NEWSFLASH 24th August 2015 PLEASE NOTE: The newsflash is

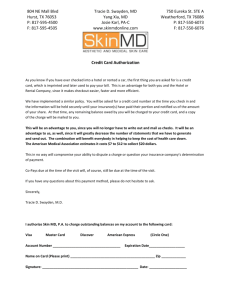

advertisement

NEWSFLASH 24th August 2015 PLEASE NOTE: The newsflash is taking a holiday, there will be no newsflash 1st & 8th September but a bumper edition 14th September. Hibernia REIT has formed a 50:50 joint venture, the Windmill Lane Partnership (WLP), with an affiliate of Starwood Capital Group Global, to own and develop the Windmill Lane site in Dublin’s South Docks. The Windmill Lane Site is a one-acre development site with planning permission for over 120,000 sq ft of offices, around 7,000 sq ft of retail, 15 residential units, and forms one part of the quadrant of adjoining or adjacent assets Hibernia has assembled in the South Docks. Hibernia is targeting completion of the development of the site by the end of 2017. The Confederation of British Industry upgrades UK growth forecasts, even as Chinese growth slows. The CBI expects the UK economy to grow by 2.6pc this year and 2.8pc in 2016, up from its June estimates of 2.4pc and 2.5pc. Robust investment and strong consumer spending will boost growth this year as Britain's "twin engines" fire up to support the recovery, according to the UK's largest business group. The Confederation of British Industry (CBI) revised up its forecasts for UK growth over the next two years as it said rising business investment would help to lift living standards through stronger productivity. The CBI expects the UK economy to grow by 2.6pc this year and 2.8pc in 2016, up from its June estimates of 2.4pc and 2.5pc. While this is slower than the 3pc growth seen in 2014, the CBI said a strong domestic expansion would outweigh slower export growth triggered by a slowdown in China and the stronger pound. The CBI believes average earnings will grow by 2.5pc this year and 2.8pc in 2016, higher than predicted in June. Concerns about slower Chinese growth and its impact on the global economy sent stock markets plunging after the country's central bank devalued the renminbi for the first time in modern history. The CBI revised down its forecasts for UK export growth over the next two years and now believes China will grow by 6.3pc this year, down from a forecast of 6.9pc in June. It also cut its forecasts for global growth over the next two years. Many economists believe the recent turbulence is likely to delay interest rate rises in the UK and US. Earlier this month, markets were pricing in June rate rise in the UK, but now believe rates won't rise until August. The CBI believes interest rates will rise in the first quarter of 2016, three months earlier than it predicted in June. Birmingham City Council has given the green light to a new mixed-use building set to become one of the city’s tallest towers. The 26-storey building is being delivered by Sterling Property Ventures and Rockspring Property Investment Managers. Designed by Doone Silver Architects, 103 Colmore Row will by 102 m tall and the highest building in Birmingham’s central business district, according to the project team. It will include 200,000 sq ft of office space, 15,000 sq ft leisure space and will be able to accommodate 2,000 workers. Demolition of the exisiting 22-storey concrete-clad tower will begin in early August and the project is due to complete by spring 2018. Plans for a major mixed-use development in Newcastle which includes partially demolishing a once popular night club and building three blocks of student accommodation comprising 329 beds look set to be approved. The site is the former Liquid/Envy nightclub building which is fronted onto New Bridge Street by the grade II-listed Dobson House and sits between Oxford Street to the east and Back Higham Place to the west. Magnetic Ltd's proposals include the demolition of the nightclub premises at the rear and replacing it with a mixed-use development consisting of a podium building providing a single retail unit, cycle parking, refuse storage facilities, laundry room, movie room and student hub. Behind this would be the main element of the development; three linked student residential blocks of eight, 11 and 13 storeys comprising 36 shared cluster apartments and 120 studios, made up of 329 bed spaces overall. The application also covers the change of use of the listed property from nightclub use to a new bar/restaurant. SOLIHULL £16.9M Land At, Jetstream Road Birmingham Airport. Planning authority: Solihull Job: Detail Plans Granted for hotel Client: Mr. Robert Hancocks Developer: Base Architecture & Design, Nexus, Roushill, Shrewsbury, Shropshire, SY1 1PT Tel: 01743 236400/ Plans to build a new 223-bedroom Radisson Blu hotel within the boundary at Birmingham International Airport have been recommended for approval by local planners. The hotel would include conference and restaurant facilities. If final approval is granted, the Birmingham Airport scheme will be the 28th Radisson Blu hotel in the UK and will join the 39-storey, 211 bedroom Radisson Blu Hotel in the centre of Birmingham. THETFORD £6M Elveden Forest Holiday Village, Brandon Road Elveden Planning authority: St. Edmundsbury Job: Detail Plans Granted for 13 lodges/2 hotels & 2 energy centre/workshop units Client: BCFA NEWSFLASH Page 1 Center Parcs Ltd Developer: CPMG Architects, 23 Warser Gate, Nottingham, NG1 1NU Tel: 0115 958 9500 HARROGATE £4.245m Rudding Park Hotel, Rudding Park Follifoot Planning authority: Harrogate Job: Detail Plans Granted for spa complex Client: Rudding Park Ltd Agent: Enjoy Design Ltd, Blayds House, 21 Blayds Yard, Leeds, West Yorkshire, LS1 4AD COLNE £2M Glen Mil, North Valley Road Planning authority: Pendle Job: Detail Plans Granted for supermarket & employment units/pub Client: Marstons Inns & Taverns Developer: HTC Architects, York Place Studio, 8 Britannia Street, Leeds, West Yorkshire, LS1 2DZ Tel: 0113 244 3457 NORTHWICH £1.1m Abbey Wood, Abbey Lane Delamere Planning authority: Cheshire West Job: Detail Plans Granted for hotel (conversion/extension) Client: Mr. H Rowlinson Developer: Willacy Horsewood Partnership, Mollington Grange, 13a Parkgate Road, Mollington, Chester, Cheshire, CH1 6NP Tel: 01244 853891 OLDHAM £2.3m Whitegate Inn, Broadway Chadderton Planning authority: Oldham Job: Detail Plans Granted for hotel (extension/alterations) Client: Premier Inn Developer:Allison Pike Partnership, 7 Buxton Road West,Disley, Stockport, SK12 2AE Tel: 01663 763000 A £7m extension has been approved for to the Rusacks Hotel, overlooking the 18th green of The Old Course at St Andrews. The extension will provide an additional 44 suites as well as a rooftop restaurant, bar and terrace. It has been designed by WCP Architects and will be built using traditional materials in keeping with its location in the historic town of St Andrews. A multimillion-pound plan to convert Wigan’s Grade II-listed Haigh Hall into a luxury hotel and spa has been given the go-ahead. A £6million restoration plan will see Haigh Hall restored to its former glory and transformed into a four-star boutique hotel complete with 30 en-suite bedrooms, a spa and a fitness centre. Alton Towers in Staffordshire is planning a substantial extension to its Alton Towers Hotel which would include 74 new bedrooms and a restaurant. The hotel would be located at the rear of the existing Alton Towers Hotel gardens, behind the Alton Towers Spa. Bedrooms would be located on the ground, first and second floors and would be themed ‘colonial-styled’ family rooms. The restaurant would accommodate up to 200 guests. The hotel would also include an entertainment space similar to that in the Alton Towers Hotel and Splash Landings Hotel on site. If planning permission is granted, Merlin Entertainments, owners of the theme park, anticipate construction on the new extension commencing in the first quarter of 2016 with a potential opening date of mid-late 2017. Asian fusion restaurant group Inamo is thought to be in line to acquire the site of Cafe des Amis in London's Covent Garden. Cafe des Amis, which has been popular with theatregoers since it opened around 30 years ago, is currently closed and is thought to be on the market. It would be the third restaurant for Inamo if a deal were to go ahead. Its original restaurant is on Wardour Street in Soho, and its second, Inamo St James, is on Lower Regent Street. Casual dining group Bill’s Restaurants has announced the opening of five new sites, plus two more to come in the next month. From June to August 2015, the 71-strong group has opened in Sheffield, Gloucester Quays, Colchester, Taunton and Muswell Hill, in a variety of locations aimed at shoppers and families, including in former industrial buildings, a Georgian period property and busy high-street venues. Most also have seats outdoors. Witney is set to open on 7 September, while the Leeds branch in Albion Place is expected for 21 September. Originally founded by a fruit and veg salesman from Lewes, Sussex, Bill’s is now directed by former Caprice Holdings managing director Andy Bassadone. In December 2014, the group was ranked the fastest-growing hospitality operator by The Sunday Times Fast Track 100 list, after its turnover grew an average of 108% for each of the previous three years. In its latest figures it revealed turnover of £53.9m, and then said it planned to add 25 more locations to its then-51 sites. PS there is also one under construction in High Wycombe. Argentine restaurant brand Cau is to open another four restaurants before the end of the year, taking its portfolio to 17 sites. The company, which is owned by the same shareholders that own Gaucho and was launched by Gaucho founders Zeev and Patsy Godik, currently has 12 UK sites and a thirteenth in Holland. It is due to open its next site in Didsbury Village in Greater Manchester towards the end of next month, with further sites due to launch in Bath in October, and at 110 Queen Street in Glasgow later that month. A fourth, unidentified site in the North West is also thought to be close to being signed, although no details are yet available. The business, which is run by director Graham Hall, is predicted to generate turnover of £12m this calendar year. Hall has previous stated that he expects Cau to become a 30- to 40-site business. AccorHotels is to open its fourth hotel in Reading, having completed a franchise agreement for the ibis Styles Reading Oxford Road hotel. After a renovation programme, the 97-bedroom hotel will open by the end of the year. It will be managed by BCFA NEWSFLASH Page 2 Interstate Hotels & Resorts under a franchise agreement with Habro properties. At present AccorHotels operates nine ibis Styles in the UK. New London theatre set for Tower Bridge Nicholas Hytner and Nick Starr, the former artistic director and chief executive of the National Theatre, are planning to open a 900-seat theatre venue at Tower Bridge in 2017. The duo have created the London Theatre Company and said that the new venue will be 'London's first theatre of scale in 40 years and the only commercial theatre not in the historic West End'. Revolution Bar Group is to create 100 jobs at a new £1.5m bar due to open in Leeds in October, and aims to open up to five sites a year. The Revolucion de Cuba branded new outlet, situated on the corner of Lower Briggate and Call Lane, will have three bars across three floors. The group operates five other Revolucion de Cuba bars based in Manchester, Derby, Sheffield, Norwich and Cardiff. The Leeds site will be the firm's second biggest after Manchester. Revolution is planning to open the next new outlets in Milton Keynes and Nottingham. German budget chain, Motel One’s has revealed its half-year financial results, which shows that sales grew 29% year-on-year to €147m. The group's total room capacity reached 13,500 and EBITDA rose 22% year-on-year to €43m, up €7m by comparison. The company, which operates 50 hotels across the UK and Europe, opened five new properties during the first-half, adding 1,446 rooms to its inventory. Motel One has two UK hotels in Edinburgh and the newly-opened site in Manchester. The British estate wll grow firther when Motel One London-Tower Hill opens in December. The pipeline for Motel One remains strong with 19 hotels (6,105 rooms) planned. Annual report shows coffee shops come out on top Limited-service brands among the Top 100 restaurant chains saw a sales revenue increase of 5.9%, according to annual data just released by Technomic. The menu categories with the largest percentage growth were coffee shops at 11.6%, sandwich (9.1%), and Italian/pizza (7.8%).The chain with the largest sales increase was at coffee shop firm, Costa (up £161m), followed by pub restaurant group, JD Wetherspoon (£109m), and Domino’s (£84m). Similarly, the brands that grew the most in units were Costa (176 units), Subway (155 units), and Domino’s (40 units). Technomic’s research sheds light onto actionable insights to help operators and suppliers:• Ethnic flavours make an impression: operators who keep menus fresh with the addition of global flavours can attract and retain customers.• Menus trend toward simpler, streamlined formats: menus have shrunk 2.6% in a year-over-year comparison. Smaller menus can illustrate quality over quantity.• Fresh and local ingredients are vital: customers appreciate the effort and feel a connection to operators who keep things fresh and sourced in the UK when possible.• Sales surge at burger concepts: the versatility of burgers is driving the growth, from simpler, premium options to over-the-top indulgence. Investec Structured Property Finance has agreed one of its biggest joint-venture deals to date, buying a vacant office behind the BBC’s central London newsroom with Kier Property for £55m. The South African bank and Kier have acquired 31-36 Foley Street from British Airways Pension Trustees and joint venture partner Dukelease. Investec is also providing a £55m debt facility on a 70% loan-to-cost basis to help fund the acquisition and finance a major refurbishment of the building. Built in the 1920s as a printing factory, the empty 34,000 sq ft office was recently occupied by the BBC as the headquarters for its commercial division. The building has consent for a residential conversion but given the high demand for office space in the West End and the lack of supply, the jointventure partners are set to refurbish it as a high-quality office. The Office Group is under offer to take three floors in London & Regional’s 10 Bloomsbury Way. The serviced office group is understood to be eyeing the first, second and third floors, which total 54,229 sq ft, in the 153,800 sq ft building in London’s Midtown. The Office Group has previously also taken space in developments such as the Shard and White Collar Factory. The flexible office provider will join digital marketing company Criteo, pharmaceutical company BioMarin, healthcare communications agency Chandler Chicco and software firm PubMatic in the nine-storey building. WeWork has signed a deal to take 48,000 sq ft of space near Old Street. The co-working office operator will take two floors at the Space Shoreditch building, on Corsham Street. The firm will take the ground and first-floor accommodation at the Scape Livingowned scheme at a rent in the region of £50/sq ft. The remainder of the 11-storey building comprises 540 student accommodation units, which will be completed in September. WeWork is likely to take occupation of the space in early 2016. The firm has now taken its central London footprint to around 400,000 sq ft and it has plans to grow to 1.5m sq ft by the end of 2016. This would make the firm one of the largest occupiers in London. Its biggest deal to date has been the 167,913 sq ft letting at Brookfield’s Moor Place and last month signed to take 70,000 sq ft at Fox Court in Midtown. UK regional office markets have seen a surge in occupier demand of 51% in the second quarter of the year compared to the first three months, according to Knight Frank. A combined take up of 2.08m sq ft was recorded in Q2 which is 49% above the five year quarterly average. Birmingham was the clear stand-out performer in the quarter, with take-up of 521,136 sq ft. This was boosted by a number of large transactions, the most significant being the 212,000 sq ft pre-let to HSBC at Arena Central. Pre-letting activity has also increased in Q2 impacting on new and grade A availability, which is down by 17% year-on-year collectively to 2.2m sq ft. BCFA NEWSFLASH Page 3 Luxury online fashion retailer Farfetch is expanding its offices at Crosstree Real Estate Partners and Helical Bar’s The Bower on Old Street roundabout. Farfetch is taking the sixth floor, which totals 12,260 sq ft, in the 122,000 sq ft Warehouse building. It already occupies the fourth and fifth floors in the nine-storey building, and is believed to be paying less than £55/sq ft. Farfetch, which was founded in 2008 and showcases more than 1,000 labels, originally took space in the building at the end of 2014. Travel Counsellors has taken 28,500 sq ft at Peel Land & Property’s Venus building in Manchester’s Trafford Quays for its new head office. The business will move from its current Bolton base before the end of the year, and £2m will be spent refurbishing the new space. Rents at Venus range from £21-50 /sq ft. Travel Counsellors facilitates independent travel agents to run their own home-based travel businesses. The office will include new training facilities for its agents, of which there are 1,400 globally. EGHAM £3.95M Meadlake Place, Thorpe Lea Road Planning authority: Runnymede Job: Detail Plans Granted for office building Client: Rockspring UK Value Centurion (Jersey) Ltd Developer: Tate Hindle Design Limited, 1 Lindsey Street, Smithfield, London, EC1A 9HP Tel: 020 7332 4850 EGHAM £25M Tamesis, 1 The Glanty Planning authority: Runnymede Job: Detail Plans Granted for office building Client: Royal London Asset Management Agent: Scott Brownrigg Ltd, 77 Endell Street, London, WC2H 9DZ Contractor: BAM Construction UK Ltd, Building 4 Centrium Business Park, Griffiths Way, St. Albans, Hertfordshire, AL1 2RD Tel: 01727 89420 LINCOLN £15M University of Lincoln, 514 Isaac Newton, Campus Way Planning authority: Lincoln Job: Reserved Matters Granted for university Client: University of Lincoln Developer: Maber Associates, St Marys Hall, 17 Barker Gate, TheLace Market, Nottingham, NG1 1JU Tel: 0115 941 5555 NEWCASTLE-UNDER-LYME £5.5m The Huxley Building Keele Univ, Three Mile Lane Keele Planning authority: Newcastle-Under-Lyme Job: Detail Plans Granted for university (extension/alterations) Client: Keele University Agent: Halliday Meecham Architects Ltd, Rodwell Tower, 111 Piccadilly, Manchester, M1 2HY HOUNSLOW £11M Wellington Primary School, Sutton Lane Planning authority: Hounslow Job: Detail Plans Granted for school buildings (extension/alterations) Client: London Borough of Hounslow Developer: Pick Everard, 322 High Holborn, London, WC1V 7PB Tel: 0345 045 0050 ASHFORD £18M K College, Elwick Road Planning authority: Ashford Job: Detail Plans Granted for college Client: K College Agent: HNW Architects, 61 North Street, Chichester, West Sussex, PO19 1NB Contractor: BAM Construction UK Ltd, Building 4 Centrium Business Park, Griffiths Way, St. Albans, Hertfordshire, AL1 2RD Tel:01727 894200 CANTERBURY £22.5m Former Peugeot Site, Rhodaus Town Planning authority: Canterbury Job: Detail Plans Granted for student accommodation Client: Canbury Holdings Ltd Agent: Guy Hollaway Architects LLP, Tramway Stables,Rampart Road, Hythe, Kent, CT21 5BG Contractor: Cardy Construction Limited, Maynard Road, Wincheap Industrial Estate,Canterbury, Kent, CT1 3RH Tel: 01227 763444 SALISBURY £4.6m Tollgate Road Planning authority: Wiltshire Job: Detail Plans Granted for college Client: Salisbury Sixth Form Developer: Blue Sky Engineering, Building 1000, Kings Reach, Yew Street, Stockport, SK4 2HG Tel: 0161 475 0220 A £20m bid has won Willmott Dixon the job to build a landmark building for Kingston University in Surrey.The project will see the firm demolish an existing building to make way for the 120,000 sq ft complex. Designed by Grafton Architects the education complex will boast open colonnades along two of the building’s elevations and rise to various heights ranging up to six storeys. The building, which gained full planning earlier this month, will consist of a library with a permanent home for the collections and special archive, flexible project space, specialist learning spaces for dance and a 300 seat auditorium. BCFA NEWSFLASH Page 4 Construction is set to start next month on a new £18.4m student accommodation scheme in Nottingham. Empiric Student Property has acquired the city centre site – known as The Frontage – which will become a 162 bed scheme. Empiric will acquire the freehold to the 1980s office conversion, behind a Grade II listed façade. The scheme will also contain three commercial units at the ground floor level let to restaurant tenants. Frontier Estates will supervise construction of the property on behalf of Empiric and are expected to be on-site next month. The student element of the property is expected to be delivered for September 2016, in time for the 2016/17 academic year. Birmingham City University has submitted a detailed planning application for a £41m building designed to house a new School of Life Sciences and a relocated School of Education. The 10,500m² building at its City South campus in Edgbaston would enable the university to offer a wider range of courses and take on more students. Sheppard Robson is architect for the new build, with White Young Green as structural and civil engineer. Couch Perry Wilkes is the mechanical and services engineer and Sweet Group will be cost consultant on the project. Spire Healthcare says Government plans to tackle the multi-billion pound black hole in the NHS budget will dampen its full-year earnings. The private healthcare provider, which runs 39 hospitals across the UK, generates roughly one-third of its revenue from work carried out on behalf of the NHS. But measures announced by the struggling state health care system in August to reduce costs means that growth in Spire’s NHS business will flatline in the second-half, affecting the group’s full-year performance. Already, Spire says the flow of cases from the NHS to the private sector has started to fall. Accordingly, management now expects revenues and earnings to grow by 4pc to 6pc for the full-year, down from earlier estimates of "mid to high single digit" growth. Many people choose to self-pay, rather than wait for NHS treatment. Meanwhile, Spire enjoyed a reasonably healthy first-half, despite being paid less by the NHS for the work it carries out and problems finding qualified nursing staff in the UK. Sales grew 6pc in the six months to June 30 to £449.8m, driven by growth across all three patient groups: private medical insurance (PMI), self-pay and NHS. Spire continued to expand in the period. It is building new hospitals in Manchester and Nottingham, as well as a specialist care centre in Essex and a new theatre at its Elland hospital. NORWICH £2.5m Lionwood Junior School, Yare Valley Medical Centre, Wellesley Avenue North Planning authority: Norwich Job: Detail Plans Granted for medical centre/pharmacy Client: Iceni Developments Ltd Developer: Chaplin Farrant Ltd, 51 Yarmouth Road, Thorpe, Norwich, Norfolk, NR7 0ET Tel: 01603 700000 A whopping one-off accounting gain related to Norwegian Cruise Line Holdings plus hefty proceeds from the sale of NCLH shares helped lift Genting Hong Kong to a record first half profit of US$2.16bn. That was up from $216.7m in the first six months of 2014. A one-off accounting gain of $1.57bn was related to reclassifying NCLH from an 'associate' of the group to an 'available for sale' investment in May, when Genting reduced its stake to 17.7% from 22%. (A further share sale in August put Genting's current stake in NCLH at 13.3%.) Gains of $212.5m and $387.1m from large NCLH share sales in March and May generated a total of $863.9m net sale proceeds. Earnings before interest, taxation, depreciation and amortization were up 46.5%, to $29.6m from $20.2m. Revenue from cruise and cruise-related activities increased 2.5% to $265.1m. Net revenue rose 6.4% to $218m on more capacity days— 1.37m, up from 1.29m—mainly due to the acquisition of Crystal Cruises, completed on May 15. Occupancy edged up to 69.4% from 68.7%. Stable net yield was attributed to higher ticket revenue resulting from the Crystal acquisition offset by lower on-board revenue due to lower gaming revenue. China State Shipbuilding Corporation (CSSC) has entered into an agreement with sovereign wealth fund China Investment Corporation (CIC) to cooperate on developing the country’s cruise sector. The comprehensive strategic cooperation framework will see the two sides establish a joint venture cruise company, dedicated to support China’s local yards building cruise vessels and to grow the cruise ship supplier sector. Dong Qiang, chairman of CSSC, was reported saying that China aims to eventually be able to build world class cruise ships, and CSSC aims to the main driving force behind that goal. Ding Xuedong, chairman and ceo of CIC, has expressed confidence that the partnership will push China’s cruise shipbuilding industry to the forefront, tapping on CSSC’s industrial experience as the country's largest ship construction group and CIC’s strong financial resources. Last October, Carnival Corp. & plc signed a memorandum of understanding with CSSC to explore a possible joint venture aimed at accelerating the development and growth of cruising in China. A month later, Fincantieri signed memoranda of understanding with Carnival Corp. and China's largest shipbuilding group to explore the possibility of joint ventures in constructing cruise ships for the Chinese market. BCFA NEWSFLASH Page 5