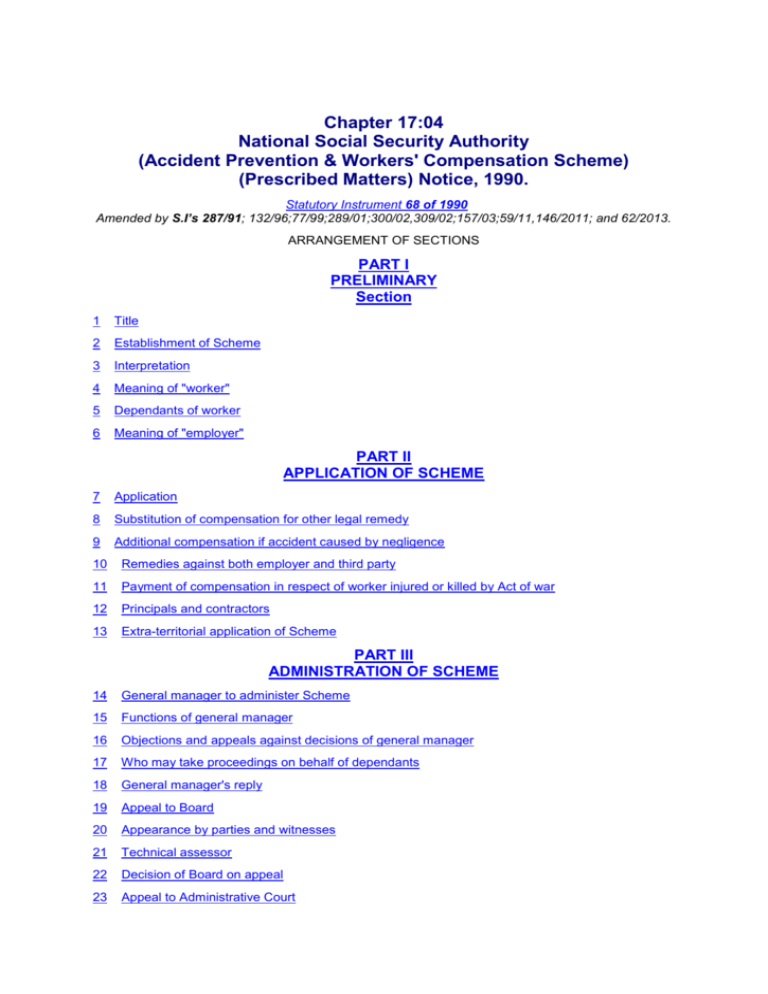

Statutory Instrument 68 of 1990 - National Social Security Authority

advertisement