Instructions Sheet

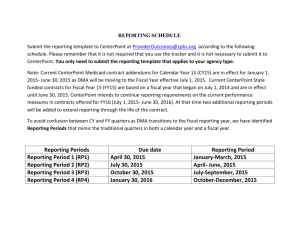

advertisement

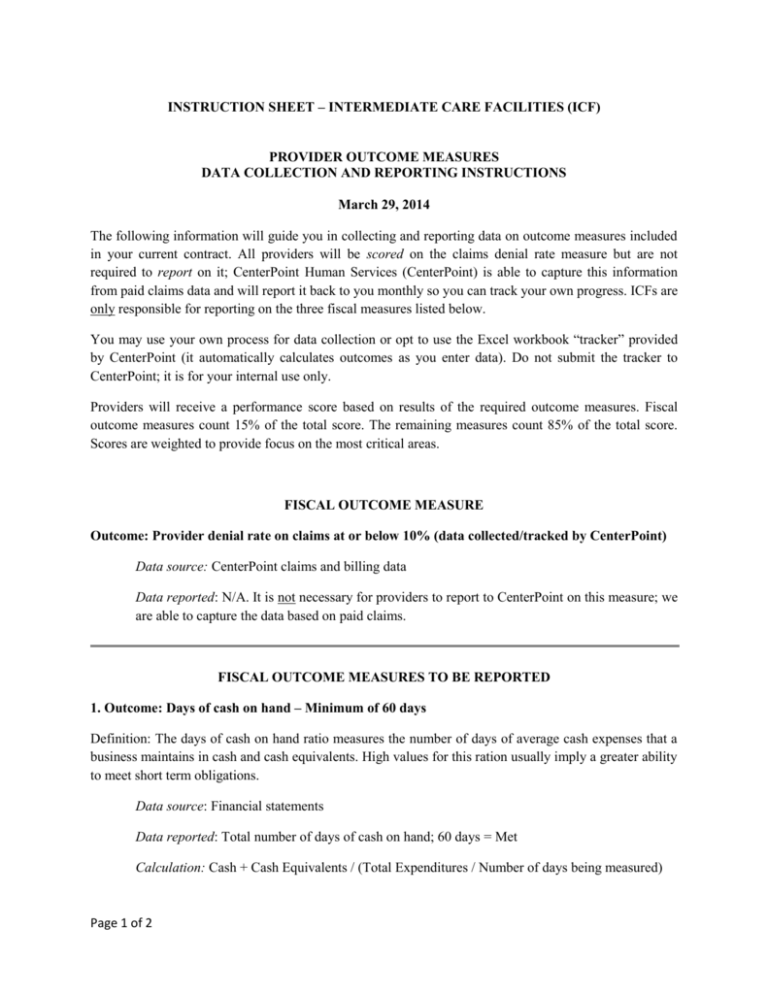

INSTRUCTION SHEET – INTERMEDIATE CARE FACILITIES (ICF) PROVIDER OUTCOME MEASURES DATA COLLECTION AND REPORTING INSTRUCTIONS March 29, 2014 The following information will guide you in collecting and reporting data on outcome measures included in your current contract. All providers will be scored on the claims denial rate measure but are not required to report on it; CenterPoint Human Services (CenterPoint) is able to capture this information from paid claims data and will report it back to you monthly so you can track your own progress. ICFs are only responsible for reporting on the three fiscal measures listed below. You may use your own process for data collection or opt to use the Excel workbook “tracker” provided by CenterPoint (it automatically calculates outcomes as you enter data). Do not submit the tracker to CenterPoint; it is for your internal use only. Providers will receive a performance score based on results of the required outcome measures. Fiscal outcome measures count 15% of the total score. The remaining measures count 85% of the total score. Scores are weighted to provide focus on the most critical areas. FISCAL OUTCOME MEASURE Outcome: Provider denial rate on claims at or below 10% (data collected/tracked by CenterPoint) Data source: CenterPoint claims and billing data Data reported: N/A. It is not necessary for providers to report to CenterPoint on this measure; we are able to capture the data based on paid claims. FISCAL OUTCOME MEASURES TO BE REPORTED 1. Outcome: Days of cash on hand – Minimum of 60 days Definition: The days of cash on hand ratio measures the number of days of average cash expenses that a business maintains in cash and cash equivalents. High values for this ration usually imply a greater ability to meet short term obligations. Data source: Financial statements Data reported: Total number of days of cash on hand; 60 days = Met Calculation: Cash + Cash Equivalents / (Total Expenditures / Number of days being measured) Page 1 of 2 2. Outcome: Current ratio of 1.0 Definition: The current ratio is used to measure liquidity. The value of the current ratio measures the number of dollars held in current assets per each dollar of current liabilities. High values for this imply good ability to pay short–term obligations. Data source: Financial statements Data reported: Ratio; 1.0 =Met Calculation: Current assets / Current liabilities 3. Outcome: Long-term debt to net assets ratio – Maximum ratio of 2.5:1 Definition: The long term debt to net assets ratio is used to measure the company’s assets that are financed with loans and financial obligations lasting more than one year. The ratio provides a general measure of the financial position of the company, including its ability to meet financial requirements for outstanding loans. A year-over-year decrease in this metric would suggest the company is progressively becoming less dependent on debt to grow their business. Data source: Financial statements Data reported: Ratio; 2.5:1 = Met Calculation: Long term debt / Total Net Assets REPORTING SCHEDULE Submit the reporting template to CenterPoint at ProviderOutcomes@cphs.org according to the following schedule. To simplify data collection, CenterPoint provided a “tracker” that automatically calculates outcomes as you enter the data. You may use this option or your own process. Please remember that it is not required that you use the tracker and it is not necessary to submit it to CenterPoint. You only need to submit the reporting template type that applies to your agency. CY * / QUARTER CY 14 Quarter 1 CY 14 Quarter 2 CY 14 Quarter 3 CY 14 Quarter 4 * CY = Calendar Year Page 2 of 2 DUE DATE April 15, 2014 July 15, 2014 October 15, 2014 January 15, 2015 REPORTING PERIOD February - March 2014 April – June 2014 July – September 2014 October – December 2014