New Capital Weekly

New Capital Update – September 2012

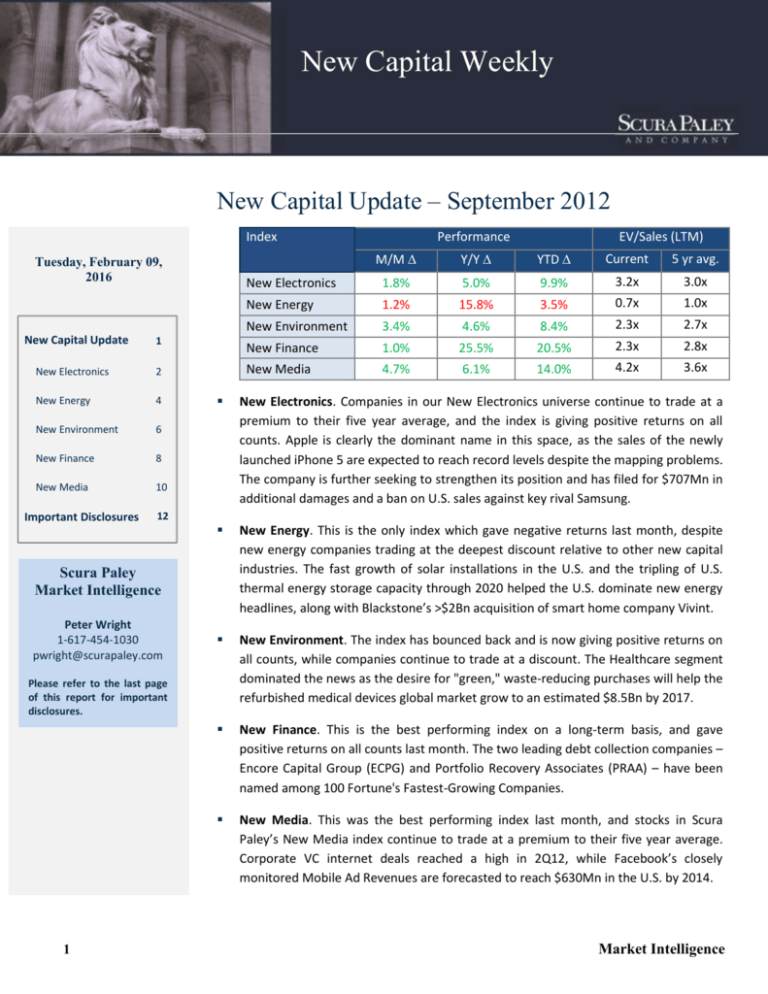

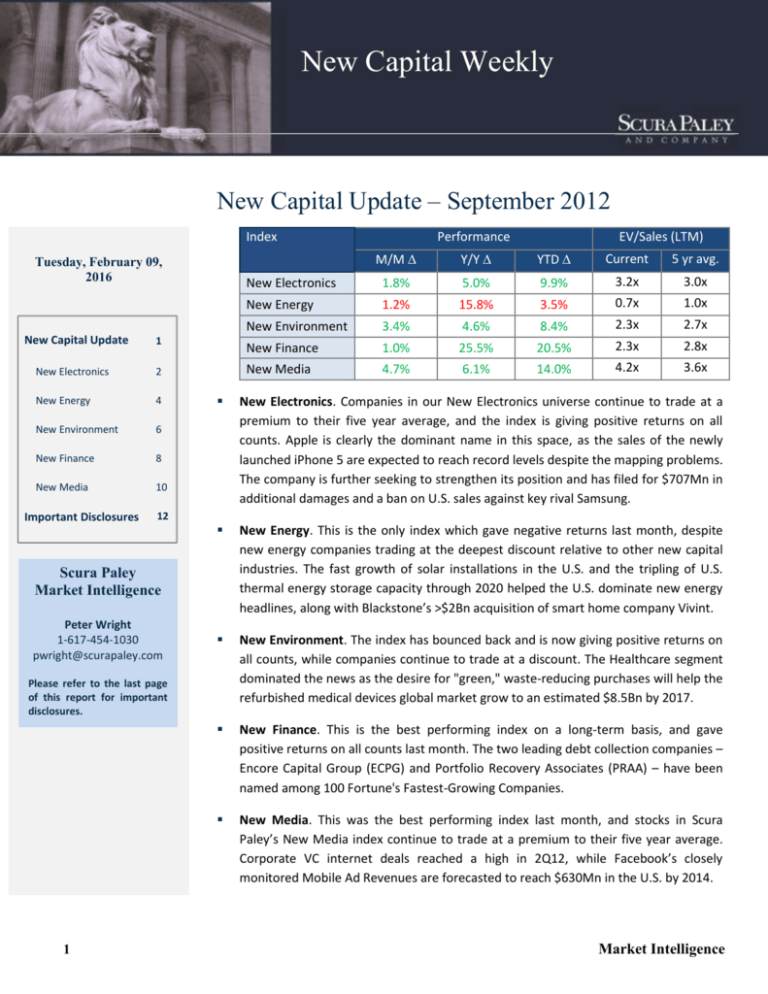

Index

Tuesday, February 09,

2016

Performance

EV/Sales (LTM)

M/M

Y/Y

YTD

Current

5 yr avg.

New Electronics

1.8%

5.0%

9.9%

3.2x

3.0x

New Energy

1.2%

15.8%

3.5%

0.7x

1.0x

New Environment

3.4%

4.6%

8.4%

2.3x

2.7x

1

New Finance

1.0%

25.5%

20.5%

2.3x

2.8x

New Electronics

2

New Media

4.7%

6.1%

14.0%

4.2x

3.6x

New Energy

4

New Environment

6

New Finance

8

New Media

10

New Capital Update

Important Disclosures

12

New Electronics. Companies in our New Electronics universe continue to trade at a

premium to their five year average, and the index is giving positive returns on all

counts. Apple is clearly the dominant name in this space, as the sales of the newly

launched iPhone 5 are expected to reach record levels despite the mapping problems.

The company is further seeking to strengthen its position and has filed for $707Mn in

additional damages and a ban on U.S. sales against key rival Samsung.

New Energy. This is the only index which gave negative returns last month, despite

new energy companies trading at the deepest discount relative to other new capital

industries. The fast growth of solar installations in the U.S. and the tripling of U.S.

thermal energy storage capacity through 2020 helped the U.S. dominate new energy

headlines, along with Blackstone’s >$2Bn acquisition of smart home company Vivint.

New Environment. The index has bounced back and is now giving positive returns on

all counts, while companies continue to trade at a discount. The Healthcare segment

dominated the news as the desire for "green," waste-reducing purchases will help the

refurbished medical devices global market grow to an estimated $8.5Bn by 2017.

New Finance. This is the best performing index on a long-term basis, and gave

positive returns on all counts last month. The two leading debt collection companies –

Encore Capital Group (ECPG) and Portfolio Recovery Associates (PRAA) – have been

named among 100 Fortune's Fastest-Growing Companies.

New Media. This was the best performing index last month, and stocks in Scura

Paley’s New Media index continue to trade at a premium to their five year average.

Corporate VC internet deals reached a high in 2Q12, while Facebook’s closely

monitored Mobile Ad Revenues are forecasted to reach $630Mn in the U.S. by 2014.

Scura Paley

Market Intelligence

Peter Wright

1-617-454-1030

pwright@scurapaley.com

Please refer to the last page

of this report for important

disclosures.

1

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Notable Announcements in New Electronics

Industry Update

Gartner: Cloud services worth $109Bn.

Read More

IHS: Tablet display shipments to grow 56% in 2012.

Read More

Apple’s share of U.S. smartphone market now over 33%.

Read More, See Chart on Page 3

Apple files for U.S. sales ban, $707Mn damages against Samsung.

Read More

Europe lays out proposals for wireless spectrum sharing.

Read More

500Mn android devices activated globally.

Read More

Chip sales grew slightly in July.

Read More, See Chart on Page 3

Fab tool book-to-bill declines again.

Read More

Microinverters, power optimizers to grow by 70% in 2012.

Read More

PCs used less than half of DRAM bits in 2Q.

Read More

Company Update

iPhone 5 sales break record, shipping slips to 3-4 weeks.

Read More, Read More

Samsung building China fab, to add iPhone 5 to lawsuits vs. Apple.

Read More, Read More

Yahoo raises $4.3Bn from Alibaba sale.

Read More

Alibaba spins off Aliyun mobile OS team.

Read More

GoDaddy outage takes down millions of sites.

Read More

Palo Alto Networks beats estimate – revenue up 88% to $75Mn.

Read More

HP revises layoff plan by increasing job cuts to 29,000 by 2014.

Read More

Japan Inc. reportedly moves to block KKR’s Renesas takeover.

Read More

TSMC to expand 2013 capex to $10Bn.

Read More

Intel slashes 3Q revenue forecast.

Read More

New Capital Update

2

Temasek, Goldman to participate in $1Bn Bharti Infratel IPO.

Read More

Cypress buying Ramtron for $110M.

Read More

iRobot acquires Evolution Robotics for $74Mn.

Read More

Pre-IPO Nimble Storage raises $40.7Mn from Sequoia and Accel.

Read More

Virident Systems raises $26Mn from Sequoia, Mitsui & Others.

Read More

Nebula raises $25Mn from Comcast, Kleiner Perkins.

Read More

SnapLogic raises $20Mn from Ignition, Andreessen Horowitz.

Read More

Carlyle pays 35% share premium in vwd group takeover.

Read More

Xilinx acquires wireless backhaul IP provider.

Read More

eBay acquires shopping discovery site Svpply.

Read More

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Chart 1.

US Smartphone Market Share

Chart 2.

Global Chip Sales – Americas Weaken

Sources: Scura Paley, comScore

Sources: Scura Paley, SIA, EE Times

Chart 3.

Chart 4.

Scura Paley New Electronics Index – Eq. Wt

Sources: Scura Paley, Capital IQ

Chart 5.

Scura Paley New Electronics Index – vs. S&P 500

Sources: Scura Paley, Capital IQ

Comparative Analysis of New Electronics

Sources: Scura Paley, Capital IQ

3

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Notable Announcements in New Energy

Industry Update

U.S. thermal energy storage capacity to triple by 2020.

Read More

US solar installations continue to grow at record setting pace.

Read More, See Chart on Page 5

Energy management software powered by $1.22Bn in VC.

Read More

70% of municipal utilities could install smart meters by 2017.

Read More

China to invest $39.5Bn in PV during 2011-15.

Read More

China tops renewables attractiveness index.

Read More, See Chart on Page 5

Germany's clean tech industry to more than double by 2025.

Read More

>237Mn smart meters will be deployed in Europe by 2020.

Read More

China and Europe sign memorandum of understanding.

Read More

U.K. proposes incentives for home heating from biomass to solar.

Read More

Company Update

Chinese solar firms dropped from NASDAQ green index.

Read More

Siemens to Cut 615 US Wind Energy Jobs.

Read More

Mainstream gets Macquarie loan for wind farms & expansion.

Read More

Hitachi Zosen plans $1.5Bn offshore wind farms in Japan.

Read More

Fotowatio plans to build Australia's largest solar project.

Read More

GreenVolts loses ABB as investor, lays off bulk of staff.

Read More

GM losing nearly $50,000 on every Chevy Volt produced.

Read More

Smith Electric Vehicles halts IPO plans.

Read More

Vodafone Teams with IBM for smart home appliances.

Read More

GE launches demand response management technology.

Read More

New Capital Update

4

Blackstone acquires home automation giant Vivint for >$2Bn.

Read More

Blackstone exceeds $2Bn target for maiden energy fund.

Read More

EnCap Investments targets $4.25Bn for new upstream fund.

Read More

NewWorld Capital raising $300Mn green-tech fund.

Read More

Morgan Stanley leads consortium in $300Mn Chinese hydro deal.

Read More

Modular green homes start-up Blu Home raises $60Mn.

Read More

CIGS specialist Ascent Solar sees shares plunge after offering.

Read More

Suntech threatened with NYSE delisting.

Read More

Suzlon seeks more time to settle further $220Mn chunk of bonds.

Read More

McWane Acquires wireless smart grid solution co. Nighthawk.

Read More

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Chart 6. U.S. Solar Installations

Chart 7. Renewable Attractiveness Index

Sources: Scura Paley, GTM Research, SEIA

Sources: Scura Paley, Ernst & Young

Chart 8.

Chart 9.

Scura Paley New Energy Index – Eq. Wt

Sources: Scura Paley, Capital IQ

Chart 10.

Scura Paley New Energy Index – vs. S&P 500

Sources: Scura Paley, Capital IQ

Comparative Analysis of New Energy

Sources: Scura Paley, Capital IQ

5

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Notable Announcements in New Environment

Industry Update

PE investments in Environmental Services rise.

Read More, See Chart on Page 7

Refurb. Medical Devices market to be worth $8.5Bn in 5 years.

Read More, See Chart on Page 7

Investment into greener data centers to soar to $45Bn by 2016.

Read More

Water-tech outperforms other climate themes in Climate index.

Read More

Guangdong steps closer to carbon trading launch.

Read More

Hybrid medical imaging to spot tumors earlier.

Read More

China's stockpile effort could stabilize rare earth metals prices.

Read More

2,900 mines closed down in China's coal and rare earth region.

Read More

Brazilian government agrees to boost ethanol blend.

Read More

Govt. invests $73Mn in potable water plants.

Read More

Company Update

Lynas’ Malaysia plant receives temporary operating license (TOL).

Read More

Northern Minerals expands HREE target area.

Read More

Ford reducing rare earth metal use in 2013 electrified cars.

Read More

SocGen, GSK dropped from sustainability index.

Read More

IBA inks $50Mn Texas proton deal.

Read More

Baxter to pay Onconova $50Mn in Cancer Therapy Deal.

Read More

Caterpillar to provide $21Mn for Blue Sphere biogas projects.

Read More

Valero restarts ethanol plants in Indiana, Nebraska.

Read More

Biochemical group Elevance withdraws IPO.

Read More

Itron announces water fixed network in Western Australia.

Read More

New Capital Update

Harvest Partners hits record $1.1Bn fundraise for buyout fund.

Read More

Khosla Venture leads deal for agritech company Blue River.

Read More

Ludgate targets up to $300Mn for environmental growth fund.

Read More

Nord-Pas de Calais issues €80Mn municipal SRI bond.

Read More

PE investor Foresight backs £21Mn waste management plant.

Read More

WMS, Demeter Partners invest in environmental monitoring co.

Read More

CHS-backed Heartland Dental eyeing $1.4Bn auction sale.

Read More

Cinven completes £465Mn acquisition of Mercury Pharma.

Read More

Thoma Bravo to take Nasdaq-listed Mediware private for $195Mn. Piper Jaffray leads $30Mn Series D round for Torax Medical.

Read More

Read More

6

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Chart 11. Environmental Services – PE Deals since 2008

Chart 12.

Sources: Scura Paley, Pitchbook

Sources: Scura Paley, Markets and Markets, DotMed

Chart 13.

Chart 14.

Scura Paley New Environment Index – Eq. Wt

Sources: Scura Paley, Capital IQ

Chart 15.

Global Refurbished Medical Devices Market

Scura Paley New Environ. Index – vs. S&P 500

Sources: Scura Paley, Capital IQ

Comparative Analysis of New Environment

Sources: Scura Paley, Capital IQ

7

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Notable Announcements in New Finance

Industry Update

Alternative finance loan approvals increased in August.

Read More, See Chart on Page 9

U.S. debt collectors cash in on $1Tn in student loans.

Read More

Mega rounds growing phenomenon in financial services.

Read More, See Chart on Page 9

ABS market surges, with more than $7Bn in deals lined-up.

Read More

Payday lending ordinance passed by City Council.

Read More

California legislature approves three BHPH bills.

Read More

Rent-to-own housing on the rise in Winnipeg.

Read More

2Q subprime originations exceed pre-recession levels: Experian.

Read More

Moody's: U.S. banking outlook negative.

Read More

SEC fines NYSE $5Mn for giving clients preferential data access.

Read More

Company Update

Encore Capital, Portfolio Recovery among 100 Fortune's FastestGrowing Companies for 2012. Read More, Read More

US treasury launches $18Bn stock offer to slash stake in AIG.

Read More

CompuCredit tender offer for stock oversubscribed.

Read More

DFC global beats 2Q12 street estimates.

Read More

Credit Acceptance completes $252Mn Asset-Backed Financing.

Read More

Wells Fargo lends support to finance alternative EasyPay.

Read More

Marlin business services expands Healthcare Finance Group.

Read More

CareFusion takes lease question to SEC.

Read More

Nicholas Financial opens three new branches.

Read More

GM Financial Announces $1.3Bn Senior Subordinate ABS.

Read More

New Capital Update

8

Private-equity buyouts on track to reach highest total since 2007.

Read More

ADIA, GIC, Norges Bank buy $1.3Bn shares in China Pacific Ins.

Read More

TA sells stake in hedge fund K2 Advisors to Franklin Templeton.

Read More

GE reportedly considers selling $2.2Bn stake in Thai bank.

Read More

PAG closes Asia-focused buyout fund on $2.4Bn.

Read More

Affinity Equity Partners seeks $3.5Bn fund.

Read More

Partners Group raises $483Mn for senior debt financings.

Read More

Ventech closing €100Mn fund to invest in Europe and BRICs.

Read More

CVC said to sell 10% stake to three sovereign-wealth funds.

Read More

Mega transactions mask Middle East M&A deal slump.

Read More

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Chart 16.

Loan Approval Rates

Chart 17.

Financial Services Deals (by Deal Size)

Sources: Scura Paley, Biz2Credit Small Business Lending Index

Sources: Scura Paley, Pitchbook

Chart 18.

Chart 19.

Scura Paley New Finance Index – Eq. Wt

Sources: Scura Paley, Capital IQ

Chart 20.

Scura Paley New Finance Index – vs. S&P 500

Sources: Scura Paley, Capital IQ

Comparative Analysis of New Finance

Sources: Scura Paley, Capital IQ

9

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Notable Announcements in New Media

Industry Update

Corporate VC Internet deals hit a high in 2Q12.

Read More, See Chart on Page 11

U.S. Mobile Ads: Twitter sales are 2x that of Facebook.

Read More, See Chart on Page 11

Mobile app market to almost double this year to 45Bn.

Read More

Fake social media ratings, reviews to be 10- 15% by 2014.

Read More

Google sites top U.S. online video content properties.

Read More

Pinterest becomes 4th largest traffic driver worldwide.

Read More

comScore: 4 out Of 5 smartphone owners use device to shop.

Read More

Apple tops mobile ad impressions, lead to grow with iPhone 5.

Read More

20% of the U.S. can’t watch online video in HD.

Read More

Iran announces plan to launch domestic internet by March 2013.

Read More

Company Update

Facebook turns off facial recognition in The EU.

Read More

Apple working on Pandora-like service.

Read More

Nokia launches free music streaming service in U.S.

Read More

Google shopping to switch to paid model in october.

Read More

Twitter to dump third-party image hosts from apps.

Read More

Square is now valued at $3.25Bn.

Read More

VEVO: 40Bn videos watched last year, mobile traffic doubled in 2Q. Google & Harris Interactive launch new Consumer Research Tool.

Read More

Read More

PlaySpace to expand its social games to U.S., Latin America. Read

More

Reddit reached 3.4Bn Pageviews in August.

Read More

New Capital Update

10

Trulia stock surges more than 40% in first day of trading.

Read More

Square closes $200Mn Series D From Starbucks, Citi & Others.

Read More

Desire2learn raises $80Mn from NEA & OMERS Ventures.

Read More

Social Finance lands $77Mn from Baseline, Renren.

Read More

Quirky bags $68Mn from A16Z, KPCB, Norwest and RRE.

Read More

Zendesk raises $60Mn from Redpoint, Goldman & Others.

Read More

SingTel acquires social photo aggregator Pixable for $26.5Mn.

Read More

Photo- And Video-Sharing app Mobli raises $22M.

Read More

Google acquires Photoshop competitor Snapseed.

Read More

CVC, Goldman propose debt-for-equity swap for Nine Ent.

Read More

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Chart 21.

Corporate VC Internet Deals

Chart 22.

US Mobile Ad Revenue – Market Share

Sources: Scura Paley, CB Insights, Techcrunch

Sources: Scura Paley, eMarketer, Techcrunch

Chart 23.

Chart 24.

Scura Paley New Media Index – Eq. Wt

Sources: Scura Paley, Capital IQ

Chart 25.

Scura Paley New Media Index – vs. S&P 500

Sources: Scura Paley, Capital IQ

Comparative Analysis of New Media

Sources: Scura Paley, Capital IQ

11

Market Intelligence

N e w C a p i t a l U pd a t e – S e p t em b e r 2 0 1 2

Important Disclosures

Scura Paley is a member of FINRA and SIPC.

This market intelligence is not an offer to sell or the solicitation of an offer to buy any

security.

Neither Scura Paley nor its affiliates holds any beneficial ownership in any of the

recommended securities and does not hold 1% or more of the subject company’s

equity securities.

Neither we, nor any member of our household, nor any person that depends on U.S.

for financial support, holds a financial interest in the securities of this report or

related companies.

The persons who prepared this report do not receive compensation based on

investment banking revenues, nor receive compensation directly from the subject

company.

Scura Paley has not received compensation for investment banking activity or from

any activity from any company mentioned in this report within the twelve months

preceding publication. However, Scura Paley does expect to receive or seek

compensation for investment banking activity in the three months following

publication.

Scura Paley does not act as a market maker in the stock of the subject company.

To the best of our knowledge, there are no other actual, material conflicts of interest

to disclose.

All Rights reserved. Scura Paley Securities LLC

12

Market Intelligence