corp comm & capital mkts

advertisement

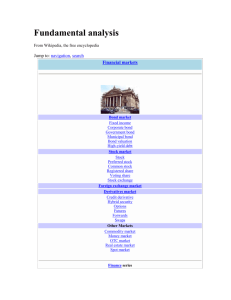

Sample Syllabus Management Communication Program Stern School of Business 40 W. 4th Street New York. NY 10012. Phone: 212 – 521 - 4834 Fax: 212 – 521 - 4900 e-mail: lar@kekst.com Teaching Asst: Lyndsey Estin Phone: 212 – 521 - 4877 e-mail: lyndsey-estin@kekst.com CORPORATE COMMUNICATION AND THE CAPITAL MARKETS B45.2126.30 Professor Lawrence A. Rand Classroom: Class Sessions: KMC 5-75 Course Objectives This course will examine, by both theory and case histories, how investors assign value to corporate equities and explain how companies, through their communications, can impact investor attitudes. Financial communication involves a range of activities that concern how organizations manage relations with financial stakeholders. Course Objectives: Examine various methodologies of financial communication Define target audiences and media Become aware of legal and regulatory restrictions Selected Topics: Pricing of initial public offerings (“IPOs”) and corporate spin-offs Investor relations: dealing with analysts and institutional and retail investors Financial media and corporate reputation Crises that can affect a stock price (e.g., activist and/or hedge fund investors, takeovers and proxy fights, product recalls and legal and/or regulatory issues) Disclosure requirements that have affected stock valuations (e.g., “Mayday,” the origin of investor relations, Sarbanes-Oxley, SEC Regulation FD, FASB rulings on accounting changes, etc.) Required Readings Levitt, Arthur, Take on the Street (Random House, 2002) Blumenthal, Karen, Grande Expectations (Crown Business, 2007) Rand, Lawrence and Siegfried, Robert, “Mayday, the Capital Markets and Corporate Communications” (Kekst and Company, 1975) -1- Recommended Readings Throughout the course, references will be made to events that have profoundly affected Wall Street and matters that have either influenced or impacted investor attitudes and, concomitantly, have taken effect upon a company’s market valuation. For this discussion, students may want to familiarize themselves with the following recommended readings: Shiller, Robert J., Irrational Exuberance (Second Edition) (Doubleday, 2005) Eichenwald, Kurt, Conspiracy of Fools (Broadway Books, 2005) Bruck, Connie, The Predators’ Ball (Simon and Schuster, 1988) Weiner, Eric J., What Goes Up (Little, Brown, 2005) Frantz, Douglas, Levine & Co. (Henry Holt, 1987) Hamilton, James T., All the News That’s Fit to Sell (Princeton University Press, 2004) And some classics: Malkiel, Burton, A Random Walk Down Wall Street Graham, Benjamin and David Dodd, Security Analysis As well as some selected articles and monographs: Bogle, John, “Democracy in Corporate America” Daedalus, Summer, 2007 Lev, Baruch, “To Guide or Not to Guide” Rand, Lawrence, “To Guide or Not to Guide” *All of these materials are available on reserve at the Bobst Library Reserve Desk. Additionally, the articles and monographs are available on Blackboard under “Course Documents.” Teaching Approach The course will be conducted in three modes: lecture, discussion and group presentations. Additionally, individual participation is an important component of your grade and participants are expected to contribute insights to class discussion and engage guest speakers with meaningful questions and comments. Graded Assignments 50% Report Paper on a company-specific issue. For example, a company provides forward-looking earnings guidance on an “annual or rolling quarterly basis” and then, during the course of the year, for various reasons, the company feels an “obligation to update” its guidance. How would you counsel the company on this issue? Your paper should detail the ramifications of your decision and the tactical approach you would recommend. The paper should include the following: 1) an analysis of the underlying causation; 2) what stakeholder analysis needs to be considered and why; 3) a review of what the organization did and how its decision may factor into setting new policies on the issue in the future; and, 4) an example of a company that has implemented your approach, which evaluates the company’s effectiveness in communicating the decision and explores the ramifications of both the decision and the tactics used. Length: 5 pages Due March 30. Submit via Blackboard/Assignments 25% Position paper concerning any topic that is covered in the course. The paper should offer a concise summary of the issue being covered and your critical analysis of the subject matter and a list -2- of unresolved issues or questions that emanated from that session. Length: 2-3 pages. Submit at any point or by March 30. Submit via Blackboard/Assignments 25% Participation including the in-class group presentation. Suggested presentation topics are asterisked in the Course Outline section (your topic should differ from your position paper, unless approved beforehand). Course Outline Session One Reading: Rand and Siegfried: “Mayday, the Capital Markets and Corporate Communications” “Mayday” and the Shift to Proactive Corporate Communications: a. How the onset of negotiated rates (May 1, 1975) affected corporate communications b. The decline of the soft dollar on “sell-side” research c. The rise of “buy-side” analysis and how companies responded Session Two Suggested reading: Bruck: The Predators’ Ball or Frantz: Levine & Co. How the “Junk Bond” Takeovers and Corporate Raiders Changed the Way Companies Communicate to Shareholders: a. The view from the “corporate raiders” camp and how they made their pitch to investors b. How corporate America responded to the activist movement and became more aggressive c. How Boone Pickens, Carl Icahn and Ronald Perelman helped the growth of investor relations and reformed corporate communications Session Three Reading: Levitt: Take on the Street Presentation: Groups 1 and 2 “Cowboy Capitalism” and How it Affected Corporate Communications: a. The rise of the dot.coms and how their stories were told * b. Silicon Valley IPOs and the NASDAQ bubble: the selling of a concept and the loss of accountability c. How Amazon and E-Toys “Killed” Toys “R” Us: how the “click and pick” business model changed the brick and mortar model d. The fallout from the dot.com downfall and how corporate communications had to change with the times * -3- Session Four Suggested reading: Schiller: Irrational Exuberance Presentation: Groups 3 and 4 Guest Speaker: Laurie Hays, Senior Editor, Bloomberg CNBC v. Wall Street Journal v. Bloomberg v. Blogosphere a. How the financial media affects the stock markets b. The new financial media paradigm and how investors from the day traders to Fidelity now “get the news” * c. The rise of the markets’ volatility and how “irrational exuberance” replaced Graham-Dodd analysis * Session Five Reading: Blumenthal: Grande Expectations Presentation: Group 5 Guest Speaker: Dennis D’Andrea, Vice President, Investor Relations, The Estee Lauder Cos. The Enron Effect: How the Demise of Enron Led to the Birth of Sarbanes-Oxley and Other Regulatory Measures: a. The demand for “greater corporate transparency and accountability” * b. Tyco’s “Money Machine” and how it changed corporate reporting c. Reg FD and its implications on corporate communications d. ‘Mark to market’ v. ‘mark to maturity’ and asset impairment issues * Session Six Presentation: Group 6 Back to the Future: Why Issues of Today are Reminiscent of Times Past: a. Are hedge funds the new corporate raiders? b. Did Sarbanes-Oxley and Reg FD make corporate reporting less transparent? * c. What is the impact of the “earnings guidance” debate? -4-