Recitation 5 and Solutions

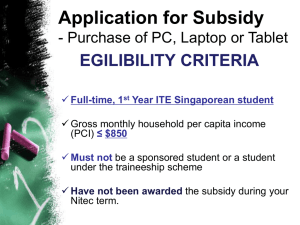

advertisement

Recitation #5 1. The following information is given for the market for fire extinguishers (FE). Assume each buyer is allowed to only buy one FE and that each seller is allowed to only sell one FE. The buyer value represents the most that the given buyer is willing to pay for a FE and the seller cost represents the minimum amount that the seller is willing to receive for a FE. Furthermore, assume that a FE can only be used once and that the use of an FE creates a positive externality of $10. Buyer Value $10 $15 $18 $17 $20 $12 a. b. c. d. e. Seller Cost $17 $22 $5 $25 $18 $10 What is the competitive equilibrium price and quantity? What is the value of CS, PS, external benefit, and total surplus at the competitive equilibrium? What is the value of the DWL at the competitive equilibrium? What is the social equilibrium quantity? Suppose a Pigouvian subsidy is given to buyers in this market so that the social equilibrium will be reached. i. What is the value of the per-unit subsidy? ii. After the subsidy is implemented, how much will a fire extinguisher cost buyers? How much will sellers receive for each subsidy? iii. What is the value of the TS? DWL? Bonus Problem: (optional problem for those who seek the challenge) The following table shows the marginal costs for each of four firms (A, B, C, and D) to eliminate units of pollution from their production processes. For example, for Firm A to eliminate one unit of pollution, it would cost $54, and for Firm A to eliminate a second unit of pollution it would cost an additional $67. Firm Unit to be eliminated First unit Second unit Third unit Fourth unit a. b. c. A 54 67 82 107 B 57 68 86 108 C 54 66 82 107 D 62 73 91 111 If the government charged a fee of $69 per unit of pollution, how many units of pollution would the firms eliminate altogether? If the government charged a fee of $84 per unit of pollution, how many units of pollution would the firms eliminate altogether? Suppose the government wants to reduce pollution from 16 units to 8 units and auctions off 8 pollution permits to achieve this goal. Which of the following is a likely auction price of the permits? $69, $81, $83, or $97 Solutions to Question 1: a. To find the competitive equilibrium, we want to find the price where the quantity demanded = quantity supplied. Through trial and error, you will find that when P = $17, Q d = Qs = 3. Alternatively, sort the data so that the buyer values are in descending order and the seller costs are in ascending order as shown below: Quantity 1 2 3 4 5 6 BV $20 $18 $17 $15 $12 $10 SC $5 $10 $17 $18 $22 $25 When written this way, each BV represents a point on the demand curve and each SC represents a point on the supply curve at the different quantities. The quantity where BV = SC represents the point where the demand and supply curves intersect. This occurs at when P = $17 and Q = 3. b. CS = BV – $17 for each of the 3 units consumed = $4 PS = $17 – SC for each of the 3 units sold = $19 External benefit = $10 per unit; since 3 units are sold, the total external benefit = $30. TS = CS + PS + External benefit = $53 c. To answer this question, you must first determine the socially efficient quantity of output. The socially efficient quantity is the quantity that maximizes TS. This quantity occurs where the social value = seller cost for the last unit consumed, i.e. where the social value curve intersects the supply curve. . Let’s create a column for SV = BV + per unit external benefit = BV + $10 Quantity BV 1 2 3 4 5 6 $20 $18 $17 $15 $12 $10 Social Value (SV) $30 $28 $27 $25 $22 $20 SC $5 $10 $17 $18 $22 $25 The quantity that will max TS is 5 b/c that is where SV = SC. To figure out what the DWL is we can calculate the “unrealized gains from trade.” In other words, how much surplus was lost b/c the 4 th and 5th transaction did not occur? To find this value look at the difference between SV and SC for the 4 th and 5th transaction. A total of $7 was unrealized → this is the DWL. Alternatively, the DWL can be found by looking at the difference in TS from 5 versus 3 transactions. We already calculated TS for 3 transactions above. A quick and dirty way to calculate TS for 5 transactions (note: you could have also employed this method to calculate TS for 3 transactions) is to look at the difference between the SV curve and supply curve for each of the 5 transactions (i.e., sum up the difference between SV and SC for each of the 5 transactions). TS = $60 if we have 5 transactions. So the unrealized surplus at the market equilibrium is $60 - $53 = $7 (the DWL). d. 5; we answered this in part c e. Set the per-unit subsidy = per-unit value of the external benefit = $10. The buyers are now willing to pay $10 more per unit. The column “WTP with subsidy” represents the new demand curve which has shifted up by $10. It now lies on top of the SV curve and with this little nudge (i.e. the subsidy) the market equilibrium with the subsidy is the same as the social equilibrium. The seller receives $22 and the buyer only pays $12 out of pocket. Remember, the government is covering the difference. Quantity BV 1 2 3 4 5 6 $20 $18 $17 $15 $12 $10 WTP with subsidy $30 $28 $27 $25 $22 $20 Social Value (SV) $30 $28 $27 $25 $22 $20 SC $5 $10 $17 $18 $22 $25 TS, which was already calculated above, is $60 and there isn’t a DWL. If all of this is still a little unclear to you, try the following. Calculate CS and PS when a subsidy is in place, then add in the total external benefit. Finally, subtract out the subsidy paid by the government. If you did your work correctly, you will get $60 for the TS. Answers to Bonus Problem: a. b. c. 7 units 10 units $81