Costing Sheet FAQs

advertisement

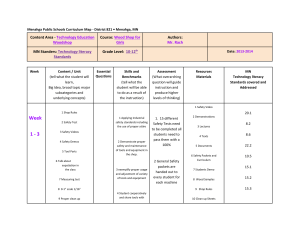

Costing Sheet Frequently Asked Questions - We hope that this information is helpful. If you have additional questions after reviewing this file and the Entry Instruction sheets in the workbook; please email Scott Lloyd, President of MTM Services via: Scott.Lloyd@mtmservices.org. 1. Filling out the worksheets – a. Software – These sheets are set up in Microsoft Excel. Utilizing other software like Microsoft Works for example will cause issues. As well, using very old versions of Excel has often caused challenges with linkages in the workbook. We would suggest that you use Microsoft Excel 2003 or above. b. Entry Cells / Blue Cells - For each of the worksheets, you will fill out the blue cells only, as the rest of the cells are password protected to preserve the math. c. Copy and Paste Only – These sheets are locked to protect the math formulas. This works well with all things except for if teams cut and paste information within the sheet, as that messes up the formulas and creates a Reference Error (#REF). If you will copy and paste, or normally the best method is to copy and paste values is the best way to go. d. Staff Time Hours vs. Client Time Hours – The Actual Billable/Direct Service Hours to be entered on sheet FFS-1 should be the staff time hours, not the client time hours. For Example – If a staff member runs a 2 hour group with 12 people, you would enter the 2 to 2.5 hours depending on the extra credit often given for groups, NOT the 24 hours of client time. e. Actual Time & Actual Salary – The staff count for everyone entered defaults to 1 as you will want to enter Actual Hours delivered for the timeframe of the study, not what is expected. As well, you will put in what was actually paid to the staff member for the timeframe, therefore anyone who is part time will have numbers that are accurate because the math ties to real time and real cost. f. Completion Order – You can fill them out in any order you like, however it is suggested to complete the sheets in numeric order. For Example – Sheet FFS-2 gives the CPT codes needed for sheet FFS-3 where you enter the hours delivered per staff broken out by the hours delivered per code. g. Formulas – You can see any of the formulas on any of the worksheets, just by clicking on the cells despite them being locked. 2. Selecting your worksheets a. FFS vs. PD Sheets – There are two sets of worksheets in this workbook (Fee for Service and Per Deim). Some teams will utilize both sets of sheets, while others will utilize only one set. The determining factor of which worksheets you should utilize depends on your funding source. Here is the information on the sheets: i. The Fee-For-Service (FFS) - Are for programs that deliver direct services to consumers and are then paid a fee for every direct service hour/unit they deliver. (Example - Outpatient MH, SA Individual of Group services, CM Services.) ii. Per Diem Per Day (PD) - Are for programs that deliver direct services to consumers, but the payment for the care is not tied to the number of direct service hours delivered. Instead the organization is paid a set fee based upon the census of the organization/every participant that attendees services for a fixed time frame. (Examples – Residential, DD, Day Treatment.) 3. Grant Fund Entry Options – a. There are two ways to enter grant funds. The first is to enter grant funds that are considered general revenue on sheet FFS-1 in Cells H4 through H9: All funds entered here will be spread out evenly across all of the direct service providers based upon which program that you assign them to, just like the Non-Direct Funds. If you want/need to be more strategic with the application of your grant funds, then you would: b. Apply the grant funds to specific codes as part of the NET revenue you enter per code on sheet FFS-4. This will show the impact of the Grant reimbursement only in the codes that you want. 4. If you cannot Enter Data into your sheet – A few teams have had an issue and emailed us that they were not able to delete the information in or add information in the blue cells. To be clear, NONE of the blue entry cells are locked or in a read only format. If that happens to you, then one of two things has happened: 1. Pasting Issue - You have pasted data into the blue cells from a locked worksheet, which brings the locked designation with it. That is why you always use the “Paste Values” option. 2. Temporary File Issue - More commonly, teams will open the worksheet directly from their email and start to work on it without saving it to their hard drive. If you do this, then the sheet will lock down in a read only mode because the file is located in a non-writable temporary network folder. If this happens, please simply do a save-as function and save the file to your hard drive. Teams have found that doing that will fix the issue immediately. 5. Showing a Loss – It is not uncommon to show a loss on these sheets and not on your financials based upon the following: a. Teams traditionally only include their at risk funding in these models, and do not include private contracts, fund raising, etc., which often make up the difference in their losses tied to their straight governmental funding. b. You are putting in your actual net revenue deposited, not your full billing rates and/or AR. c. Finally, you are not entering in depreciation, write offs, etc. Additional Miscellaneous Questions from Teams: 3. Q - Some of our supervisors also provide a small amount of clinical services. How do they need to be handled of the FFS sheets? Do I need to estimate their salaries related to direct services and put the remainder in non-direct costs? If so, do you have any suggestions on how to estimate their direct cost? A - Most teams have an allocation of time that is on their books already. If you don’t have that, then you would just need to approximate based upon a formula tied to their actual hours compared to the standard for your team. So for example, if you have someone who delivers 200 hours, and your direct services standard is 1,000 hours, then you would put them down as a .2 FTE and count 20% of their salary and fringe for direct service. 4. Q - During the 6 month costing period, non-paid interns provided some of the billable services to our consumers. How should I treat them since they were neither paid wages nor a stipend? Should I use the hourly rate and benefits of their supervisor in order to impute a value, or should I ignore them totally. If I ignore them, do I also remove the related revenues? A - For Interns, teams have simply applied their hours to whoever supervised them. This way you can see the productivity, match up the revenues, and not have them mess up your cost per staff member and/or service. 5. Q - We allocate the cost of transporting consumers from their homes to each of our sites (where applicable). The state partially pays us for this service and those payments are allocated to each site as revenue. I’m assuming that I should offset this revenue against the expenses when calculating non-direct expenses. A - I would enter the costs as they are, and then apply the revenue via the grant entry on sheet FFS-1 next to the Non Direct cost entry. The grant revenue is spread across all of the staff selected for that program. 6. Q - Regarding personnel costs, are Days of PTO the number of days earned/accrued or the number of days actually taken/used? A - The days actually taken/used is what we are looking for in this case. Thanks for your hard work, we will be looking forward to your questions and/or completed worksheets to review and offer feedback!

![Creating Worksheets [MS Word, 78 Kb]](http://s3.studylib.net/store/data/006854413_2-7cb1f7a18e46d36d8c2e51b41f5a82fa-300x300.png)