2. (a) F has established a herd of deer that she keeps

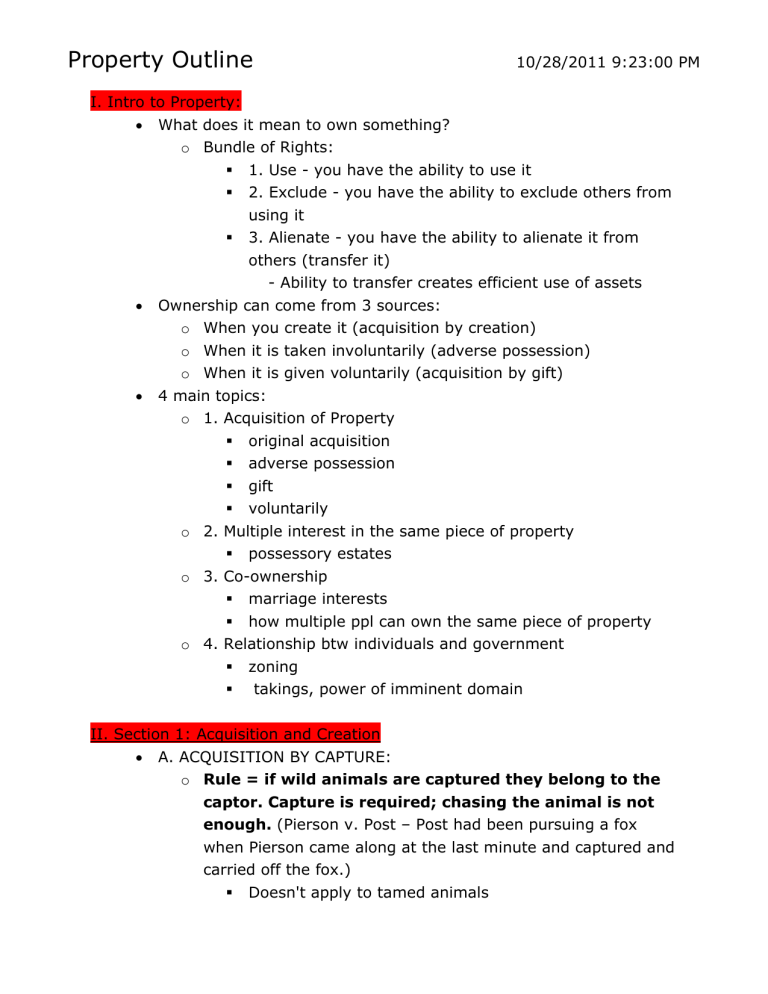

Property Outline

10/28/2011 9:23:00 PM

I. Intro to Property:

What does it mean to own something? o Bundle of Rights:

1. Use - you have the ability to use it

2. Exclude - you have the ability to exclude others from using it

3. Alienate - you have the ability to alienate it from others (transfer it)

- Ability to transfer creates efficient use of assets

Ownership can come from 3 sources: o When you create it (acquisition by creation) o When it is taken involuntarily (adverse possession) o When it is given voluntarily (acquisition by gift)

4 main topics: o 1. Acquisition of Property

original acquisition

adverse possession

gift

voluntarily o 2. Multiple interest in the same piece of property

possessory estates o 3. Co-ownership

marriage interests

how multiple ppl can own the same piece of property o 4. Relationship btw individuals and government

zoning

takings, power of imminent domain

II. Section 1: Acquisition and Creation

A. ACQUISITION BY CAPTURE: o Rule = if wild animals are captured they belong to the captor. Capture is required; chasing the animal is not

enough. (Pierson v. Post – Post had been pursuing a fox when Pierson came along at the last minute and captured and carried off the fox.)

Doesn't apply to tamed animals

2 o Rule = (First in Time Rule) The first to physically

capture/kill wild animals gets the title (Pierson v. Post)

Dissent: CONSTRUCTIVE POSSESSION: Post's pursuit put him in constructive possession of the fox. The pursuit of the fox has the same effect as actual possession; he had the right to possession even though it was not yet actual possession esp. b/c Post expended much more effort and labor in pursuing the fox. o Rule = custom/trade usage is sufficient when:

Its application is limited to the industry and those working in it

The custom is recognized by the whole industry

The custom requires in the 1st taker the only act of appropriation that is possible

The custom is necessary to the survival of the industry o

The custom works well in practice (Ghen v. Rich – P is a whales-man that captures whales by marking them w/a bomb lance. Someone else found one of P’s whales and sold it at auction.)

Rule = Interference by a non-competitor: if someone hinders another trade, he is liable for not allowing

another to practice his trade freely. (Keeble v. Hickeringll

- P owns land which contains a decoy pond to attracts wild game and D shot guns near the decoy pond for the purpose of interfering with P’s capture operation.)

Rationale: Society wants the animals caught; promotes killing not conservation of wildlife which is the goal at this time

Productivity of Land

Trade competition is allowed but not malicious intereference o The Rule of capture and other "fugitive" resources

1. Oil and gas - Oil and natural gas commonly collect in reservoirs that underlie many acres of land owned by

3 many different people. The resources have a fugitive character in that they wander from place to place.

When problematic situations arose about ownership of oil and gas the courts likened the resources to wild animals b/c of their fugitive nature.

"minerals ferae naturae" = have the power and tendency to escape w/o the volition of the owner – similar to animals

this type of thinking was overruled b/c it denies society at large the benefits of economical underground storage

2. Water - The rule of capture has played a formative role in the case of water

i. Absolute Ownership Doctrine: Allowed each landowner to withdraw freely w/o regard to effects on neighbors

ii. Reasonable Use Doctrine: wasteful uses of water, if they harm neighbors, were considered unreasonable and hence unlawful

Western US = first in time or prior appropriation is used in the West where water is not an abundant resource

the person who captures the water 1st and puts it to reasonable and beneficial use has the superior right to it

Creates externalities b/c once someone starts to capture the water, everyone will rush to use to it so that it is not depleted by just one person

Eastern US = riparian rights are used in the East where water is an abundant resource

each owner of land along a water source

(riparian land) has a right to use the water subject to rights of other riparians o Benefits to the rule of capture:

4

low transaction costs

easy to implement b/c the parties know what's involved

clear rules are nice when there is a small amount of money at stake because you don't want to spend a lot of money transacting when there is only a small amount of gain to be realized

B. PROBLEM OF THE COMMONS o Externality:

costs, which are external to the decision maker so that they are costs, which are not taken into account which can lead to insufficient use of resources

Decisions are beneficial to the maker but harmful to society

a cost that gets placed elsewhere, costs are pushed out on other people other than the individual b/c the individual only looks at the benefits and not the costs.

This causes people to use resources inefficiently.

Hypo: a factory pollutes the air which is the best for the factory b/c in order to not pollute the air, it would cost them a lot of money and not polluting the air doesn't benefit the factory at all, and the community bears the cost of having to live with unclean air o Problem of the holdout - why should I do it if no one else is going to?

Hypo: Suppose Midway airport wants to build a runway and there are 10 houses in the way which each cost

$100,000. Midway offers each homeowner $140,000 b/c the gain to midway is going to be more than that. 9 out of 10 people say yes and the 10th person holds out and waits for a better offer b/c the 10th person understands that the gain to Midway is much more than

$140,000. o 3 Types of Property Ownership:

1. Communal ownership - a right which can be exercised by all members of the community; the community denies the state or the individual the right

5 to interfere with any person's exercise of communally owned rights

i.e. everyone had the right to put their animals on common property

Problem with the commons is that individuals have incentives to look only at their own private gains, not the gains of the community.

Hypo: There are 100 people that have ownership of a forest w/100 trees. If one person rushes out and cuts down a tree to take it as their own, that person is better off and society is worse off. What is society going to do? Run out and cut down all the trees before someone can take them all.

2 conditions must be met for the problem of the commons to hold:

1. You need to know the information – you need to know what is the best for the community as a whole in order to act accordingly

2. Finite amount of resource (property)

Problems with Communal Property

*Assumes Exhaustible resource of land*

*Assumes sufficient knowledge*

Everyone has access to commons and everyone is likely to be worse off as a result o Individuals with access to commons have incentives only to look at own gain and own costs (private gain/private costs); not benefits for gains to the community as a whole o Communal situations are likely to have many externalities.

2. Private ownership - implies that the community recognizes the right of the owner to exclude others from exercising the owner's private rights

6

Private property makes it easy to internalize the externalities. There are costs associated with internalizing externalities, but doing so is more worthwhile than not doing so.

By internalizing externalities, you look at the cost and benefit and therefore make the best decision, which is what private property forces people to do.

Moving from common property private property has advantages:

1. Internalizes externalities

2. Individuals have incentives to act in a societally beneficial way

3. Cuts down on transaction costs b/c we don't have to negotiate with other people

4. Able to transfer property to the person who is going to value it most highly

5. Allows people to plan prospectively

3. State ownership - implies that the state may exclude anyone from the use of a right as long as the state follows accepted political procedures for determining who may not use state-owned property

C. ACQUISITION BY CREATION: o 1. Property in One’s Ideas and Expressions: General Principles of Intellectual Property

General Rule = If you create something you are essentially first in time and that something is yours to exploit

Rationale: The purpose is to reward labor

Rule = misappropriation or unfair competition -

When a P has by substantial investment created in an intangible thing of value not protected by a patent, copyright, or other intellectual property law, and the D appropriates the intangible at little cost which injures the P and puts the P's continued use of the intangible in jeopardy as a

7

result, an action for misappropriation will lie.

(International News Service v. Associated Press - INS was bribing members of AP to give them gathered news so that INS can publish the news before AP.) -

Rule = In the absence of some recognized right at common law or under the statutes, a man's property is limited to the chattels which embody his invention. Others may imitate at their

pleasure. (Cheney Brothers v. Doris Silk Corp - The P owns a silk shop where he designs patterns and the D copied one of the popular patterns which took business away from P.)

Policy: Imitation promotes business competition – property must be protected by law (patents, copyright) if they are to be safe from imitation

Rule = When copying another's product, it can claim to be equivalent without claiming to be

identical. (Smith v. Chanel - D copied perfume from P and stated in the advertisements that the imitation perfume was the equivalent of the original perfume.) o 2. Property in One’s Person

Rule = Property rights are terminated when biological material is excised so that one cannot bring an action for conversion (wrongful exercise of ownership – must show reasonable expectation

of possession, dominion and control) (Moore v.

Regents of the University of California - P consented to a spleen removal operation and P's spleen was retained for research purposes w/o his knowledge or consent as well as samples of P's tissue and blood which Ds used to establish a pantented cell line which will yield billions of dollars in the future.)

No conversion where P would not have wanted his excised skin/cells anyway

Rule = right to exclude others from property is an

important right which must be protected. (Jacque

v. Steenberg Homes Inc - D was delivering a mobile home to the P and the P told the D not to cut across their land for delivery but D did it anyways.)

Policy: Private landowners should feel confident that wrongdoers who trespass upon their land will be appropriately punished so that they are less likely to resort to self-help remedies.

Rule = One cannot use property rights to injure/harm the rights of others; the right to

exclude is not absolute. (State v. Shack- A farmer attempted to exclude an attorney from speaking to migrant workers living on the land.)

III. Adverse Possession and Gift

A. ACQUISITION BY ADVERSE POSSESSION: o 1. The Theory and Elements of Adverse Possession

A means by which interest in property can be transferred w/o the consent of the prior owner

General Rule = An adverse possessor should be able to obtain property at the time that the statute of limitations has passed

Length of time varies by jurisdiction

Policy: This rule developed b/c of the idea that we should use property efficiently

Punishes unproductive users

Encourages productive users

If someone has been using your land for so long and you haven't noticed, you obviously aren't using your land efficiently

Five Elements of Adverse Possession (Pneumonic: An

Ox Has Carried Cargo)

1. Actual Entry – time of trespass begins the statute of limitations

2. Open and notorious – have to use property as a true owner would and to give notice to the owner

8

9

3. Hostile or adverse – in defiance of the owner/can’t be there with permission

4. Continuous for the Requisite statutory period – to give the owner an appropriate period of time to discover someone on his or her property

To establish continuous possession for the statutory period, an adverse possessor can tack onto her own period of adverse possession any period of adverse possession by her predecessors provided there is privity

5. Claim of title (states differ in what this means – often disputed) – claim of right by the adverse possessor

i. Passive Adverse Possessor - You can only adversely possess property if you are an innocent or good faith trespasser; only then do u have a claim of title

ii. Active Adverse Possessor - You only have a claim of title if you know that the property you are trying to claim is not yours; an aggressive claimant

iii. It doesn't matter which way you do it

iv. A very small number of states require color of title (refers to a claim founded on a written instrument that is for some reason defective and invalid; so that in good faith the adverse possessor believes they own the entire property)

Color of title – defective form of title giving some rights but not all rights, usu. a written instrument which facially looks like you have the right to title

If you have color of title you may be able to show constructive possession for more property than you are actually, physically possessing

10

If you have color of title to the entire property, but you are only improving and cultivating ½ of it, you may be able to claim color of title for the entire property which is dependent upon who else has claim to the property

Rule = To acquire title to real property by adverse possession it must be shown by clear and convincing proof that for at least a statutorily limited amount of time there was an actual occupation under a claim of title. Elements of proof being either that the premises (1) are protected by a substantial enclosure, or are (2)

usually cultivated or improved (Van Valkenburgh v.

Lutz – D was using an un-owned lot for 35 years when

P came along and purchased the lot and wanted D to get his possessions off the lot.)

Rule = Only when there is actual knowledge that the land you are adversely possessing is not yours will the statue of limitations begin running

(Mannillo v. Gorski - D's son made additions and changes to the house including steps and a concrete walk which encroached upon the P's land to the extent of 15 inches.) o 3. The Mechanics of Adverse Possession

Rule = Continuity of possession may be established although the land is used regularly for only a certain period each year. It is not necessary that the occupant should be actually

upon the premises continually. (Howard v. Kunto –

D wanted to tack the time his predecessor owned the land onto his own for purposes of adverse possession but his predecessor only used the land as a summer home.)

Tacking:

11

An adverse possessor may establish continuous possession by tacking onto his time of possession, any period of adverse possession by predecessors in interest so long as there is privity of estate (a possessor voluntarily transferred to a subsequent possessor either an estate in land or physical possession).

An adverse possessor may not tack on a prior period of possession if he has ousted the prior possessor or if the prior possessor abandoned the property.

Tacking could occur by either:

1. Successive adverse possessors

2. Change in ownership o Change in ownership does not destroy adverse possession

Rule = A purchaser may tack the adverse use of its predecessor in interest to that of his own where the land was intended to be included in the deed between them but was mistakenly omitted, if the successive

occupants are in privity. (Howard v. Kunto)

Disabilities:

Look at the statute on pg. 149 – same one on the exam

When the adverse possessor enters the property, if the true owner is a minority, of unsound mind or imprisoned at the time of entry the statute of limitations extends whichever is the longer of 21 years or 10 years added to the time when the disability is removed.

Rationale: Most legislatures think it is unfair for a statute of limitations to run upon a person who is unable to bring a lawsuit; therefore most statutes give an additional period of time to bring an

12 action if the owner is under a disability. However, disability provisions are limited in 2 ways:

1. Only the disabilities specified in the statute can be considered

2. Usually only disabilities of the owner at the time adverse possession begins count

Ways disabilities can be removed:

Reach the age of majority

Declared of sound mind

Released from prison

Disabled owner dies

A disability is immaterial unless it existed at the time when the cause of the action accrued.

You cannot tack successive disabilities, only one disability applies

Rule = Adverse possession does not run against

the government - local, state, or federal (for better or worse)

Rationale: Purpose of this rule is that the state owns its land in trust for all the people, and the gov't should not lose land b/c of the negligence of a few state officers or employees o 3. Adverse Possession of Chattels

Rule = The discovery rule - provides that a cause of action will not accrue until the injured party discovers, or by exercise of reasonable diligence and intelligence should have discovered, facts which form the basis of a cause of action - controls in actions involving the adverse

possession of chattels. (O'Keeffe v. Snyder - P contends that she created 3 paintings which were stolen out of a gallery. She later discovered that the D was in possession of the paintings and the D is claiming title by adverse possession.)

B. ACQUISITION BY GIFT

13 o A gift is a voluntary transfer of property without any consideration. o 3 elements –

(1) Intent – determined by statements and actions of donor

a. The donor must intend to make a gift

(2) Delivery

a. Actual

Physically handing over the gift

b. Constructive

When actual manual delivery is impracticable

The handing over of the means of obtaining possession and control (usually a key)

Rule = small, tangible objects must be handed over for delivery to be

enforced. (Newman v. Bost – P was her lover’s housekeeper. On his death bed, her lover gave her keys to a drawer which contained his life insurance policy.) o You cannot have constructive delivery when actual delivery is possible.

c. Symbolic

Again, where actual manual delivery is impracticable

the handing over of some object that is symbolic of the thing given (most common is an instrument in writing)

Rule = A gift of property evidenced by a written instrument executed by the donor is valid without a manual

delivery of the property. (In re Cohn – A husband wrote a letter stating that he was giving his wife shares of stock in his company for her birthday.)

(3) Accept

a. The donee must accept the gift (hardly ever an issue) o Two types of gifts:

1. GIFT INTER VIVOS - made during the donor's life when the donor is not under any threat of impending death

Once made is irrevocable

a. You can't take the gift back

b. You have no control over how the property is used

2. GIFT CAUSA MORTIS - made in contemplation of immediately approaching death

Revoked if the donor doesn't die

Substitute for a will o Exam Tip: On the exam, determine if the gift is inter vivos or causa mortis by analyzing the intent of the donor. Did the donor intend the donor intend the gift to be irrevocable? the gift to be irrevocable? Or was it made in contemplation of death and to be revoked if death does not ensue? o Rule = Black letter law - if it is practicable you have to actually deliver the gift. If it isn't practicable then you have to deliver the gift either constructively or symbolically.

If you can hand it over, you must

IV. The Land Transaction

A. INTRODUCTION TO BUYING AND SELLING REAL ESTATE o Determine purchase price w/contingencies after inspection o Title insurance – the opinion of the insurer concerning the validity of title, backed by an agreement to make that opinion good if it should prove to be mistaken and loss results as a consequence

You want title insurance b/c it covers things that the abstract or certificate won’t

Does not run with the land

14

15

Developed b/c of the inadequacies and inefficiencies of the public records in protecting private titles

Bought by one premium paid at the time the policy is issued

Premium is based on the amount of insurance purchased:

1. In a homeowner's policy it's the amount of the purchase price of the property

2. In a lender's policy it's the amount of the loan

B. THE CONTRACT OF SALE o 1. Statute of Frauds - sought to make people more secure in their property and their contracts by making deceitful claims unenforceable

Applies to transfers of any interest in real estate

Requires that all land transactions (except leases less than 3 years) need to be in writing and contain:

Identification of the Parties

Signature of bound party (seller)

Description of the property

Sale price or method to determine price

Exception: (where oral agreements can be enforced)

1. Part performance: allows specific enforcement of oral agreements when particular acts have been performed by one of the parties to the agreement o i.e. Pay the contract price, take possession of the property, or improve the property

2. Estoppel: applies when unconscionable injury would result from denying enforcement of the oral contract after one party has been induced by the other seriously to change his position in reliance on the contract

16

Rule = An oral contract for the transfer of interest in land may be enforced despite the Statute of

Frauds if the party seeking specific performance changed his position in reasonable reliance on the contract so that injustice can be avoided only by

specific performance (Hickey v. Green – P and D agreed that P would buy D’s lot. In reliance on this agreement, P sold their house and then D revoked the offer.) o 2. Marketable Title - means the quality of title, which a reasonable person with competent legal advice would be wiling to accept

A title free from reasonable doubt, not free from every doubt

If the seller cannot convey marketable title then the buyer can rescind, however, the fact that there is not marketable title does not mean that the property cannot be sold

If you have a restriction/easement/covenant which would effect marketability of title can still be sold as long as it is contractually negotiated for

Rule = the mere existence of public zoning ordinances do not make titles automatically

unmarketable (Lohmeyer v. Brown - P entered into a contract to buy a lot from D. The contract provided that the D would convey a deed with an abstract of title showing good merchantable title, free and clear of all encumbrances but it showed the building on the lot was in violation of zone ordinances.)

Rule = A party cannot convey good merchantable title if violations of covenants or zoning ordinances exists on the property at the time it is

to be sold. (Lohmeyer v. Brown)

Rule = Private restrictions constitutes an encumbrance rendering the title to land

unmarketable (Lohmeyer v. Brown)

17

Policy: private restrictions are not as easily found as a public restrictions therefore a buyer would have no reason to know of a private restriction

Rule = Title is unmarketable when it poses doubt in the mind of the P and subjects P to possible

litigation (Lomeyer v. Brown) o 3. The Duty to Disclose Defects

The duty can be put on the seller to disclose or the buyer to find out

The duty to be put on the seller to disclose is much more efficient b/c the seller knows much more about the property

Doctrine of Caveat emptor: “Let the buyer beware” - buyer alone is responsible for assessing the quality of a purchase before buying

Under this doctrine there is no obligation for the seller to disclose unless:

1. Fiduciary relationship

2. Conduct which shows active concealment of seller

3. Confidential relationship

no longer prominent

Exception to the Rule of Caveat Emptor = When a condition/defect has been created by the seller that materially impairs the value of the contract and is peculiarly within the knowledge of the seller or unlikely to be discovered by a prudent purchaser exercising due care, the seller has a duty to

disclose. (Stambovsky v. Ackley - P contracted to buy a house from D, which was widely reputed to be possessed by poltergeists.)

Latent Defect Rule = A seller has a duty to disclose when the seller of a home knows of facts materially affecting the value of the property that are not readily observable and

18

are not known to the buyer. (Johnson v. Davis

- The P entered into a contract to buy the D’s home. The D’s knew that the roof leaked but they told the P there were no problems w/the roof.)

Policy: We want to deter this type of behavior by sellers b/c o 1. misrepresentation o 2. unethical bargaining conduct o 3. creates bad transactions b/c good transactions are made by conveying information to both parties

C THE DEED o 1. Warranties of Title

The Deed - a short legal document whose purpose is to transfer title

Description of Tract - A deed must contain a description of the parcel of land conveyed that locates the parcel by describing its boundaries. Customary methods include:

Reference to natural or artificial monuments and, from the starting point, reference to directions and distances (‘metes” and “bounds”).

Reference to a government survey, recorded plat, or some other record.

Reference to the street and number or name of the property.

3 types of deeds: Property is sold in 3 different ways -

1. General warranty deed – warrants title against all defects in title

2. Special warranty deed – contains warranties only against the grantor’s own acts but not the acts of others

3. Quitclaim deed – contains no warranties

Difference btw general and special is not what's covered but when it is covered.

19

General warrants against all defects irrespective of whether the seller was the owner when the error occurred

Blanket protection for all time

Special warrants against defects that occurred only during the time at which I was the owner of the property

Quitclaim deeds don't warrant anything.

Most common at foreclosure sales.

All quitclaim warranties do is transfer the property.

6 Traditional Warranties – Promises or representations that title is as presented at closing and no one will step forward later claiming an undisclosed interest in the property (even if not stated, inferred, unless specifically listed in warranty to exclude)

Present covenants - If a present covenant is breached, it will be breached at the time the property is conveyed. The statute of limitations begins running at the time of the conveyance.

1. A covenant of seisin - The grantor warrants that he owns the estate that he purports to convey

2. A covenant of right to convey - The grantor warrants that he has the right to convey the property.

3. A covenant against encumbrances - the grantor warrants that there are no unexpected encumbrances on the property

Future Covenants - Future covenants can be breached at any point in the future, if this happens the statute of limitations begins running at whatever point in time they are breached.

1. A covenant of general warranty - the grantor warrants that he will defend against lawful claims, and he will compensate the

20 grantee for any loss that the grantee may sustain by assertion of superior title

2. A covenant of quiet enjoyment - grantor warrants that the grantee will not be disturbed in possession and enjoyment of the property by assertion of superior title

3. A covenant of further assurance - the grantor promises that he will execute any other documents required to perfect the title conveyed. o Rule = the mere existence of a paramount title does not constitute a breach of the covenant of quiet

enjoyment (Brown v. Lober – P bought land w/ 2/3 interests in the mineral rights by a general warranty deed. Years later,

P tried to sell their mineral rights to a coal co. but P discovered that they only owned 1/3 of the mineral rights.) o Rule = To render a title unmarketable, the defect must present a real and substantial probability of litigation

or loss at the time of the conveyance. (Frimberger v.

Anzellotti - When the P wanted to make improvements on his land he discovered there was a tidal wetlands violation on the property.) o Rule = as long as the statute of limitations has not run, owners can bring actions against owners who

transferred title by general warranty deed. (Rockafellor v. Gray) o Rule = Whether a chose in action runs with the land

varies between jurisdiction. (Rockafellor v. Gray) o Rule = The amount of recovery of the remote grantee is limited to the consideration recited in the deed from the original grantor to his immediate grantee, even if

the remote grantee paid a larger consideration.

(Rockafellor v. Gray – Gray held a mortgage on property which was obtained by general warranty deed by Rockafellor.

When payments were missed, Gray foreclosed on the mortgage.)

21 o Rockafellor v. Gray dealt w/how different types of deeds work in the context of whether a successor in interest is entitled to the benefits which were brought by a general warranty deed even if they weren’t given a general deed

AKA Does the chose in action run to remote grantees?

Depends on the jurisdiction

D. FINANCING REAL ESTATE TRANSACTIONS o 1. Introduction to Mortgages and the Mortgage Market

When a mortgage is granted, the lender receives a security interest usually called a lien

Security Agreement:

Grants bank security interest in property you’re purchasing

Gives bank priority over other creditors if there is a default

Establishes priority of payment; determined by who first obtains secured interest

A lien insures that the lender will get paid in the event of a default

Usually people sign:

A promissory note promising to pay back the money,

A mortgage, and

A basic contract that sets out the terms of the agreement

By signing and properly filing the mortgage, the lender is insuring that they have 1st rights to the value of the collateral if the collateral has to be sold

Lien Theory:

The legal title remains in the mortgagor

(borrower) and the mortgagee (lender) has a lien on the property.

Authorizes the mortgagee to have the sheriff seize the property and sell it, in the event the mortgagor defaults on the payment of a loan.

22

Policy: The idea of a lien is good for every party involved.

It's good for the lender b/c it makes it easier for the lender to get paid in the event of a default, and

Its good for the buyer b/c since it is easier for the lender to get paid, the interest rate will be lowered. o Hypo: suppose the value of the property is $300K and there is a 1 st lien on the property worth $200K and a 2 nd lien on the property worth $50K and a 3 rd lien on the property worth

$20k

if the property sells for $300K, every lien would be extinguished and the debtors would receive the balance as equity

if the property sells for $220K, creditor 2 would have a deficiency of 30K and creditor 3 would have a deficiency of 20K unless there is an anti-deficiency statute they can go after the debtor for $ that they didn't get paid and

then they would be general unsecured creditors and be in a race with every other unsecured creditor to go to court and get a judgment and find assets which are not encumbered by a security interest or not subject to an exemption statute to sell them and get paid

1 st , 2 nd , and 3 rd lien means the order in priority which will be paid in the event of foreclosure - order of priority by the date by which the creditor perfected their interest

when lender 3 looks in the recording office, they will see that the 1 st and 2 nd lenders are there

Unsecured creditors can't get paid from the foreclosure sale. o 2. Secured Interests

Over-secured v. under-secured creditors:

23

An over-secured creditor is when the value of the collateral is greater than the debt owed

i.e. if the collateral is $250,000 and the debt is $200,000 when the creditor sells the house, they will get $250,000 and they will only have to pay $200,000 in debt and the extra $50,000 left over is known as the equity cushion

In the event of foreclosure, the remaining difference after all creditors have been paid will be returned to the owners of the house

Under-secured is when the collateral is less than the debt owed

i.e. if value of collateral is $200,000 and the debt is $250,000 then this means not all that they are owed is going to be repaid.

There is not sufficient credit to protect the creditors position

Creditors want to be as over secured as they can.

But the amount of the collateral and the amount of the debt fluctuates

Creditors insist on 20% down b/c:

That way the creditor would only be lending

80% and by definition would be oversecured.

Hopefully, the house would bring enough money realized at a foreclosure sale that they would get paid back everything they have lent

If someone can put 20% down then they are financially stable enough to do so which means that they could probably make their payments in the future

Acceleration clauses:

Most mortgages have an acceleration clause

24

A clause, which says that in the event that the debtor defaults on the mortgage, the creditor, at its discretion, may accelerate the loan so that the entire amount that is owed will be immediately payable

If the owner defaults on their mortgage, and the loan is accelerated or if the house goes into foreclosure it is very unlikely that the owner will be able to pay the full amount that they owe on the house if they weren't able to pay their monthly bills o 3. Mortgage Foreclosure

Generally occurs when there is a default on the payment of the loan

3 traditional methods of foreclosing on real property

1. Judicial foreclosure - far more common

Requires the creditor to go to court and this is accomplished by entry of a court order which follows a civil action for foreclosure brought by the creditor

How the creditor goes about foreclosing is set out by individual state statue

Typically the court sets a date for the foreclosure sale, and the sale is proceeded by a sheriff

2. Power of sale foreclosure - much less common

About 1/2 the states offer it

Situation where the parties agree in the security agreement to a power of sale. A trust is set up which allows the trustee in the event of a default to sell the property, and use the proceeds of the sale to repay the creditor

The lawsuit to establish the right to foreclose is not necessary - circumvents the court process, do not need a sheriff

25

3. Strict foreclosure

Unusual and rarely seen; occurs where a buyer can’t get financing any other way

Foreclosure sales:

Rarely bring much value, other than the fair market value of the property

The method of sale is almost always one of auction.

If the sale doesn't bring enough to pay back the creditor, the homeowner may be able to sue.

Most state statutes allow the homeowner to object to the sale b/c of:

Insufficient advertising

Winning bid was just not high enough o In the absence of some other defect in the title, the price must be “grossly inadequate” or must

“shock the conscience of the court” for the sale to be invalidated. Generally, the mere inadequacy of the foreclosure sale price will not invalidate a sale.

Unfair agreement btw the purchaser and the creditor

Equitable right of redemption – the owner has a period of time to try and buy back the property by paying the purchase price

Problems w/ Foreclosure Sales:

Advertising

Inspection of the property is difficult

There is no title insurance; buyer receives a quitclaim deed

Creditors have little interest in receiving a high price

The existence of a redemption period

The existence of additional costs

26

General Rule = The mortgagee never gets possession of the property; the mortgagor keeps the property until the foreclosure sale is confirmed and then the purchaser would get the property

The debtor typically stays in the property

If the debtor has no equity then they have no incentive to upkeep the property.

If you are concerned as a creditor that the debtor will not maintain the property, the creditor can go to court and ask for a receiver to make sure the property is maintained in good

To get a receiver appointed:

1. One must be provided for in the mortgage document; and

2. The ct. has to determine, in its equitable discretion, that a receiver is needed o Creditor has to show that they have no other remedy o This would mean the creditor is under-secured b/c if they were oversecured the collateral is worth more than the mortgage and depreciation of the property wouldn't affect the creditor. If they are under-secured depreciation of the property would affect the creditor.

Exemption statutes:

Every state has an exemption statute which tells us what properties creditors can’t reach

You get property exempt based on the state you are in

Purpose is so that individual debtors are not left absolutely destitute so as to provide unsecured creditors cannot get at certain assets

27

Unsecured creditors cannot get at exempt property.

Secured creditors and some tax liens can generally get at exempt property, which is covered by an exemption statute.

3 different forms

1. You can exempt specific type of property at a maximum dollar amt. (most common) o i.e. jewelry, automobile

2. You can exempt a max amt. of money and apply it to any property you want (rare)

3. You can exempt the following property irrespective of value o i.e. your home

If your property is exempt, it can’t be reached by creditors

General method by which creditors gets paid:

If you are a secured creditor, in the event of a default you can have the property seized and sold and you have the right to be paid from the proceeds.

In the event that you are not paid in full by the proceeds, you still have the right to get paid but you have the status as a general unsecured creditor

Then you are in a situation where you are in a race w/every other unsecured creditor to go to court to get a judgment for a lien, which directs the sheriff to get to the property and are not covered by security interests that are of value

Or if they have security interests that they have equity in the property, and sell it to get paid

General unsecured creditors do not trump exemption loss

Secured creditors do trump exemption loss as a general matter

28

Distribution of the Proceeds

1 st to get paid on a foreclosure is the cost of sale.

If the senior creditor brings the foreclosure, he gets paid first and then the junior liens are paid in the order credit was given (First to give credit gets paid first).

If a junior creditor brings foreclosure, he gets paid first and then all liens junior to him are paid in the order credit was given

Liens senior to the foreclosing creditor are not extinguished by the foreclosure sale; the purchaser at the foreclosure sale picks up the remainder of the mortgage.

If you do not have you lien extinguished, you can’t be paid

i.e. if the 2 nd creditor forecloses, the purchaser will buy the property subject to the 1 st creditor’s lien

Whoever takes the appropriate measures to file their lien first has a superior lien. Monetary value has nothing to do with the order of the lien payments upon foreclosure.

If there is excess after the junior lenders have been paid, the unsecured creditors don’t get paid

- the homeowner gets the rest in equity.

Deficiencies:

A deficiency is the amount a creditor, who is under-secured, is not being paid at the foreclosure sale

i.e. if a house has a loan for $100,000, the house is foreclosed for $60,000, there is a $40,000 deficiency

Generally, the bank has the right to sue the home owner for the money difference

This is only applicable to under-secured creditors

Anti-Deficiency Statutes:

29

They may deny deficiencies in all foreclosures

They may deny deficiencies in certain foreclosure processes (i.e. power of sale)

They may deny deficiency when the creditor is the purchaser

They may set forth the use of the market value of the property to determine the deficiency

Rule = Unrecorded mortgages are not effective against subsequent good faith

purchasers.

Rule = Anybody against whom their is a

default has the right to foreclose.

Rule = The only liens that get extinguished at a foreclosure sale are those of the foreclosing creditor and those junior to the foreclosing creditor if there are sufficient assets

The economic impact is the same o The amount that they get paid ought to be the same (see example)

Rule = if your lien is extinguished in a foreclosure sale, you have the right to get paid

Rule = If you are a foreclosing creditor, you have to notify all junior creditors of

foreclosure.

Rule = In his role as a seller, the mortgagee has a duty to act in good faith and due diligence to get fair market value and

protect the mortgagor’s equity in the house.

(Murphy v. Fin.Dev.Corp.- Ps were in arrears on their mortgage payments and had failed to pay other utility and tax bills therefore the D foreclosed.)

Mortgagee’s duty is essentially that of a fiduciary

30 o 4. The Subprime Mortgage Crisis

The subprime foreclosure rates are unbelievably higher than prime foreclosure rates

Why would lenders give loans that they knew would likely end in foreclosure?

Bank practices changed where due diligence disappeared and it became common practice for the lenders to lend w/o the buyers having sufficient income or assets to pay because:

1. The housing crisis, which created incentives for lenders to lend subprime b/c worst-case scenario for them was to foreclose and get their money back

2. Rise of mortgage back security - share in a pool of mortgages which were expected to generate a regular cash flow for the life of the mortgage (30 years usually) o Pool had to be large which gave incentives to lenders to write overly risky loans o Lenders got paid based on the number of loans they hold o Lenders didn't care if they could get repaid, b/c they only had to hold them long enough to sell them to wall street o Therefore due diligence went by the wayside

3. Creation of collateralized debt obligations

- pools of portions of mortgage backed securities o Formed an incredibly risky asset pool which people thought were safe o Easy credit meant the purchase price of the homes rose, which meant equity in the homes rose

31 o Housing prices doubled but household income did not raise as quickly. So ppl. bought homes and then reached a point where they could no longer pay on their mortgages

Which lead to defaults

Which lead to foreclosures

Which lead to more houses on the markets

Which lead to a decrease in the value of homes and therefore less equity in the homes

Rule = It is unfair for lenders to lend money when they know or should have known that the borrower would default and eventually have to

foreclose on their property. (Commonwealth v.

Fremont Investment & Loan- The D is an industrial bank who sold subprime loans to residents of

Massachusetts.) o 5. Mortgage Substitutes: The Installment Land Contract

Installment Land Sale Contracts:

The seller retains legal title and does not deed the property to the purchaser until the purchaser pays the full purchase price.

The payment period under an installment contract may be as long as the normal deed and mortgage period

Equitable Conversion: where there is a sale of land where the contract is specifically enforceable, equity

(fair action) is done and secured:

The buyer is viewed as the owner of the property from the date of the contract (equitable title)

And the seller holds the title as trustee for the buyer and has a claim for money secured by a vendor’s lien on the land

32

Rule = The vendee under a land sale contract acquires an interest in the property of such a nature that it must be extinguished before the

vendor may resume possession. (Bean v. Walker -

The P agreed to sell and the D agreed to purchase a home to be paid in monthly installments and in the event of a default a forfeiture clause came into play whereby the P could retain all the money paid under the contract as "liquidated" damages and would be considered payment of rent.)

B. THE RECORDING SYSTEM o To ensure reliability of recorded documents, statutes required deeds to be acknowledged before notary public or other public official before it is entitled to recordation. o Functions:

Establishes a system of public recordation of land titles

Preserves important documents

Protects purchasers for value and lien creditors against prior unrecorded interests

Gives constructive notice of your claim to anyone with future interests o 1. The Indexes

Indexing is how searches are done.

2 types of indexes:

1. Tract index - index title according to parcel identification number

Not common

2. Grantor-grantee indexes

2 separate indexes, alphabetized one for the grantors, one for the grantees - so any grant of property is indexed twice

The key is that you want search both grantor and the grantee indexes

You need to search back on the grantee line as far as you need to under the statute to find who has owned the property in the past

33

You search forward on the grantor line to find any liens, mortgages (any instruments which might be there) that you don’t know of o Rule = An instrument, which describes the property to be conveyed with a Mother Hubbard clause is not sufficiently specific as to be effective against subsequent purchasers and mortgagees, unless they

have actual knowledge of the transfer. (Luthi v. Evans -

Grace Owens assigned all her interests in oil and gas leases to

International Tours, Inc. The written instrument included a

Mother Hubbard clause.) o Rule = A misspelled name does not give constructive notice to title searchers under the doctrine of idem

sonans (Orr v. Beyers - The P obtained a judgment against

William Elliott. The written judgment identified Elliott erroneously as "William Duane Elliot", "William Duane Elliot" and "William Duane Eliot")

idem sonans - though a person's name has been inaccurately written, the identity of such a person will be presumed from the similarity of sounds btw the correct pronunciation and the pronunciation as written.

Therefore, absolute accuracy in spelling names is not required in legal proceedings and if the pronunciations are practically alike, the rule of idem sonans is applicable o General rule = subsequent bona fide purchasers for value are protected from unrecorded prior interests but

they have to search o 2. Types of Recording Acts

Exam Tip: It is critical to know which recording act applies to the jurisdiction before you start analyzing the issues

1. Race statute - (pretty obsolete) as btw successive purchasers of Blackacre, the person who wins the race to record prevails. Whether a subsequent purchaser has

34 actual knowledge of the prior purchaser's claim is irrelevant.

The 1st person to record prevails which is easily determined. Advantage is that the whole inquiry is based on written record.

O owner of Blackacre, conveys Blackacre to A, who does not record the deed. O subsequently conveys Blackacre to B for a valuable consideration. B actually knows of the deed to A.

B records the deed from O to B. Under a race statute, B prevails over A, and B owns Blackacre.

2. Notice statute - (IL uses this) A subsequent bona fide purchaser for value prevails over prior claimants as long as the subsequent purchaser acquires the interest w/o notice of the prior claim and prevails immediately upon closing

If a subsequent purchaser has actual notice of a prior unrecorded instrument, the purchaser could not prevail over the prior grantee, for such would work a fraud on the prior grantee, even if they record 1st

Protects a subsequent purchaser against prior unrecorded instruments even though the subsequent purchaser fails to record

O, owner of Blackacre, coveys Blackacre to A, who does not record the deed. O subsequently conveys Blackacre to B for a valuable consideration. B has no knowledge of A's deed.

Under a notice statute, B prevails over A even though B does not record the deed from O to B.

3. Race-Notice statute - Under a race-notice statute a subsequent purchaser is protected against prior unrecorded instruments only if the subsequent purchaser (1) is w/o notice of the prior instrument and

(2) records before the prior instrument is recorded.

35

O, owner of Blackacre, coveys Blackacre to A, who does not record the deed. O subsequently conveys Blackacre to B, who does not know of A's deed. Then A records. Then B records. A prevails over B, even though B had no notice of A's deed,

B did not record before A did.

A sells to B, A sells C, and then C sells to D

It is the contest btw. C and B which determines

D’s rights

Rule = You can only properly record your deed only if all the prior deeds in your chain of title

have been recorded (Messersmith v. Smith - Carolyn conveyed property to Smith and the 1st time she did it, the deed was in error and was ripped up. The 2nd time,

Carolyn never appeared before the notary so the deed was invalid.)

Rule = An unacknowledged deed does not qualify for recordation (both parties need to be present w/a notary public) and therefore the recording does not give constructive notice to subsequent

purchasers. (Messersmith v. Smith)

Rule = Zimmer Rule - if a deed in chain of title is defective then every deed down the chain is

defective (Messersmith v. Smith) o 3. Chain of Title Problems

Chain of title- refers generally to the recorded sequence of transactions by which title has passed from a sovereign to the present claimant

Technical meaning: the period of time for which records must be searched and the documents that must be examined within that time period

Meaning varies by jurisdiction

Dependant upon the searcher being able to find the appropriate document and then be able to link it properly

36

Problems occur referring to the recorded sequence of transactions by which title has been passed

Rule = constructive notice of real property can only be obtained if the chain of title includes all parties to whom a deed has been transferred (if part of the chain of title is missing, no way to link

the title) – KEY TO CHAIN OF TITLE (Bd. Of Ed v.

Hughes - Bd. of Ed. purchased land from Hoerger but had no way of knowing that Hoerger had conveyed the same tract of land to D&W b/c they hadn’t recorded yet.)

Rule = Implied Authority - A deed that does not name a grantee is nullity, and wholly inoperative as a conveyance, until the name of the grantee is legally inserted. When the grantor receives and retains the consideration and delivers the deed w/o the grantee’s name filled in, the grantee is presumed to have the authority to insert his

name. (Bd. Of Ed v. Hughes)

Bd of Ed v. Hughes was designed to show that if the title isn’t properly linked in the chain of title, then a subsequent purchaser is not going to be able to track title

Who gets the benefit of the bona fide subsequent purchaser statute (which is the person who is protected)? The system protects the last to purchase

C. TITLE INSURANCE o 2 types of Title Assurance:

1. Title searches documents of record

2. Title insurance o All instruments affecting land can and should be recorded in the public records office

Easily searchable to determine who has title o People who want additional title assurance can get it by buying title insurance

Dual back up system o Title Insurance:

Title insurance may be taken out either by the owner of the property or the mortgage lender.

The insurance protects only the person who owns the policy.

The policy does not run with the land to subsequent purchasers.

Back up to traditional title assurance

Back up of the recording system

Developed b/c of the problems w/the recording system and that it didn't always protect people the way it should

Good investment, not very expensive

In all insurance policies it's common for them to have lots of exclusions:

Easements

Losses resulting from gov't regulation

Things that an accurate survey would have shown

Rule = In the absence of a recital of acreage, a title company does not insure the quantity of land.

Title companies are in the business of

guaranteeing title, not acreage (Walker Rogge, Inc. v. Chelsea Title & Guaranty Co.- The P bought land

V. System of Estates where he thought the acreage was larger than it actually was.)

A. POSSESSORY ESTATES o There are only 5 possessory estates (AKA free hold estate - means the owner is seized of the property):

1. Fee Simple Absolute

2. Fee Tail

3. Life Estate

4. Fee Simple Determinable

5. Fee Simple Subject to Condition Subsequent

37

38

---------------------------------------------------------------------

6. Term of Years - not a possessory estate but a nonfreehold estate o Possessory estates are simultaneous interest in the same piece of property and they are linked to future interests

one person has the property now, and another person has a legal recognizable right to own the property in the future

i.e. to A for life and then to B and his heirs

Indicates A has a current possessory interest which is legally recognizable and enforceable, and they have ownership interest but only for their lifetime.

When A dies, the land will go to B, B's heirs,

B's devisees, or B assigns to a third party

B. FEE SIMPLE ABSOLUTE (FSA) - "To A and his/her heirs"

(translate this in your mind as to A and FSA which tells you there is no future interest that follows) o The only possessory estate that does not have to be coupled with a future interest which means a FSA owner has the right to possess the property forever o The owner has the property w/o any qualifications at all o Consists of a number of elements:

O owns Whiteacre in fee simple absolute:

O has the right to property in it forever

to freely transfer it

to devise the property in O's will,

and if O fails to devise the property, at his death it will pass to his heirs in an intestacy statute o Largest estate you can own o It is created by words of purchase and words of limitations

words of purchase (aka words of transfer) are "to A"

words of limitations are "and his/her heirs"

words of limitations are used to designate a fee simple absolute

C. FEE TAIL - least significant b/c it is largely obsolete at this point

39 o it has to be followed by a future interest o doesn't have to end anytime soon, but it is treated by law that it will end at some point o Lords back in the day wanted to ensure their property would stay in their direct lineal line and this would continue as long as there are lineal descendants o "to A and the heirs of his/her body" - deals w/lineal descendants exclusively, not heirs o when the fee tail ends there is a reversion back to the grantor, the grantor may leave it in his will to devise his interest to someone else o fee tails at common law weren't devisable, however each individuals interest could be alienated. o Only a handful of states allow for a fee tail - Delaware, Maine,

Massachusetts, and Rhode Island

if someone tries to create a fee tail in a state that does not allow it, most states will say the fee tail is a FSA

on the other hand some states recognize fee tails that were created at common law but that still exist today o the holder of a possessory fee tail can destroy a fee tail by alienating the fee tail during their lifetime

Can disentail by conveying a fee simple absolute while alive (“straw”). This destroys the fee tail and converts it to fee simple. Must disentail when alive. o Concerns about fee tail estate:

1. inefficient

2. we don't want dead hand control over property

D. LIFE ESTATE - estates for life; for the duration of the grantees life o "to A for life"

cannot be devised by A or inherited by A's heirs

life estates can be alienated to a very limited degree

you can alienate your life interest referred to as life estate pur autre vie = life estate measured by the life of another

40

A conveyance "to A for life" gives A a life estate that lasts for the duration of A's life. A can transfer his life estate to B, in which case B has a life estate pur autre vie that is, an estate that is measured by A's life-span, not B's. If B dies during A's lifetime, the life estate passes to B's heirs or devisees until A dies. o default rule at common law for an improperly drafted conveyance

i.e. "to A." = common law would take this to mean a life estate

today we would take this to mean FSA

life estates are not devisable and they are not inheritable o Rule = Unless the words of a will clearly evidence an intention to convey only a life estate it will be

interpreted as conveying a fee simple absolute (White v.

Brown - Mrs. Lide died leaving a handwritten note saying: "I appoint my niece, to the executrix of my estate. I wish Evelyn

White to have my home to live in and not to be sold. I also leave my personal property to my niece. My house is not to be sold.")

E. LEASEHOLD ESTATES o Non-freehold possessory estate o leasehold tenants do not have seisin

law regarded the freeholder (landlord) as still seised of the land even after he had granted a term of years and given up physical possession to the leasing tenant

therefore when a lease is involved the landlord holds seisin; the tenant merely has possession but this distinction is of little importance today o Term of Years - an estate ending on a fixed calendar date

F. Defeasible Estates - defeasible estate means it will terminate, prior to its natural end point, upon the occurrence of some specified future event o Fee Simple Determinable

41

Key Words: as long as, while, until, during o Fee Simple Subject to Condition Subsequent

Key Words: but if, upon the condition that, provided that, provided however

FSD and Fee Simple SCS operate in almost identical fashion

Both have a grant in fee subject to a condition. What distinguishes them is what happens if the condition is breached.

O conveys to A and her heirs so long as A farms the land. And A ceases to farm the land

Under a FSD, when A ceases to farm the land, the fee automatically terminates upon breach of the condition and this is called a possibility of reverter

Under a Fee Simple SCS when A ceases to farm the land, the fee doesn't automatically terminate upon breach of the condition but only terminates when the grantor exercises his right of entry

Primary difference:

when there is a condition that is breached under a FSD the estate terminates automatically

when there is a Fee Simple SCS and the condition is breached, the estate doesn't terminate until the person holding the right of entry comes in and exercises their right o As a general rule restraints on alienation are null and

void. (White v. Brown.)

Rationale: Objections to restraints on alienation:

1. Such restraints make property unmarketable the particular land is made unavailable for its highest and best use

2. Restraints tend to perpetuate the concentration of wealth by making it impossible for the owner to

42 sell the property and consume the proceeds of sale

3. Restraints discourage improvements on land

an owner is unlikely to sink his money into improvements on land that he cannot sell

if a mortgage cannot be placed on the land

(giving the moneylender the right to sell the land if the borrower defaults on the loan), lenders will not make money available to finance improvements

4. Restraints prevent the owner's creditors from reaching the property, working hardship on creditors who rely on the owner's enjoyment of the property in extending credit

5. Efficiency - the ability to transfer property lets us put property in the hands of people who value it most highly o Rule = Absolute restraints against alienation are null

and void. (Mountainbrow Lodge v. Toscano – P acquired land by gift deed w/a habendum clause stating "Said property is restricted for the use and benefit of the 2nd party, only; and in the event the same fails to be used by the 2nd party or in the event of sale or transfer by the 2nd party of all or any part of said lot, the same is to revert to the 1st parties herein, their successors, heirs or assigns.)

Restraints on Alienation:

Disabling: withholds from grantee the power to transfer the interest

Forfeiture: if grantee tries to transfer his interest the property is forfeited to a third party

Promissory: grantee promises not to transfer his interest o Rule = In the interest of preserving giving restricted gifts to charities, restrictions on usage are allowed.

(Mountain Brow Lodge v. Toscano)

43 o Rule = Where land, restricted by a deed, is taken by eminent domain, a ct. shall divide the eminent domain damages between the owner of the fee and holder of

the right of reverter (Ink v. City of Canton – The lineal descendants of Harry Ink conveyed tract of land to the D. In each deed, the grantor made it very clear that the land was only to be used as a public par and if the land was not used as a public park it was to revert to the grantor) o Helpful Definitions:

Heir - anyone who can take under the intestacy statute

a person who (1) outlives the decedent and (2) is designated as an intestate successor.

You don't become an heir until the person dies

Historically spouses were not heirs, but they are now

beyond spouses, heirs are typically lineal descendants - children, grandchildren, great grandchildren (in that order)

if I die w/no spouse, and no children, then my property will go to my parents if they survive me

if I die w/no spouse, no children, and no parents, then my property will go to my collaterals (siblings, cousins)

issue - children, grandchildren, great children; a lineal descendant

Devisee - is a person who gets property from a person who died and left that property to them in their will

Per stirpes distribution - suppose the testator, O has 3 kids, A, B, and C, and C has two kids, X and Y. C predeceases O and O's will says I leave things equally to A, B, and C. Per stirpes distribution would mean that

X and Y stand in C's shoes for purposes of distribution.

Under this situation A would get a 1/3, B would get a

1/3, and X and Y would split C's 1/3 so they would each get 1/6

Rule of Primogeniture - in the event of intestacy, the oldest son inherits. And if the oldest son has predeceased the descendant and leaves children it will go to his oldest son

Ancestors - people who preceded you (parents, grandparents)

Collaterals - people who are related by blood but are neither ancestors or blood lineals (siblings, cousins)

Escheat - someone who dies intestate and there is no one left under the appropriate intestate statute that can take the property; in this event it is called escheating to the state - idea is that the property will go back to the state

very rare o Rule = A court of equity has the power to order a judicial sale of land affected with a future interest and an investment of the proceeds, where this is necessary

for the preservation of all interests in the land. (Baker v.

Weedon – D’s husband created a life estate in his wife followed by a contingency – if she had children, the land would go to them, if she died childless the land would go to his grandchildren.)

VI. Future Interests

A. INTRODUCTION o The Modern Relevance of Future Interests

Future interests confer rights to the enjoyment of property at a future time

Future interests recognized in our legal system are:

(1) Interests retained by the transferor:

a. Reversion

b. Possibility of Reverter

c. Right of entry

(2) Interests created in a transferee:

1. Remainders o A. Vested Remainder

44

45

i. Indefeasible

ii. Subject to open

iii. Subject to complete divestment (you will see a separate divesting clause) – look to see if the condition is a condition precedent written into the same clause or a condition subsequent written into a separate clause

iv. Subject to open and complete divestment o B. Contingent Remainder

2. Executory Interest o A. Springing – will always divest the grantor o B. Shifting – always follow a conveyance to a 3 rd party grantee

A future interest gives a legal right to its owner.

it is a presently existing property interest, protected by the ct. as such

O conveys Blackacre "to A for life, then to B and her heirs"

B has present legal rights and liabilities

B can sell or give away her remainder

B can enjoin A from committing waste

B can sue third parties who are injuring the land

If B dies during the life of A, B's remainder will be transmitted to B's heirs or devisees

A federal estate tax or state inheritance tax may be levied upon its value

Although a future interest does not entitle its owner to present possession, it is a presently

existing interest that may become possessory in the future.

B. FUTURE INTERESTS IN THE TRANSFEROR

46 o 1. Reversion - the interest left in an owner when he carves out of his estate a lesser estate and does not provide who is to take the property when the lesser estate expires

Reversion follows transfers of estates of a lesser quantum

When you transfer estates of the same quantum, it cannot be a reversion.

At common law a reversion was transferable during life and descendible and devisable at death. It remains so today.

If O, a FSA owner, granted the land "to A for life", the land would revert (come back) to O at A's death.

O's right to future possession is called a reversion

If O dies during A's life, O's reversion passes under his will or to his heirs

If O owning a FSA, creates a fee tail, a life estate, or a term of years, and does not at the same time convey away a vested remainder in FSA, O has a reversion.

If A, owning only a life estate, creates a term of years,

A has a reversion.

Example: O conveys Blackacre "to A for life". O has a reversion that is certain to become possessory. At A's death, either O or O's successors in interest will be entitled to possession.

Example: O conveys Whiteacre "to A for life, then to B and her heirs if B survives A." O has a reversion in FSA that is not certain to become possessory. If B dies before A, O will be entitled to possession at A's death.

On the other hand, if A dies before B, O's reversion is divested on A's death and will never become possessory. o 2. Possibility of Reverter - arises when an owner carves out of his estate a determinable estate of the same quantum

a future interest remaining in the transferor or his heirs when a FSD is created

47

Example: O conveys Blackacre "to Hartford School

Board so long as used for school purposes." O has a possibility of reverter.

Any time you see a FSD, it will necessarily be followed by a possibility of reverter

O conveys Whiteacre to A, as long as A uses

Whiteacre as a farm - FSD followed by a possibility of reverter o 3. Right of entry - when an owner transfers an estate subject to condition subsequent and retains the power to cut short or terminate the estate, the transferor has a right of entry

Example: O conveys Whiteacre "to Hartford School

Board, but if it ceases to use the land for school purposes, O has the right to re-enter and retake the premises"

Any time you see a Fee Simple SCS, it will necessarily by followed by a right on entry

C. FUTURE INTERESTS IN THE TRANSFEREE o 1. Remainder - future interests, where it is possible for the interest to become possessory immediately at the end of the prior estate, there cannot be a mandatory gap btw the end of the prior estate and the commencement of a new estate

Remainders break into:

1. Vested - for a remainder to be vested, you need the remainder-men to be (1) born, (2) ascertainable, and (3) there can be no express conditions precedent to the holder of the remainder being able to take possession upon the termination of the preceding estate

when something vests, it means that it is certain to become possessory to the individuals, assigns, heirs, devisees but it doesn't mean it is currently possessory

vested remainders are devisable, alienable, and inheritable

There are 4 kinds:

48

i. Indefeasible - certain to become possessory upon the expiration of a prior estate created at the same time o to A for life, then to B and her heirs o B has an indefeasibly vested remainder

Example: O conveys "to A for life, then to B and her heirs." B has an indefeasibly vested remainder certain to become possessory upon termination of the life estate. If B died during A's life, on B's death B's remainder passes to B's devisees, or if B dies w/o a will, passes to B's heirs, or, if B dies w/o a will and w/o heirs, escheats to the state. B or B's successor in interest is certain to take possession upon A's death

ii. Subject to open - remainders which are limited in favor of a class of people o You need to have at least one living member of the class, and no unmet express conditions precedent. o It's open b/c there is a possibility that new people can join the class, and it's not open when the possibility of new people joining the class is no longer available o Example: O conveys "to A for life, then to A's children and their heirs." A has one child, B. The remainder is vested in B subject to open to let in

A's later-born children. B's exact share cannot be known until A dies. If

A has no child at the time of the conveyance, the remainder is contingent b/c no taker is ascertained.

49

When A dies, the class can no longer remain open b/c A can't have anymore children. When A dies this becomes an indefeasibly vested remainder.

iii. Subject to complete divestment - remainders that are born, ascertainable people, or in a class that can still be subject to open but is not subject to the occurrence, or non-occurrence of a condition subsequent so that the remainder may not become possessory or if it becomes possessory it may not remain possessory o If it is subject to complete divestment there will be a vesting clause and then that clause will be followed by a divested clause o Example: "O conveys to A for life, then to B and her heirs, but if B is unmarried, then to C and his heirs" o these are not subject to the rule of perpetuities

iv. Subject to open and complete divestment o Example: To A for life and then to A’s children and their heirs, but if A is not survived by any children at A’s death, then to Q. A has a living child, B and

A is alive. B has a vested interest subject to open and subject to complete divestment.

2. Contingent - remainders are contingent when they are given to unborn people or to unascertainable people

Example: "To A for life, then to B and her heirs only if B is married when A dies"

50

Contingent remainders are subject to rule against perpetuities

A remainder that is contingent b/c its takers are

unascertained is illustrated below:

O conveys "to A for life, then to the heirs of

B." B is alive. The remainder is contingent b/c the heirs of B cannot be ascertained until B dies.

A remainder that is contingent b/c it is subject to

a condition precedent is illustrated below:

O conveys "to A for life, then B and her heirs if B survives A." The language if B survives A subjects

B's remainder to a condition precedent. B can take possession only if B survives A.

Example 1. O conveys "to A for life, then to B and her heirs if B survives A, and if B does not survive A to C and his heirs." The language if B survives A subjects B's remainder to the condition precedent of B surviving A and the language if B does not survive A subjects C's remainder to the opposite condition precedent. Here we have alternative contingent remainders in B and C. If the remainder in B vests, the remainder in C cannot and vice versa.

The granting clause, which creates the interest, is in the same clause which divests, is contingent, which means there has to be an alternate contingent remainder

possessory life estate in A, contingent remainder in FSA in B, and an alternate contingent remainder in FSA in C

These may or may not become possessory in the future

Example 2. O conveys, "to A for life, then to B and her heirs, but if B does not survive A to C and his heirs."

Note carefully: B does not have a contingent remainder.

B has a vested remainder in fee simple subject to

51 divestment. C has a shifting executory interest which can become possessory only by divesting B's remainder.

Key to understanding why B's interest is contingent in Example 1 and vested in Example 2 is that you must classify interest in sequence as they are written. Start reading to the right, classify the 1st interest, then move on to the 2nd interest and classify it, and then move to the next interest. o Vested v. Contingent:

1. A vested remainder accelerates into possession whenever and however the preceding estate ends

either the life tenant's death or earlier if the life estate ends before the life tenant's death

A contingent remainder cannot become possessory so long as it remains contingent

2. At early common law a contingent remainder was not assignable during the remainder-man's life and hence was unreachable by creditors

contingent remainder was thought of as a mere possibility of becoming an interest and not as an interest that could be transferred

Now, in most states, contingent remainders are transferable during life and reachable by creditors

Vested remainders have always been transferable during life as well as death

3. At common law contingent remainders were destroyed if they did not vest upon termination of the preceding life estate, where as vested remainders were not destructible in this manner

4. Contingent remainders are subject to the Rule

Against Perpetuities, whereas vested remainders are not o 2. Executory Interests - a future interest in a transferee that must, in order to become possessory:

52

(1) divest or cut short interest in another transferee

(AKA shifting executory interest), or

(2) divest the transferor in the future (AKA springing executory interest)

Generally executory interests are devisable, inheritable, and alienable

Shifting Executory Interest:

Future interest created in a third party transferee that in order to become possessory must on the occurrence or non-occurrence of an event

(depending on how its written) divest the current possessory interest or future interest of another transferee

Example: O conveys "to A and his heirs, but if A dies without issue surviving him, to B and her heirs." A has a possessory fee simple subject to an executory limitation (or subject to divestment by B's executory interest). B's future interest can become possessory only by divesting A.

Example: To A for life, and upon A's death to B and her heirs, but if C marries D then to C and her heirs

current life estate in A, followed by a vested remainder subject to complete divestment in FSA in B, and a shifting executory interest in C

3 possibilities: o 1. C and D never marry, which would mean B's interest is no longer subject to complete divestment and is then indefeasibly vested when C or D dies o 2. A dies, B takes the property in FSA subject to a potential executory limitation based on whether C & D marry and if so then the future interest would go to C

53 o 3. C marries D before A dies, so it never becomes possessory in B, and what gets divested is B's potential future interest which was a future remainder subject to complete divestment

Springing Executory Interests:

future interests that in order to become possessory has to divest the transferor

Example: O conveys Blackacre to A upon her marriage, A is soon to be married. O has the property subject to the executory limitation.

When A gets married, A divests O's interest.

Example: O conveys Blackacre "to A for life, then to B if B gives A a proper funeral".