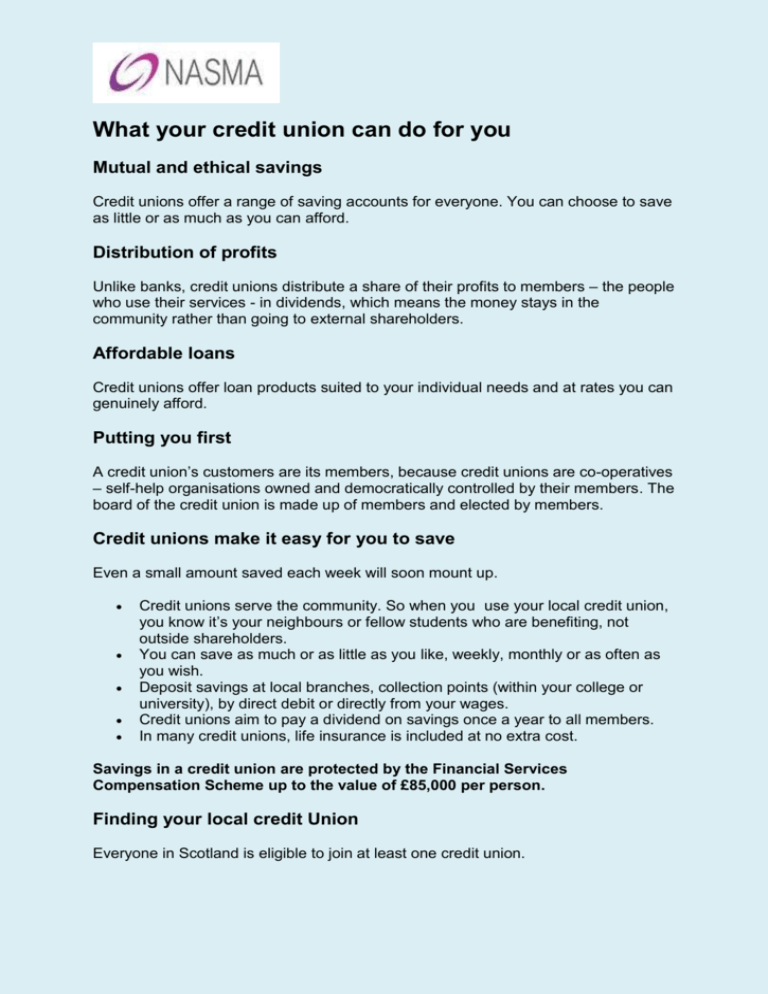

What your credit union can do for you

advertisement

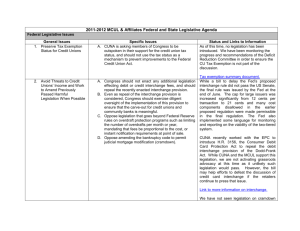

What your credit union can do for you Mutual and ethical savings Credit unions offer a range of saving accounts for everyone. You can choose to save as little or as much as you can afford. Distribution of profits Unlike banks, credit unions distribute a share of their profits to members – the people who use their services - in dividends, which means the money stays in the community rather than going to external shareholders. Affordable loans Credit unions offer loan products suited to your individual needs and at rates you can genuinely afford. Putting you first A credit union’s customers are its members, because credit unions are co-operatives – self-help organisations owned and democratically controlled by their members. The board of the credit union is made up of members and elected by members. Credit unions make it easy for you to save Even a small amount saved each week will soon mount up. Credit unions serve the community. So when you use your local credit union, you know it’s your neighbours or fellow students who are benefiting, not outside shareholders. You can save as much or as little as you like, weekly, monthly or as often as you wish. Deposit savings at local branches, collection points (within your college or university), by direct debit or directly from your wages. Credit unions aim to pay a dividend on savings once a year to all members. In many credit unions, life insurance is included at no extra cost. Savings in a credit union are protected by the Financial Services Compensation Scheme up to the value of £85,000 per person. Finding your local credit Union Everyone in Scotland is eligible to join at least one credit union. To find your local credit union visit http://www.ScotlandsFinancialHealthService.gov.uk Key Features of a Credit Union Meeting the common bond criteria To be a member, you must meet the common bond criteria set by the credit union. This might simply be that you live, work or study in a certain area, or might be based on the college or university you attend or employer you work for. Credit union services Although different credit unions offer a different range of services, all credit unions offer: Savings accounts – members are encouraged to build up savings. Affordable loans – taking into account the member’s personal circumstances, payment history and ability to repay the loan. Many credit unions offer insurance products, and some offer a wider range of products including prepaid debit cards, budgeting accounts, foreign exchange, current accounts and even mortgages.