problem 3.1 - QM for Business class of Mr Huy

advertisement

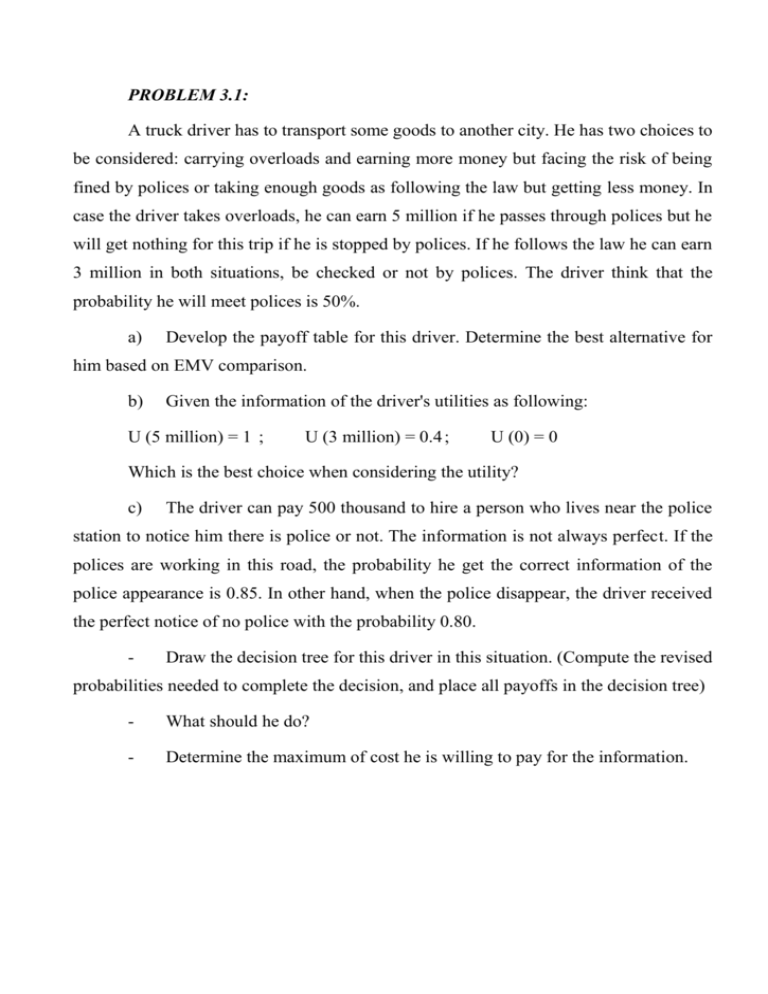

PROBLEM 3.1: A truck driver has to transport some goods to another city. He has two choices to be considered: carrying overloads and earning more money but facing the risk of being fined by polices or taking enough goods as following the law but getting less money. In case the driver takes overloads, he can earn 5 million if he passes through polices but he will get nothing for this trip if he is stopped by polices. If he follows the law he can earn 3 million in both situations, be checked or not by polices. The driver think that the probability he will meet polices is 50%. a) Develop the payoff table for this driver. Determine the best alternative for him based on EMV comparison. b) Given the information of the driver's utilities as following: U (5 million) = 1 ; U (3 million) = 0.4 ; U (0) = 0 Which is the best choice when considering the utility? c) The driver can pay 500 thousand to hire a person who lives near the police station to notice him there is police or not. The information is not always perfect. If the polices are working in this road, the probability he get the correct information of the police appearance is 0.85. In other hand, when the police disappear, the driver received the perfect notice of no police with the probability 0.80. - Draw the decision tree for this driver in this situation. (Compute the revised probabilities needed to complete the decision, and place all payoffs in the decision tree) - What should he do? - Determine the maximum of cost he is willing to pay for the information. PROBLEM 3.2: CCO is a chemical company. The research and development manager is trying to decide whether or not to develop a new solvent that would work at all conditions. It is thought that the solvent project may be a major success with an estimated value of $1,500,000, a moderate success with an estimated value of $800,000 since it can be sold to another company to help with its current project, or a total failure. If the project is a failure, it will cost the company $700,000. Based on the subjective judgment of the manager, the following probabilities are assigned to the three possibilities. P (major success) = 0.20 P (moderate success) = 0.40 P (failure) = 0.40 The company is also considering consulting an expert from a research institution to study the project for a fee of $30,000. The expert will develop a prototype solvent to determine if it would work at all temperatures. Based on previous experience with the expert, the following conditional probabilities are realistic appraisals of the expert’s evaluation accuracy. P (prototype works | major success) = 0.9 P (prototype works | moderate success) = 0.6 P (prototype works | failure) = 0.3 a. Construct a decision tree for this problem, and determine all probabilities. What is the optimal decision strategy and its expected value? b. What is the maximum amount the company should be willing to pay to the expert? PROBLEM 3.3: An automotive importer is considering some plans to import one kind of cars, either luxury or economy cars. At that time, the government considers to change the automotive import tax to high, normal or low decrease with the corresponding probabilities of 0.2; 0.4 and 0.4. If the decreasing of tax is high, the importer can earn either $300,000 for luxury car import or $150,000 for economy cars imports. If the decreasing of tax is normal, the importer can earn either $80,000 for luxury car import or $50,000 for economy cars imports. If the decreasing of tax is low, the importer can lose either $100,000 for luxury car import or $40,000 for economy cars imports. The importer can give up all plans and open a saving account for his capital with the interest of $10,000. From some information sources, the importer knows that there is an argument in government. The Radical group wants to decrease much in importing tax in order that many people can own a car. The Conservative group wants to reduce very slightly the tax in order to protect the domestic automotive manufacturers. The importer knows that if the Radical group wins in this argument, the decreasing of tax rate is high, normal or low with the respective conditional probabilities of 0.6; 0.35 and 0.05. If the Conservative group wins in this argument, the conditional probabilities of 0.1; 0.35 and 0.55 accord respectively to the tax decreasing of high, normal or low decrease. The probability that Radicals win is 70%. The importer does certainly not know this information. He intends to pay $30,000 to get this information. Develop the decision tree for this problem. What should the car importer do? How the cost of this information is? PROBLEM 3.4: CMM company wants to expand capacity for producing printers. There are two alternatives being considered: build a large plant and build a small plant. Cost for building large plant is of 30 mil. USD while the cost for building small plant is 10 mil. USD. CMM believes that probability for high demand (H) is 70%, while probability for low demand (L) is 30%. The following table shows estimated revenues (excluding building cost): Bảng 1 Demand High demand Low demand (H) (L) 180 90 Alternatives large plant Demand plant 110 70 However, before making investment decision, CMM manager should like to conduct a marketing research which costs 20 mil. USD. The research results in two outcomes: positive (P) and negative (N). Based on the historical data, research group surveys companies who conducted marketing research and the data are given as follows: Bảng 2 State of nature High demand (H) Low demand (L) Positive P(P|H)=0.65 P(P|L)=0.22 Negative 0.35 0.78 Develop the decision tree for this problem. What should CMM do?