Ch. 11 HW solutions

advertisement

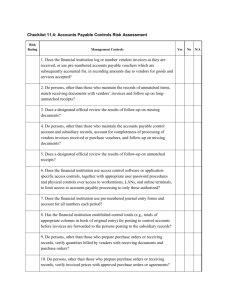

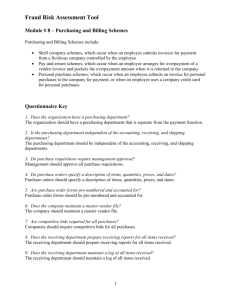

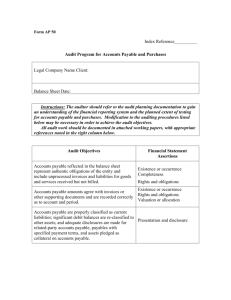

Chapter 11 - Auditing the Purchasing Process 11-25 a. The flowchart for Kida Company is shown on the following page: 11-1 Chapter 11 - Auditing the Purchasing Process 11-8 Chapter 11 - Auditing the Purchasing Process b. Kida Company's major internal control weaknesses are: Purchasing: The buyer does not verify that the department head's request is within budget limitations. No procedures have been established to ensure that the best price is obtained. Large-dollar requisitions should be ordered after receiving quotes and/or sealed bids. Prior to placing an order, the buyer does not determine the adequacy of the vendor's past record as a supplier to Kida. Receiving: Receiving clerk does not make blind counts for all special equipment or at least for large-dollar items. Written notice of equipment received is not sent to the purchasing department. Written notice of equipment received is not sent to accounts payable department. Accounts Payable: The mathematical accuracy of the invoice is not recomputed. Invoice quantity is not compared with a report of quantity received. Notification of the acceptability of the equipment from the requisitioning department is not obtained before the payable is recorded. No alphabetic file of vendors from which purchases are made is maintained. Treasurer: Documentation supporting the checks is not sent by the accounts payable Department to the cashier in order for the cashier or treasurer to be assured that the check is for properly authorized and received equipment. Checks for large-dollar purchases are not signed by two officers of Kida Company to ensure that material expenditures are proper. All documentation to support a check is not canceled by the check signer and returned to the accounts payable department. The cashier alone has custody of the key, the signature plate, and record of usage. The controller is authorized to sign checks. 11-26 The substantive audit procedures Coltrane should apply to Jang's trade accounts payable balances include the following: Foot the schedule of the trade accounts payable. Agree the total of the schedule to the general ledger trial balance. Compare a sample of individual account balances from the schedule with the accounts payable subsidiary ledger. Compare a sample of individual account balances from the accounts payable subsidiary ledger with the schedule. Investigate and discuss with management any old or disputed payables. 11-8 Chapter 11 - Auditing the Purchasing Process Investigate debit balances and, if significant, consider requesting positive confirmations and propose reclassification of the amounts. Review the minutes of the board of directors' meetings and any written agreements and inquire of key employees as to whether any assets are pledged to collateralize payables. Perform cutoff tests. Perform analytical procedures. Confirm or verify recorded accounts payable balances by: Reviewing the voucher register or subsidiary accounts payable ledger and consider confirming payables for a sample of vendors. Requesting a sample of vendors to provide statements of account balances as of the date selected. Investigating and reconciling differences discovered during the confirmation procedures. Testing a sample of unconfirmed balances by examining the related vouchers, invoices, purchase orders, and receiving reports. Perform a search for unrecorded liabilities by: Examining files of receiving reports unmatched with vendors' invoices and searching for items received before the balance sheet date but not yet billed or on the schedule. Inspecting files of unprocessed invoices, purchase orders, and vendors' statements. Reviewing support for the cash disbursements journal, the voucher register, or canceled checks for disbursements after the balance sheet date to identify transactions that should have been recorded at the balance sheet date but were not. Inquiring of key employees about additional sources of unprocessed invoices or other trade payables. 11-27 a. b. c. d. e. 5 3 4 6 1 11-8