Case 7 _ Liquid Chemical, Ltd.

advertisement

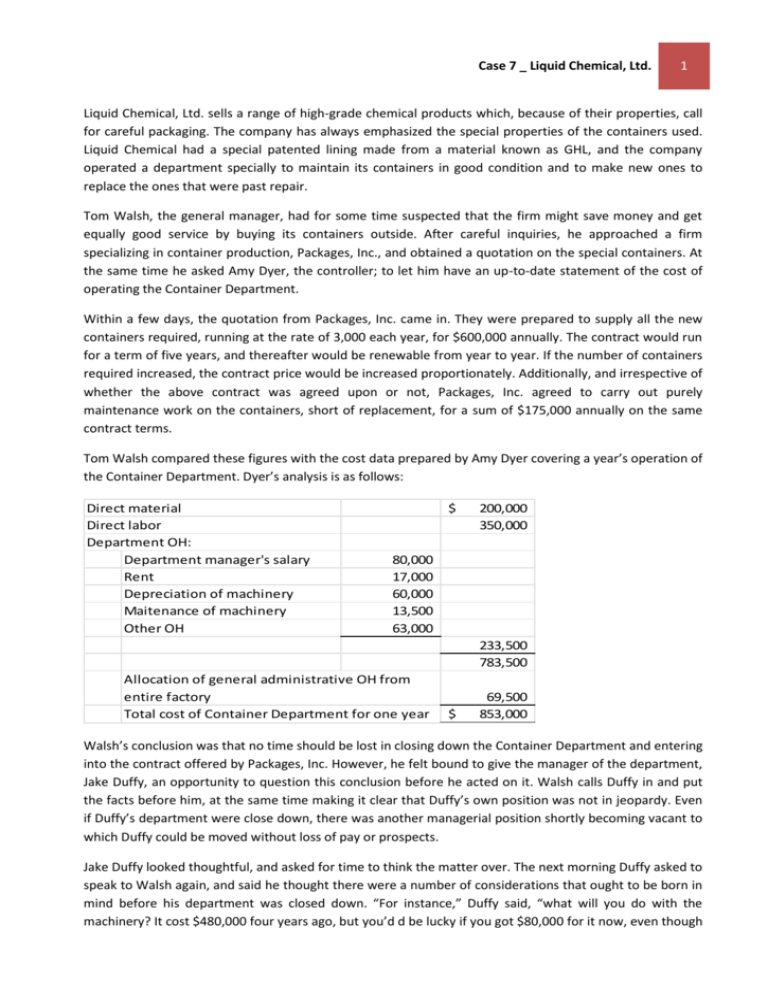

Case 7 _ Liquid Chemical, Ltd. 1 Liquid Chemical, Ltd. sells a range of high-grade chemical products which, because of their properties, call for careful packaging. The company has always emphasized the special properties of the containers used. Liquid Chemical had a special patented lining made from a material known as GHL, and the company operated a department specially to maintain its containers in good condition and to make new ones to replace the ones that were past repair. Tom Walsh, the general manager, had for some time suspected that the firm might save money and get equally good service by buying its containers outside. After careful inquiries, he approached a firm specializing in container production, Packages, Inc., and obtained a quotation on the special containers. At the same time he asked Amy Dyer, the controller; to let him have an up-to-date statement of the cost of operating the Container Department. Within a few days, the quotation from Packages, Inc. came in. They were prepared to supply all the new containers required, running at the rate of 3,000 each year, for $600,000 annually. The contract would run for a term of five years, and thereafter would be renewable from year to year. If the number of containers required increased, the contract price would be increased proportionately. Additionally, and irrespective of whether the above contract was agreed upon or not, Packages, Inc. agreed to carry out purely maintenance work on the containers, short of replacement, for a sum of $175,000 annually on the same contract terms. Tom Walsh compared these figures with the cost data prepared by Amy Dyer covering a year’s operation of the Container Department. Dyer’s analysis is as follows: Direct material Direct labor Department OH: Department manager's salary Rent Depreciation of machinery Maitenance of machinery Other OH $ 200,000 350,000 80,000 17,000 60,000 13,500 63,000 233,500 783,500 Allocation of general administrative OH from entire factory Total cost of Container Department for one year $ 69,500 853,000 Walsh’s conclusion was that no time should be lost in closing down the Container Department and entering into the contract offered by Packages, Inc. However, he felt bound to give the manager of the department, Jake Duffy, an opportunity to question this conclusion before he acted on it. Walsh calls Duffy in and put the facts before him, at the same time making it clear that Duffy’s own position was not in jeopardy. Even if Duffy’s department were close down, there was another managerial position shortly becoming vacant to which Duffy could be moved without loss of pay or prospects. Jake Duffy looked thoughtful, and asked for time to think the matter over. The next morning Duffy asked to speak to Walsh again, and said he thought there were a number of considerations that ought to be born in mind before his department was closed down. “For instance,” Duffy said, “what will you do with the machinery? It cost $480,000 four years ago, but you’d d be lucky if you got $80,000 for it now, even though Case 7 _ Liquid Chemical, Ltd. 2 it’s good for another five years. Then there’s the stock of GHL we bought a year ago. That cost us $300,000. At the rate were using it now, it will last us another three years. We used up about a quarter of it last year. Amy Dyer’s figure of $200,000 for materials probably includes about $75,000 for GHL. But it’ll be tricky stuff to handle if we don’t use it up. We bought well, paying $1,500 a ton for it. You couldn’t buy it today for less than $1,800a ton. But you wouldn’t have more than $1,200 a ton left if you sold it, after you’d covered all the handling expenses. Tom Walsh thought that Amy Dyer ought to be present during this discussion. He asked her to come in and then reviewed Duffy’s points. “I don’t much like all this conjecture,” Dyer said. ‘I think my figures are pretty conclusive. Besides, if we are going to have all this talk about ‘what will happen if’, don’t forget the problem of space we’re faced with. We’re paying $27,500 a year in rent for a warehouse a couple of miles away. If we closed Duffy’s department, we’d have all the warehouse space we need without renting.” “That’s a good point,” said Walsh, ‘though I must say, I’m a bit worried about the employees if we close the Container Department. I don’t think we can find room for any of them elsewhere in the firm. I could see whether Packages, Inc. can take any of them. But some of them are getting on in years. There’s Walters and Hines, for example. They ‘ve been with us since they left school many years ago. Their severance pay would cost us $10,000 a year each, for five years.” Duffy showed some relief at Walsh’s comment. “But I still don’t like Amy’s figures,” he said. “What about this $69,500 for general office if I’m closed down, do you?” “Probably not,” said Dyer, “but someone has to pay for these costs. We can’t ignore them when we look at an individual department, because if we do that with each department in turn, we’ll wind up by convincing ourselves that general managers, accountants, typists, and the like, don’t have to be paid. And they do, believe me.” “Well, I think we’ve thrashed this out pretty fully,” said Walsh, “but I’ve been wondering about the possibility of perhaps keeping on the maintenance work ourselves. What are your views on that, Duffy?” “I don’t know,” said Duffy, “but it’s worth looking into. We shouldn’t need any machinery for that, and I could hand the management over to a department supervisor. You’d save about $20,000 a year there. You’d only need about one-fifth of the employees, but you could keep the oldest. You wouldn’t save any space, so I suppose the rent would be the same. I shouldn’t think the other overhead expenses would be more than $26,000 a year.” “What about materials?” asked Walsh. “We use about 10% of the total on maintenance,” Duffy replied. “Well, I’ve told Packages, Inc. that I’d let them know my decision within a week,” said Walsh. “I’ll let you know what I decide to do before I write to them.” Required: What action should be taken? Liquid Chemical’s tax rate is 40%, and its after-tax hurdle rate is 10%. The company uses straight-line depreciation for tax purposes. (Ignore the half-year convention.) The depreciation expense in each year of the next four years is $60,000. The equipment will be fully depreciated after four more years. You will have to seek out the information you need from the remarks of Walsh, Dyer, and Duffy. In some cases, you will have to interpret their remarks and make assumptions. State all your assumptions clearly when answering the above question.