download420911887

advertisement

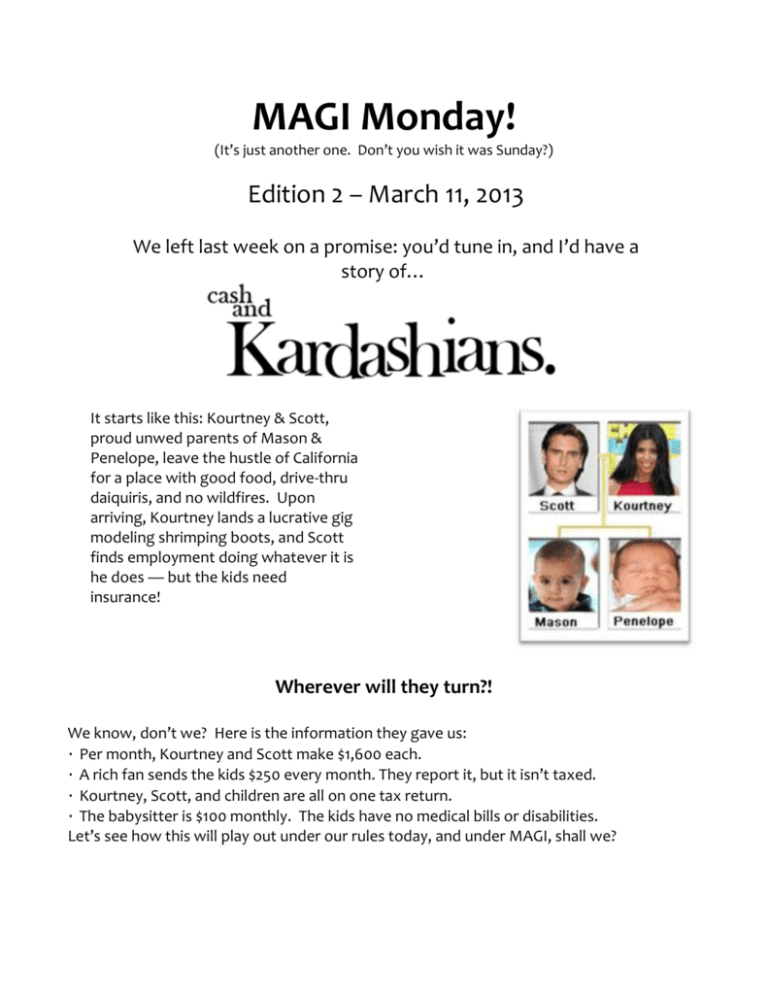

MAGI Monday! (It’s just another one. Don’t you wish it was Sunday?) Edition 2 – March 11, 2013 We left last week on a promise: you’d tune in, and I’d have a story of… It starts like this: Kourtney & Scott, proud unwed parents of Mason & Penelope, leave the hustle of California for a place with good food, drive-thru daiquiris, and no wildfires. Upon arriving, Kourtney lands a lucrative gig modeling shrimping boots, and Scott finds employment doing whatever it is he does — but the kids need insurance! Wherever will they turn?! We know, don’t we? Here is the information they gave us: · Per month, Kourtney and Scott make $1,600 each. · A rich fan sends the kids $250 every month. They report it, but it isn’t taxed. · Kourtney, Scott, and children are all on one tax return. · The babysitter is $100 monthly. The kids have no medical bills or disabilities. Let’s see how this will play out under our rules today, and under MAGI, shall we? Household members Monthly income Monthly deductions Countable income Right now And with MAGI? Four Everyone on the same tax return: also four! $3,200 between the parents Likewise, $3,200 $250 to the kids This isn’t taxed, so it’s not counted. $180—2 working adults ($90 x 2) $100 dependent care $3170 A flat 5% of total, which is $160 $3040 Under MAGI, just like now, the children are eligible in LaCHIP. Had Kourtney and Scott applied as well, without bills or disabilities, we’d still figure their budget using MAGI, and they’d be over limits for LIF-C and regular MNP. Tune in next week for our continuing saga: When a household is torn apart by strife… MAGI Monday! (It’s about to get a little soapy.) Edition 4 – March 25, 2013 Does your job get a bit intense from time to time? In this week’s installment of… ...we’ll learn just how hairy some sorts of employment can be. When last we heard of the Kardashian-Molinere household, they were doing well enough for themselves to exceed the income limits for regular LaCHIP as one big happy family. But just like everything changed the night your Uncle Jim had a few too many at bingo and “commandeered” the fire truck (no shame; we all have that one uncle), catastrophe befalls our intrepid J.P. during one of his forays into the swamp. A particularly peevish alligator, fed up with Big Boy’s continued harassment, takes matters into his own hands and relieves J.P. of one of his with a wellplaced bite. The gator, in the end, gets the worst of it, and a frantic Kourtney rushes J.P. to the emergency room, his recovered hand stowed safely in a gas station ice chest. Well-wishers from every walk of life, even some from Canada, hear of the tragedy and take up a collection to pay the ER bills. Generous, sure, but since not even MMA fighters just ‘shake off’ a gator bite, there’s going to be some follow-up care needed. As you might imagine, Medicaid application is involved. J.P., ever the manly man, doesn’t much consider having a freshly-reattached dominant hand to be a disability, and so doesn’t signal it on the application. He no longer has income, earned or unearned. Kourtney’s deal with LUXE has only made the waders even more popular, and so she is now earning $2,500/mo from her modeling. Scott’s not sending child support, choosing instead to take a sailboat to Hawai’I to “find himself,” and J.P. is valiantly watching the children and Swamp People reruns so Kourtney can work. There are no medical bills, and no other expenses. Briefly, then: Currently Under MAGI Household 4: J.P. is essential person 4: Step-parents, since they’re all filing together Monthly income Kourtney: $2,500, LUXE hipwaders Kourtney: $2,500, LUXE hip-waders Deductions $90 per working person Flat 5% of total, which is $125 Countable income $2,410 $2,375 Sadly, in MAGI as in today’s rules, J.P. cannot qualify for LIF-C due to income. Whatever will he do?!? Without applying for disability-related programs, there is little for J.P. in Medicaid programs. BUT! Under the Affordable Care Act, there is a new provision for those who don’t qualify for any Medicaid assistance, but whose income exceeds 100% but is less than 400% of the Federal Poverty Income Guidelines (FPIG). If you’ve heard of the tax credits available to buy insurance, this may sound familiar. Current FPIG charts show that 100% for a family of 4 is $1,921, and 400% is $7,684. J.P. (and Kourtney as well) could receive advance tax credits to purchase insurance. Come back in April to hear all about it, and the Super Analyst who practically saved the world... MAGI Monday #8 – June 24th, 2013 It’s okay. We all feel this way at times: a little uncertain, a little overwhelmed. Perhaps you found the parable of the Penguins Who File Income Taxes instructive. Or perhaps it made you question the existence of Order and Justice in the universe. Whether inspired or intimidated, I hope you’ll be happy to learn that there are indeed easy, set rules we can use to figure the households of applicants, be they gator wranglers from the swamps of Louisiana or delightfully tuxedoed flightless birds. And you would know, these rules include two things with which we are all familiar: Marriage and taxes. When we have a determination to make for a MAGI group, we’ll figure the household under the new MAGI rules. In this new world, there are three main groups of people to keep in mind: tax filers, tax dependents, and spouses. A MAGI household always has at least one of these people in it, for how indeed could you have a zero person household. As you may have deduced, it is usually the tax filer who will be person #1. But no man is an island, and humans have been pairing off in special ways since time immemorial. In the cases of married couples who live together, the MAGI household will include the spouse of the tax filer. This is true regardless of whether they file jointly or one claims the other as… A tax dependent, which is our third group to include in the MAGI household. I can already hear it now: “Oh how nice! I’m glad I started claiming the pizza delivery man as a tax dependent! We can both get Medicaid!” In deference to the abstract concepts of Order and Justice as mentioned above, the tax dependent category has a few caveats which stop it from resembling a carnival sideshow. Three conditions will stop a person from fitting in as a tax dependent: 1. Being claimed by someone who is not their spouse or parent (natural or legal), 2. Being claimed by a non-custodial parent, or 3. Being claimed by one parent when they live with both parents, who do not file jointly. As far as rules go, this is a fairly simple set that we’ll use to figure our households under MAGI. So how absorbent are you? Let us suppose Adelie and King from last week both file as head of household. Adelie claims Humboldt and Galápagos, King claims Macaroni. Is Galápagos a tax dependent? And yes, you just got pop quizzed... but hey, you’ve a week to think it over. (Make me proud!)