Self-Governance General Citizenship Report 9-7

advertisement

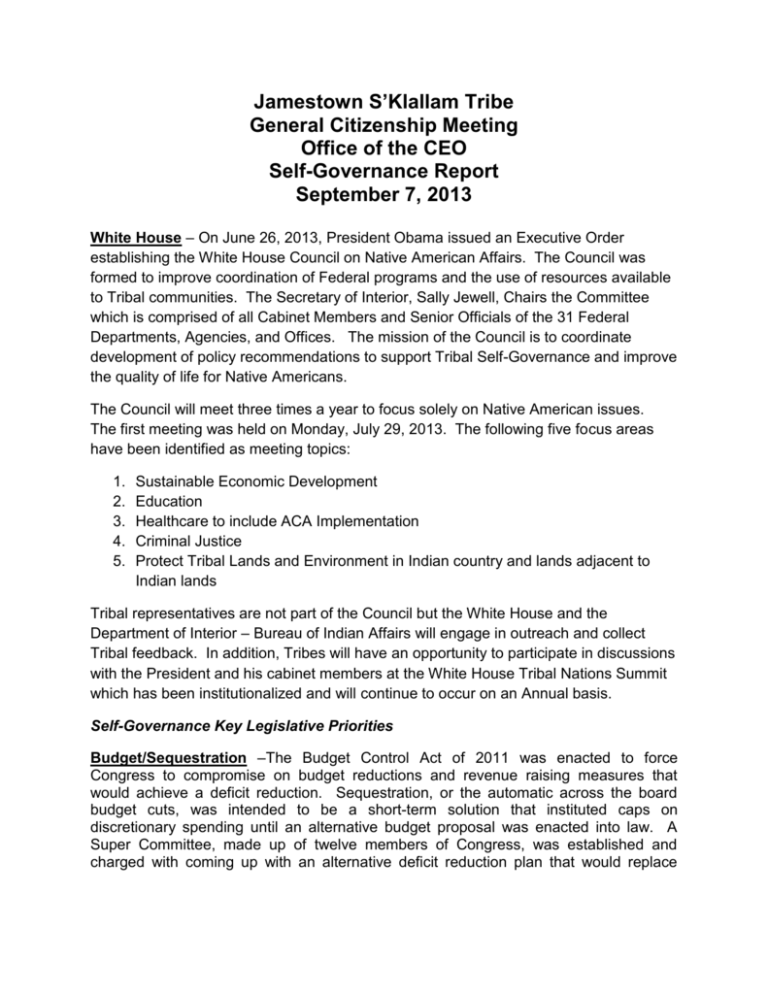

Jamestown S’Klallam Tribe General Citizenship Meeting Office of the CEO Self-Governance Report September 7, 2013 White House – On June 26, 2013, President Obama issued an Executive Order establishing the White House Council on Native American Affairs. The Council was formed to improve coordination of Federal programs and the use of resources available to Tribal communities. The Secretary of Interior, Sally Jewell, Chairs the Committee which is comprised of all Cabinet Members and Senior Officials of the 31 Federal Departments, Agencies, and Offices. The mission of the Council is to coordinate development of policy recommendations to support Tribal Self-Governance and improve the quality of life for Native Americans. The Council will meet three times a year to focus solely on Native American issues. The first meeting was held on Monday, July 29, 2013. The following five focus areas have been identified as meeting topics: 1. 2. 3. 4. 5. Sustainable Economic Development Education Healthcare to include ACA Implementation Criminal Justice Protect Tribal Lands and Environment in Indian country and lands adjacent to Indian lands Tribal representatives are not part of the Council but the White House and the Department of Interior – Bureau of Indian Affairs will engage in outreach and collect Tribal feedback. In addition, Tribes will have an opportunity to participate in discussions with the President and his cabinet members at the White House Tribal Nations Summit which has been institutionalized and will continue to occur on an Annual basis. Self-Governance Key Legislative Priorities Budget/Sequestration –The Budget Control Act of 2011 was enacted to force Congress to compromise on budget reductions and revenue raising measures that would achieve a deficit reduction. Sequestration, or the automatic across the board budget cuts, was intended to be a short-term solution that instituted caps on discretionary spending until an alternative budget proposal was enacted into law. A Super Committee, made up of twelve members of Congress, was established and charged with coming up with an alternative deficit reduction plan that would replace General Citizenship Meeting Self-Governance Update September 7, 2013 Page 2 sequestration. However, the Super Committee was unable to reach agreement and the automatic cuts were triggered. In March, the Fiscal year 2013 Continuing Resolution was passed and sequestration was applied resulting in a 5% reduction of funds for all Tribal programs. These funding cuts are exacerbating the already dire economic conditions in Indian country and many Tribes have been forced to make some hard decisions regarding their core governmental programs and services. Some Tribes have reduced spending by using cost containment measures that institute hiring freezes, limit travel and trainings to those that are essential, monitoring overtime and eliminating vacant or unfilled positions. Other Tribes have been forced to resort to laying-off staff, reducing government office hours, closing government offices, freezing salaries, and reducing services provided to their Tribal citizens. The President’s budget for Fiscal year 2014 was released in April. The House and Senate have also released their budget resolutions. Unfortunately, Congress and the Administration are still at an impasse when it comes to the Federal budget. The House budget plan would leave sequestration in effect for FY2014 and the discretionary cap would be at the FY2014 level after sequestration, or, $966 billion. The House bill also overrides a key provision of the Budget Control Act by shifting billions of dollars from domestic programs to defense and national security. The Senate proposes passing a budget that totals $1.058 trillion. The difference between the two Houses is $92 billion. Unless a compromise is reached with specific language that would replace the sequester, in mid-January, budget reductions for FY2014 will again be imposed with an additional 5% or more in cuts for Indian programs. Budget cuts and Sequestration undermine the Federal Governments Trust and Treaty obligations towards Tribes. The cumulative impact of all of the cuts to the FY2014 Interior, Environment and Related Agencies Appropriations Bill, which funds the Bureau of Indian Affairs and Indian Health Service Tribal programs, is -18%. Tribes have been putting pressure on the Appropriations Committees to uphold the treaty promises. The White House and Congress must compromise on a deficit reduction solution that repeals sequestration and implements a balanced approach to deficit reduction that includes both spending caps and revenue raising measures. Contract Support Costs – Under the Indian Self-Determination and Education Assistance Act (ISDEAA), the United States enters into intergovernmental contracts with Tribes. Under these Agreements, Tribes administer federal programs either through contracts or self-governance compacts for the benefit of their Tribal citizens. There are administrative and overhead costs associated with carrying out federal programs activities, services or portions thereof, which are known as Contract Support Costs (CSC). The Indian Self-Determination and Education Assistance Act requires full funding for CSC. When CSC is not fully funded, Tribes may have to reduce the number of services they provide to their Tribal citizens or go without essential administrative activities. General Citizenship Meeting Self-Governance Update September 7, 2013 Page 3 Underfunding CSC undermines Self-Determination and Self-Governance because it will lock new Tribes out of the process and discourage participating Tribes from expanding into other program areas due to the short fall of funds. The Supreme Court affirmed the right of Tribes to receive full CSC funding and found that the Bureau of Indian Affairs (BIA) and the Indian Health Service (IHS) violated the law by failing to fully pay the Tribes for services rendered on behalf of the Federal Government. The BIA and IHS have acknowledged liability for underfunding CSC in years past. Although the Tribes and the agencies have been discussing options for how to address past CSC shortfalls, to date, a resolution of this issue has not materialized. The ISDEAA currently requires that the agencies fully fund CSC. However, instead of complying with the law, the Administration has proposed to change the law. Under the Administration’s proposal, CSC would be funded contract by contact and Tribes who are underpaid CSC would be denied the opportunity to seek legal redress from the courts. Tribes strongly disagree with the President’s FY2014 Budget Request. On July 29 through August 30, 2013, Tribes from across the country met in Portland Oregon for a Tribal Contract Support Cost Summit. The purpose of the Summit was to bring together Tribal leaders, legal and finance experts to present on the recent CSC issues and to strategize and develop a common position to take to the Administration and Congress. Recommendations developed at the CSC Summit include: 1. There should be no change to CSC policy or implementation by the Administration or Congress until true and meaningful Tribal consultation has been conducted. 2. Consultation should be jointly undertaken by the BIA, IHS and Tribal leadership, with the participation of a joint Tribal/Federal technical workgroup and coordinated through regional and national Tribal organizations. If legislative changes are deemed necessary, such changes should be developed jointly with Tribal input. 3. Congress should reject the Administration’s proposal to restructure the Appropriations Act to limit the amount of CSC for each Tribe. The Administration’s proposal singles out Tribes from all other Federal contractors and denies Tribes future compensation for Federal services rendered under their contacts and Self-Governance compacts. 4. The Administration’s proposal is unworkable and based on inaccurate and outdated data. The table amounts were not verified with the Tribes and contain errors. General Citizenship Meeting Self-Governance Update September 7, 2013 Page 4 5. The Supreme Court decision makes it clear that the payment of CSC is a binding contractual obligation due to all Tribes and Tribal organizations that operate under contracts or compacts. 6. Congress should not include any CSC caps in the FY2014 Appropriations. 7. There needs to be a political solution for the IHS process for settling claims. 8. The White House, Congress and BIA and IHS agencies need to develop a strategy for an accelerated settlement process that is fair and that complies with the Supreme Court decision. 9. IHS should revamp their settlement approach and begin settlement discussions based on IHS shortfall reports that have been submitted to Congress. Title IV Legislation – Title IV Legislation remains a top priority for Self-Governance Tribes. In May, S.919, the Department of Interior Tribal Self-Governance Act of 2013, was introduced by Senator Maria Cantwell and referred to the Committee on Indian Affairs. The amendments contained in this bill are the result of a combined effort on the part of the Department of Interior and Tribal representatives. Tribes made concessions to take non-BIA programs off of the negotiation table in order to move the legislation forward. The hold up in moving this bill forward last session was concerns (both Tribal and non-Tribal) over water rights and compacting with the Bureau of Reclamation. A technical team has been working through the language to resolve any remaining concerns and Tribes are still hopeful that a bill will gain traction during this legislative session. Land into Trust - Self-Governance and Tribal sovereignty is closely tied to Tribal lands. Two recent court cases, Carcieri and Patchak have negatively impacted the land into trust process and Tribes are working with both the Administration and Congress to try and lessen the impact of these decisions. The Carcieri decision held that the Secretary of Interior’s ability to acquire land into trust is limited to only Indian Tribes who were under federal jurisdiction in 1934. Tribes oppose this ruling because it delays the land acquisition process, has led to numerous litigation challenges, jeopardizes Tribal jurisdiction and inhibits job creation and economic development in Indian country. Tribes have been advocating Congress for a clean fix to reaffirm the Secretary’s authority to take land into trust for all Tribes. This legislative session, two bills are pending in the House of Representatives that seek to address the Carcieri issue. H.R.279, a bill to amend the Act of June 18 th of 1934, to reaffirm the authority of the Secretary of Interior to take land into trusts for Indian tribes and for other purposes is sponsored by Representative Tom Cole. The bill has 9 cosponsors. Representative Markey has also sponsored a bill, H.R.666 and there are 30 co-sponsors. Both Bills have been referred to the House Subcommittee on Indian and Alaska Native Affairs for consideration General Citizenship Meeting Self-Governance Update September 7, 2013 Page 5 Recently, the repercussions of Carcieri were exacerbated by the Match-E-Be-NashShe-Wish Band of Potawatomi v. Patchak decision when the Supreme Court permitted retroactive challenges to the status of Tribal trust land. This decision will open the floodgates to frivolous litigation challenges to land-into-trust acquisitions because it broadened the class of challengers and the scope of reasons for filing a suit. Tribes have been urging the Department of Interior to explore an Administrative solution to Patchak. The Tribal proposal is to have the Department of the Interior (DOI) repeal 25 CFR 151.12(b) of Part 151 regulations and modify the BIA Manual and Land-into-Trust Handbook. This would require an individual to appeal a land-into-trust decision with the Interior Board of Indian Appeals (IBIA) and impose a thirty-day time limit on an aggrieved party seeking resolution. An Administrative solution would mitigate the negative impact of the Patchak decision. The Department of Interior has initiated Tribal consultation to discuss potential revisions to a section of the regulations addressing decisions by the Secretary to approve or deny applications to acquire land into trust. The revisions to the regulations would address the Patchak decision by ensuring that the Department of Interior acquires title in trust as soon as possible after a decision is made to take land into trust. The revisions would also ensure notice requirements are established to ensure the statute of limitations on potential challenges begins running as soon as possible. Interior is attempting to preserve the authority of Secretary of Interior’s Authority to take land into trust by amending 25 CFR § 151.12. The proposed rule would provide that appeals of a land into trust acquisition would go to the Interior Board of Indian Appeals (IBIA). The benefits of this process include: 1. Parties would have to appeal the decision within 30 days; 2. If no one appeals to the IBIA, they have not exhausted their administrative remedies and will lose their right to appeal; 3. IBIA decisions should be entitled to deference by federal court; 4. Revisions would add more certainty to trust acquisitions. Tax – In April of 2011, a Tax Summit was held in Florida to coordinate an effort to address Tribal tax policy on a national scale. A short term plan was developed to address four issues: 1. General Welfare Exclusion – administrative and legislative process; 2. Tax Exempt Bonds – financing for projects on reservation “essential government function”; 3. Tribal Trade – tobacco sales and Tribes ability to regulate their own businesses; and, 4. State taxation on the reservation – taxation of permanent improvements. General Citizenship Meeting Self-Governance Update September 7, 2013 Page 6 General Welfare Doctrine – In recent years the Internal Revenue Service (IRS) has sought to impose federal income taxes on benefits that individual Indians receive from a wide range of Government programs and services. Comprehensive comments were submitted to Treasury by Tribes and intertribal organizations that spoke to the IRS Guidance. Tribal Comments were focused on Tribal tax deference and expanding the safe harbor rule. There is also a legislative effort underway. Congressman Nunes sponsored H.R.3043, the Tribal General Welfare Exclusion Act of 2013. The bill would amend the IRS Code by broadening the scope of the General Welfare Exclusion for Tribes. It would exclude most Tribal programs and services from federal income taxation. It would also the Treasury Secretary to establish a Tribal Advisory Committee whose role would be to educate and train IRS field agents on Federal Indian law and the unique treaty and trust obligations of the Federal Government towards Tribes. Adoption Tax Credit – Congressman Derek Kilmer from WA introduced an Adoption Tax Credit Bill HR2332 on June 12, 2013. The bill allows parents adopting special needs children in Tribal court to utilize the special needs adoption tax credit. Unlike state courts, Tribal courts were not included in the definition of court so Tribes families did not have access to the tax credits. This bill seeks parity for Tribes and Tribal families. Tax Reform – the last time the IRS code was overhauled was 1986 and now there is a window of opportunity for Tribes to be included in tax reform efforts that are currently underway. Tax Reform will be challenging however, because it has now been linked to IRS reform which may stall the forward motion. Tax Reform Efforts in Regulations – The BIA has created new leasing regulations that: 1. Reduce the role of the BIA; 2. Promotes economic development; 3. Rule critical to the successful implementation of the Hearth Act; 4. Resolves local tax question in favor of Tribal self-determination. What do the new rules do? Applies to surface leasing; Rules do not get rid of BIA Leasing approval requirement but the Hearth Act does if Tribes opt to develop their own regulations; shifts the burden from landowners to the BIA: burden is on the BIA to show why a disapproval is warranted rather than on the landowners to show why approval is warranted; Imposes time limits on the BIA for lease review; allows for direct pay where there are 10 or fewer land owners (all must consent); clarifies that Lease provisions may provide for Tribal preference in employment; clarifies tax status on land, improvements and certain activities under a lease. Indian Child Welfare Act – Three National Native Organizations, the Native American Rights Fund, the National Indian Child Welfare Association and the National Congress of American Indians filed a Federal Civil Rights complaint on behalf of Veronica, a three General Citizenship Meeting Self-Governance Update September 7, 2013 Page 7 year old Cherokee Nation citizen who has become the subject of an intense custody dispute. The case was filed in the State of South Carolina’s federal district court after the States Supreme Court denied a best interest hearing and ordered the state family court to finalize the adoption of the child by a non-Indian couple. More than 40 Tribes signed a letter in support of the lawsuit. Health Care Implementation - Implementation of the Indian Health Care Improvement Act (IHCIA) is steadily progressing. New regulations that address Essential Health Benefits rules, Federally Facilitated Health Exchanges and Single Streamlined Applications are published on a regular basis. As rulemaking continues in 2013, it is essential for Tribal leader engagement to ensure Tribes receive maximum benefits from health initiatives.