Case Application Chapter 6 Pg.106

advertisement

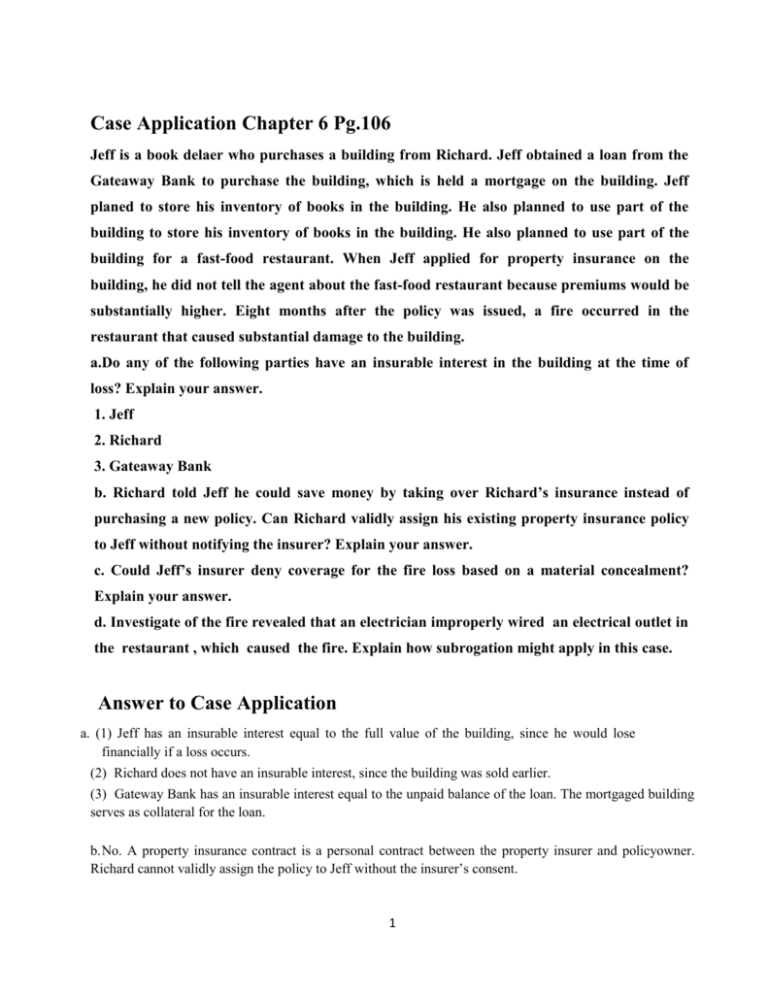

Case Application Chapter 6 Pg.106 Jeff is a book delaer who purchases a building from Richard. Jeff obtained a loan from the Gateaway Bank to purchase the building, which is held a mortgage on the building. Jeff planed to store his inventory of books in the building. He also planned to use part of the building to store his inventory of books in the building. He also planned to use part of the building for a fast-food restaurant. When Jeff applied for property insurance on the building, he did not tell the agent about the fast-food restaurant because premiums would be substantially higher. Eight months after the policy was issued, a fire occurred in the restaurant that caused substantial damage to the building. a.Do any of the following parties have an insurable interest in the building at the time of loss? Explain your answer. 1. Jeff 2. Richard 3. Gateaway Bank b. Richard told Jeff he could save money by taking over Richard’s insurance instead of purchasing a new policy. Can Richard validly assign his existing property insurance policy to Jeff without notifying the insurer? Explain your answer. c. Could Jeff’s insurer deny coverage for the fire loss based on a material concealment? Explain your answer. d. Investigate of the fire revealed that an electrician improperly wired an electrical outlet in the restaurant , which caused the fire. Explain how subrogation might apply in this case. Answer to Case Application a. (1) Jeff has an insurable interest equal to the full value of the building, since he would lose financially if a loss occurs. (2) Richard does not have an insurable interest, since the building was sold earlier. (3) Gateway Bank has an insurable interest equal to the unpaid balance of the loan. The mortgaged building serves as collateral for the loan. b. No. A property insurance contract is a personal contract between the property insurer and policyowner. Richard cannot validly assign the policy to Jeff without the insurer’s consent. 1 c. Yes. A restaurant on the premises can substantially increase the probability of a fire or other loss. Premiums must be substantially higher if the restaurant was also covered. Since the physical hazard would be substantially increased and this fact was not disclosed, the insurer could attempt to deny coverage on the basis of a material concealment. d. Subrogation applies when the insurer makes a loss payment to the insured because of a loss caused by the negligence of a third party. In this case an electrician improperly wired an electrical outlet, which caused the fire. The insurer could attempt to recover the loss payment from the negligent electrician or from the firm employing the electrician. Answers to Question1 and 5 1. (a) (1) The Gateway Bank has an insurable interest in the boat because it serves as collateral for the loan. Thus the Gateway Bank has an insurable interest in the amount of $800,000. (2) The Harbor Company also has an insurable interest in the property. The Harbor Company is a bailee, and there may be possible legal liability if Jake is negligent while docking the boat and using the facilities. Also, the Harbor Company would lose rental income if the boat is damaged. The loss of rental income will support an insurable interest. (3) The White Shark Fishing Company also has an insurable interest in the property. Jake is acting as the company’s agent, and his negligence can be imputed to the White Shark Fishing Company. Thus potential legal liability for a negligent act by Jake would support an insurable interest. (b) Yes. Jake is using the boat and has a potential legal liability as a bailee if he should damage the boat. In addition, if the boat is damaged there may be a business income loss and the loss of earnings, which would also support an insurable interest. 5. (a) No. If Kristen collects from her own insurer, she gives her insurer the right to subrogate against the negligent driver who caused the accident. Her insurer then has the legal right to collect damages from the negligent driver or negligent driver’s insurance company. (b) Subrogation supports the principle of indemnity since the insured does not profit from the loss. By giving up subrogation rights, the insured does not collect twice for the same loss, which supports the principle of indemnity. 2