Residential Energy Credits

advertisement

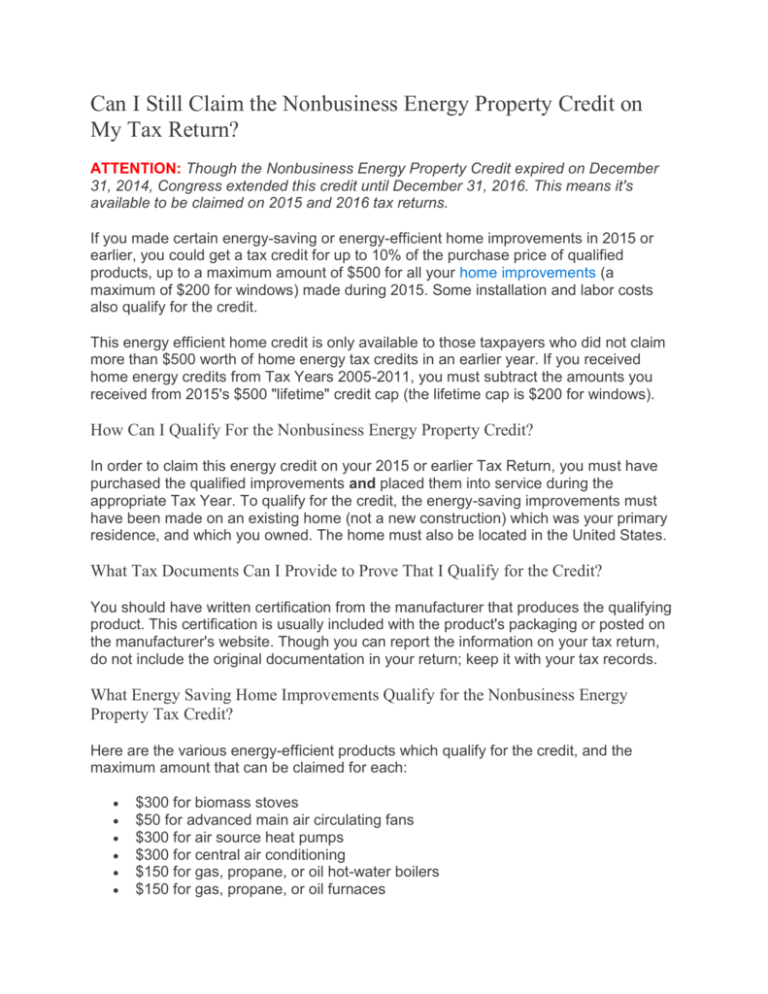

Can I Still Claim the Nonbusiness Energy Property Credit on My Tax Return? ATTENTION: Though the Nonbusiness Energy Property Credit expired on December 31, 2014, Congress extended this credit until December 31, 2016. This means it's available to be claimed on 2015 and 2016 tax returns. If you made certain energy-saving or energy-efficient home improvements in 2015 or earlier, you could get a tax credit for up to 10% of the purchase price of qualified products, up to a maximum amount of $500 for all your home improvements (a maximum of $200 for windows) made during 2015. Some installation and labor costs also qualify for the credit. This energy efficient home credit is only available to those taxpayers who did not claim more than $500 worth of home energy tax credits in an earlier year. If you received home energy credits from Tax Years 2005-2011, you must subtract the amounts you received from 2015's $500 "lifetime" credit cap (the lifetime cap is $200 for windows). How Can I Qualify For the Nonbusiness Energy Property Credit? In order to claim this energy credit on your 2015 or earlier Tax Return, you must have purchased the qualified improvements and placed them into service during the appropriate Tax Year. To qualify for the credit, the energy-saving improvements must have been made on an existing home (not a new construction) which was your primary residence, and which you owned. The home must also be located in the United States. What Tax Documents Can I Provide to Prove That I Qualify for the Credit? You should have written certification from the manufacturer that produces the qualifying product. This certification is usually included with the product's packaging or posted on the manufacturer's website. Though you can report the information on your tax return, do not include the original documentation in your return; keep it with your tax records. What Energy Saving Home Improvements Qualify for the Nonbusiness Energy Property Tax Credit? Here are the various energy-efficient products which qualify for the credit, and the maximum amount that can be claimed for each: $300 for biomass stoves $50 for advanced main air circulating fans $300 for air source heat pumps $300 for central air conditioning $150 for gas, propane, or oil hot-water boilers $150 for gas, propane, or oil furnaces $300 for gas, propane, oil, or electric heat pump water-heaters $500 for energy-efficient doors (installation costs do not count) $500 for energy-efficient skylights (installation costs do not count) $200 for energy-efficient windows (installation costs do not count) $500 for insulation (installation costs do not count) $500 for metal or asphalt roofing (installation costs do not count) Remember that only $500 of all combined qualified costs may be credited.