Policies and Procedures - Resource and Crisis Center of Galveston

advertisement

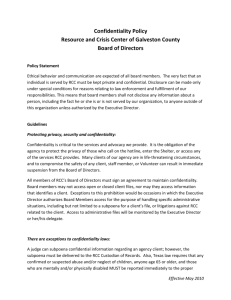

Resource and Crisis Center of Galveston County POLICIES AND PROCEDURES OF THE RCC BOARD OF DIRECTORS Responsibilities of a Non Profit Board of Directors: The primary purpose of the board of directors is to assure that the agency fulfills its mission and meets its goals. This is done by setting broad policy, reviewing and approving programs and budgets developed and implemented by the executive director and ensuring the financial stability and accountability of the agency. Board members must abide by the powers and duties granted the corporation by Texas law, its Articles of Incorporation and its bylaws. Directors must act in good faith and must ensure that the interest of the corporation prevails over any personal interests. It is recommended that the board have regular updates of changes made in the Texas NonProfit Corporation Law. Financial Responsibility: The board of directors must approve an agency budget annually. The budget should include all programs and expected incomes and expenditures. The board should assure that the budget is reasonable and responsible and reflects the mission and goals of the agency programs. The stewardship function of the board of directors is to ensure fiscal accountability of all funds received and spent by the agency. The RCC board receives regular financial reports detailing the actual and expected income and expenditures of all agency monies. The reports include approved budget figures. It is the responsibility of members to review the reports and assure themselves that the agency is functioning in a responsible manner. Functional Responsibility: In addition to the above responsibilities, the board of directors has functional responsibilities in the following areas: Human Resources - Board members have four key responsibilities in this area: 1) Board Membership - includes recruiting new board members, recognizing and nurturing existing members and providing board members with opportunities to grow and develop as leaders. It is the policy of RCC that new members be recruited by a procedure which encourages a diverse representation of members in terms of ethnicity, age, profession or background, and communities served; 2) Executive Director Accountability - includes hiring, firing and ongoing evaluation of the Executive Director; Effective April 09 Resource and Crisis Center of Galveston County 3) Agency Policies - includes providing policy guidance about salaries, benefits and grievance procedures and approving all agency policy; and 4) Volunteer Involvement - includes setting policies regarding how volunteers should be utilized, in what areas volunteer work is appropriate, and, in general, how the organization should treat, recognize and celebrate its volunteers. Planning - Board Members have four key responsibilities in this area: 1) Mission/Philosophy - includes setting and reviewing organizational mission/philosophy; 2) Short/Long Range Goals - includes planning for the future of the organization by means of short and long-range planning; 3) Services/Programs - includes deciding and planning which services/programs the organization will provide; and 4) Program Evaluation - including evaluating the organization's programs and operations on a regular basis. Finance - Board Members have four key responsibilities in this area: 1) Financial Accountability - including financial accountability for the organization; 2) Budget - includes overseeing an ongoing process of budget development, approval, and review. 3) Fund-raising - includes raising funds and/or ensuring that adequate funds are raised to support organization policies and programs; and 4) Property Management - including managing and maintaining properties and/or investments the organization owns or is responsible for. Community Relations - Board Members have four key responsibilities in this area: 1) Addressing Community and Client Needs - Includes ensuring that organization programs and services appropriately address the needs of the community and the client we serve, 2) Marketing - includes marketing organization services and programs; 3) Public Relations - includes ongoing public relations and developing an awareness in board members that they, as representatives of the agency, are always emissaries of the organization in the community; and 4) Cooperative Action - including occasions when the organization could/should Effective April 09 Resource and Crisis Center of Galveston County participate in coalitions, joint Fund-raising, etc. Organizational Operations - board members have four key responsibilities in this area: 1) Ensuring that the board operates adequately and appropriately; 2) Organizational Structure - includes ensuring that the agency's organizational structure is adequate and appropriate; and 3) Legal and Funding Requirements - includes ensuring that the organization and the members of the board meet all applicable legal requirements and those required by funders. This should include ensuring that the agency maintains documents required by law or by funders for required time periods. Such documents include, but are not limited to: Articles of incorporation and letter(s) granting 501 (c) (3) status, A mission statement, A brief history of the agency, Appropriate insurance policies, By laws that include all required sections, Current list of board members, A current organizational chart, A list of current programs with a description of each, Agency policies that contain all required information, Current and past operating budgets, amendments and audits, A list of donors, Minutes of board meetings, Any other documents by law or a funding source. The Texas Non Profit Corporation Act requires that all records, books and annual reports of the financial activity of the corporation must be kept at the principal office for at least three years after the closing of the fiscal year and must be available to the public for inspection and copying during normal business hours. All records related to Texas Department of Human Services contracts, Office of the Attorney General and most other state or federal funding sources must be maintained by the agency for three years and 90 days or until all litigation, claims or audit findings are resolved, whichever is longer. Effective April 09 Resource and Crisis Center of Galveston County Conflict Of Interest/Nepotism: The Resource and Crisis Center shall ensure that no officer, employee, or member of the governing body of the agency shall vote for or confirm the employment of any person related within the second degree by affinity or third degree by consanguinity to any member of the agency's governing body or to any officer or employee who would directly supervise such people. This prohibition shall not prohibit the continued employment of a person who has been continuously employed for a period of two years to the election or appointment of the officer, employee, or governing a body member related to such person in the prohibited degree. Composition of the Board: It is the policy of Resource and Crisis Center to assure that the board of directors will remain diverse and representative of the community and the populations we serve. The nominating committee of the board should endeavor to include a range of professions, backgrounds, ethnicity, age and special populations on the board at all times. The by laws of the agency limit board members to two three year terms. Members who fill an unexpired term may complete that term and then complete two full three year terms. RCC conducts criminal background checks on all staff and volunteers, including members of the board of directors. The policy related to criminal background checks follows. ADVISORY BOARD: The Board of Directors may appoint an unlimited number of persons to serve on an Advisory Board at their discretion. The purpose of the Advisory board is to advise and assist the Board of Directors. a.) Advisory Board members are appointed for a one-year term and may serve an unlimited number of terms if so elected by the Board of Directors. b.) The Board of Directors may appoint a Chairman of the Advisory Board. CRIMINAL HISTORY BACKGROUND CHECKS For the protection of clients, staff and volunteers, RCC does a complete background check on all applicants for employment and potential volunteers who have direct client contact or have access to client information. The background check will include contacting three references (supplied by the applicant or potential volunteer) and a criminal history check. A criminal history does NOT automatically rule out employment or volunteer service. The Effective April 09 Resource and Crisis Center of Galveston County incident should be discussed with the Program Coordinator. The Program Coordinator and the Executive Director will make a determination regarding further affiliation with the agency. The factors to be considered in making a final determination will include the nature of the crime, circumstances surrounding the incident, the length of time since the crime, evidence of rehabilitation and the applicant's/volunteer's willingness to be honest about the events. Applicants for employment and potential volunteers will be told of the final determination and the rationale for that decision. In some instances, the applicant or potential volunteer may be offered other opportunities to be of service to the agency. Refusal to participate in the background check or provide necessary information to complete the background check will result in terminating the affiliation with the agency. Each employee or volunteer should complete a Release for Criminal History Background Check form, providing the necessary information to complete the check. RCC maintains the confidentiality of clients within the limits of the law. Members of the board of directors are expected to abide by and uphold this confidentiality and are asked to sign a copy of the policy. The agency policy on confidentiality follows. CLIENT CONFIDENTIALITY AND RELEASE OF CONFIDENTIAL INFORMATION All those affiliated with RCC, employees, contractors and volunteers in any capacity are expected to observe the rules of confidentiality. All information regarding clients, including the information that a named individual is a client, is to remain confidential within the limits of the law. An employee, contractor or volunteer must obtain a written authorization from the client before divulging information about the client or the client's situation with any other person other than another agency employee with authorization and/or reason to have the information. The agency has Release of Information forms to be used for written authorization. There are exceptions to releasing confidential information without a written authorization from the client. When we are presented with a valid court order or subpoena requiring the information we may be forced to comply. When we receive a valid request for information available under the Public Information Act, we will request guidance from the Attorney General's office before releasing information. The law requires that any person report information about child abuse or elder abuse, regardless of how the information was learned. When we Effective April 09 Resource and Crisis Center of Galveston County learn of a threat to self or others, we will ethically take appropriate actions to protect those threatened. All clients should be told of these exceptions during the intake process. Confidentiality applies to written and verbal information and all records related to the client or the services provided to the client. Client records should not be taken from agency property without specific permission of a Program Coordinator. Client records or other information regarding clients should not be left in areas where unauthorized persons might see the information. All those affiliated with RCC, employees, contractors and volunteers in any capacity are will be asked to sign a confidentiality agreement. Adult clients who participate in group activities will also be asked to sign confidentiality agreements. The agreement is binding even after the employee, contractor, and volunteer have left the program. Annual Budget Process: The following guidelines were approved for implementation in May 2002. 1. The annual budget proposal should be presented no later than the October Board meeting, with an in-depth presentation. This will allow time for review by the Board and discussion prior to approval. 2. The annual budget should include a budgeted reserve of 5% for emergencies. 3. After each of the first three quarters a reforecast needs to be done if there is a 25% or greater variance in the actual budget. Monthly Financial Reports: Monthly reports should be submitted to the Treasurer no later than 10 business days following the close of the month. This will allow for review and revision if necessary before the Board meeting. Each monthly financial report should include a detailed explanation for any items showing a variance greater than $1000 and 10% in actual current and YTD budget columns. A detailed revenue and expenditure statement for each of the thrift stores should be available to Effective April 09 Resource and Crisis Center of Galveston County the Thrift Store Committee. A monthly monitoring of all expenses is included in reports. Investment Policy Measurement of Performance 1. The total return is expected to exceed the total return of a balanced index, which reflects the asset mix of the portfolio as determined by the Investment Committee. 2. The investment manager is expected to consistently maintain volatility (beta) of no more than 1.00 -1.50 and is expected to maintain a positive risk-adjusted performance (alpha). 3. The total return for various segments of the equity portion of the fund is expected to exceed the total return of the S&P 500 (large cap equities). S&P Mid-Cap stock index (mid cap equities). Russell 2000 stock index (small cap equities) or the EAFE index (international equities). 4. The total return for the fixed income portion of the fund is expected to exceed the total return of the Lehman Brother Aggregate Bond Index. Investment Manager Evaluation Criteria 1. Adherence to the philosophy and style articulated to the investment committee at, or subsequent to, the time the manager was retained. 2. The investment manager shall handle the voting of proxies and tendering of shares in connection with a tender offer. The investment manager shall vote proxies and tender shares in a manner that is consistent with the investment objectives and in the best interest of the Endowment. 3. The investment manager shall immediately notify the Investment Committee in writing of any material changes in its investment strategy, ownership, organizational structure, financial condition, and senior or investment personnel. 4. The investment manager should be prepared to meet with the Investment Committee semi-annually. Restrictions The investment manager shall be subject to the Prudent Man Standard of the Uniform Trustees Powers Law of the State of Texas. While the investment committee cannot impose specific restrictions on pooled investment vehicles, it is intended that the majority of the Endowments investments meet these Effective April 09 Resource and Crisis Center of Galveston County broad restrictions. Each of the following restrictions must be adhered to unless written approval is received from the Investment Committee. 1. There shall be no short-selling, margin trading, securities lending, private placements, or investing in commodities. Investments in derivative securities shall not be utilized to increase the actual or potential risk posture of any investment portfolio. 2. There shall be no investments in non-marketable securities (including unregistered and restricted stocks). 3. The fixed income portfolio must have a weighted average credit rating of AA or better by S&P or AA or better by Moody's rating services, and should never have more than 10% below investment grade securities. No fixed income investment shall have a maturity date exceeding ten years, with the exception of pooled investment vehicles. 4. If any security becomes an unauthorized investment subsequent to purchase, the investment manager must immediately submit a written notice and analysis of the security to the Investment Committee providing a recommendation for holding or disposing of such security. Asset Allocation The Endowment shall have the following asset allocation through the use of mutual funds approved by the Investment Committee. The investment manager shall follow this asset allocation with a variance allowed of 5-10%. This asset allocation reflects a portfolio objective of growth and income. 1. Cash Equivalent 2.Short/lntermediate Investment Grade Bonds 3.Long-lnvestment Grade Bonds 4.Real Estate 5.U.S. Large Cap Stocks 6.U.S. Mid Cap Stocks 7.U.S. Small Cap Stocks 8.Foreign Developed Stocks 5% 20% 10% 5% 15% 20% 10% 5% Effective April 09