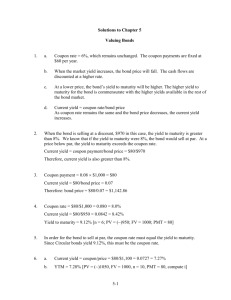

Chapter 05

advertisement

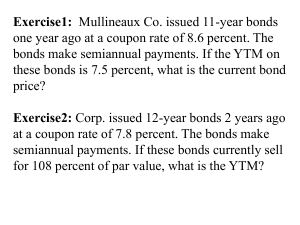

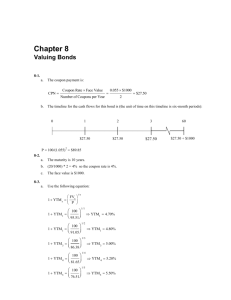

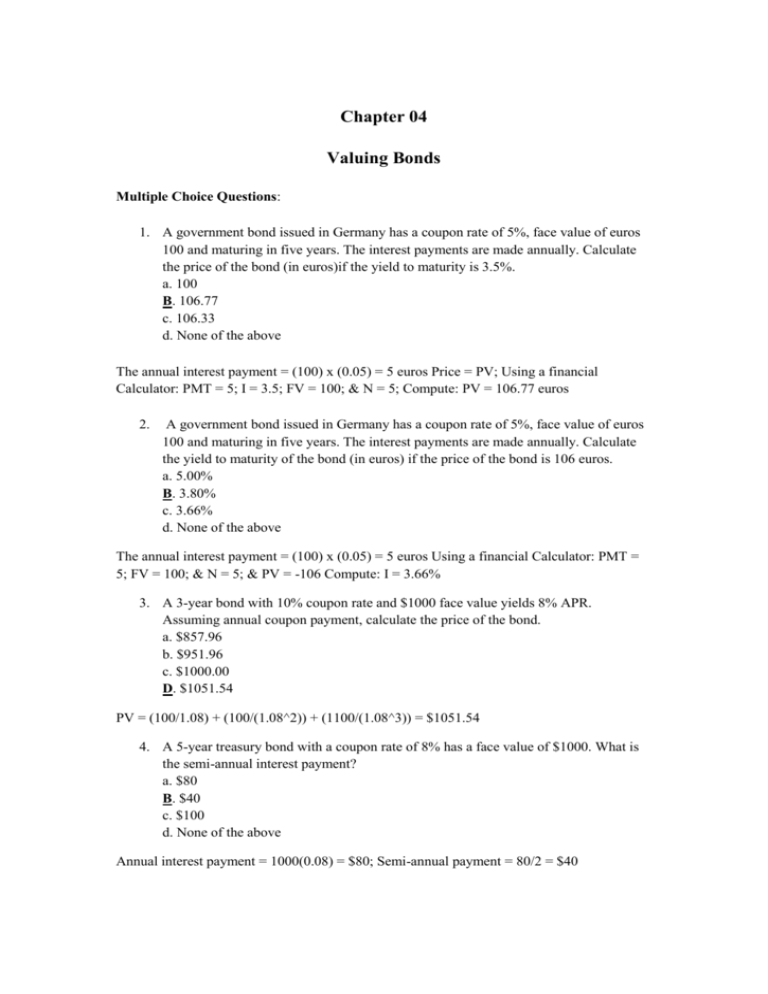

Chapter 04 Valuing Bonds Multiple Choice Questions: 1. A government bond issued in Germany has a coupon rate of 5%, face value of euros 100 and maturing in five years. The interest payments are made annually. Calculate the price of the bond (in euros)if the yield to maturity is 3.5%. a. 100 B. 106.77 c. 106.33 d. None of the above The annual interest payment = (100) x (0.05) = 5 euros Price = PV; Using a financial Calculator: PMT = 5; I = 3.5; FV = 100; & N = 5; Compute: PV = 106.77 euros 2. A government bond issued in Germany has a coupon rate of 5%, face value of euros 100 and maturing in five years. The interest payments are made annually. Calculate the yield to maturity of the bond (in euros) if the price of the bond is 106 euros. a. 5.00% B. 3.80% c. 3.66% d. None of the above The annual interest payment = (100) x (0.05) = 5 euros Using a financial Calculator: PMT = 5; FV = 100; & N = 5; & PV = -106 Compute: I = 3.66% 3. A 3-year bond with 10% coupon rate and $1000 face value yields 8% APR. Assuming annual coupon payment, calculate the price of the bond. a. $857.96 b. $951.96 c. $1000.00 D. $1051.54 PV = (100/1.08) + (100/(1.08^2)) + (1100/(1.08^3)) = $1051.54 4. A 5-year treasury bond with a coupon rate of 8% has a face value of $1000. What is the semi-annual interest payment? a. $80 B. $40 c. $100 d. None of the above Annual interest payment = 1000(0.08) = $80; Semi-annual payment = 80/2 = $40 5. A three-year bond has 8.0% coupon rate and face value of $1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes semi-annual coupon interest payments. a. $857.96 B. $949.24 c. $1057.54 d. $1000.00 PV = (40/1.05) + (40/(1.05^2)) +. . . + (1040/(1.05^6)) = $949.24 6. A four-year bond has an 8% coupon rate and a face value of $1000. If the current price of the bond is $878.31, calculate the yield to maturity of the bond (assuming annual interest payments). a. 8% b. 10% C. 12% d. 6% Use trial and error method. (80/1.12) + (80/(1.12^2)) + (80/(1.12^3)) + (1080/(1.12^4)) = $870.51. Therefore, yield to maturity is 12%. Or use a financial calculator: PV = -878.31; N = 4; PMT = 80; FV = 1000; COMPUTE: I = 12% 7. A 5-year bond with 10% coupon rate and $1000 face value is selling for $1123. Calculate the yield to maturity on the bond assuming annual interest payments. a. 10.0% b. 8.9% C. 7.0% d. None of the above Use a financial calculator: PV = -1123; FV = 1000; PMT = 100 and N = 5 and compute I = 7.0% 8. Moerdyk Corporation's bonds have a 10-year maturity, a 6.25% semiannual coupon, and a par value of $1,000. The going interest rate (rd) is 4.75%, based on semiannual compounding. What is the bond’s price? A. 1,063.09 B. 1,090.35 C. 1,118.31 D. 1,146.27 E. 1,174.93 Bond valuation: semiannual coupons Par value $1,000 Coupon rate 6.25% Periods/year 2 Yrs to maturity 10 N = periods 20 Annual rate 4.75% Periodic rate 2.38% PMT/period $31.25 FV $1,000 PV $1,118.31 Answer: c MEDIUM 9. Consider some bonds with one annual coupon payment of 7.25%. The bonds have a par value of $1,000, a current price of $1,125, and they will mature in 13 years. What is the yield to maturity on these bonds? a. 5.56% b. 5.85% c. 6.14% d. 6.45% e. 6.77% Yield to maturity: Coupon rate N Answer: b 7.25% 13 PV = Price $1,125 PMT $72.50 FV = Par $1,000 I/YR 5.85% = YTM 10. McCue Inc.'s bonds currently sell for $1,250. They pay a $120 annual coupon, have a 15-year maturity, and a $1,000 par value, but they can be called in 5 years at $1,050. Assume that no costs other than the call premium would be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with rates expected to remain at current levels on into the future. What is the difference between this bond's YTM and its YTC? (Subtract the YTC from the YTM.) a. 2.11% b. 2.32% c. 2.55% d. 2.80% e. 3.09% Yields to maturity and call Answer: a If held to maturity: N = Maturity If called in 5 years: 15 PV $1,250 PMT $120 N = Call PV PMT 5 $1,250 $120 FV = Par $1,000 FV=Call Price $1,050 I/YR = YTM 8.91% I/YR = YTC 6.81% Difference: 2.11% 11. Wachowicz Corporation issued 15-year, noncallable, 7.5% annual coupon bonds at their par value of $1,000 one year ago. Today, the market interest rate on these bonds is 5.5%. What is the current price of the bonds, given that they now have 14 years to maturity? a. $1,077.01 b. $1,104.62 c. $1,132.95 d. $1,162.00 e. $1,191.79 Bond valuation: annual coupons Par value Coupon rate Answer: e $1,000 7.5% N 14 I/YR 5.5% PMT $75 FV $1,000 PV $1,191.79 12. Taussig Corp.'s bonds currently sell for $1,150. They have a 6.75% annual coupon rate and a 15-year maturity, but they can be called in 6 years at $1,067.50. Assume that no costs other than the call premium would be incurred to call and refund the bonds, and also assume that the yield curve is horizontal, with rates expected to remain at current levels on into the future. Under these conditions, what rate of return should an investor expect to earn if he or she purchases these bonds, the YTC or the YTM? A. 3.92% B. 4.12% C. 4.34% D. 4.57% E. 4.81% Yields to maturity and call If the coupon rate exceeds the YTM, then it is likely that the bonds will be called and replaced with new, lower coupon bonds. In that case, the YTC will be earned. Otherwise, one should expect to earn the YTM. Answer: e If held to maturity If called Par value $1,000 Par value $1,000 Coupon 6.75% Coupon 6.75% N PV 15 $1,150.00 PMT FV N PV $67.50 PMT $1,000.00 I/YR Expected rate of return: 5.28% YTC FV YTM 4.81% YTC I/YR 6 $1,150.00 $67.50 $1,067.50 4.81%