job opportunity - North Peace Savings and Credit Union

advertisement

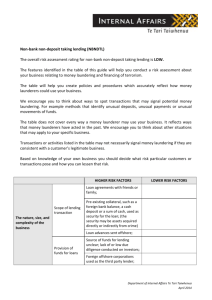

Role Description Business Account Manager Trainee Location: Fort St John Closing date: January 8, 2015 Service Center Overview Business Solutions builds rewarding relationships with neighborhood/community business leaders and members to provide comprehensive financial services to address and exceed the business and business needs of members and prospects. A dedicated, comprehensive and holistic approach provides financial and industry expertise, creative ideas and solutions to enhance member value. Business Solutions provides comprehensive financial services to deal with every member’s business requirements. Summary The primary purpose of this position is to assist North Peace Savings and Credit Union in living out our corporate Mission, “Helping our members succeed in life.” and our Service Mission, “To build rewarding relationships through a superior service experience”, by delivering outstanding service to both internal and external members. A key element of excellent service is to identify the financial needs of each member and recommend an appropriate credit union solution. Reporting to the Senior Manager, Business Solutions, this is a developmental position, designed to introduce and fully develop the concepts, skills and experience necessary to advance to a Business Account Manager position within twelve to eighteen months within North Peace Savings and Credit Union. Development will include, but not be limited to in-house training, direct coaching, external training, off-site training and self-study as outlined in North Peace Savings Business Account Manager Trainee Program. Key Responsibilities Deliver service to both internal and external members that is in alignment with the credit union’s Service Promises. o I promise to be respectful in every interaction. o I promise to do it right the first time. o I promise to deliver more than expected. o I promise to keep it simple and easy. o I promise to provide innovative solutions. o I promise to create a positive and memorable experience. o I promise to significantly improve your financial life. Meets all sales goals as established. Meets all established service goals as measured by the internal programs (ie internal service survey, success measures etc) It’s your life. Build it here. Sales and Service Management Thorough a coordinated and targeted marketing plan, identify and initiate contact with members, partners, community leaders, centers of influence (COI) and prospects to close deals and strengthen, protect and grow the business book. Maintain an ongoing sales pipeline and effectively follows up on unsuccessful referrals/prospects. Focus on the highest quality member service, ensuring alignment with overall North Peace Savings and Credit Union and business goals and objectives. Supports the credit union’s business strategy through the provision of agricultural lending services to existing and potential members and by developing and maintaining effective member relationships. Analyzing financial statements, evaluating security, establishing loan terms and interest rates relative to risk, the needs of the borrower and the costs of administration. Negotiating all terms of credit and appropriately assess risk in the relationship. Approving commercial loans within lending limits and recommending loan applications to the Senior Manager, Business Solutions. Monitoring Business Loans in assigned portfolio; ensuring adherence to established policies, procedures, checks and balances. Suggest, recommend and/or propose products/solutions to meet those needs and the member’s broader business objectives. Ensure that member continues to be aware of the benefits of using these products, as well as new products available to them. Continuously update knowledge on new products that may be of value to members Making recommendations on delinquencies to mitigate loss. Gaining expert knowledge in the area of the Investment and Lending Policy. Building a strong working knowledge and excellent analytical skills in the areas of balance sheets, cash flow mechanics, and business plans presented by members. Preparing documentation in relation to business ventures in an accurate and timely manner in accordance and compliance with all corporate policies, procedures and legislative requirements, including security and account operating documentation. Ensuring that members’ day-to-day financial and banking needs are being met at the highest level; partners and refers member to retail, where appropriate Working collaboratively with peers and colleagues throughout the delivery system by learning from the expertise of others and sharing own learning’s, where appropriate Beginning to participate and be involved in community activities or events, promoting North Peace Savings and Credit Union and demonstrating the company values Risk Management and Internal Control Use exceptional financial, industry knowledge and expertise to proactively assess and anticipate member’s needs to suggest recommend and/or propose products/solutions to meet those needs and the member’s broader business objectives. Ensure that member continues to be aware of the benefits of using these products, as well as new products available to them. Continuously update knowledge on new products that may be of value to members. It’s your life. Build it here. Structure, negotiate and document complex credit and cash management arrangements with segment members and prospects. Negotiate all terms of credit and appropriately assess risk in the relationship. Demonstrate a strong working knowledge and excellent analytical skills in the areas of balance sheets, cash flow mechanics, and business plans presented by members. After appropriate due diligence, prepare and recommend credit renewal/amendment/new business applications, submitting those exceeding individual lending limits to the appropriate lending authority. Minimize loan risks through diligent, timely and proactive financial reviews and awareness of changing economic/marketplace influences and applicable industry trends/data Proactively manage high-risk loans, developing risk issues and changing credit needs through communication with internal partners to restructure deals, remediate risks and minimize loss. Ensures all documentation in relation to business ventures are completed and submitted in an accurate and timely manner in accordance and compliance with all corporate policies, procedures and legislative requirements, including security and account operating documentation. Teamwork and Organizational Contribution Works collaboratively with peers and colleagues throughout the delivery system by sharing best practices and learning’s, where appropriate. Participate and be involved in community activities or events, promoting North Peace Savings and Credit Union and demonstrating the company values. Decision Making and Freedom to Act Works under broad managerial direction with little functional guidance, work is highly complex and involved; makes significant functional or operational decisions which require broad conceptual judgment and which may affect future policy. Contacts and Working Relationships: Members Senior Manager, Business Solutions Assigned Mentor Business Team Credit Adjudication Department Credit Underwriters Retail Solutions Team Support Services Team Financial Planning Team Employee Development Specialist Other Internal and External Subject Matter Experts It’s your life. Build it here. Required Knowledge, Skills & Abilities Sales management skills and service focus with an aptitude for business development and relationship building. Ability to work independently with confidence demonstrating dedication to providing quality member sales and service. Excellent communication and interpersonal skills. Demonstrates leadership ability and team development skills. Strong attention to detail and documentation. Accounting, business planning, budgeting and financial management skills. Extensive knowledge of North Peace Saving Credit Union products, policies and procedures. Ability to develop strong analytical, relationship, interpersonal, communication, presentation and team skills. Good business acumen coupled with a demonstrated ability to initiate action to achieve results and meet deadlines while respecting fundamental corporate values. Ability to interact at any level within the organization and in a business development capacity within the community. Advanced knowledge of credit union technology and computer application skills; computer literate in a windows environment. Ability to develop good knowledge of segment, strategies, structure, as well as its lending and deposit products and services. Strong commitment to continuous learning and advancement. Proven ability to be creative and innovative. Entrepreneurial mindset. Ability to work in normal business environment as well as flexible to work evenings and/or attend community events. Travel may be required to meet member need’s Education & Experience Completed or working towards post-secondary education in accounting, finance, commerce, business administration, Agriculture business or equivalent work experience Exceptional demonstrated ability to analyze financial statements and understand aspects of lending such as project financing, market/industry analysis, and cash management, etc. Has a strong direction of equipment financing as well as a clear and thorough understanding of the agricultural industry. Quantitative Standards The incumbent will be expected to achieve the following standards within a 12 - 18 month period. Full completion and meeting expectations of the Training Program Credits per month 18 to 25 including annual reviews Interviews per month 22 to 30 Relationships 240 to 280 Authorized portfolio $32 to $36 million It’s your life. Build it here. Average size credit $115,000 New Business $5 to $7 million/annum net of run off Application fees $50,000/annum Marketing calls per month 4 to 6 Delinquency standards < 1.00% Cross sells and insurance per month 5 to 7 Referrals 3 to 5 Insurance sales 6 to 9 Work Schedule The Business Account Trainee will be responsible for working an 8am -5pm work schedule This role description duties may be added, removed or changed from time to time. Department: Position Reporting to: Base Salary Range: Status: Business Solutions Senior Manager, Business Solutions G ($24.71 - $30.89) Full Time (40 hours per week) Last Revised: December 15, 2015 Approved by: Dave DeVos If interested please remit cover letter and resume in confidence to Olivia Young at careers@npscu.ca on or before January 8, 2016 It’s your life. Build it here.