Question 5

advertisement

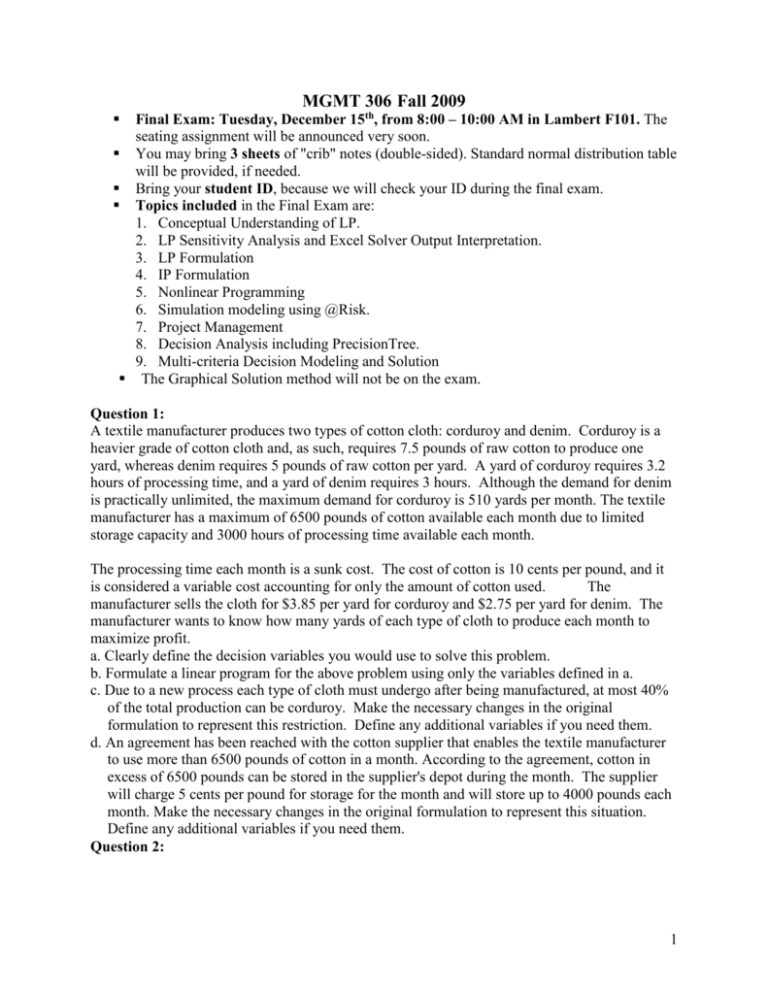

MGMT 306 Fall 2009 Final Exam: Tuesday, December 15th, from 8:00 – 10:00 AM in Lambert F101. The seating assignment will be announced very soon. You may bring 3 sheets of "crib" notes (double-sided). Standard normal distribution table will be provided, if needed. Bring your student ID, because we will check your ID during the final exam. Topics included in the Final Exam are: 1. Conceptual Understanding of LP. 2. LP Sensitivity Analysis and Excel Solver Output Interpretation. 3. LP Formulation 4. IP Formulation 5. Nonlinear Programming 6. Simulation modeling using @Risk. 7. Project Management 8. Decision Analysis including PrecisionTree. 9. Multi-criteria Decision Modeling and Solution The Graphical Solution method will not be on the exam. Question 1: A textile manufacturer produces two types of cotton cloth: corduroy and denim. Corduroy is a heavier grade of cotton cloth and, as such, requires 7.5 pounds of raw cotton to produce one yard, whereas denim requires 5 pounds of raw cotton per yard. A yard of corduroy requires 3.2 hours of processing time, and a yard of denim requires 3 hours. Although the demand for denim is practically unlimited, the maximum demand for corduroy is 510 yards per month. The textile manufacturer has a maximum of 6500 pounds of cotton available each month due to limited storage capacity and 3000 hours of processing time available each month. The processing time each month is a sunk cost. The cost of cotton is 10 cents per pound, and it is considered a variable cost accounting for only the amount of cotton used. The manufacturer sells the cloth for $3.85 per yard for corduroy and $2.75 per yard for denim. The manufacturer wants to know how many yards of each type of cloth to produce each month to maximize profit. a. Clearly define the decision variables you would use to solve this problem. b. Formulate a linear program for the above problem using only the variables defined in a. c. Due to a new process each type of cloth must undergo after being manufactured, at most 40% of the total production can be corduroy. Make the necessary changes in the original formulation to represent this restriction. Define any additional variables if you need them. d. An agreement has been reached with the cotton supplier that enables the textile manufacturer to use more than 6500 pounds of cotton in a month. According to the agreement, cotton in excess of 6500 pounds can be stored in the supplier's depot during the month. The supplier will charge 5 cents per pound for storage for the month and will store up to 4000 pounds each month. Make the necessary changes in the original formulation to represent this situation. Define any additional variables if you need them. Question 2: 1 The Tots Toys Company is trying to schedule production of two very popular toys for the next three months: a rocking horse and a scooter. Information about both toys is given below. Toy Rocking Horse Scooter Summer Schedule June July August Beginning Inventory on June 1st 25 55 Required Plastic Per Toy 5 4 Required Time Per Toy 2 3 Production Cost Per Toy 12 14 Plastic Available 3500 5000 4800 Time Available 2100 3000 2500 Monthly Demand Horse 220 350 600 Inventory Cost Per Toy 1 1.2 Monthly Demand Scooter 450 700 520 Develop a model that would tell the company how many of each toy to produce during each month. You are to minimize total cost. Inventory cost will be levied on any items in inventory on June 30, July 31, or August 31 after demand for the month has been satisfied. The company wants to end the summer with 150 rocking horses and 60 scooters as beginning inventory for Sept. 1. Don't forget to define your decision variables. 2 Question 3: No-name B-School is trying to decide how many of each type of computer to buy for its computer labs. The Appease (A) model can only be used for spreadsheets and word processing and costs $1400. The Basic (B) model can be used for spreadsheets, word processing and databases and costs $2000. The Capture (C) model can only be used for multimedia and costs $2500. Finally, the Doitall (D) model can do any task and costs $3500. Due to class enrollments, the school must have at least 100 machines capable of doing spreadsheets and word processing, at least 50 machines capable of doing databases, and at least 30 machines capable of doing multimedia. The dealer the school is buying from has only 45 of model A available. The school wishes to minimize their total purchase cost. The following is an LP formulation for the problem with solution and sensitivity analysis. Let A=number of Appease model purchased Let C=number of Capture model purchased Minimize 1400A+2000B+2500C+3500D Subject to A +B + D 100 B + D 50 C + D 30 A 45 A, B, C 0 Let B=number of Basic model purchased Let D=number of Doitall model purchased (constraint for spreadsheets/wp) (constraint for database course) (constraint for multimedia course) (number of model A’s available) Answer Report Target Cell (Min) Cell Name $G$3 Obj. (Min) Original Value Final Value 0 218000 Adjustable Cells Cell Name $B$2 A $C$2 B $D$2 C $E$2 D Original Value Final Value 0 45 0 25 0 0 0 30 Constraints Cell Name $G$4 Sp/wp $G$5 Dbase $G$6 Multimedia $G$7 Model A Cell Value Formula 100$G$4>=$I$4 55$G$5>=$I$5 30$G$6>=$I$6 45$G$7<=$I$7 Status Slack Binding 0 Not Binding 5 Binding 0 Binding 0 3 Sensitivity Report Adjustable Cells Cell $B$2 $C$2 $D$2 $E$2 Name A B C D Final Reduced Objective Allowable Allowable Value Cost Coefficient Increase Decrease 45 0 1400 600 1E+30 25 0 2000 1500 600 0 1000 2500 1E+30 1000 30 0 3500 1000 1500 Constraints Cell $G$4 $G$5 $G$6 $G$7 Final Shadow Constraint Allowable Allowable Name Value Price R.H. Side Increase Decrease Sp/wp 100 2000 100 1E+30 5 Dbase 55 0 50 5 1E+30 Multimedia 30 1500 30 25 30 Model A 45 -600 45 5 45 a. If enrollment in the database course is limited to 45 students instead of the original 50, what would be the new total purchase costs for all the computers? b. If the dealer could supply three additional model A’s, what would be the new total purchase costs for all the computers? c. If the dealer agrees to lower the price for Model C computers, at what new lower price would the B-school consider buying any Model C computers? d. The dealer has warned that the price of Model D computers may actually increase before the purchase order goes through. At what higher price would the school consider changing the order? e. A local community college would like to offer a 60 person multimedia course in the Bschool’s labs, so the school will need 60 instead of 30 multimedia computers. The community college is willing to make a one-time payment of $30,000 to do this. Assuming the B-school gets no other advantages than this one time payment, should the school take the offer? Why or why not? 4 Question 4: A product manager for a soap manufacturer must decide whether or not to offer a new, biodegradable laundry detergent. The projected profit from a successful detergent is $2 million, whereas failure of the product would result in a loss of $1 million. The manager currently thinks there is a 40% chance that the product will be successful. Not offering the product would not change profits. a. Construct a decision tree for this decision. What is the optimal strategy? What is the EMV of this strategy? What is the risk profile? What is the EVPI? The manager also has the opportunity to test the product before taking it to market. At a cost of $100,000, the product can be tested. Consumer testing can be favorable, a 50% chance, or unfavorable. Given a favorable test result, the chance of product success is judged to be 80%. However, for an unfavorable test result, the chance of product success is judged to be only 30%. b. Construct a decision tree in PrecisionTree for this problem. What is the optimal strategy and its expected value? What is the risk profile for this strategy? Question 5: Remington Manufacturing is planning its next production cycle. The company can produce three products, each of which must undergo machining, grinding and assembly operations. The following table summarizes the hours of machining, grinding and assembly required by each unit of each product, and the total hours of capacity available for each operation. Operation Machining Grinding Assembly Hours Required by Product 1 Product 2 2 6 5 Product 3 3 3 6 6 4 2 Total hours Available 600 300 400 The per unit profit from each of the products and the setup costs are listed in the table below: Profit per unit Setup cost Product 1 $48 $1000 Product 2 $55 $800 Product 3 $50 $900 Since there is a heavy demand for the products, the marketing department believes that all the products produced within the available capacities can be sold. The management of Remington wants to determine the most profitable mix of products to produce. Formulate an integer-programming model on behalf of Remington. Define any variables you use and clearly specify the objective function and constraints. 5 Question 6: Building a backyard swimming pool consists of six major activities. According to the knowledge of activities and their immediate predecessors, the project network is drawn below: A C E START FINISH B D F Assume that the activity time estimates (in days) for the swimming pool construction project are Activity A B C D E F Optimistic hidden hidden hidden hidden 1 hidden Most Probable Hidden hidden hidden hidden 2 hidden Pessimistic hidden hidden hidden hidden 3 hidden Expected Time 5 4 6 9 8 Variance 0.5 0.6 0.1 0.3 0.2 (a) What are the expected time and variance for activity E? (fill them into the above table) (b) What are the critical activities? (c) What is the expected time to complete the project? (d) What is the probability that the project can be completed in 21 or fewer days? 6 Question 7: Office Automation, Inc. has developed a proposal for introducing a new computerized office system that will improve word processing and interoffice communications for a particular company. Contained in the proposal is a list of activities that must be accomplished to complete the new office system project. The following information about the activities is given. Activity A B C D E F Immediate Description Predecessor Plan needs Order equipment A Install equipment B Set up training lab A Conduct training lab D Test system C, E Time (weeks) Normal Crash 10 8 8 6 10 7 7 6 10 8 3 3 Cost ($1000s) Normal Crash 30 70 120 150 100 160 40 50 50 75 60 - The length of the critical path for the above project is 31 weeks. However, the company wants to complete the project in 26 weeks. Formulate a linear programming model that could be used in making the crashing decisions. Question 8: EasyRent just started its DVD rental business. It charges $3 for overnight rental of new movies and guarantees that every new DVD they have is never out of stock. If a customer is not able to rent a DVD, EasyRent offers three free rentals as compensation. The estimated cost of this compensation is $8. Not every customer asks for the free rentals for compensation. EasyRent estimates that 80% of customers will ask for the free rental offer if the movie is not on the shelf. Recently, a new action movie is just about to be launched on DVD. According to historical data about action movies, the daily demand during the first month of release is a normal distribution with mean 130 and standard deviation 15. EasyRent has to pay $60 per copy of DVD for right to rent out the movie during its first month of release. Considering the stock levels of 120, 130, 140, 150, 160, and 170 use simulation approach to decide which stock level EasyRent should have in order to maximize its profit during the first month (30 days.) a. Create an @RISK model for the first month of rentals to simulate net monthly income for the DVD for each stock level. b. How many copies of the DVD should they stock? 7 Multiple Choice Questions: 1. Which of the following statements is correct? a. Sensitivity analysis of a linear program investigates how the optimal solution changes when the value of a decision variable changes. b. When the objective function coefficient of a variable changes, the current optimal solution may become infeasible. c. If a constraint is not binding at the current optimal solution, then its shadow price is zero. d. As long as the objective function coefficient of a variable is in its optimality range, the optimal objective function value remains the same. 2. The earliest start time for an activity is: a. Based on the length of the critical path b. Determined by the maximum of the earliest finish times of its immediate predecessors c. The same as the latest start time of its immediate predecessor d. None of the above 3. The project management strategy of injecting additional resources in order to reduce the length of the project is called: a. Rushing b. Panicking c. Crashing d. None of the above 4. Which of the following are ways of crashing an activity? a. Using overtime b. Hiring more workers c. Using specialized equipment d. All of the above 5. Which of the following is not part of PERT? a. Uncertain activity durations. b. A list of activities and precedence relations. c. Activities overlapping with their immediate predecessors. d. A calculation of expected project completion time. 6. Which of the following statements related to decision trees are correct? I The branches emanating from each decision node represent the precedence relationships between decision alternatives. II The sum of probabilities of each state of nature (outcome) branch emanating from a given event node must be equal to one. III Nodes of a decision tree can be ordered arbitrarily. a. b. c. d. Only I Only II I and II I, II and III 8 Consider the following for Questions 7 - 11. The Big Ten Company (BTC) is considering expanding production to meet increases in demand. BTC has three alternatives, and the payoffs for each alternative under various market situations are presented in the table below: Payoff Table (profit in $1000s) Market Situations A B C Alternative 1 100 120 180 Alternative 2 200 100 60 Alternative 3 120 140 120 7. If BTC takes a conservative approach, the choice will be: a. alternative 1 and/or 2. b. alternative 1. c. alternative 2. d. alternative 3. 8. Which one of the following is correct? a. The regret for alternative 3 under state A is 100. b. The regret for alternative 3 under state B is 40. c. The maximum regret for alternative 3 is 140. d. The maximum regret for alternative 3 is 80. 9. Under Minimax regret approach, BTC should select: a. alternative 1. b. alternative 2. c. alternative 3. d. alternative 2 and/or alternative 3. For questions 10 and 11, refer to the above payoff matrix, and suppose the probabilities for the three market situations A, B, and C are 0.3, 0.5, and 0.2, respectively. 10. To maximize the expected profit, BTC should select: a. alternative 1. b. alternative 2. c. alternative 3. d. alternative 2 and/or alternative 3. 11. Suppose BTC could hire a consultant who could predict the future with 100% accuracy. Which one of the following is correct? a. With such perfect information, BTC’s expected payoff would be 130. b. BTC would be willing to pay at most $44 to the consultant. c. The value of the perfect information provided by the consultant is 36. d. The information provided by the consultant will not increase BTC’s expected profit. 9 12. Which one of the following is correct about goal programming models? a. In a goal-programming model with preemptive priorities, we always permit tradeoffs between higher and lower level goals. b. There can only be one goal at each priority level. c. Deviation variables represent the difference between the target value for the goal and the level achieved. d. The priority levels of the goals are represented in the goal equations. 13. The Royal Seas Company wants to run TV ads promoting its Caribbean cruises to high-income men, high-income women, and retirees. The company is considering four ad campaigns, namely A, B, C, D, and would like to select a campaign with the objectives of minimizing the cost of the campaign, and maximizing estimated exposures to the target audience. Campaign A B C D Total Cost ($) 130,000 120,000 80,000 90,000 Estimated exposures to the target audience 7 million 8 million 2 million 1 million The Royal Seas Company can eliminate from consideration campaigns: a. A and B b. B and C c. C and D d. A and D 10 Consider the following for Questions 14, 15 and 16. The Lofton Company, a distributor of exercise equipment, wants to decide on how many units to order from two of the most popular models. The company has developed the following linear program to maximize its profits, but found out that it is infeasible. x = Number of units to be ordered from model 1 y = Number of units to be ordered from model 2 Max s.t. Storage constraint Budget constraint Demand constraint 5x + 3y 2x 2x x + + + x, y 3y y y 10 24 16 0 In revision, Lofton drops the original objective and establishes the following three goals in order of importance: Priority 1, Goal 1: Don’t exceed 10 in the storage constraint. Priority 2, Goal 2: Don’t exceed 24 in the budget constraint. Priority 3, Goal 3: Don’t fall short of 16 in the demand constraint. Let di+ be the over-achievement of goal i, and let di- be the under-achievement of goal i. 14. Converting the inequality 2x + y 10 into a goal equation will result in the following: a. 2x + y + d1+ - d1- = 10 b. 2x + y + d1- - d1+ = 10 c. 2x + y + d1- - d1+ 10 d. 2x + y + d1+ - d1- 10 15. Which one of the following is the goal equation for goal 3? a. x + y + d3+ - d3- = 16 b. x + y + d3- - d3+ = 16 c. x + y + d3+ = 16 d. x + y - d3- = 16 16. What will be the new objective function? a. Min P1 (d1-) + P2 (d2-) + P3 (d3+ ) b. Max P1 (d1-) + P2 (d2-) + P3 (d3+ ) c. Min P1 (d1+) + P2 (d2+) + P3 (d3- ) d. Min P1 (d1+) + P1 (d2+) + P2 (d3- ) 11