE • OPTIDX NIFTY 27 SEP 2001 PE • 3 Month trading cycle-Minimum 30 contracts available for trading from day 1 Nifty Options - Contract specifications • Expiry on last Thursday of a month • Lot size of 200 units • Price steps 0.05 • GTC/GTD orders cancelled end of 7 days • Last day Closing Value of S&P CNX Nifty • all in the monty contracts on the last Thursday day are automatically exercised by the NSCCL Contract Specifications • 3 Month trading cycle - Minimum 930 contracts available for trading from day 1 • Expiry on last Thursday of a month • Lot size to maintain minimum value of Rs.2 lacs. • Each security has different mkt lot e.g Reliance - 600 units, Infosystch - 100 units • Price steps 0.05 • GTC/GTD orders cancelled end of 7 days • Contracts can be exercised at any time before the expiry date of the contract • Assignment to sellers done on a random basis end of day • Last day all in the money contracts are automatically exercised by the NSCCL