confidential * commercially sensitive

advertisement

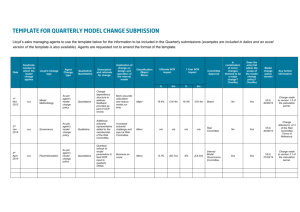

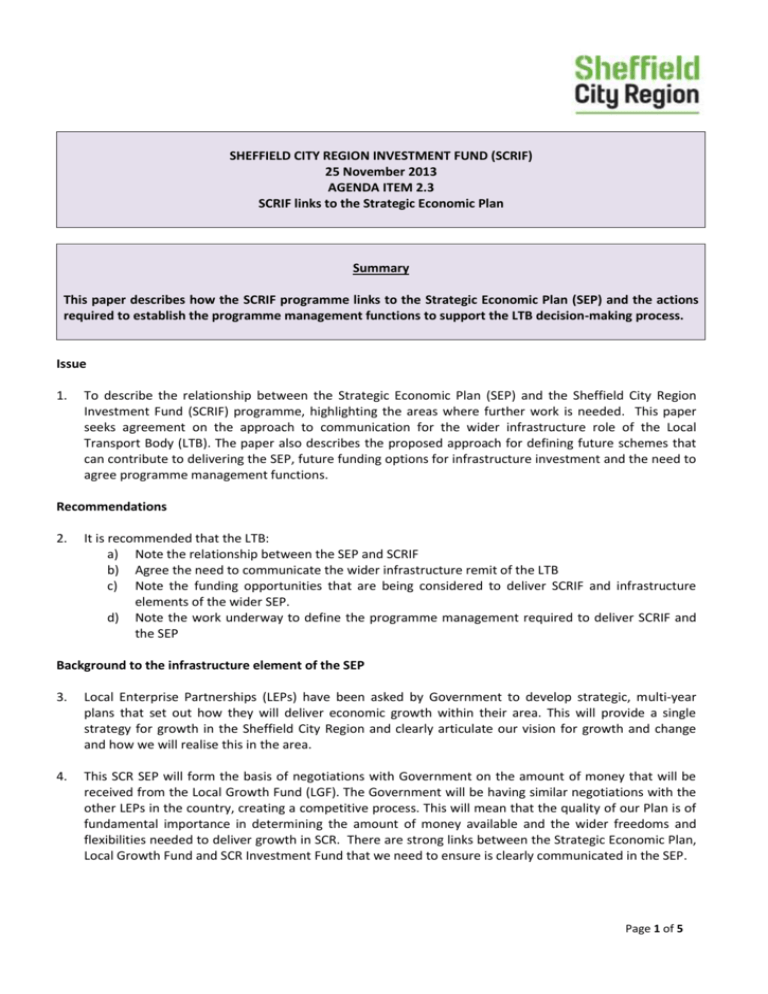

SHEFFIELD CITY REGION INVESTMENT FUND (SCRIF) 25 November 2013 AGENDA ITEM 2.3 SCRIF links to the Strategic Economic Plan Summary This paper describes how the SCRIF programme links to the Strategic Economic Plan (SEP) and the actions required to establish the programme management functions to support the LTB decision-making process. Issue 1. To describe the relationship between the Strategic Economic Plan (SEP) and the Sheffield City Region Investment Fund (SCRIF) programme, highlighting the areas where further work is needed. This paper seeks agreement on the approach to communication for the wider infrastructure role of the Local Transport Body (LTB). The paper also describes the proposed approach for defining future schemes that can contribute to delivering the SEP, future funding options for infrastructure investment and the need to agree programme management functions. Recommendations 2. It is recommended that the LTB: a) Note the relationship between the SEP and SCRIF b) Agree the need to communicate the wider infrastructure remit of the LTB c) Note the funding opportunities that are being considered to deliver SCRIF and infrastructure elements of the wider SEP. d) Note the work underway to define the programme management required to deliver SCRIF and the SEP Background to the infrastructure element of the SEP 3. Local Enterprise Partnerships (LEPs) have been asked by Government to develop strategic, multi-year plans that set out how they will deliver economic growth within their area. This will provide a single strategy for growth in the Sheffield City Region and clearly articulate our vision for growth and change and how we will realise this in the area. 4. This SCR SEP will form the basis of negotiations with Government on the amount of money that will be received from the Local Growth Fund (LGF). The Government will be having similar negotiations with the other LEPs in the country, creating a competitive process. This will mean that the quality of our Plan is of fundamental importance in determining the amount of money available and the wider freedoms and flexibilities needed to deliver growth in SCR. There are strong links between the Strategic Economic Plan, Local Growth Fund and SCR Investment Fund that we need to ensure is clearly communicated in the SEP. Page 1 of 5 5. Government has set out that the agreement of Strategic Plans will be an iterative process. Our initial draft Plan will need to be presented to Government before the end of the year, but prior to this, the document will have been developed in consultation with partners. SCRIF and the SCR Growth Plan 6. The SCR SEP will contain significant ‘bottom up’ element of inputs and priorities articulated by the SCR Local Authorities. The programme of schemes already within SCRIF will form part of the SCR SEP, setting out a significant element of our capital investment priorities. 7. The programmes presented in the paper for item 2.1 provide a strong starting point for developing a economic plan that seeks to grow a bigger and stronger private sector. We can clearly demonstrate the focus that has been placed on selecting schemes that are forecast to create GVA and job growth as our primary objective. It is suggested that this well-defined objective, underpinned by the robust Assurance Framework, represents an attractive offer to Government and negotiation platform for further funding and flexibilities in the future. 8. Going forward, it is expected that the SCR Growth Plan will influence future iterations of the SCRIF programme and future prioritisation exercises. The SCR SEP may, for example, identify priority areas or themes for investment to which the current SCRIF proposition does not respond. Perhaps the clearest emerging example is broadband speed and coverage. The SCR SEP would be used help to define these future infrastructure investments. The SEP will also help to define how we approach SCR wide interventions, where investment is needed across Local Authority boundaries. 9. The LTB is asked to note the strong links that have been made between the SCRIF programme and the SEP. Communicating the remit of the Local Transport Body 10. The specific requirement to establish a decision making body named the ‘Local Transport Body’ was made by the Department for Transport, in response to the devolution of Major Scheme Transport Funding. SCR Leaders and the LTB took an early decision to consider a wider range of infrastructure investment, beyond transport, with supporting governance structures developed to support this wider approach. SCR are also progressing with the creation of a Combined Authority which seeks to make decisions on strategic economic regeneration and investment in one place. 11. The creation of the Combined Authority and the wider focus on infrastructure investment has meant the communication of the role and function of the LTB could be improved. Specifically the naming of the body immediately sparks confusion as it does not only consider strategic transport investment. 12. The LTB are asked to agree that the name is changed to the ‘Infrastructure Investment Body’ to provide a more transparent description for the role and function of the body. If agreed, the Assurance Framework will be revised to reflect this change. It is suggested that this change will better align the body with the functions of the Combined Authority and governance for the SEP. Page 2 of 5 Funding the SCRIF programme and SEP 13. A number of programmes have been developed for the consideration of the LTB, ranging in cost from £120m to £280m. Funding sources that are considered to be available to contribute towards SCRIF include: Source Devolved Major Scheme Transport Funding Local Growth Fund Comments £113m has already been committed to the SCR over a 10 year period from 2015/16. This will be wholly available to SCRIF. Other National Funds Potential sources of other national funds to SCRIF are more likely to be at a project level and may have already been factored in by project sponsors to reduce the direct call on SCRIF. However, agencies such as the HCA and Highways Agency may still contribute towards SCRIF projects where such activity aligns with their investment priorities and these are being explored. In particular where projects are associated with initiatives such as the Enterprise Zones options for funding with other funds need to be fully explored. European Programme The current ERDF Programme comes to a close in 2013 limiting the opportunity to access funds to complement SCRIF activity. However if funds are returned to the Programme, there might be an opportunity to support SCRIF activity subject to the eligibility, match funding and the need for projects to be complete by mid-2015. The Government has announced a 5 year LGF to support economic growth from 2015/16. The first year national allocation is £2.1bn. A per capita SCR ‘share’ of this would be c£70m per year, although the proportion of this available for infrastructure investment is yet to be agreed. The 2014-20 Programme is currently under development but indications are that there will be very limited funding available to capital projects within SCRIF but the option to utilise this funding will not wholly be ruled out within the drafting of the EU Strategy. Private Sector With the exception of energy generating projects the majority of SCRIF projects are providing ‘public’ infrastructure rather than income generating assets. Such investment will not directly attract private sector finance unless a PFI or similar route is adopted. However, this investment should leverage significant private sector associated investment, as development proceeds on the back of public sector investment in infrastructure. Where applicable joint ventures or similar models would be pursued. JESSICA As with the private sector, the £23m JESSICA fund will only look to fund development that has an ability to generate a return. As such, any contribution from JESSICA will likely be in the form of leverage rather than a direct contribution to the current SCRIF programme. Page 3 of 5 Local Contributions Local contributions to SCRIF activity is may occur at two levels (although no decisions have currently been reached:: Project Level – The promoter of a SCRIF project has the ability to contribute towards the project cost through whatever means it considers appropriate, eg CIL, NHB, TIF, covenant strength or capital programme to enable a project to proceed. This contribution at project level reduces the call on SCRIF resource. Programme Level: Local Authorities have the option to raise finance to supplement the programme. In addition pooled business rates such as those from the Enterprise Zone could also contribute to SCRIF activity. 14. The reference to Local Contributions in the table above is considered as a potential part of the overall budget for the SCRIF Programme for the following reasons: Local contributions will enable the SCRIF budget to increase the number of projects brought forward and/or enable an earlier start to projects by making funds available ahead of any Government allocation. Within the Guidance of for the Growth Deal, Government will welcome Local Contributions and will consider them as part of the process when determining the competitive allocation of the Local Growth Fund. Greater Manchester (GM) has recently secured an ‘Earn Back’ deal with Government whereby the Government will allocate additional and new funding to GM’s equivalent to SCRIF in return for uplift in GVA. This deal is based upon GM’s local contribution to their Fund. Should Government consider Earn Back for other areas it will likely also require local contributions. Programme management for SCRIF and the SEP 15. The LTB will need to monitor the progress of schemes included in the SCRIF programme as they progress through the stages of the Assurance Framework. To enable the LTB to make informed decisions, a programme management function will be established that makes use of existing best practice for monitoring a significant programme of investment. This will include the creation of a monitoring framework, regular reporting on programme updates, decision making on schemes to progress through the stages of the Assurance Framework and issue resolution to manage the risk of delivering the overall programme, where individual schemes stall or fail. 16. To enable the agreed programme to be delivered, promoters will require advice on when funding will be available. The following sets out the principles that should enable the programme to be managed: The expectation that schemes providing the highest forecast GVA per £ are progressed by promoters first Page 4 of 5 Where this direction is not followed there should be a clear explanation provided. It is expected that the main consideration will be deliverability In this case the Promoter will be asked to explain when the highest performing schemes will be progressed and any corrective action required Scheme Promoters will be encouraged to progress all schemes in the agreed programme, subject to available resources. This will enable the programme to bring forward schemes if others stall or fail As each scheme progresses through a stage of the Assurance Framework, the available funding across the programme will be reviewed. Where costs are reduced this will be reflected in programme reporting and schemes ready to progress will be identified to take up the available funding 17. The LTB are asked to note that a future paper will propose how the programme management functions will be implemented and the wider role for programme management for the SEP. Page 5 of 5