C31CM_C4 - Heriot

advertisement

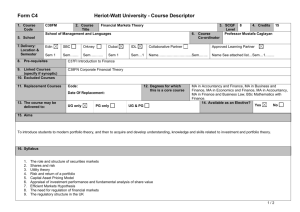

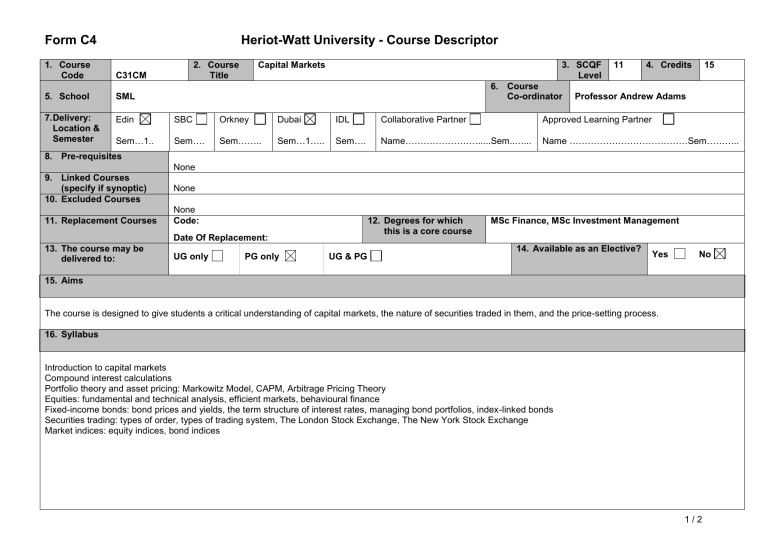

Form C4 Heriot-Watt University - Course Descriptor 1. Course Code C31CM 2. Course Title Capital Markets 3. SCQF Level 5. School SML 7. Delivery: Location & Semester Edin SBC Orkney Dubai IDL Collaborative Partner Approved Learning Partner Sem…1.. Sem…. Sem…….. Sem…1….. Sem…. Name…………………….....Sem..…... Name …………………………………Sem……….. 6. Course Co-ordinator 11 4. Credits 15 Professor Andrew Adams 8. Pre-requisites None 9. Linked Courses (specify if synoptic) 10. Excluded Courses 11. Replacement Courses None None Code: 12. Degrees for which this is a core course Date Of Replacement: 13. The course may be delivered to: UG only PG only UG & PG MSc Finance, MSc Investment Management 14. Available as an Elective? Yes No 15. Aims The course is designed to give students a critical understanding of capital markets, the nature of securities traded in them, and the price-setting process. 16. Syllabus Introduction to capital markets Compound interest calculations Portfolio theory and asset pricing: Markowitz Model, CAPM, Arbitrage Pricing Theory Equities: fundamental and technical analysis, efficient markets, behavioural finance Fixed-income bonds: bond prices and yields, the term structure of interest rates, managing bond portfolios, index-linked bonds Securities trading: types of order, types of trading system, The London Stock Exchange, The New York Stock Exchange Market indices: equity indices, bond indices 1/2 Form C4 Heriot-Watt University - Course Descriptor 17. Learning Outcomes (HWU Core Skills: Employability and Professional Career Readiness) Subject Mastery Understanding, Knowledge and Cognitive Skills Personal Abilities Scholarship, Enquiry and Research (Research-Informed Learning) understand the purpose of capital markets critically evaluate portfolio theory and basic asset pricing models know the principles of the valuation of equities and bonds; be able to apply certain analytical techniques regarding equities and bonds; understand the sources of bond risk and the factors affecting bond prices; understand the procedures for trading securities in international markets, in particular New York and London know the principles employed in constructing capital market indices. Industrial, Commercial & Professional Practice Autonomy, Accountability & Working with Others Communication, Numeracy & ICT understand the context within which market professionals work; have some familiarity with the main capital markets and instruments traded therein; have some familiarity with the investment industry; understand the role of the various institutions involved in capital markets; be able to write a coherent essay in a way which demonstrates that they have understood the material demonstrate the ability to learn independently manage time, work to deadlines and prioritise workloads 18. Assessment Methods Method 19. Re-assessment Methods Duration of Exam Weighting (%) Synoptic courses? Method (if applicable) Exam Coursework 2 hours Duration of Exam Diet(s) (if applicable) 80% 20% Exam 2 hours 20. Date and Version Date of Proposal March 2013 Date of Approval by School Committee March 2013 Date of Implementation September 2013 Version Number 2/2 1