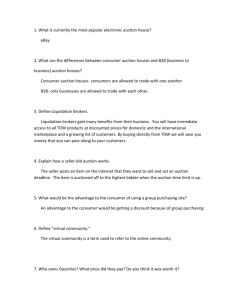

ECON 515 Information, Game Theory and Market Design Lecture

advertisement

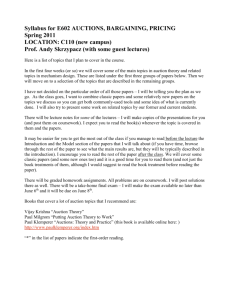

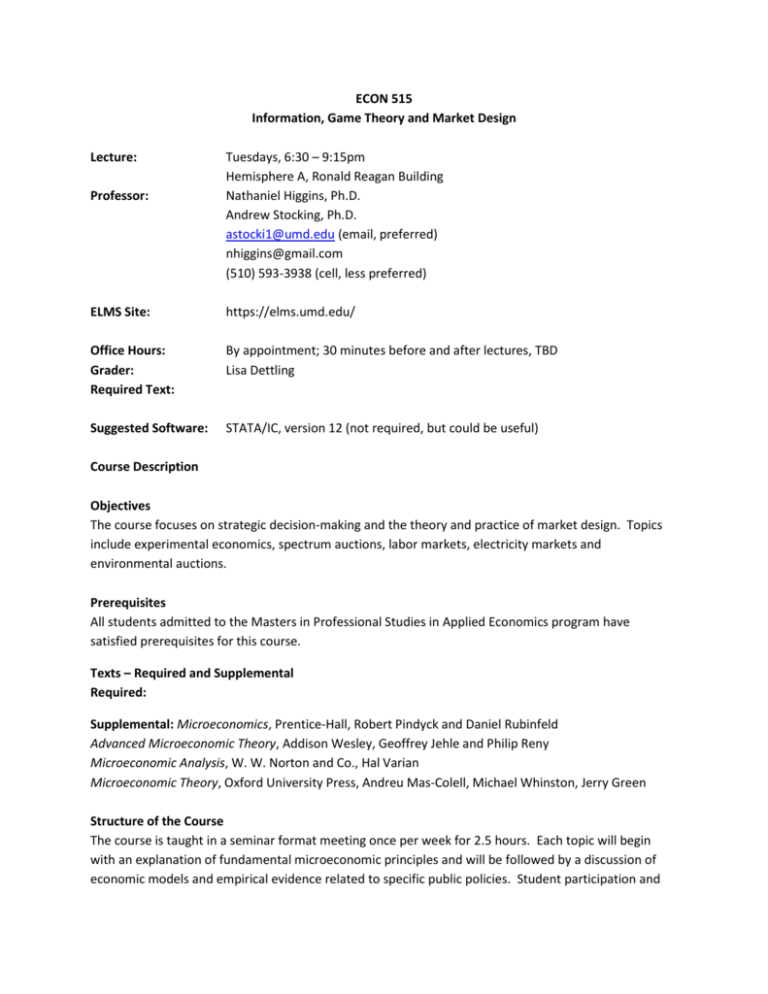

ECON 515 Information, Game Theory and Market Design Lecture: Professor: Tuesdays, 6:30 – 9:15pm Hemisphere A, Ronald Reagan Building Nathaniel Higgins, Ph.D. Andrew Stocking, Ph.D. astocki1@umd.edu (email, preferred) nhiggins@gmail.com (510) 593-3938 (cell, less preferred) ELMS Site: https://elms.umd.edu/ Office Hours: Grader: Required Text: By appointment; 30 minutes before and after lectures, TBD Lisa Dettling Suggested Software: STATA/IC, version 12 (not required, but could be useful) Course Description Objectives The course focuses on strategic decision-making and the theory and practice of market design. Topics include experimental economics, spectrum auctions, labor markets, electricity markets and environmental auctions. Prerequisites All students admitted to the Masters in Professional Studies in Applied Economics program have satisfied prerequisites for this course. Texts – Required and Supplemental Required: Supplemental: Microeconomics, Prentice-Hall, Robert Pindyck and Daniel Rubinfeld Advanced Microeconomic Theory, Addison Wesley, Geoffrey Jehle and Philip Reny Microeconomic Analysis, W. W. Norton and Co., Hal Varian Microeconomic Theory, Oxford University Press, Andreu Mas-Colell, Michael Whinston, Jerry Green Structure of the Course The course is taught in a seminar format meeting once per week for 2.5 hours. Each topic will begin with an explanation of fundamental microeconomic principles and will be followed by a discussion of economic models and empirical evidence related to specific public policies. Student participation and discussion in class are essential. In addition, students are expected to participate in online discussions in between classes, which will be monitored by me. Grades are determined as follows: 20% class participation and online discussion participation 10% problem sets (approximately 5) 25% in-class midterm 15% group presentation (details discussed during the first class) 30% in-class final exam Given the limited time we have together, attendance is mandatory. If you need to miss a class for an emergency, you must contact me prior to class and let me know. Each missed class will require a 1-2 page writing submission on a topic to be determined, which will be graded on a progressively more rigorous scale for subsequent absences. In addition, those who miss a class should expect to be called on during the next class if participation is light. Homework is due at the beginning of class. Homework submitted more than 15 minutes into class will not be accepted. Students who must miss an exam and submit appropriate documentation explaining their absence will be offered a make-up exam. It will probably be harder. Course Outline: Students are expected to have done the readings prior to class so they can participate in the class discussion (except the first class). This course studies the design of organized markets, focusing on efficient organization and the incentives created by market rules. Applications include online auction markets, government auctions of natural resources, procurement auctions, matching markets (students to classes or schools, medical residents to hospitals, kidneys to recipients). The analysis relies on a mix of documenting the rules of real-world markets, game theoretic analysis, empirical analysis, and experimental work. A research paper is optional with advance permission of instructor. What is Market Design (class 1) – Varian/Pindyck & Rubenfeld/Mankiw Closed markets, market design Nobel Prize (technical nomination award) Incentives Strategy proof – Truth revealing Why do markets need design (how do they fail) Roth, Alvin E. "The Economist as Engineer: Game Theory, Experimental Economics and Computation as Tools of Design Economics," Econometrica, 70, 4, July 2002, 13411378. Roth, Alvin E. " What have we learned from market design ?" Hahn Lecture, Economic Journal, 118 (March), 2008, 285-310. Game Theory (Gibbons book) (class 2) Nash Pick particular games o Prisoner dilemma o Cournot Auction Theory (Class 3-4) – Gibbons/Krishna/Klemperer (Why every economist should learn some auction theory) Private Value Common Value : Hendricks, Ken, and Robert Porter, "An Empirical Study of an Auction with Asymmetric Information," American Economic Review, 1988. [Classic study of the winner’s curse in bidding for off-shore oil leases. We’ll talk about the results in class.] Richard Thaler, “Anomalies: The Winner’s Curse,” Journal of Economic Perspectives, 2(1), Winter 1988, 191-202. [Accessible article describing experimental and empirical evidence on the winner’s curse, by one of the pioneering behavioral economists.] Affiliated Types Combinatorial Endogenous Entry Reserve prices (Optimal, Secret) Participation Set-asides & Subsidies Multiunit Bulow, Jeremy and John Roberts (1989) The Simple Economics of Optimal Auctions, Journal of Political Economy, 97(5), 1060-1090. Klemperer, Paul. 2002. " What Really Matters in Auction Design?" Journal of Economic Perspectives, 16(1), 169-189. Milgrom, P., “ Auctions and Bidding: A Primer,” Journal of Economic Perspectives, Summer 1989, pp 3-22. Auction Application (class 5-6) FCC Treasury Medicare Premium Support Medicare DME Medicare Part D Oil and Gas Airport landing slots Pollution: Cramton, Peter and Suzi Kerr. 2002. " Tradeable Carbon Permit Auctions: How and Why to Auction Not Grandfather." Energy Policy, 30, 333-345. Online auctions Conservation Reserve Program Sears Outlet pricing Electricity: Wolak, Frank A. 2001. "What Went Wrong in California's Restructured Electricity Market?" Presentation at the AEI. Midterm (class 7) Two sided Markets (Intermediation) (class 7) Online Advertising Credit Cards Advertising Readings: David Evans and Richard Schmalensee, “The Industrial Organization of Markets with Two-Sided Platforms,” Competition Policy International, 3(1), Spring 2007. [High-level overview of platform competition and especially antitrust issues.] Jonathan Levin, “The Economics of Internet Markets,” [Section 2 has a discussion of what we know about the economics of platforms, and the model from class.] Matching Markets (Class 8) Theory : David Gale and Lloyd Shapley, "College Admissions and the Stability of Marriage," American Mathematical Monthly, 69, 1962, pp. 9-15. Reading: Alvin Roth and Elliott Peranson, The Re-Design of the Matching Market for American Physicians: Some Engineering Aspects of Economic Design American Economic Review, 89, 4, September, 1999, 748-780. [Describes the redesign of the matching algorithm used to assign residents to hospitals – a challenging read.]. Two short articles by Sara Robinson: “Are Medical Students Meeting Their (Best Possible) Match?” (Siam News, April 2003) and Tweaking the Math to Make Happier Medical Marriages,” (New York Times, August 24, 2004). Christopher Avery, Christine Jolls, Richard Posner and Alvin Roth, “The Market for Federal Judicial Law Clerks” and “The New Market for Federal Judicial Law Clerks,” University of Chicago Law Review, Summer 2001 (793-902) and Spring 2007 (447-486). [Long but interesting articles on the unraveling Unraveling : Roth, Alvin E, "Marketplace institutions related to the timing of transactions, and reply to Priest (2010)" October, 2010. Application Kidney School choice : Abdulkadiroglu, Atila, and Tayfun Sonmez. " School Choice: A Mechanism Design Approach." 2003. American Economic Review 93-3: 729-747, June. Atila Abdulkadiroğlu, Parag Pathak and Alvin Roth, “The New York City High School Match,” and (with Tayfun Sonmez) “The Boston Publich School Match,” American Economic Review, 95(2), May 2005, 364-367 and 368-371, [Two short articles discussing the design of the New York and Boston school choice systems. National residency Roth, Alvin and Elliot Peranson (1999). The Redesign of the Matching Market for American Physicians: “Some Engineering Aspects of Economic Design. American Economic Review Prediction Markets (class 9) Justin Wolfers and Eric Zitzewitz (2004), "Prediction Markets", Journal of Economic Perspectives. Additional Topics (Class 10) Scoring auctions Budget constraints Signaling (Peter’s FCC example) Collusion (Intentional & Tacit) Market Thickness Congestion Combinatorial Health exchanges Evidence-Based Policy (Class 11) Large Scale Field Experiments Market Microstructure Circuit breakers Short sales Congestion pricing (easy pass and changing prices) Final (Class 12) – Maybe presentation Assignments Presentation Replication (all do the same paper) Discussion boards Midterm – after auction theory Roth Assignment: One final paper. The objective of the final paper is to study an existing market or an environment with a potential role for a market, describe the relevant market design questions, and evaluate how the current market design works and/or propose improvements on the current design. Cramton Econ 415 Topics auctioning a single item independent private value common value affiliated value benchmark model English Dutch 1st price 2nd price winner’s curse revenue equivalence theorem reserve price optimal auction royalties risk aversion collusion participation costs wallet game bidder asymmetries linkage principle auctioning many items uniform-price auction pay-as-bid auction Vickrey auction ascending clock descending clock Ausubel ascending clock inefficiency theorem demand reduction bidding behavior in uniform-price simultaneous ascending auction activity rule collusion in simultaneous ascending auction information policy matching problems deferred acceptance algorithm package auction (combinatorial auction) clock-proxy auction revealed-preference activity rule proxy auction core electricity capacity markets Academic Integrity The University of Maryland, College Park has a nationally recognized Code of Academic Integrity, administered by the Student Honor Council. This Code sets standards applicable to all undergraduate and graduate students, and you are responsible for upholding these standards as you complete assignments and take exams in this course. Please make yourself aware of the consequences of cheating, fabrication, facilitation, and plagiarism. For more information see www.studenthonorcouncil.umd.edu Students with Disabilities The University of Maryland College Park does not discriminate regardless of differences in age, race, ethnicity, sex, religion, disability, sexual orientation, class, political affiliation, and national origin. Reasonable accommodations will be made to students with documented disabilities.