ST384 MS May 14

advertisement

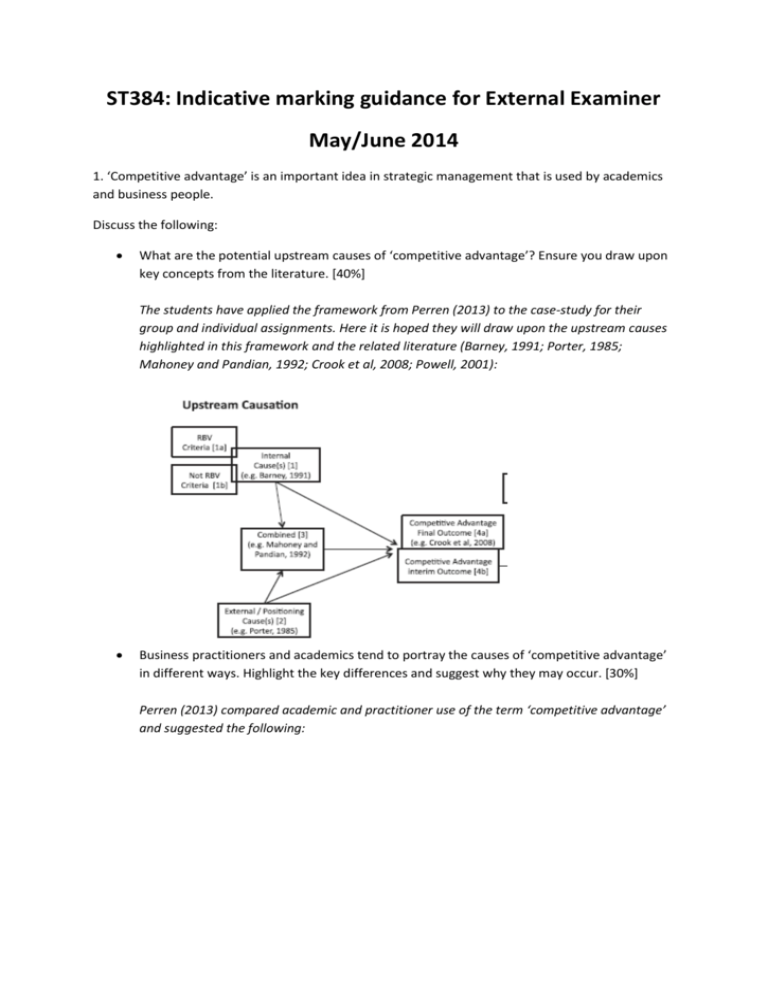

ST384: Indicative marking guidance for External Examiner May/June 2014 1. ‘Competitive advantage’ is an important idea in strategic management that is used by academics and business people. Discuss the following: What are the potential upstream causes of ‘competitive advantage’? Ensure you draw upon key concepts from the literature. [40%] The students have applied the framework from Perren (2013) to the case-study for their group and individual assignments. Here it is hoped they will draw upon the upstream causes highlighted in this framework and the related literature (Barney, 1991; Porter, 1985; Mahoney and Pandian, 1992; Crook et al, 2008; Powell, 2001): Business practitioners and academics tend to portray the causes of ‘competitive advantage’ in different ways. Highlight the key differences and suggest why they may occur. [30%] Perren (2013) compared academic and practitioner use of the term ‘competitive advantage’ and suggested the following: The key differences expected to be identified include: time orientation, causal commitment, justification, and causal complexity. Assuming ‘competitive advantage’ is an interim outcome, what potential ‘causal complications’ may influence performance? Ensure you provide some examples to illustrate your observations. [30%] Causal complications disrupt the relationship between competitive advantage and performance (Perren, 2013; Powell, 2001): Causal complications can for example be ‘appropriations’ by powerful stakeholders (e.g. landlord, skilled employees) (see Crook et al, 2010) of value before it generates performance or unexpected external events (e.g. severe weather and other ‘acts of God’) which may reduce or improve performance. 2. Herbert Simon puts forward the notions of ‘perfect rationality’ and ‘bounded rationality’. Contrast these two views of rationality. [30%] ‘Perfect rationality’ being that all environmental information is absorbed and processed for so there is optimal decision-making. ‘Bounded rationality’ being the notion that there is too much environmental information to be absorbed so frames, heuristics and search selectivity lead to ‘satisficing decisions’ (Simon, 1978). Assuming the idea of ‘bounded rationality’ is right, how might this help or hinder strategic thinking? [40%] The heuristics and frames of ‘bounded rationality’ may reduce information overload and allow strategic decisions to be made quickly. If the heuristics are right this can lead to strategic advantage. However, if the heuristics are wrong then this will lead to poor decisions. The selectivity of information can lead to a lack of ‘peripheral vision’ so that shifts in the environment are not noticed (Winter, 2004). How important is intuition to strategic thinking? Ensure you draw upon concepts from the literature. [30%] The students have read and discussed Hodgkinson et al (2009) in seminar so it is hoped they will call upon these ideas. They are summarised in this quote (Hodgkinson et al, 2009: 278279): “In our view, intuitive judgment is an indispensable component of strategic competence... In recent decades, the possibility that much of human thought... is nonconscious has become a centrally important precept of modern cognitive science... Reasoning is seen no longer as an exclusively conscious or deliberative process. Rather, consciousness, as well as being, figuratively speaking, the ‘‘workshop’’ of the mind, is also the ‘‘control panel’’ upon which signals from the ‘‘interior’’ appear to offer potential guidance for individual judgment and decision making.” 3. ‘Positioning’ is one of the key concepts in strategic management. What is strategic positioning? Give an example to illustrate your explanation. [40%] Mintzberg et al’s (2009, 13) defines positioning as ‘locating particular products [and/or services] in particular markets’. Building upon this general idea it is hoped students will provide an example, perhaps drawing upon Porter’s generic strategies. They may also call upon some of the assumptions identified by Mintzberg et al (2009 ) in chapter 4. What are the strengths and weaknesses of such an approach? [30%] It is expected that students will draw upon Mintzberg et al (2009) to identify strengths such as: potentially helpful in stable environments, awareness of competitive situation, can be appropriate where there are ‘high barriers to entry’, forces managers to make difficult decisions (see Porter, 1996) and focuses on the drivers of competitive advantage. Weaknesses from Mintzberg et al (2009) might include: action and thinking are separated, too much focus on competition and not enough on other strategic drivers, may not be helpful in turbulent environments, may discourages originality and perhaps more appropriate to large businesses. What sort of scanning activities are firms with a differentiated strategy likely to adopt? Justify your suggestions. [30%] Students read and discussed the paper by Jennings and Lumpkin (1992). It is hoped they will call upon this work to explain that differentiating firms will have scanning activities that emphasize identification of ‘opportunities and customer requirements’. This information helps them differentiate further from their competitors by tailoring products and services even more to their customers, whereas cost leaders are focused on checking for competitive threats. 4. “... organizations need to be aligned with their environment...” (Ben-Menahem et al, 2013: 217) Explain what is meant by a firm being aligned with its environment and why it is important. [30%] It is expected that students will draw upon Darwinian notions that to survive an organisation must be adapted to its environment (Mintzberg et al, 2009). Here they may call upon ideas from Hannan (2005), Hannan and Freeman (1984) and Mintzberg et al’s (2009) environmental school. How can a firm remain aligned with its environment? Ensure you draw upon key concepts from the literature. [40%] Here the students have a number of conceptual resources they have read and discussed. These include, for example: From Ben-Menahem et al (2013): “We argue that a firm’s absorptive capacity is a key mechanism underlying the alignment of internal and external rates of change. Accordingly, we conjecture that the higher a firm’s potential absorptive capacity (i.e., its ability to identify and assimilate external knowledge), the more likely it will be able to adjust the rate of strategic renewal actions to the environmental rate of change.” (page 225) From Winter (2004): “Like biological organisms, organisations have sensors to inform them of threats and opportunities. The process by which these sensors are developed is ‘selection, adaptation and learning’, or SAL. While SAL’s influence is helpful, it is not always on the side of the organisation. However there are systems that can help an organisation detect oncoming challenges. These include: leveraging the peripheral vision of the CEO; improving general purpose sensors; a better reading of specialised sensors; and installing new specialised or routine sensors in areas where none presently exists.” (page 163) From Ghosal and Nohria: “What drives fit [in MNCs] is the principle of requisite complexity – the complexity of a firm’s structure must match the complexity of its environment” (page 23) What happens if a firm become misaligned with its environment? Consider a number of possibilities. [30%] The students should consider a range of possibilities from the firm not surviving through to the firm going through a major transformation. Here they may call upon ideas from Mintzberg’s et al’s configuration school; the ideas of Miller and Friesen (1984) are particularly germane. They may also consider the strategic formation diagram in the final chapter of Mintzberg et al (2009:386): References Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99—120 Ben-Menahem, S.M., Kwee, Z., Volberda, H.W. and Van Den Bosch, F.A.J. (2013) Strategic renewal overtime: the enabling role of potential absorptive capacity in aligning internal and external rates of change, Long Range Planing, 46, 216-235 Crook, T. R., Ketchen, D. J., Combs, J. G., & Todd, S. Y. (2008). Strategic resources and performance: A meta-analysis. Strategic Management Journal, 29, 1141—1154 Durand, R., & Vaara, E. (2009). Causation, counterfactuals and competitive advantage. Strategic Management Journal, 30, 1245—1264 Ghoshal, S. and Nohria, N. (1993) Horses for Courses: Organizational Forms for Multinational Corporations Sloan Management Review, 34(2), 23-35 Hannan, M.T. (2005) ‘Ecologies of Organizations: Diversity and Identity’, Journal of Economic Perspectives, 19(1), 51-70 Hodgkinson, G.P., Sadler-Smith, E., Burke, L.A., Claxton, G. and Sparrow, P.R.(2009) Intuition in Organizations: Implications for Strategic Management, Long Range Planning, 42, 277-297 Maitlis, S. and Sonenshein, S. (2010) ‘Sensemaking in Crisis and Change: Inspiration and Insights form Weick (1998)’, Journal of Management Studies, 47(3), 551-580 Jennings, D.F. and Lumpkin, J.R. (1992) ‘Insights between environmental scanning activities and Porter’s Generic Strategies: an empirical analysis’, Journal of Management, 18(4), 791-803 Miller, D., and Friesen, P. H. (1984) Organizations: A Quantum View, Englewood Cliffs, NJ: Prentice Hall Mintzberg, H. (1987) ‘The Strategy Concept I: Five Ps For Strategy’, California Management Review, 30 (1), 11-24 Mintzberg, H., Ahlstrand, B. and Lampel, J. (2009) Strategy Safari: Your complete guide through the wilds of strategic management, Second Edition, Harlow: Pearson Mahoney, J. T. and Pandian, J. R. (1992). The resource-based view within the conversation of strategic management, Strategic Management Journal, 13, 363—380 Perren, L. (2013) ‘Strategic Discourses of 'Competitive Advantage': Comparing Social Representation of Causation in Academia and Practice’, Scandinavian Journal of Management, 29(3), 235-246 Porter, M. E. (1980) Competitive strategy: Techniques for analyzing industries and competitors. New York: Free Press Porter, M.E. (1996) What is Strategy? Harvard Business Review, March-April, 61-78 Powell, T. C. (2001). Competitive advantage: Logical and philosophical considerations. Strategic Management Journal, 22, 875—888 Simon, H. (1978) Rational Decision-making in business organizations, Nobel Memorial Lecture, 8 December, 1978 Winter, S.G. (2004) Specialised Perception, Selection, and Strategic Surprise: Learning from the Moths and Bees, Long Range Planning, 37 (2), 163-169