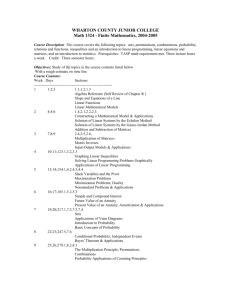

new product & service review compliance issue identification

advertisement

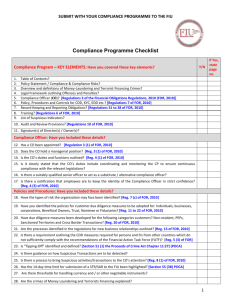

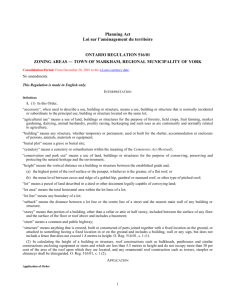

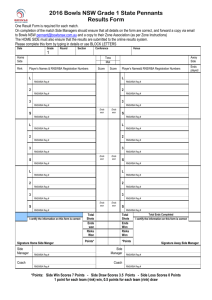

NEW PRODUCT & SERVICE REVIEW COMPLIANCE ISSUE IDENTIFICATION Product Name: Implementation Manager: Desired/Projected Launch Date: TO-DO’S Who Task Review Agreement between Bank and vendor, if any, gain understanding of how the product/program will work o Review vendor due diligence materials to ensure all requirements are met o Ensure vendor can comply with all federal and state regulatory requirements for the product or service. If there are gaps, identify them and plan to address Review the Risk Assessment, make comments as needed Get any operational/due diligence questions answered Consider regulatory impacts o Outline of compliance aspects of program detailed below. Review any new product codes developed for the product as established in Fiserv or other vendor o Review test outputs to ensure product works as intended, reg. issues, [below] as relevant, are addressed Review customer & Bank employee materials/fact sheet of how the product/program will work Review any brochures/advertisements/special information or procedures developed for the customer Develop/Assist in development of procedures for affected staff to follow. o Publish to the intranet Ensure a new workflow in Expedite or other systems needed to accommodate this product and its unique paperwork are developed and compliance issues addressed as they arise in the process Compliance Dept. Signoff If there are as yet unresolved operational tasks that need to be implemented to address identified and detailed compliance issues, (identified below as a “GAP”), the Product Manager will keep the Compliance Officer informed on progress to address those issues. Signoff indicates that the compliance issues and gaps have been identified. Mitigation & follow up are ongoing post signoff. Date Compliance Officer Date Chief Risk Officer 1|P a g e 2/9/16 MECHANICS - HOW THE PRODUCT/PROGRAM WILL WORK . . . REGULATORY ISSUES Describe How Each Rule’s Requirements Will Be Impacted & Addressed By The New Service Or Product. A “GAP” indicates that there is/could be additional steps the Bank must take to address the issue. REGULATORY APPROVAL N/A YES DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS Will an application or notice need to be filed with our federal or state regulator(s), and, if so, do we have the necessary information to submit with the application? BSA – CIP, OFAC - Consider overall BSA risk profile and impact product may have N/A YES GAP? DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS/GAP UNFAIR, DECEPTIVE, ABUSIVE ACTS & PRACTICES [UDAAP] – Also complete detailed UDAAP risk assessment DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS Are features, risks, and terms of the product explained clearly and conspicuously, or are they buried in a lengthy document full of "legalese" that makes it difficult for the consumer to make a truly informed choice? IMPACT Are fees or penalties structured in such a way that unsuspecting, unsophisticated, or vulnerable consumers could experience financial difficulties from which it would be difficult to extricate themselves? IMPACT Are there financial incentives for bank employees to offer this product over other products that may also be suitable for the consumer? IMPACT Is this a product or service we would recommend to our families? IMPACT ?? IMPACT 2|P a g e 2/9/16 DEPOSIT RULES Rule REG CC/EXPEDITED FUNDS AVAILABILITY ACT REG E/ELECTRONIC FUNDS TRANSFERS (OD) REG DD/TRUTH IN SAVINGS REG D/RESERVE REQUIREMENTS REG J/CHECK COLLECTIONS REG GG/ PROHIBITION ON FUNDING UNLAWFUL INTERNET GAMBLING 3|P a g e 2/9/16 Covered or NA? GAP? DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS/GAP LENDING RULES Rule REG Z/TRUTH IN LENDING/CARD Act REGULATION B/EQUAL CREDIT OPPORTUNITY ACT REGULATION C/HMDA FAIR CREDIT REPORTING ACT COMMUNITY REINVESTMENT ACT FAIR DEBT COLLECTION PRACTICES ACT REAL ESTATE SETTLEMENT PROCEDURES ACT REG O/LOANS TO INSIDERS SAFE ACT/MORTGAGE LICENSING REG U/CREDIT BY BANK FOR PURPOSE OF PURCHASING MARGIN STOCK REG FF/OBTAININGUSING MEDICAL INFORMATION IN CONNECITON WITH CREDIT 4|P a g e 2/9/16 Covered or NA? GAP? DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS/GAP OTHER RULES & REQUIREMENTS Rule ESIGN/ELECTRONIC SIGNATURES GLBA & RFPA/RIGHT TO FINANCIAL PRIVACY RED FLAG ID THEFT FDIC INSURANCE DORMANCY STATE OF MD ESCHEATMENT RULES GARNISHMENT OF ACCOUNTS CONTAINING FEDERAL BENEFITS PAYMENTS SCRA/SERVICEMEMBERS CIVIL RELIEF ACT DEFENSE DEPARTMENT REGULATION LIMITATIONS ON TERMS OF CONSUMER CREDIT 5|P a g e 2/9/16 Covered or NA? GAP? DESCRIBE IMPACTS OF RULE/BANK’S ACTIONS/GAP