European QE, US Interest Rates & OPEC

advertisement

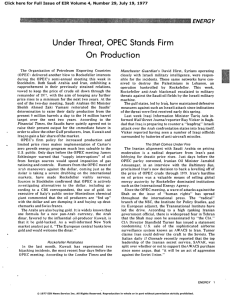

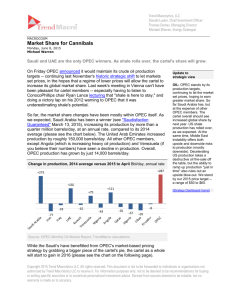

For immediate release: 8 December 2015 European QE, US Interest Rates & OPEC Recent events suggest increased tension in emerging markets dependent on oil export revenues and US Dollar denominated debt, says Rowan Dartington Signature’s Guy Stephens We were reminded yet again last week that the markets are entirely focussed on external factors rather than the fundamentals. The big story on Thursday was the size of the European QE extension from Mario Draghi whilst Friday saw US employment payroll data which is key for the US interest rate rise, and finally there was the OPEC meeting in Vienna, discussing oil price quotas. The markets had clearly talked themselves into heightened expectations that Mario’s bazooka was loaded and there was going to be a big bang. In the end, he delivered a six month timetable extension to March 2017 on the same monthly QE purchases and reduced the deposit rate on ECB bank balances by 10 basis points to -0.3%. This amounted to mere tinkering at the edges and was interpreted by the markets as a big disappointment. There was a big swing in the Euro/Dollar currency rate with the Euro strengthening whilst equity markets sold off as there was no immediate extra stimulus per se. On Friday, in the US, the payrolls data came in ahead of consensus forecast which made the odds of a US interest rate rise an almost certainty. The decision on this will be delivered on 16th December and is largely priced into markets. The focus will then shift to when the next rise will occur and there are polarised views on this. The much analysed dialogue from Janet Yellen has shifted in emphasis, with a key addition being a desire to normalise rates and control the build-up of excessive personal debt. This was debated at our last Asset Allocation meeting and comments were made that the monitoring of inflation and linking this to interest rates didn’t stop the last three bubbles involving technology, commercial property and credit. Indeed, there are signs in the UK that personal debt is actually above the levels seen in 2007 due to low interest rates and a proliferation of deals, most notably car financing, and inflation does not capture this. It was generally viewed as positive that the influence on rate decisions may broaden away from an inflation target and more to economic stability including levels of household debt. Some say that Mark Carney, Janet Yellen, and now Mario Draghi, are all guilty of giving mixed messages to the markets but then the markets are guilty of hanging onto every word and taking that as decisive going forward whilst the macro-economic data is changing all the time. A benefit of forward guidance is that we get greater transparency on Central Bank actions. However, the downside to this is that Central Banks become a much greater influence over the markets and this is very much what we are seeing. Daily analysis focuses on who is saying what and when, and precisely what various comments mean. Committee member statements are also analysed and can easily become the latest view of central policy, even though they are the views of one individual outside of the Committee meetings. And finally we had the OPEC meeting which was a complete non-event. This was dominated by reports that the return of Iranian production next year is seen as the biggest threat to OPEC market share as that will amount to 1 million barrels per day. This is unlikely to hurt the US shale producers, which has been the main reason for maintaining supply above demand. The previous quota ceiling was abandoned and this will be re-set once Iran has started production. Clearly, OPEC’s influence on world oil markets has reduced to who can keep going for the longest at the lowest prices. This suggests on-going caution and increased tension in emerging markets dependent on oil export revenues and US Dollar denominated debt. The last thing they need is a weaker oil price and higher US interest rates from here. It tells us that the Saudi’s are totally focused on maintaining market share and hurting US shale producers, even if this causes pain for some of the smaller OPEC members.