Econ 1312 Final Study Guide

advertisement

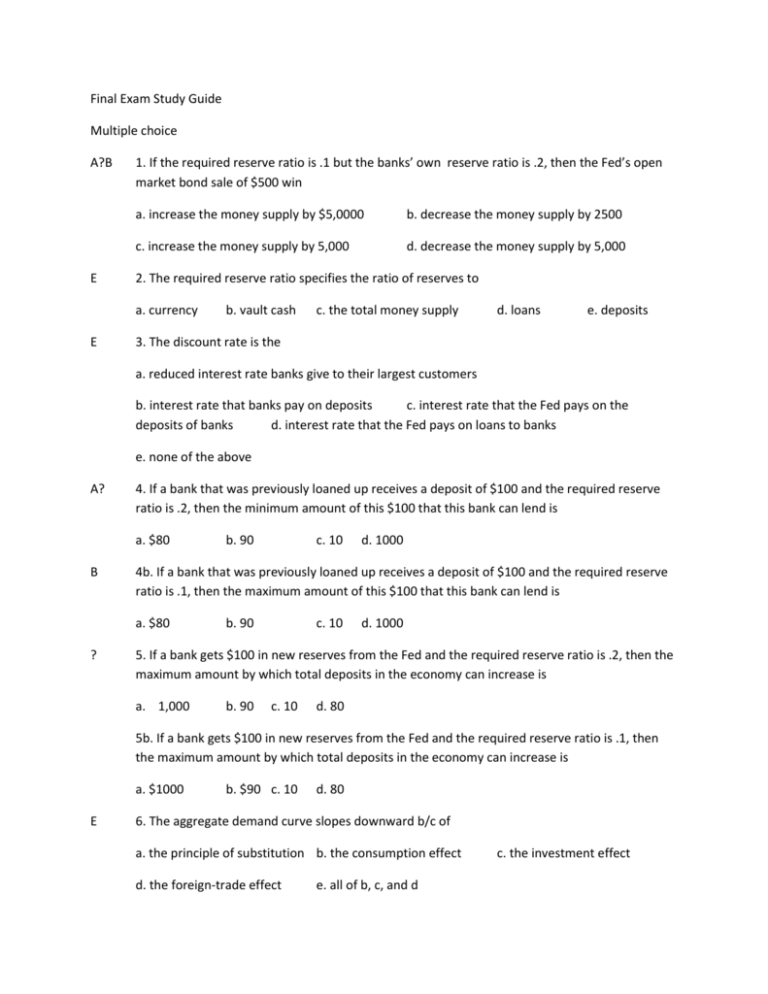

Final Exam Study Guide Multiple choice A?B E 1. If the required reserve ratio is .1 but the banks’ own reserve ratio is .2, then the Fed’s open market bond sale of $500 win a. increase the money supply by $5,0000 b. decrease the money supply by 2500 c. increase the money supply by 5,000 d. decrease the money supply by 5,000 2. The required reserve ratio specifies the ratio of reserves to a. currency E b. vault cash c. the total money supply d. loans e. deposits 3. The discount rate is the a. reduced interest rate banks give to their largest customers b. interest rate that banks pay on deposits c. interest rate that the Fed pays on the deposits of banks d. interest rate that the Fed pays on loans to banks e. none of the above A? 4. If a bank that was previously loaned up receives a deposit of $100 and the required reserve ratio is .2, then the minimum amount of this $100 that this bank can lend is a. $80 B c. 10 d. 1000 4b. If a bank that was previously loaned up receives a deposit of $100 and the required reserve ratio is .1, then the maximum amount of this $100 that this bank can lend is a. $80 ? b. 90 b. 90 c. 10 d. 1000 5. If a bank gets $100 in new reserves from the Fed and the required reserve ratio is .2, then the maximum amount by which total deposits in the economy can increase is a. 1,000 b. 90 c. 10 d. 80 5b. If a bank gets $100 in new reserves from the Fed and the required reserve ratio is .1, then the maximum amount by which total deposits in the economy can increase is a. $1000 E b. $90 c. 10 d. 80 6. The aggregate demand curve slopes downward b/c of a. the principle of substitution b. the consumption effect d. the foreign-trade effect e. all of b, c, and d c. the investment effect E 7. An increase of 3 percent in the inflation rate causes the natural level of output to a. increase by 3 percent c. decrease by 3% b. increase by an amt. that can’t be determined from given data d. decrease by an amt. that can’t be determined from data given e. not change A 8. If government spending rises by 200, mpc = .8, and the price level rises, then real GDP will a. rise by 1,000 b. rise by more than 1,000 C A C B c. rise by less than 1,000 d. rise by 1,500 9. If the aggregate supply curve between P and Y is vertical, than a decrease in aggregate demand leads to a. an increase in unemployment b. a decrease in output c. no change in output d. either increase or a decrease in output 10. The short run effects of a tax increase are likely to be a. lower output and lower prices b. lower output and higher prices c. higher output and higher prices d. higher output and unchanged prices 11. An expansionary fiscal policy would be one that a. lowers government spending and lowers taxes b. increase the nation’s money supply c. raises government spending and lowers taxes d. raises tax rates 12. If the equilibrium output of the economy is 2,000 billion and the GDP at full employment is 2,500 billion, according to Keynes, the government should a. attempt to lower private investment through a corporate tax increase or reduce gov spending b. raise transfer payments c. cut its own spending but leave tax policy unchanged d. raise the income tax A B 13. A bank account that can be accessed by writing a check is called a a. demand deposit b. cash deposit c. savings deposit d. automatic deposit 14. The central bank of the US is the a. FDIC b. Federal Reserve System c. Bank of America d. Bank of the US A? 15. If taxes fall by 200, the price level stays constant and the mpc = .8, then the short run real GDP will a. rise by 1,000 C b. rise by less than 1,000 D c. rise by more than 1,000 d. rise by 500 16. In a bubble economy a. share prices rise very fast b. the law of demand breaks down c. debt rises sharply d. all of the above 17. When the real wage trails labor productivity a. the wage gap rises D d. rise by 500 15b. If taxes fall by 200, the price level falls by 10%, and the mp c= .8, then the short run real GDP will a. rise by 1,000 b. rise by less than 1,000 D c. rise by more than 1,000 b. debt grows sharply c. profits may jump fast d. all the above 18. A fall in the wage gap a. causes a fall in employment b. forces the govt to expand the budget deficit c. forces the govt to expand money supply D 19. If both productivity and the real wage doubles, then a. consumption doubles A d. keeps employment high b. investment doubles c. there is no rise in debt d. all above 20. When the wage gap grows a. profits grow, causing stock prices to rise b. profits fall, causing stock prices to fall c. the government lowers the interest rate d. the living standard rises for all True and False False? T/F 1. If the Fed buys Treasury bills, interest rates are likely to rise, causing a fall in investment and consumption True T/F 2. According to Say’s law, aggregate demand is always equal to aggregate supply True T/F 3. The aggregate supply curve in the classical model is vertical True T/F 4. The most commonly used tool of monetary policy is open market operations True T/F 5. Through open-market operations, the Fed may exercise some control over the money supply True T/F 6. A rise in mpc raises the GDP multiplier False T/F 7. A rise in rrr raises the money multiplier False T/F 8. The Fed does not use changes in bank reserve requirements to expand or contract the money supply True T/F 9. According to Milton Friedman money supply should grow at the same rate as real gdp False T/F 10. If taxes fall and government spending rises by the same amount, there is very little change in GDP False T/F 11. If AD rises then output is constant in the short run True T/F 12. If AD rises and the AS curve btwn P & Y is vertical, then prices go up but output is constant True T/F 13. If the AS curve shifts to the left, then output falls and the price level rises True T/F 14. If the govt budget deficit rises and crowding out occurs, then investment will fall False? T / F 15. An increase in the Fed discount rate will encourage banks to borrow from the Fed rather than from private sources False? T / F 16. If the Fed buys govt bonds from the private sector, output and prices will rise in the short run True T/F 17. If money supply expands, interest rates fall, consumption and investment rise, GDP goes up and the rate of unemployment declines False? T / F 18. Expansionary monetary policy during a recession causes a fall in the natural rate of unemployment True 19. If the wage gap falls, profits go down T/F True? T/ F 20. If the wage gap rises, profits cannot rise unless there is a rise in debt III. Problems 1. If your income rises by 200, taxes rise by 20, and savings rise by 60, calculate your marginal propensity to consume. 2. If the mps = .2, and the price level is constant, what should be the change in government spending so that the GDP falls by 500? 3. If the public’s cash = 20, the legal rrr = .1, the banking system’s rr = .2, BR = 10, calculate M1 4. If the public’s cash = 20, the legal rrr = .1, BR = 10, the Fed sells government bonds worth $6 to the public and the public pays half of it by drawing on its cash and the other half by writing a check, then calculate the change in M2. 5. If the real wage is $5, productivity is $15, investment is 50, all wages are consumed, employment is 10, what is the level of new debt so that full employment remains?