Form RA/6 - Carleton University

advertisement

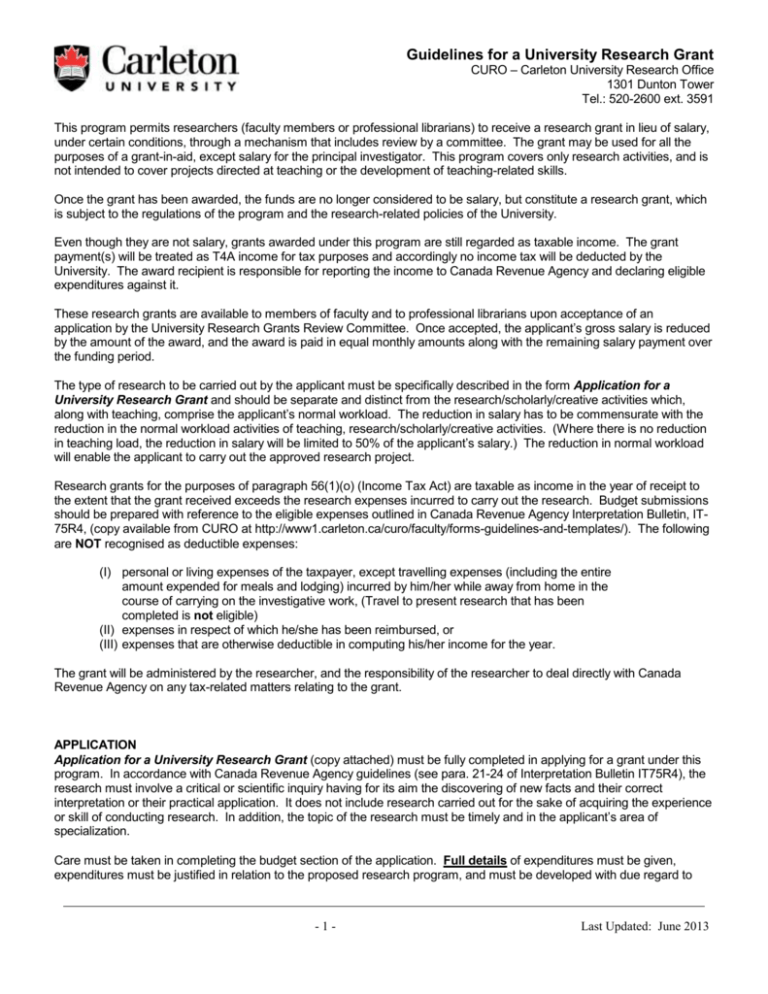

Guidelines for a University Research Grant CURO – Carleton University Research Office 1301 Dunton Tower Tel.: 520-2600 ext. 3591 This program permits researchers (faculty members or professional librarians) to receive a research grant in lieu of salary, under certain conditions, through a mechanism that includes review by a committee. The grant may be used for all the purposes of a grant-in-aid, except salary for the principal investigator. This program covers only research activities, and is not intended to cover projects directed at teaching or the development of teaching-related skills. Once the grant has been awarded, the funds are no longer considered to be salary, but constitute a research grant, which is subject to the regulations of the program and the research-related policies of the University. Even though they are not salary, grants awarded under this program are still regarded as taxable income. The grant payment(s) will be treated as T4A income for tax purposes and accordingly no income tax will be deducted by the University. The award recipient is responsible for reporting the income to Canada Revenue Agency and declaring eligible expenditures against it. These research grants are available to members of faculty and to professional librarians upon acceptance of an application by the University Research Grants Review Committee. Once accepted, the applicant’s gross salary is reduced by the amount of the award, and the award is paid in equal monthly amounts along with the remaining salary payment over the funding period. The type of research to be carried out by the applicant must be specifically described in the form Application for a University Research Grant and should be separate and distinct from the research/scholarly/creative activities which, along with teaching, comprise the applicant’s normal workload. The reduction in salary has to be commensurate with the reduction in the normal workload activities of teaching, research/scholarly/creative activities. (Where there is no reduction in teaching load, the reduction in salary will be limited to 50% of the applicant’s salary.) The reduction in normal workload will enable the applicant to carry out the approved research project. Research grants for the purposes of paragraph 56(1)(o) (Income Tax Act) are taxable as income in the year of receipt to the extent that the grant received exceeds the research expenses incurred to carry out the research. Budget submissions should be prepared with reference to the eligible expenses outlined in Canada Revenue Agency Interpretation Bulletin, IT75R4, (copy available from CURO at http://www1.carleton.ca/curo/faculty/forms-guidelines-and-templates/). The following are NOT recognised as deductible expenses: (I) personal or living expenses of the taxpayer, except travelling expenses (including the entire amount expended for meals and lodging) incurred by him/her while away from home in the course of carrying on the investigative work, (Travel to present research that has been completed is not eligible) (II) expenses in respect of which he/she has been reimbursed, or (III) expenses that are otherwise deductible in computing his/her income for the year. The grant will be administered by the researcher, and the responsibility of the researcher to deal directly with Canada Revenue Agency on any tax-related matters relating to the grant. APPLICATION Application for a University Research Grant (copy attached) must be fully completed in applying for a grant under this program. In accordance with Canada Revenue Agency guidelines (see para. 21-24 of Interpretation Bulletin IT75R4), the research must involve a critical or scientific inquiry having for its aim the discovering of new facts and their correct interpretation or their practical application. It does not include research carried out for the sake of acquiring the experience or skill of conducting research. In addition, the topic of the research must be timely and in the applicant’s area of specialization. Care must be taken in completing the budget section of the application. Full details of expenditures must be given, expenditures must be justified in relation to the proposed research program, and must be developed with due regard to -1- Last Updated: June 2013 Guidelines for University Research Grant page 2 of 3 economy of funds. APPLICATIONS WHICH DO NOT PROVIDE SUFFICIENT DETAIL WILL BE RETURNED TO THE APPLICANT. Approved grants are normally paid during a single calendar year, and expenditures incurred should primarily fall in that same calendar year. Paragraph 33 of IT-75R4 states: 34. Paragraph 56(1)(o) provides that, in order for research expenses to be deductible from the grant, the research expenses must be incurred in the same year in which the research grant is received. In some cases, research expenses may be incurred in the year immediately before or immediately after the year in which the grant is received. While those expenses cannot be deducted in the year in which they are incurred, they are considered to be deductible in the year in which the grant is received. However, for any expenses incurred in the year before the grant is received, those expenses incurred before the taxpayer is notified that the grant will be paid are not deductible from that grant. Research expenses incurred more than one year before or more than one year after, the year in which the grant is received are not deductible from that grant. These provisions should be borne in mind in deciding on the grant period. TRAVEL Travel costs will be allowable for purposes essential to the research outlined. Travel to present research that has been completed is not eligible. The nature and limits of travel expenditures must conform to the University’s travel policy. According to Revenue Canada guidelines, researchers may claim only their own expenses of travelling between their home and the place at which they sojourn (temporarily reside) while engaged in research work, provided that such travel is essential to the research. Travelling expenses of spouses and children may not be claimed. Researchers are not permitted to claim their own personal and living expenses, including meals and lodging, while sojourning (temporarily residing) in a place while engaged in research; however, researchers are entitled to claim expenses for meals and lodging while on brief field trips in connection with their research. Personal moving expenses are not allowable under this program. Note particularly paragraph 33 of the Canada Revenue Agency Taxation Bulletin IT-75R4, (copy available from CURO at http://www1.carleton.ca/curo/faculty/forms-guidelines-and-templates/). PAYMENT OF RESEARCH PERSONNEL Payments to individuals from the grant may be subject to statutory deductions such as income tax, unemployment insurance and Canada Pension Plan premiums. Advice on payments to individuals may be obtained from the Payroll Office. No salary payments may be made to the applicant. EQUIPMENT Ownership of equipment purchased with funds awarded through this program vests in the individual. Purchase of this equipment is a personal transaction, and the Director of Finance has, therefore, indicated that these purchases should not be made through the University’s Purchasing Department. SUBMISSION AND ADJUDICATION One original application should be submitted to the chair/director. The chair/director and faculty dean will approve it in accordance with the following criteria: 1. The topic of the research is timely and in the applicant’s area of specialization. 2. The research will be of benefit to the University. 3. The budget request appears reasonable and justifiable. 4. The amount of the research grant requested is reasonably commensurate with the value of the reduction in the normal workload of the applicant. Assessment and review of applications will be made by a committee normally comprising the Faculty Deans and the VicePresident (Research and International). Applications will be assessed on the basis of the quality of the proposal, its description and justification, the justification of the budget in relation to the proposal, and the applicant’s past research record. -2- Last Updated: June 2013 Guidelines for University Research Grant page 3 of 3 Application deadlines are: the first of February, May, August, and November. The applicant and chair/director will be advised of the results of the Committee’s review by letter. If the applicant accepts the Committee’s decision, a letter formally requesting reduction of the salary payment will be forwarded to the Director of Finance before the grant payments are to begin. TAX INFORMATION The researcher is not required to submit an accounting for these funds to the University, but since it is the responsibility of the researcher to support claims for deductions to Canada Revenue Agency, researchers should keep detailed records of research expenditures. Receipts should be retained in the event that substantiation is requested by Canada Revenue Agency. The University is unable to provide any tax information in addition to Interpretation Bulletin IT-75R4. Requests for additional information should be directed to Canada Revenue Agency. LEAVING THE UNIVERSITY If, at any time during the term for which the grant has been made, the grantee ceases to be a member of the University, and his or her salary ceases, the grant arrangement will terminate, and the salary and the grant amount are to be reconciled between the researcher and the University. -3- Last Updated: June 2013 Application Form – University Research Grant CURO – Carleton University Research Office 1301 Dunton Tower Tel.: 520-2600 ext. 3591 * - indicates mandatory field Family Name* Given Names* Department* Telephone* Position* FACULTY* Arts and Social Sciences Engineering and Design Science Public Affairs and Management Short Title of Proposed Research* Total Amount Requested* $ Summary Period during which the research will be carried out Starting* Ending* This application is made in accordance with University Research Grants Policy stated and if an award is granted, I agree to use such funds in compliance with that policy and this application. I will allocate time from my normal workload as agreed with my dean/director/chair in order to carry out the research project described herein. Applicant’s Signature* Date* Attachments: A CV must be attached; including a list of publications and currently active research. A NSERC, SSHRC or CIHR CV is preferable. -1- Last Updated: June 2013 Application for a University Research Grant Family Name PROGRESS REPORT AND OUTLINE OF PROPOSED RESEARCH Applicants are requested to provide the following information (attach extra sheets if necessary). 1. scope and objectives 2. theoretical and practical importance 3. relationship to work done in the field 4. research plans and methods 5. schedule of work to be done 6. report on use of previous awards from University The degree of conciseness and clarity in the description of the proposed research project or program may have a significant influence on the outcome of the application. --------------------------------------------------------------------------------------------------------------------------------------------- -2- Last Updated: June 2013 Application for a University Research Grant Family Name BUDGET FOR THIS PROJECT Amounts Requested a) Salaries of technical and professional assistants b) Stipends to graduate students c) Purchase or rental of equipment d) Materials, supplies and incidentals e) Travel (estimates) f) Others TOTAL _____________________________________________________________________________ DETAILS OF ABOVE (If already in receipt of other research funds, include a budget for your total research program. Please justify the budget items above and indicate the location of the research. The objectives of the budget items must be reasonable in the context of the research outline). RESEARCH SUPPORT, INCLUDING THE PERIOD PRECEDING AND/OR OVERLAPPING THE CURRENT APPLICATION. Title and Type of Support Agency -3- $ Amount/Year Status Years of Tenure Last Updated: June 2013 Application for a University Research Grant Family Name The Chair/Director acknowledges that he/she has reviewed this application. Chair/Director of Department/School Date Recommendation of the Faculty Dean Highly Recommended Recommended Faculty Dean’s Signature Not Recommended Date _____________________________________________________________________________________ Please forward this Application to: CURO – Carleton University Research Office 1301 Dunton Tower Tel: 613-520-2600 ext 3591 -4- Last Updated: June 2013