Territory Management Lecture Notes

advertisement

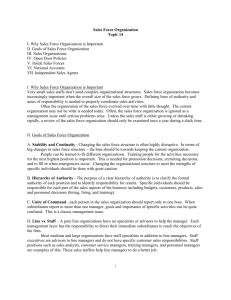

Territory Management Lecture 12 I. The Importance of Time and Account Management II. Territory Management III. Account Analysis and Time Allocation IV. Coaching Time Management V. Dropping Small Accounts VI. Territory Management Example Think this over – are all customers equally important? How can a salesperson best allocate their time? I. The Importance of Time and Account Management A critical difference between effective and ineffective salespeople is how they manage their time. A good salesperson is not idle when waiting on a client. They review their presentation, they handle their paperwork, they review accounts for future calls and needs. The most successful salespeople look at their territory as a business and recognize the need to minimize their cost while maximizing the return potential. Time and account management tools are most useful when examining current accounts, but are also useful in determining the best prospects for new sales. Salespeople need to identify their “prime selling time.” This time must be guarded jealously. Backup plans are needed for canceled appointments or times when appointments run far faster than anticipated. This is a good time to call on "c" accounts or to cold-call prospects. Flexibility and contingency plans are necessary. II. Maximizing Your (and your Salesforce's) Productivity For many firms, selling costs have risen faster than sales volume. This greatly lowers sales force productivity. Productivity can be increased by 1] increasing the amount of time salespeople spend selling and 2] spending the time more efficiently to generate more sales. A. Increasing the Amount of Selling Time - A good chunk of salespeople's time is not spent on selling or servicing accounts. Administration, travel and internal meetings take up a large percentage of the average salesperson's time. The most important thing driving sales is face-to-face selling time and time spent servicing accounts. Increasing the time spent in face-to-face selling can increase sales. Technology may increase productivity by allowing salespeople to handle reports and account servicing faster. It also enables better communication with the home office. B. Concentrating on the most profitable customers and products - Focusing on selling customers and products with the best profit potential can also greatly increase productivity. A survey of 192 firms found: 10% of total customers average 50% of total sales. The top 20% of customers represent 75% of total sales. The top 50% of customers represent 90% of total sales. However, geographic dispersion of customers makes it difficult to focus solely on the top 10% or even 50%. Also, focusing only on your current users does not leave room to find new customers. Sales managers need to help their salespeople identify the most profitable customers and products and help plan sales call schedules to maximize the salespersons effectiveness. These tools are under the general heading of territory management. II. Territory Management A. Minimum Account Size - An important starting point is determining the minimum size customer you should be calling on. Don't spend face-to-face selling time when it is not profitable to do so (with the sole exception of fill-ins, explain). To do this, a salesperson needs to determine the cost-per-call, current sales and potential sales. B. Cost-Per-Call - is a function of the number of calls you make per day, the number of days available to call on customers, and your direct selling expenses. Direct selling expenses include compensation, travel, lodging, entertainment and communications (they are direct or incremental costs, explain). Each salesperson must determine their own cost-per-call because it varies considerably depending on the direct selling costs and the geographic concentration of accounts and prospects. Example of Computing Cost-Per-Call: Compensation: Salary, commissions and bonus: Fringe Benefits Direct Selling Expenses: Car Lodging and Meals Entertainment Communications Samples, promotional material Miscellaneous Total Direct Expenses Calls Per Year Total Available Days Less: Vacation Holidays Sickness Meetings Training Net Selling Days Average Calls Per day Total Calls Per year (211 x 3.5) Average Cost Per Call ($82500/738) $51,000 11,000 $ 6,500 4,900 2,700 3,450 1,750 1,200 $62,000 20,500 $82,500 260 days 6 10 6 12 15 49 days 211 days 3.5 calls 738 calls $111.79 C. Break-Even Sales Volume - the sales volume necessary to cover direct selling expenses (not total selling expenses). This calculation helps determine the minimum size customer that should be pursued. It requires knowing the cost per call, the number of calls necessary to close a sale (from experience or firm averages) and what direct selling expenses should be as a percentage of total sales. All three variables (cost per call, number of calls necessary to close a sale, and direct selling expenses as a percentage of total sales) will vary considerably from firm to firm. In making these calculations be sure that: 1] the time units are in constant units and 2] The cost information is in constant units. This calculation is also useful when prospecting for new customers. The calculations are the same, though sales volume and sales call per month figures are estimates. Break-Even Sales Volume = [Cost per call x number of calls to close] Sales Costs as a percent of Sales “Number of calls to close” are face-to-face meetings, not phone calls, email or other contacts. For example, if a firm has a cost per call of $95, the average number of calls to close is 3.5 and sales costs as a percentage of total sales is 7.2% then: Break-even sales volume is = [$95 x 3.5]/.072 = $4,618 in sales revenue. Note: break-even calculations for current customers would compare the total revenue with the total cost of sales calls and the number of calls needed to generate the current sales level. For existing accounts you would use: Break-Even Sales Volume = [Cost per call x number of calls made on the account] Sales Costs as a percent of Sales D. Practical Implications of Using Break-Even Sales Volume to Determine Call Frequency - In the real world, these calculations provide a starting point and not the final answer. For example, the unit profitability of different products that a firm sells are usually quite different. The travel costs to reach different customers can vary sharply, especially within a big territory. Finally, all of this data is historical, it does not take into consideration the potential sales of a customer, only current sales. This is a crude measure because it ignores gross margins, account growth potential, and differing service levels necessary to generate target sales volumes. Usually a break-even sales volume is not a hard and fast dollar volume, but an indicator of justifiable account activity. I’ve never seen examples of firms using this explicit type of break-even calculation. But many firms use either ad hoc calculations or detailed response analysis to determine which accounts are too small to be profitable for face-to-face sales calls. Another way this is done is just allocating scarce salesperson time to the best current accounts. But again, ignoring account potential and only focusing on what is working best right now can be a mistake. III. Account Analysis and Time Allocation A. Single Factor Model - easiest model and most widely used. Examines a single customer characteristic to arrive at an allocation of sales calls. An "ABC" classification may be used. For example, A accounts might be the top 20%, B's the next 20% and C's the bottom 60%. Time and sales calls are a valuable resource that should be allocated to the best sales and profit opportunity. As my grandfather (a very effective salesperson) said, "you need to fish where the fish are." Spending too much time on your weak accounts and too little time on your top producers leaves your best customers vulnerable to being taken over by competitors giving better service. Don't let this happen to you or your sales force! The biggest problem of using a single factor (either sales or profit contributions) is that it does not consider all factors that make a customer valuable. One example is future growth potential. Example: You are a salesperson for Dean Smith Sports and have been very successful. Your commissions are over $70,000 a year. Demand for your products is strong, but so are time demands. You work your territory 220 days a year and make 4 calls a day. The maximum number of times you need to see any account is every other week, but you need to call on each account at least once a quarter. You have the following information on your accounts and need to develop a call schedule allocating your time to the 110 customers in your territory. Account Sales Last Year Top 10 accounts $150,000 Next 10 best accounts 37,500 Next 10 best accounts 37,000 Next 20 best accounts 56,250 Next 20 best accounts 55,500 Next 20 best accounts 18,750 Last 20 accounts 15,000 $370,000 Solution: This solution was worked on Excel and is available with the lecture and on my web site. Please refer to it and the text below. You have 110 total accounts and 880 total calls you can make (average 4 calls a day times 220 working days). You are trying to accomplish several goals: 1] You must call on each account at least four times a year. 2] You want to call on the most productive accounts far more often than less productive accounts (better service and to better protect yourself from competition). The table labeled "Starting Point" in the Excel spreadsheet gives an equal number of calls per account. This is a very poor allocation. The best service (lowest sales per call) is given to the weakest account group. Relatively little attention is being given to the account group with the highest sales. In Step 2 I allocated the sales calls as a percentage of total sales. I then rounded the results to the nearest whole number. Sales per call is now almost exactly equal for each account group. But this allocation violates the dictate that the maximum number of visits per year is 260 and the minimum number is 4 per year. Three account groups violate these rules. Again, see the spreadsheet for “step 2.” In Step 3 I changed the account allocation to a max of 260 for the top 10 and a minimum of 4 per year for the bottom two groups. Only these account groups hit the caps because the initial account allocation went counter to company policy. I then allocated the remaining calls to the accounts where I could make adjustments based on sales per call for the remaining account grouping. As you can see by the final results, the average sales per call for the account groups that I can adjust are almost exactly equal. At this point the allocation is within company policy and is roughly equal in sales per call where there is discretion on how to allocate the accounts. Overall, we accomplished getting the average sales per call to be as even as possible between accounts - while first following company policy. Minimum and maximum call levels can result in different call patterns. B. Portfolio Models - Multiple factors are used to determine the value of accounts within a territory. Again, the most attractive accounts receive the most selling efforts. The accounts are placed in four quadrants based on competitive position and account opportunity (strong/weak). Many portfolio approaches consider account opportunity and competitive position. Account Opportunity is the account's need and ability to purchase a firm's products (growth rate, financial health, strength in the market). Competitive Position is the strength of the supplier's relationship with the account. It includes the account's overall attitude towards the supplier, previous experience with the account, strength of the personal relationship with the account. Example is in the text. The portfolio model explicitly forces sales managers and sales people to consider multiple factors for each account to judge the overall attractiveness of the accounts. Often, the factors are written down and an overall joint decision of the quadrant for each account is decided by the salesperson and the sales manager. C. Decision Models - focus on the response of each individual account to the number of sales calls made over a period of time. Decision Models overcome the problem of placing each account into only one of four categories (and thus ignoring potential differences within the quadrants). Decision Models consist of two parts. First, the relationship between the number of calls to an account and sales response over a fixed period of time is developed. This is often done by the salesperson thinking about what sort of sales response they would get if they allocated varying levels (say 1, 3, 5, 10) sales calls to the account. Usually, the questions are formed in terms of halving or doubling the number of sales calls to the account. The second part of the model is to allocate calls to maximize sales based on the responses in part one. This is essentially a maximization problem with a fixed constraint (the number of sales calls available). This part is usually computer modeled. However, this usually does not consider the cost to make a call and the distance between accounts. If this is added into the model, you have three constraints due to the differences in cost to call and distance. Computer models have been developed (and are for sale) to apply decision models to call allocation. They often provide a good starting point, but again, judgement is needed to consider factors not modeled into the program. D. Prospecting Model - The models discussed in this section all depend on historical data and are thus not very useful in deciding on which potential accounts hold the best prospects for future sales. They also don't work so well for sales of big ticket items that are purchased infrequently (planes for example). Properly allocating calls for prospective accounts and for big ticket items is equally important. One way is to classify these accounts as Unqualified, Qualified and Best Few. Unqualified - data suggests a possible need for the product or service, but the need has not been verified by key people within the account. Qualified - need is verified by at least one of the buying influences; confirmed intention to buy or switch suppliers; funding is approved or exists; identified time frame for the decision. Now the selling job requires identifying all buying influences and understanding each buyers needs. Best Few - all buying influences contacted, needs identified, and sale seems at least 50% along in the selling cycle (take you half as long to gain sale as qualified accounts). One suggested set of priorities is to: 1. Close your Best Few Sales Accounts 2. Prospect for Unqualified Accounts 3. Work the Qualified Accounts. This approach is suggested to continue to have a pool of qualified accounts through prospecting. Otherwise, the pool will quickly dry up as you finish your best few and mine completely the qualified accounts. IV. Coaching Time Management Getting the sales force to make the best use of their time is critical. We have been focusing on how to allocate time (sales calls), but how do we use our time more efficiently? Things that salespeople consider some of the most common time wasters include: 1] telephone interruptions 2] drop-in visitors 3] lack of self-discipline 4] crises 5] meetings 6] lack of objectives, priorities, and deadlines 7] indecision and procrastination 8] attempting too much at once 9] leaving tasks unfinished 10] unclear communication A particularly important aspect of time management is knowing when the customer is available. This key selling time must be jealously guarded from interruptions since it a the critical factor in persuading customers to buy. This time has to be protected from all other distractions. Many sources suggest preparing a list of personal and professional goals and then pursuing them one step at a time. Each day, make a list of the tasks in order of importance and work through the list. Doing this helps keep you focused on the most important tasks every day. Once you get in the habit of daily planning, you need to plan a week or more ahead. Many salespeople are required to make weekly call plans with the idea being to force salespeople to make better use of their time. This also gets salespeople to call ahead for appointments and make regular schedules (which helps with client relations as well as getting more work out of your day). Many find a daily or weekly planner to be very useful. Part of planning includes realistic about potential accomplishments. You need to learn to set realistic goals. Learning to say no and delegating work to others is also important. You need to determine what the critical tasks are and then focus on those. Management's Role: Work with your salespeople to help them with time management. Many salespeople are poor managers and get thrown off their plans quite easily. Many people attracted to sales are rewarded by many personal contacts and forget their overall goals. Some texts suggest strict supervision. Others suggest a totally hands off approach. I suggest that you start by focusing on your new salespeople and your least efficient salespeople. Require these folks to make weekly plans and submit them for approval. Work with them on these plans. Sell them on the fact that you are trying to help them make more money by making better use of their time. Also, get your salespeople to write brief notes or logs of customer responses and status (or to better use existing sales support software). We all forget things. By keeping organized records, you are less likely to repeat the same mistakes and will remember to take advantage of prior opportunities. . V. Dropping Small Accounts Deciding when to drop existing small accounts is a very difficult sales management decision. It is always tough to drop customers who have been profitable and often helped build your business. However, your firm must allocate resources in the most productive manner to produce profits. Remember, existing customers past sales are far more reliable sources of future sales than prospective new accounts or new products. You never want to drop old customers (even small accounts) unless you are either a] losing money even if you made only one sales call and the forecasted future sales are not expected to make the account profitable. b] You KNOW that you can use the sales calls in a much more profitable manner elsewhere. An example will help clarify this. Often times, we don’t drop small accounts entirely we just drop them from face-to-face sales calls. These accounts can be shifted to an inside salesforce, 800 lines or internet service. If this significantly reduces your costs to service the account and can thus make the account profitable. You might also consider raising prices, perhaps significantly to smaller accounts. To do this successfully you must determine: a] that smaller accounts order in smaller quantities and thus raise prices while providing significant quantity discounts (cumulative or noncumulative depending on your cost structure) or b] figure out a way to successfully segment the market. If your pricing is on the basis of quotes, then raising prices and discriminating on price is easy. If you give public price lists (especially with automatic ordering through the internet), then price discrimination may well be impossible. Example: Your territory has 150 existing accounts. Your average cost-per-call is $315, product 1 is sold for $20 and product 2 sells for $43. Your cost-of-goods-sold (excluding direct selling costs) for product 1 is $12 and is $21 for product 2. Lets look at three accounts. Account P1 Sales P2 Sales Calls last year #21 100 45 7 #117 50 12 2 (revenues for #117 are in the bottom 10%). #143 10 10 1 Solution: Your unit gross margins are $8.00 for P1 and $22.00 for P2. You have the additional cost of the sales calls. For last year we have: Account Gross Margin Cost of Calls Contribution Last Year #21 $1790 $2205 - $415 #117 $664 $630 $34 #143 $300 $315 - $15 Account #143 should be dropped unless you forecast a sales increase in the near future. Even with one call, you have a negative contribution. Account #21 should not be dropped. If you cut the number of calls down (to say 4 or 5) the account would have a positive contribution. Although cutting the number of calls may cut sales levels, you will probably still get a good number of sales. The only problem with account #21 is that you are calling too much for the revenue being generated. Account #117 is a tougher case. You should probably go with cutting the calls back to only 1 next year. If sales did not drop, it would yield $329 in contribution, which is profitable. You would not eliminate #117 unless you had a very good chance of using those sales calls on another account (or on cold calling) that would yield more money than spending those 1 (or 2) calls on #117. There are two other possible solutions to this problem. First, you could decide to handle account #143 with direct mail or phone calls which would be a far lower cost per call. The second possible solution is to charge higher prices for the smallest accounts that are not profitable and/or provide profit levels that are too small to warrant having face-to-face sales calls. VI. Territory Management Example Let’s consider only the 25 accounts called on in a regular basis last year (accounts called on when appointments are cancelled or to fill in a schedule are being omitted). 450 calls are scheduled yearly. The top 25 accounts are scheduled for 300 calls, but due to appointments being cancelled, 236 calls were made. The other calls are scheduled for prospects that no sales have been made to and the remaining calls to smaller accounts. You are required to see each top 25 account at least 6 times a year. You do not want to schedule more than 24 visits per year for each account to avoid annoying the clients. Average cost-per-call = $109 and 3 calls are made in an average day. Sales costs as a percentage of total sales are 6.3%. It took an average of 2.3 calls to close a sale across all three products. Your company sells three products P1, P2 and P3. P1 has a unit selling price of $25, P2 has a unit selling price of $50 and P3 has a unit selling price of $100. Unit costs are P1 = $8; P2 = $21 and P3 = $47. So unit contributions (excluding direct selling costs) are: $17 for P1, $29 for P2 and $53 for P3. The spreadsheet accompanying the lecture has the raw data. Analysis: The products and customers are not equally profitable. This is still a relatively simple problem with a fixed cost per sales visit and only three products. Still, the unit contribution is quite different across the products. Average Break-even sales volume = $3,979 = [(109 x 2.3)/.063]. However, the break-even sales volume sharply differs by the number of calls and the contribution of the products sold. For this reason and others this calculation is of limited use. The first step in this analysis is very clear. Fill in the table to get contribution per account, contribution overall, and contribution per sales call. I just calculated the revenues and cost per account. I then calculated the contribution by account and the contribution per sales visit. This gives me a complete picture of the current situation. Note that you have two different types of costs. You have the direct variable costs of each product. You also have the cost of the sales calls which are a direct cost of the overall account, but not directly attributable to any of the specific products. This is why they are calculated as they are. Contribution per call is wildly different by account ranging from $18.15 to $558.86 per visit. We would like to have contribution per call as even as possible across accounts when doing our call planning. This would mean that the level of service is as each account deserves. But to do this makes the big assumption that sales will not be directly impacted by the number of visits. We know this is not true. Also, some accounts have purchasing habits that follow “we will call you if there are big problems” and other accounts which demand a high level of personal service. Like all other call planning techniques, this process gives you a starting point to carefully re-evaluate your existing call plan. A good call allocation based on contribution per account is given in the spreadsheet. The accounts that are sharply out of the norm for contribution per call are the ones that are hitting the minimum service level or the maximum service level (in color on the spreadsheet). This gives you a good starting point for adjusting for other factors not considered in the program. One of those factors is future sales potential. You would also adjust the call frequency due to customer needs. Some customers seldom want to see salespeople while others demand a lot of attention (which is OK as long as the cash flow is good). Another problem is that the service costs for each customer is never even. If you have a customer that is expensive to reach (they are far away - or it is costly to get there), then that would also adjust the most profitable call level. Simply because an account is larger does not mean that it is more profitable. One manufacturer did an analysis of their larger accounts. In 1987 these accounts represented 72% of the company’s overall profits. Ten years later, in 1997 their contribution had shrunk to less than 40% of profits. Two of the 10 were producing a loss and another 2 were barely breaking even. Many companies are starting to realize that account size alone is not the best predictor of profitability and are using information technology to identify their most profitable accounts. If you successfully identify your profitable accounts your salespeople can: a] Manage their time allocation according to the profit opportunity an account represents b] Manage efforts based on both volume opportunity and profitability of the product line. Most product lines are not equally profitable. c] Be more reluctant to offer price concessions to gain an order. First, doing so lowers unit profitability. Second, giving these discounts can make customers come to expect them. Surveys indicate that companies that give their salespeople wide latitude to negotiate price discounts are both less profitable and grow more slowly. However, price discounting may be a symptom of weakness in the face of competition.